简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

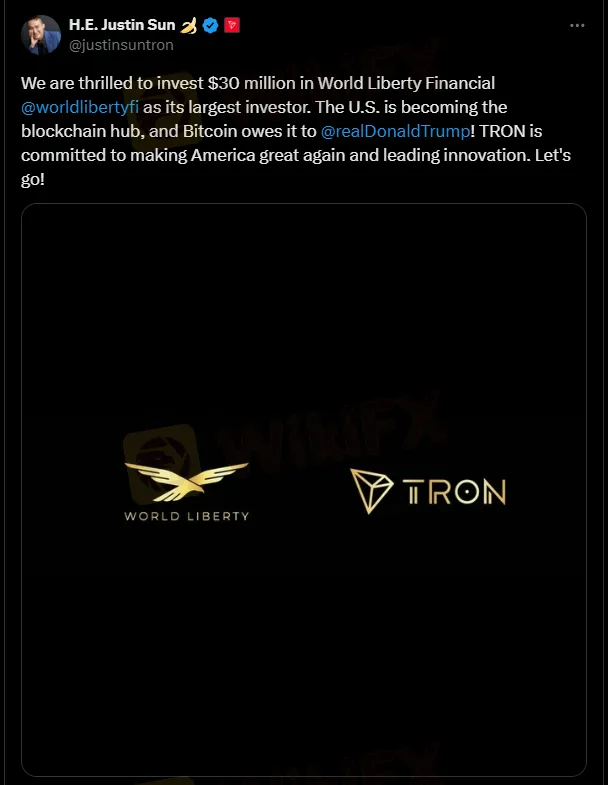

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Abstract:Crypto company World Liberty Financial, backed by Donald Trump, secures a $30M investment from Justin Sun, making him its largest investor.

Justin Sun, a cryptocurrency entrepreneur, has invested $30 million in World Liberty Financial, a crypto business with links to President-Elect Donald Trump. According to Bloomberg on November 25, this move makes Sun the biggest investor in the cryptocurrency initiative.

Sun, who is well-known for his blockchain endeavors, commented on X, stating, “The United States is becoming the blockchain center, and Bitcoin owes it to @realDonaldTrump! TRON is dedicated to remaking America great and driving innovation.”

Sun's portfolio includes firms such as Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry.

In reaction to Sun's backing, World Liberty Financial voiced its excitement: “The U.S. is becoming the blockchain hub, and Bitcoin owes it to @realDonald Trump!” Sun said in a Monday post on X. “TRON is committed to making America great again and leading innovation.”

Trump first became involved in the cryptocurrency industry in September, when he staged a webcast to promote the industry Liberty Financial. During the broadcast, Trump said, “Crypto is one of the things we have to accomplish. Whether we like it or not, I am forced to do it.” Donald Jr. and Eric Trump were also involved in this endeavor.

Trump's social media firm, Trump Media & Technology (TMTG), has submitted a trademark application for a service called TruthFi. This platform would provide Bitcoin transactions, financial custody services, and digital asset trading. The application has been submitted, but there is no set date for its introduction.

Justin Sun's climb to prominence in the Bitcoin realm has not been without controversy. The Securities and Exchange Commission (SEC) charged Sun and his enterprises in March 2023. According to the SEC, Sun violated securities laws by making unregistered transactions and manipulating market volumes for Tronix (TRX) and BitTorrent (BTT). Sun has refuted the charges, claiming that the SEC's allegations are baseless.

Who is Justin Sun?

Justin Sun is a Chinese entrepreneur and the creator of TRON, a blockchain-based decentralized platform that enables digital content and decentralized applications. He purchased BitTorrent, a well-known peer-to-peer file-sharing system, in 2018. Sun, known for his daring marketing methods, rose to worldwide prominence in 2019 when he spent $4.6 million for a meal with billionaire Warren Buffett. Despite criticism for his business practices, Sun is still a significant player in the Bitcoin industry.

Last Thoughts

The rising influence of political leaders such as Trump in the cryptocurrency field highlights the growing integration of blockchain technology into conventional businesses. The future of digital currencies and decentralized platforms is growing increasingly politically and financially relevant, with big actors like Justin Sun and World Liberty Financial leading the way. It needs to be seen if this will encourage innovation or invite further scrutiny.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

Elon Musk has issued a stark warning about the US's financial stability, suggesting that the country is heading toward bankruptcy "super-fast" unless drastic measures are taken. The billionaire's financial commentary comes amid Bitcoin's retreat from its anticipated $100,000 milestone. The cryptocurrency recently fell to just above $95,000, down from a high of $99,000.

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

UK FCA Fines Barclays £40 Million Over 2008 Deal

The UK FCA imposes a £40 million fine on Barclays for failing to disclose critical information about its 2008 capital raising with Qatari entities.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator