Score

Ivision Market

Saint Lucia|2-5 years|

Saint Lucia|2-5 years| https://www.ivisionmarket.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

France

FranceContact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+971 50-357-1984

Other ways of contact

Broker Information

More

Ivision Market Limited

Ivision Market

Saint Lucia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:300 |

| Minimum Deposit | $5000 |

| Minimum Spread | from 0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $1000 |

| Minimum Spread | from 1.4 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $5 |

| Minimum Spread | from 1.9 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Ivision Market also viewed..

XM

VT Markets

AUS GLOBAL

CPT Markets

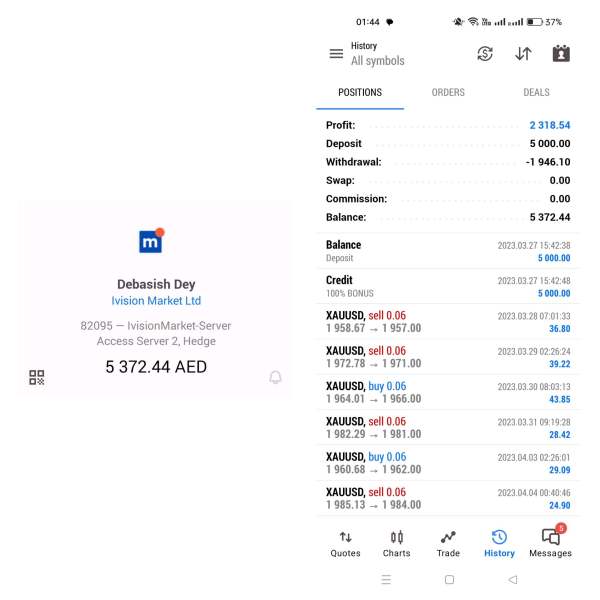

Ivision Market · Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 1-2 years |

| Company Name | IVision Market |

| Regulation | Regulated in United States, Crypto-Licence |

| Minimum Deposit | $5 (Micro Account), $1000 (Standard Account), $5000 (Spread Account) |

| Maximum Leverage | Up to 1:1000 (Micro Account), Up to 1:500 (Standard Account), Up to 1:300 (Spread Account) |

| Spreads | Starting from 1.9 pips (Micro Account), 1.4 pips (Standard Account), 0 pips (Spread Account) |

| Trading Platforms | MetaTrader 5 (MT5), IVision Market Mobile App |

| Tradable Assets | Cryptocurrencies, Precious Metals, Energies, Shares, Indices |

| Account Types | Micro Account, Standard Account, Spread Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | 24/7 availability |

| Deposit Methods | Bank transfers, Credit/debit cards, Digital wallets, Local payment options |

| Withdrawal Methods | Bank transfers, Credit/debit cards, Digital wallets, Local payment options |

| Trading Tools | Economic Calendar, Live Charts, Live Prices, News & Analysis |

Overview:

IVISION MARKET offers a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. Traders have the flexibility to choose from different account types based on their trading preferences and investment size. These accounts provide various benefits such as tight spreads, high leverage options, and market execution.

To facilitate smooth trading operations, IVISION MARKET offers two main trading platforms: their proprietary platform and MetaTrader 5 (MT5). The proprietary platform provides traders with advanced technical analysis tools, semi-automatic trading functionality, and a user-friendly interface. MT5, a popular trading platform, offers a comprehensive set of features, including extensive charting capabilities and automated trading options.

Traders on IVISION MARKET can access live charts, real-time prices, an economic calendar, and news updates. These tools enable traders to make informed decisions based on market analysis and stay updated on the latest market trends. Additionally, IVISION MARKET provides 24/7 customer support to assist traders with any inquiries or technical difficulties they may encounter.

While it offers many advantages, it's essential for traders to thoroughly review the platform's features, fees, and regulations to ensure it aligns with their trading goals. By visiting the official website or contacting customer support, traders can obtain more detailed and up-to-date information regarding IVISION MARKET's offerings.

Pros and Cons

IVISION MARKET offers several advantages and disadvantages that are important to consider before choosing it as your trading platform. Here's a table summarizing the pros and cons of IVISION MARKET:

| Pros | Cons |

| Wide range of trading instruments | Limited educational resources and research tools |

| Multiple trading platforms (proprietary and MetaTrader 5) | Limited information on account types and features |

| Free resources such as economic calendar, live charts, and news | Limited customer support availability |

| User-friendly interface and intuitive navigation | Lack of regulatory information |

| 24/7 customer support | Limited deposit and withdrawal options |

Is Ivision Market Legit?

Based on the information provided, the regulatory status of IVISION MARKET LTD appears to be unauthorized according to the National Futures Association (NFA) in the United States. The NFA is a regulatory agency that oversees futures and derivatives trading. IVISION MARKET LTD is listed as having a common financial service license regulated by the United States with license number 0553552. However, the NFA has determined that this broker exceeds the business scope regulated by the NFA, specifically the UNFX Non-Forex License. As a result, the NFA has classified the regulatory status of IVISION MARKET LTD as unauthorized.

