Score

LPL Trade

Saint Lucia|2-5 years|

Saint Lucia|2-5 years| https://www.lpltrade.com

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+1 900232390

Other ways of contact

Broker Information

More

LPL Trade Ltd

LPL Trade

Saint Lucia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | -- |

| Minimum Spread | from 1.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed LPL Trade also viewed..

XM

VT Markets

STARTRADER

FP Markets

LPL Trade · Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| LPL Trade Review Summary in 10 Points | |

| Founded | 2021 |

| Registered Country/Region | China |

| Regulation | No license |

| Market Instruments | Currency pairs, commodity, stocks, crypto CFDs, thematic investment |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | From 1.1 pips (Standard) |

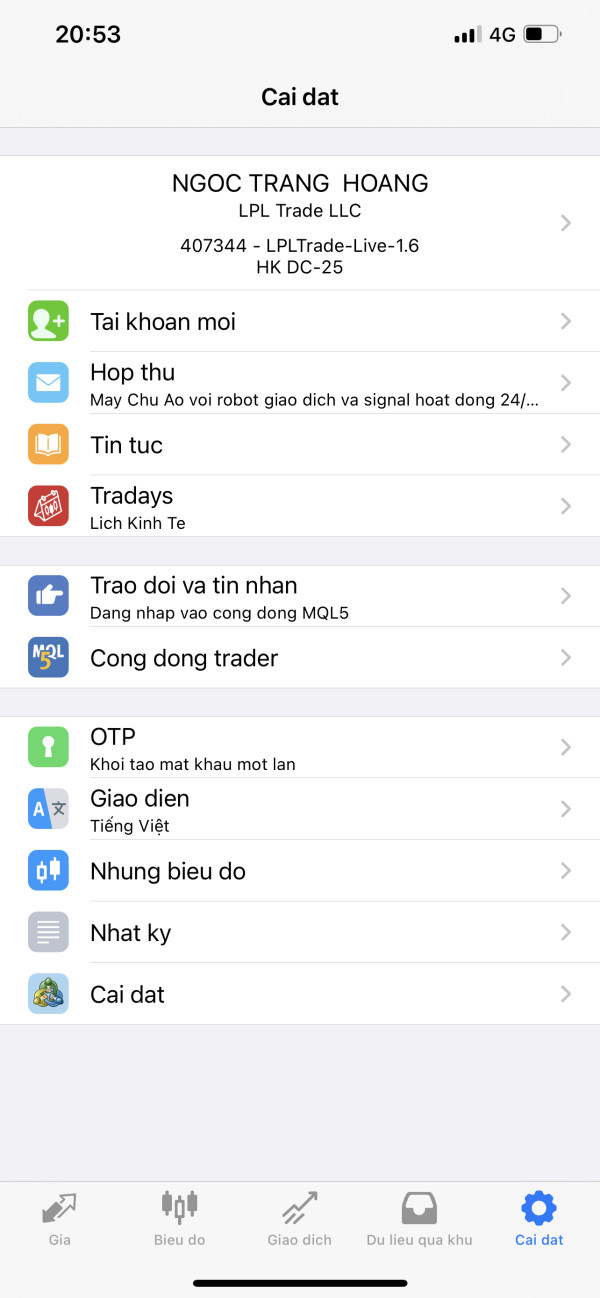

| Trading Platforms | MT4 |

| Minimum deposit | N/A |

| Customer Support | 24/5 email |

What is LPL Trade?

LPL Trade is a forex and CFD broker that provides a range of trading instruments, including currency pairs, commodities, stocks, and cryptocurrencies. The company offers three live account types, with variable and fixed spreads, as well as zero-spread trading, and leverage up to 1:400. LPL Trade's trading platform of choice is the popular MetaTrader 4, available for desktop, mobile, and web trading. However, the broker does not hold a valid regulatory license, which raises concerns about the safety and reliability of the company.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

LPL Trade has some potential advantages such as a diverse range of trading instruments, the availability of demo accounts, and the MT4 trading platform.

