简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

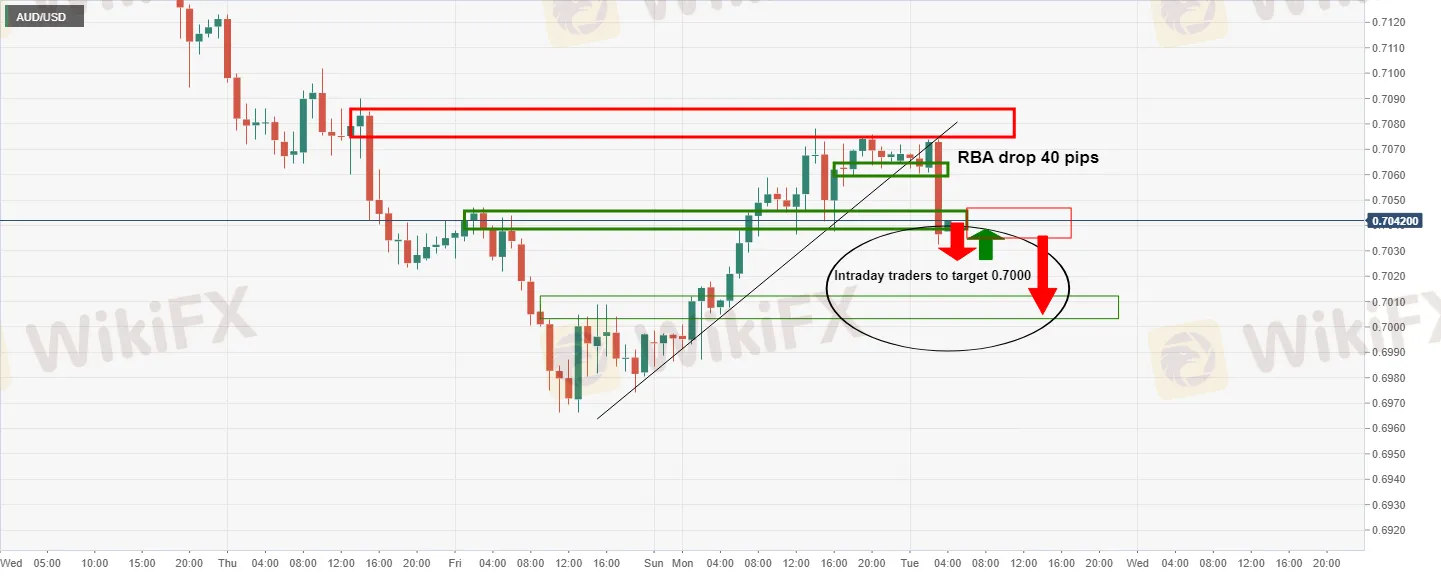

RBA Statement: Pushes back on market wagers for an early rate rise

Abstract:The Reserve bank of Australia left its cash rate at a record low of 0.1% on Tuesday and ended its A$275 billion ($194.40 billion) bond-buying campaign as expected.

However, traders were disappointed because the statement has pushed back on market wagers for an early rate rise.

The statement emphasised that ceasing bond purchases did “not imply” a near-term increase in interest rates and the Board was still prepared to be patient.

“As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range,” RBA Governor Philip Lowe said in a brief statement. “While inflation has picked up, it is too early to conclude that it is sustainably within the target band.”

Key points

Rba says it also decided to cease further purchases under the bond purchase program, with the final purchases to take place on 10 February.

RBA says committed to maintaining highly supportive monetary conditions.

RBA says the RBA's central forecast is for gdp growth of around 4¼ per cent over 2022 and 2 per cent over 2023.

RBA says will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

RBA says board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.

RBA says the central forecast is for the unemployment rate to fall to below 4 per cent later in the year and to be around 3¾ per cent at the end of 2023.

RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band

RBA says there are uncertainties about how persistent the pick-up in inflation will be as supply-side problems are resolved

RBA says likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target

RBA says ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates.

RBA says the board will consider the issue of the reinvestment of the proceeds of future bond maturities at its meeting in May.

AUD/USD reaction

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

“Seeing Diversity, Trading Safely”: WikiEXPO Dubai 2024 Opens New Horizons for the Fintech Industry

Dubai, UAE — The WikiEXPO Dubai 2024, hosted by WikiGlobal, successfully concluded on November 27, attracting wide attention from the global financial technology sector. The event was co-organized by WikiFX and the Australian Computer and Law Association (AUSCL), with strong support from the Mauritius Financial Services Institute (FSI) and the government of Liberland. Through an innovative hybrid model of online and offline participation, WikiEXPO Dubai 2024 achieved an impressive 1,267,886 online views and gathered 3500+ on-site participants, bringing together 550+ industry leaders and attracting close coverage from over 1300+ global media outlets.

BaFin Issues Warning Against Clone Broker Exploiting Pepperstone's Identity

The German Federal Financial Supervisory Authority (BaFin) has recently flagged a fraudulent clone of the licensed retail FX and CFD broker Pepperstone. This fake entity, operating under the domain pepperstone.life, has been offering financial and investment services without obtaining the necessary regulatory authorisation.

TikTok: A Rising Hub for Investment Scams in Malaysia

The Royal Malaysian Police (PDRM) have raised concerns over the increasing use of TikTok by criminal syndicates to lure victims into investment scams.

Webull Canada Expands Trading Hours with Options Trading

Webull Canada now offers extended trading hours from 4 a.m. to 5:30 p.m. ET, plus options trading. Gain flexibility and manage risk in an ever-changing market.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator