Score

WorldFirst

Australia|15-20 years|

Australia|15-20 years| https://www.worldfirst.com/au/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

China 7.60

China 7.60Surpassed 72.90% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+61 1800 744 777

+61 2 8298 4990

Other ways of contact

Broker Information

More

World First Pty Ltd

WorldFirst

Australia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 900508)Payment services Non-Forex License. Please be aware of the risk!

WikiFX Verification

Users who viewed WorldFirst also viewed..

XM

FXCM

HFM

MultiBank Group

WorldFirst · Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| WorldFirst Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Products & Services | Spot contracts, Forward contracts, Xero integration, Firm orders, Live rates, Currency converter |

| Demo Accounts | No |

| Payment Methods | Debit Cards, Online/Telephone Banking, BACS, Direct Debit, CHAPS |

| Customer Support | Live chat, phone, email |

What is WorldFirst?

WorldFirst was officially founded in London in 2004, with offices in Sydney, Australia in 2008, Singapore in 2013, and Hong Kong in 2014, making it one of the early payment service providers serving Chinese cross-border e-commerce merchants. In 2018, WorldFirst launched a new World Account and launched the Chinese brand name “Wang Li Hui WorldFirst”. In 2019, WorldFirst joined Ant Group as a wholly-owned subsidiary. WorldFirst currently holds a full license from ASIC (License No. 331945) in Australia and an exceeded payment license from the FCA (License No. 900508) in the UK.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • ASIC-regulated | • A minimum transfer amount of $2,000 is required, much higher than most money transfer companies |

| • Competitive exchange rates | • Limited currencies to transfer |

| • A number of products and services offered | • Limited transfer payout options |

| • Transfer cost easy to calculate | • Not available in the US |

| • Simple set-up and registration process | • Limited educational resources |

| • Excellent customer service |

It's important to note that individual experiences may vary, and customers should conduct their own research and consider their specific needs before choosing a currency exchange provider.

Is WorldFirst Safe or Scam?

WorldFirst is a reputable and regulated financial institution, currently regulated by the Australia Securities & Investment Commission (ASIC) under license number 331945. The regulation by ASIC indicates that WorldFirst operates within the legal framework and complies with the required standards and regulations set by the regulatory authority.

In terms of security measures, WorldFirst employs real-time fraud monitoring, blocking, and alerts to detect and prevent fraudulent activities. Additionally, the login process is secured with two-factor authentication, which adds an extra layer of security to protect user accounts. The use of the Authy app for two-factor authentication enhances the security of the login process.

However, it is important to note that no financial institution can guarantee absolute security, as the risk of security breaches and fraud always exists in the digital landscape. It is always recommended to conduct thorough research and due diligence before engaging with any financial institution. This includes reviewing their regulatory status, security measures, and reputation in the industry. Additionally, staying vigilant and promptly reporting any suspicious activities is crucial to ensure the safety of your funds and personal information.

Products & Services

Spot Contracts: WorldFirst allows users to execute spot contracts, which are immediate currency trades at the prevailing market rate. This service enables clients to quickly convert one currency into another without the need for long-term planning.

Forward Contracts: WorldFirst also provides forward contracts, which allow users to secure a specific exchange rate for a future date. This feature is particularly useful for businesses and individuals looking to protect themselves against adverse currency movements and effectively manage their budgeting and cash flow.

Xero Integration: WorldFirst has integrated with Xero, a popular accounting software, to streamline the currency management process for businesses. This integration allows users to connect their WorldFirst account with Xero, enabling them to automatically sync and reconcile currency transactions, manage accounts payable and receivable, and access real-time currency data within their accounting platform.

Firm Orders: With the firm order service, WorldFirst clients can set specific exchange rate targets. When the market reaches the desired rate, WorldFirst automatically executes the transaction on behalf of the client. This feature is beneficial for those who closely monitor exchange rates and want to take advantage of favorable movements.

Live Rates: WorldFirst provides access to live exchange rates, allowing users to view real-time currency prices and make informed decisions about their transfers. Live rates help clients stay up-to-date with market fluctuations and choose the most favorable times to execute their currency trades.

WorldFirst offers a range of products and services designed to facilitate international currency transfers and provide solutions for businesses and individuals dealing with foreign exchange. Here's a brief description of some of the key offerings:

Currency Converter: WorldFirst offers a user-friendly currency converter tool that allows individuals and businesses to quickly calculate the value of one currency in relation to another. This tool helps users estimate exchange rates and conversion amounts before initiating a transfer.

These are just some of the products and services offered by WorldFirst. The company aims to provide efficient and cost-effective solutions for international money transfers, helping businesses and individuals navigate the complexities of foreign exchange and mitigate currency-related risks.

Account Types

The WorldFirst International Payments Account

There are two distinct types of accounts are on offer: The WorldFirst International Payments Account and the WorldFirst International Collections Account. The first account is designed for business importing and paying overseas suppliers, and the second account is for business selling via online marketplaces and websites. Here some some features and offerings provided by each type of account.

Banking-beating exchange rates on international payments

International payments in 68 currencies

Send mass payments from a single transaction

Lock in an exchange rate for up to two years with a forward contract

The WorldFirst International Collections Account

Make transfers online 24/7 or through your account manager

Open locally-based currency accounts in USD, GBP, EUR, CNH, JPY, SGD, CAD, NZD, HKD & AUD

Collect overseas funds from marketplaces & payment gateways like Amazon and Stripe

Hold funds to pay suppliers and repatriare sales with ease at a great exchange rate

Use the funds you've collected to book prefunded spot contracts

Make transfers online 24/7 or through your dedicated acccount manager

Platform & Currency

WorldFirst supports more than 40 popular e-commerce platforms (Worten, Wayfair, Walmart, Shopline, AliExpress, etc.) and 30 payment gateways worldwide and supports 10 major global currencies: GBP, USD, CAD, JPY, EUR, NZD, SGD, AUD, HKD, and CNH.

Exchange Rates & Fees

Exchange rate

Despite adding a margin on their exchange rates, WorldFirst rates are still generally more competitive compared to banks. WorldFirst also has an exchange rate calculator on their webiste, but this does not accurately show the rates they offer for your personal transaction. They quote the interbank rate, which is not the rate you can make a transfer at.

Transfer Fees

Exchange rates are realtime and priced about 2% above the mid-market rate. The pricing comprises pay anything between $10 and $30 depending on the amount being transferred. Private clients transacting $100,000 and above do not pay any transfer fees.

Margin Fee

WorldFirst does not charge any fees for personal wire transfers and payments. However, businesses pay anything between $10 and $30 depending on the amount being transferred. Private clients transacting $100,000 and above do not pay any transfer fees.

WorldFirst charges a margin fee on currency exchanges, which is typically 0.60% or less. The margin fee represents the difference between the exchange rate offered by WorldFirst and the interbank exchange rate. This fee is transparently disclosed to clients before executing a transaction, allowing them to see the exact cost of the currency conversion.

No Collection/Receiving Fees

No Account Management Fees

WorldFirst does not charge any fees for collecting or receiving funds into your WorldFirst account. This means that you can receive money from your customers or business partners without incurring additional charges.

No Opening Local Currency Receiving Accounts Fees

WorldFirst does not impose any account management fees. Whether you have an individual or business account, you can maintain and manage your account without any recurring charges.

No Holding Fees for Currency Receiving Accounts

WorldFirst provides the convenience of opening local currency receiving accounts in multiple countries. These accounts allow you to receive funds in local currencies, making it easier to transact with international clients or suppliers. WorldFirst does not charge any fees for opening and maintaining these accounts.

If you choose to hold funds in your WorldFirst currency receiving accounts, there are no fees associated with this service. This means you can hold multiple currencies in your account without incurring any additional costs.

It's important to note that while WorldFirst strives to keep their fees competitive and transparent, currency exchange rates can fluctuate, which may affect the total cost of your transactions. It's recommended to review the specific fee details and exchange rates provided by WorldFirst for your specific currency transfers before proceeding with any transactions.

Overall, WorldFirst aims to provide cost-effective solutions for international money transfers, ensuring that their fee structures are transparent and that clients have a clear understanding of the costs involved in their currency exchanges.

Payment Methods

Debit Cards

Oonline/Telephone Banking

BACS

Direct Debit

CHAPS

When sending money using WorldFirst, you payment options are limited to bank transfers. In Fact, if you don't have a bank accont, it becomes almost impossible to transfer money through WorldFirst. The following are the payment methods you can use:

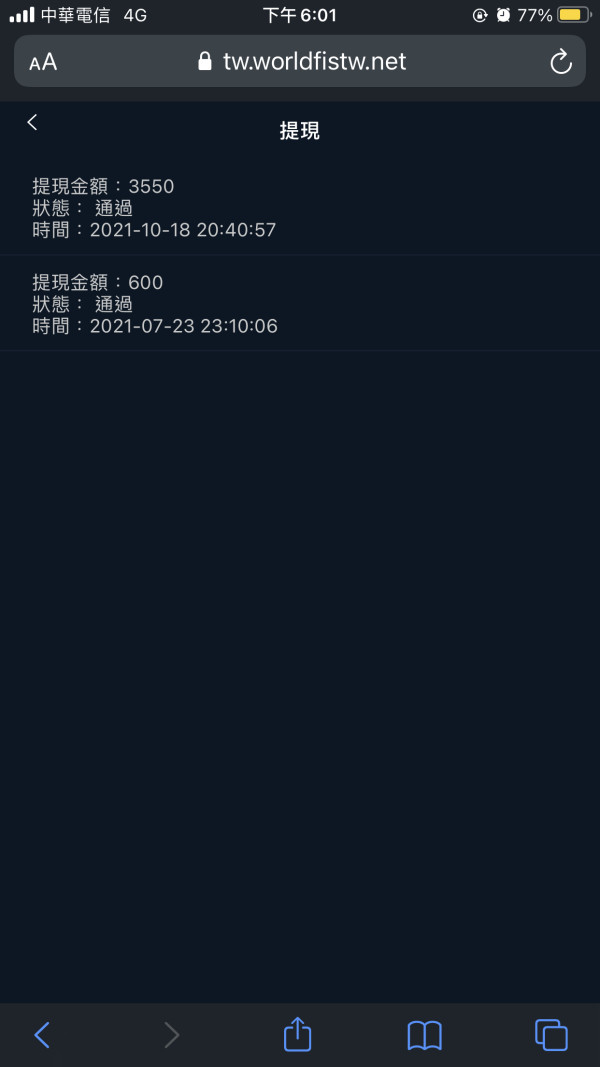

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

WorldFirst provides customer service through various channels, including live chat, phone, and email. They can directly get in touch with this company through telephone in different regions. Lines are open 8 am until 6 pm Monday to Thursday and 8 am until 5.30 pm Friday AEST/AEDT time. Local call rates and charges apply.

To further support their users, WorldFirst offers an FAQ section on their website. This comprehensive resource provides answers to frequently asked questions, covering various aspects of their services and platform. Traders can refer to the FAQ section for quick solutions to common issues or to gain a better understanding of WorldFirst's offerings.

Additionally, WorldFirst maintains a presence on various social media platforms, including Twitter, Facebook, YouTube, and LinkedIn. By following WorldFirst on these networks, users can stay updated on the latest news, announcements, and educational content shared by the broker. It provides an additional avenue for traders to connect with WorldFirst and engage in community discussions.

With their commitment to offering multiple customer service channels, comprehensive FAQ support, and active social media presence, WorldFirst aims to provide responsive and accessible assistance to their traders. Their customer service team strives to address inquiries promptly, deliver helpful solutions, and ensure a positive user experience for all their clients.

| Pros | Cons |

| • Dedicated Support | • No 24/7 support |

| • Multiple Contact | |

| • Lice chat support | |

| • FAQ available | |

| • Active social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with WorldFirst's customer service.

Education

WorldFirst provides a range of educational resources to help traders enhance their understanding of currency exchange and international payments. One of the educational features offered is a comprehensive gossary. This glossary includes key terms and definitions related to the foreign exchange market, allowing traders to familiarize themselves with the terminology used in the industry. By having access to a glossary, users can gain a better understanding of concepts and terms frequently encountered in their trading activities.

In addition to the glossary, WorldFirst also offers guides that provide in-depth information on various topics related to currency exchange and international payments. These guides serve as valuable resources for traders who want to expand their knowledge and make more informed decisions. The guides cover a wide range of subjects, such as market analysis, risk management strategies, currency trends, and practical tips for navigating the world of foreign exchange. By providing these guides, WorldFirst aims to empower traders with the knowledge and tools necessary to navigate the complexities of the currency market effectively.

Conclusion

Overall, WorldFirst is a reputable currency exchange and international payments provider with competitive exchange rates and dedicated customer support. While there are a few potential drawbacks, their commitment to security, expertise, and issue resolution make them a viable option for individuals and businesses in need of international payment services. It is always recommended for individuals to carefully consider their specific requirements and conduct thorough research before choosing any financial service provider.

Frequently Asked Questions (FAQs)

| Q 1: | Is WorldFirst regulated? |

| A 1: | Yes. It is regulated by Australia Securities & Investment Commission (ASIC, No. 331945). |

| Q 2: | At WorldFirst, are there any regional restrictions for traders? |

| A 2: | Yes. US clients are excluded. |

| Q 3: | Does WorldFirst charge fees for payments or wire transfers? |

| A 3: | WorldFirst's payouyment fees are determined by factors including the location where you and your payee are based and the currency you want to convert to. |

| Q 4: | How much can I transact with WorldFirst? |

| A 4: | Corporate clients and online sellers have no minimum transfer amounts. WorldFirsthas no minimum transfer amounts, but the transfer amounts between $2,000 and $9,999 will incur an AUD $10 fee and the transfer amount less than $2,000 will incur an AUD $20 fee. |

| Q 5: | How much does the account cost? |

| A 5: | It's free to open an account and WorldFirst does not charge any fees for receiving money or any ongoing subscription costs. |

| Q 6: | How long does a transfer take? |

| A 6: | This depends a few things, including the currency you're sending or buying, the bank used and the size of the transaction. |

| Q 7: | Can I make a same-day payment? |

| A 7: | You can book a same-day transfer for a large number of currencies and earlier you book your trade, the better. To make a same-day outgoing payment in EUR/USD or GBP, you will need to have your cleared funds with this company by the 15:00 Sydney time. For payments to Australia and New Zealand cleared funds must be received by 13:00 Sydney time. |

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now