However, there are also some concerns, including the fact that the broker does not hold any valid regulatory licenses, reports of issues with withdrawals, and lack of information on deposit/withdrawal. Traders should exercise caution and thoroughly research before investing with LPL Trade.

| Pros | Cons |

| • Wide range of trading instruments | • No regulatory licenses |

| • Offers demo accounts | • Client complaints of withdrawal issues |

| • Multiple account types to choose from | • Website only available in English and Vietnamese |

| • Variable and fixed spreads offered | • No information available on deposit/withdrawal |

| • MetaTrader 4 supported | • Limited customer support options |

| • Educational materials available |

Please note that this table is based on the available information and is not an exhaustive list of all the pros and cons of LPL Trade. It is important to conduct your own research and exercise caution when investing with any broker.

LPL Trade Alternative Brokers

OANDA - With a long history, robust trading platforms, and a wide range of trading instruments, OANDA is a reputable choice for both novice and experienced traders.

Tasman FX - With a focus on transparency and competitive pricing, Tasman FX may be a good choice for traders looking for a broker with a strong commitment to ethical business practices.

LIGHT FX - With a range of account types and a variety of trading instruments, LIGHT FX may be a good choice for traders looking for flexibility in their trading experience.

There are many alternative brokers to LPL Trade depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is LPL Trade Safe or Scam?

Based on the information available, it is not possible to determine with certainty whether LPL Trade is safe or a scam. However, the fact that they do not hold any valid regulatory licenses is a cause for concern, and the client complaints of being unable to withdraw funds should not be ignored.

It is important to exercise caution when dealing with unregulated brokers, as there is a higher risk of fraudulent activity. It is recommended to thoroughly research and evaluate any broker before investing with them, and to only choose regulated brokers that comply with industry standards and regulations.

Market Instruments

As LPL Trade is an unregulated broker, it is important to note that the information provided about their market instruments may not be reliable. According to their website, LPL Trade offers a range of trading instruments across various asset classes, including currency pairs such as EUR/USD and GBP/USD, commodities such as gold and crude oil, stock indices such as S&P 500, Dow Jones and Euro Stoxx 50, as well as crypto CFDs such as Bitcoin and Ethereum.

They also offer thematic investment options such as 5G, Cloud Computing and E-Sports. However, as an unregulated broker, there may be concerns about the transparency and safety of trading with LPL Trade.

Accounts

LPL Trade offers a range of live accounts to cater to the different needs of traders, including the Fixed, Standard VIP and Zero VIP accounts. However, there is no information about the minimum deposit requirement. LPL Trade also provides a demo account for traders to practice trading with virtual funds before committing to a live account.

Leverage

LPL Trade offers high leverage of up to 1:400, which can be attractive for traders looking to maximize their trading potential. However, it is important to remember that higher leverage also means higher risk, and traders should exercise caution when using leverage in their trading strategies. It is important to carefully manage risk and use appropriate risk management tools such as stop loss orders to help mitigate potential losses. Additionally, traders should also consider their own risk tolerance and financial situation before using high leverage.

Spreads & Commissions

LPL Trade offers different spreads and commissions depending on the account type. The Fixed account has a fixed spread of 1.8 pips, while the Standard VIP account has a variable spread of 1.1 pips. The Zero VIP account has zero spreads, but an unspecified minimal commission.

It is important to note that different instruments may have different spreads and commissions. Additionally, the lack of clarity on the commission for the Zero VIP account may be a concern for some traders. Overall, traders should carefully consider the costs associated with each account type before making a decision.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| LPL Trade | 1.1-1.8 pips | No commission (Fixed & Standard VIP), unspecified minimal commission (Zero VIP) |

| OANDA | 0.9-1.3 pips | No commission |

| Tasman FX | 0.3-0.7 pips | No commission |

| LIGHT FX | 1.6-2.0 pips | No commission |

Note: Spreads can vary depending on market conditions and volatility.

Trading Platforms

LPL Trade provides its clients with access to the MetaTrader 4 (MT4) platform, which is a widely recognized and popular trading platform in the forex and CFDs industry. MT4 is available for desktop, mobile, and web, providing traders with the flexibility to trade from anywhere at any time. The platform is user-friendly, customizable, and supports multiple order types, automated trading, and advanced charting tools.

See the trading platform comparison table below:

| Broker | Trading Platform |

| LPL Trade | MT4 |

| OANDA | OANDA Trade |

| Tasman FX | MT4 |

| LIGHT FX | MT4 |

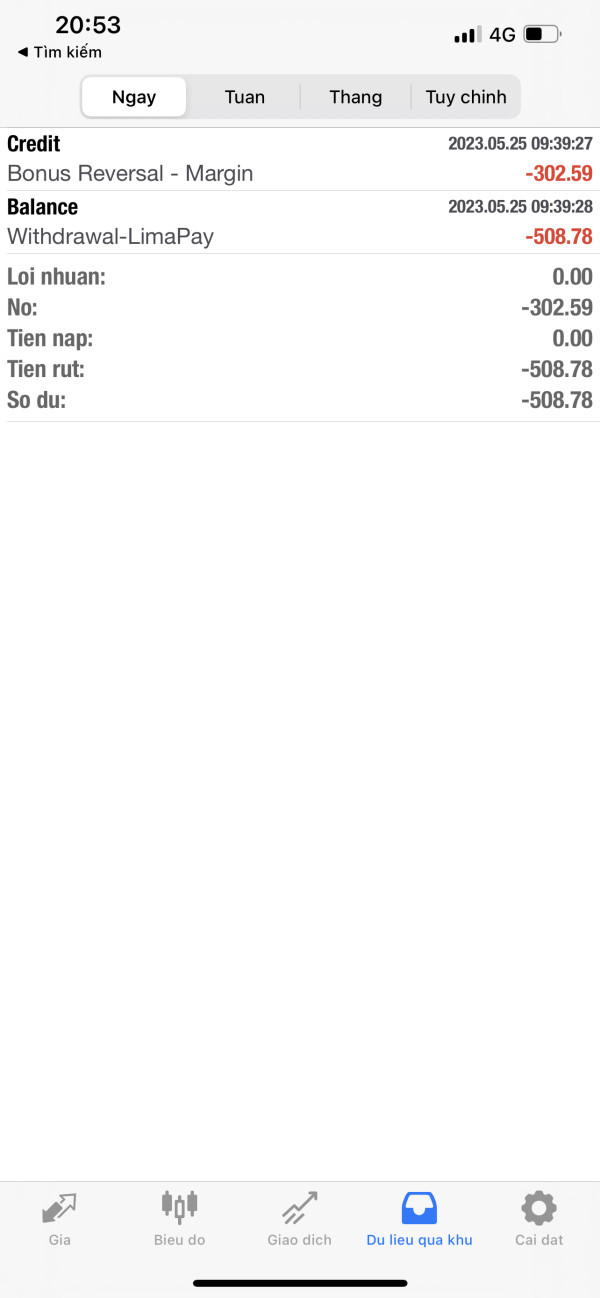

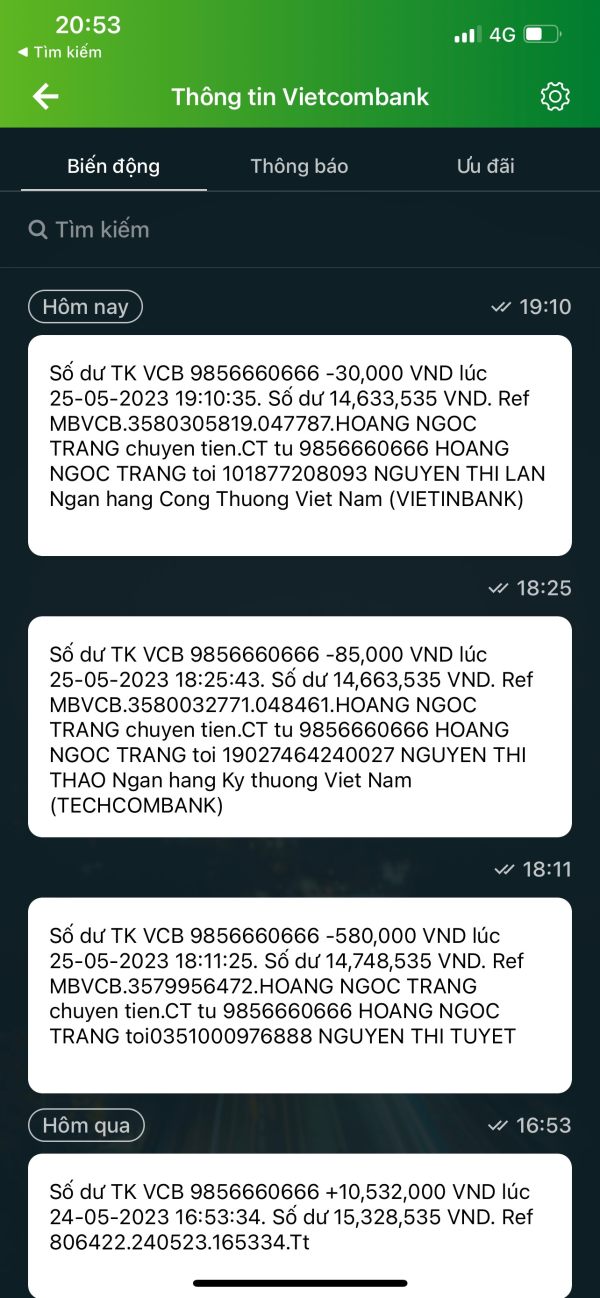

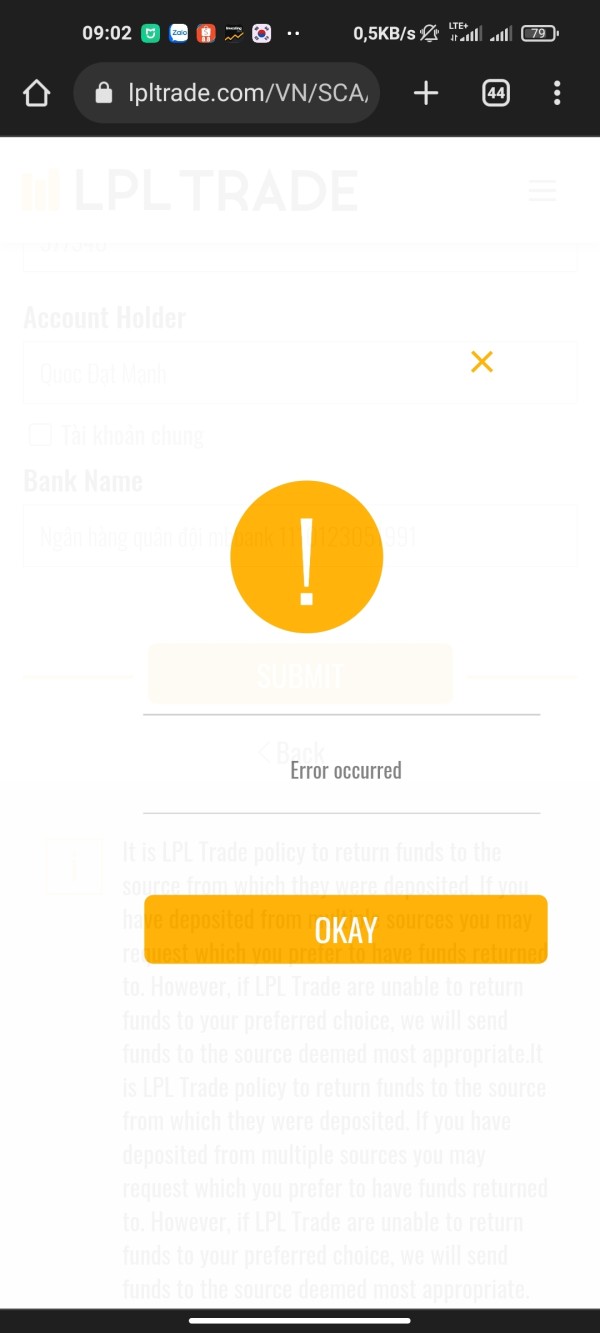

Deposits & Withdrawals

As there is no information provided on LPL Trade's website regarding deposit and withdrawal methods, fees, and processing times, it is difficult to assess their deposit and withdrawal services. This lack of transparency in financial transactions can be a red flag for potential investors, as it is essential to know the fees and processing times associated with any financial transaction before investing. It is recommended to contact LPL Trade's customer support to get more information on their deposit and withdrawal procedures.

LPL Trade minimum deposit vs other brokers

| LPL Trade | Most other | |

| Minimum Deposit | N/A | $100 |

Customer Service

LPL Trade offers 24/5 customer support via email. Their website only supports English and Vietnamese, which could be a limitation for non-native speakers. However, they do have an FAQ section, which can provide helpful information.

| Pros | Cons |

| • 24/5 customer support | • No 24/7 customer support |

| • FAQ offered | • No multilingual support |

| • No live chat or phone support | |

| • No social networks support |

Note: These pros and cons are subjective and may vary depending on the individual's experience with LPL Trade's customer service.

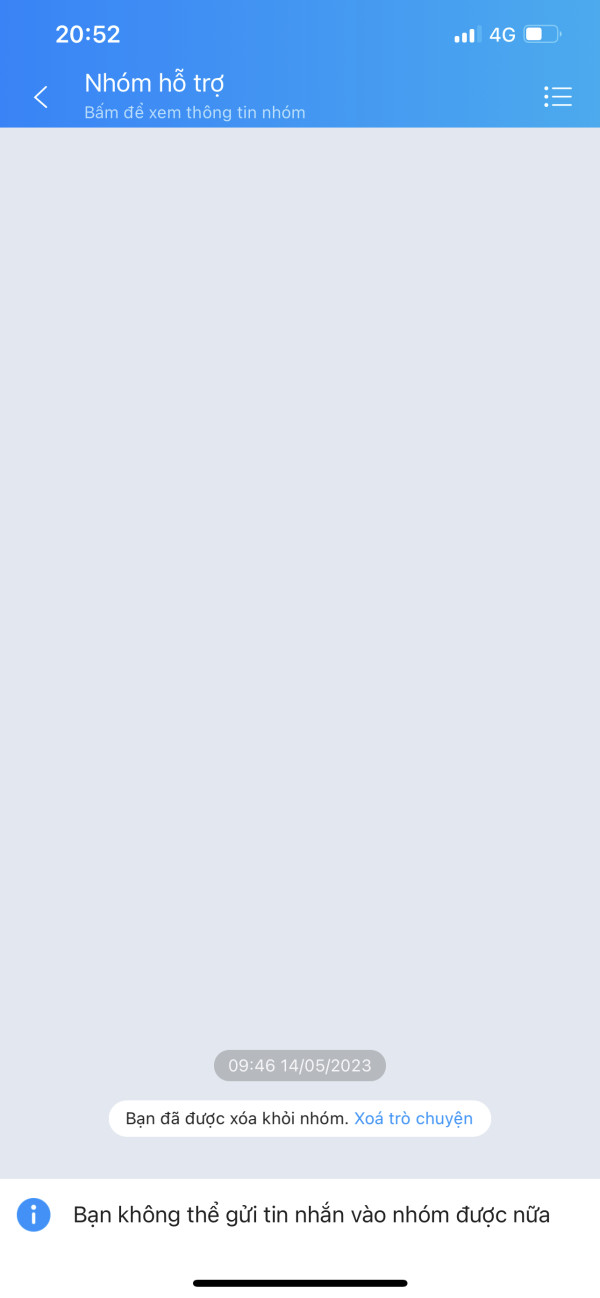

User Exposure on WikiFX

It is important to exercise caution when investing with any broker, and this includes LPL Trade. It is concerning to see a report of unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Education

There is limited information available regarding LPL Trade's educational offerings. However, the broker does offer a CFD glossary, which could be useful for beginners in understanding some of the terms commonly used in trading. In addition, they offer e-books on trading strategies and risk management. While these resources are a good starting point, traders may need to look elsewhere for more comprehensive educational materials.

Conclusion

Based on the available information, LPL Trade has some positive aspects, such as offering a wide range of trading instruments and leverage up to 1:400. However, there are some concerns regarding the lack of regulation and reports of clients being unable to withdraw their funds. Additionally, the information available on their website regarding deposit/withdrawal methods is limited, and the customer support options are also limited to email. Overall, it is important to exercise caution when considering investing with LPL Trade, and it may be wise to explore other more established and regulated brokers.

Frequently Asked Questions (FAQs)

| Q 1: | Is LPL Trade regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At LPL Trade, are there any regional restrictions for traders? |

| A 2: | Yes. LPL Trade does not provide services for the residents of certain countries and jurisdictions, such as the United States of America, Canada, Japan, Indonesia, Turkey, Israel and the Islamic Republic of Iran, and contrary to the local law and regulations. |

| Q 3: | Does LPL Trade offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does LPL Trade offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | Is LPL Trade a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Though it advertises well, it lacks valid regulatory license, and even no information on the minimum deposit requirement. |

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now