Additionally, IVISION MARKET LTD is mentioned in relation to the Financial Crimes Enforcement Network (FinCEN) in the United States. However, no specific regulatory information is provided in this regard.

It's important to note that the information provided is limited and does not provide a comprehensive overview of the regulatory status of IVISION MARKET LTD. It's recommended to consult official regulatory sources and conduct further research to obtain more accurate and up-to-date information on the regulatory status and legitimacy of the IVISION MARKET.

Market Instruments

IVISION MARKET offers a range of market instruments for trading. Here are some of the instruments mentioned in the provided information:

1. Crypto-Currency Trading: IVISION MARKET allows traders to trade a wide range of cryptocurrencies as CFDs (Contracts for Difference). The available cryptocurrencies include Bitcoin, Ether, Ripple, Litecoin, Dash, and Monero, traded against the USD dollar and other popular digital currencies.

2. Precious Metals: Traders can also trade precious metal pairs, including Gold, Silver, Platinum, and Palladium. These instruments provide an opportunity to diversify portfolios and react to global events or economic conditions.

3. Energies Trading: IVISION MARKET offers trading of Spot Energies such as Brent oil, WTI (West Texas Intermediate) crude oil, and Natural Gas. Traders can diversify their portfolios by including energy commodities.

4. Shares Trading: IVISION MARKET provides the option to trade share CFDs (Contracts for Difference) on more than 9,400 global shares, including popular stocks like Apple, BP, Lloyds Banking Group, Tesco, Rio Tinto, and many more. Traders can take positions on these shares without owning the underlying assets.

5. Indices Trading: IVISION MARKET enables trading of CFDs on over 90 cash and forward indices instruments worldwide. This includes indices like Germany 30, UK 100, and US 30. Traders can speculate on the price movements of these indices.

It's important to note that the provided information might not cover the full range of market instruments offered by IVISION MARKET. For more comprehensive and up-to-date details, it's advisable to visit their official website or contact their customer support.

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments | Unauthorized regulatory status |

| Availability of crypto-currency trading | Lack of specific regulatory information |

| Option to trade precious metals | Limited information on trading conditions |

| Opportunity to trade energy commodities | Limited information on customer support |

| Access to global share CFDs | Potential risk associated with unauthorized status |

| Trading options on various indices | Lack of detailed information on trading hours |

| Limited information on margin rates and commissions | |

| Limited information on minimum spreads |

Account Types

IVISION MARKET offers different types of trading accounts to cater to various trading styles and preferences. Here are the account types described in paragraphs:

1. MICRO ACCOUNT: The Micro Account is designed for traders who prefer to start with a smaller initial investment. With a minimum deposit of $5, this account offers tight floating spreads and maximum leverage of up to 1:1000. Market execution is employed, ensuring fast order execution. The spreads start from 1.9 pips, and traders can benefit from 24/7 support for any assistance they may require.

2. STANDARD ACCOUNT: The Standard Account is suitable for traders who have a moderate level of experience and are ready to commit a higher initial investment. With a minimum deposit requirement of $1000, this account provides tight floating spreads and maximum leverage of up to 1:500. Similar to the Micro Account, it operates with market execution, offering quick order execution. The spreads start from 1.4 pips, and traders have access to 24/7 support.

3. SPREAD ACCOUNT: The Spread Account is designed for traders who prioritize trading with zero spreads or very low spreads. It requires a minimum deposit of $5000. With this account, traders can benefit from tight floating spreads, with spreads starting from 0 pips. The maximum leverage is up to 1:300, and market execution ensures fast order execution. As with the other accounts, 24/7 support is available for any inquiries or assistance.

It's important to note that the provided information on account types is limited, and it's advisable to visit the official website of IVISION MARKET or contact their customer support for more detailed and up-to-date information regarding the features, terms, and conditions of each account type.

Pros and Cons

| Pros | Cons |

| Multiple account options | Limited information on specific trading conditions |

| Micro Account with low minimum deposit | Limited information on additional account features |

| Tight floating spreads | Lack of detailed information on trading platform |

| High leverage options | Potential risk associated with high leverage levels |

| Market execution for fast order execution | Limited information on account funding and withdrawal methods |

| 24/7 support availability | Limited information on additional account benefits |

How to Open an Account?

To open an account with IVISION MARKET, follow these steps:

1. Choose a Platform: IVISION MARKET offers its proprietary platform with over 80 technical indicators and semi-automatic trading functionality, as well as MetaTrader 5 (MT5), a popular trading platform with advanced analysis tools. Decide which platform suits your trading needs and preferences.

2. Create Your Account: Click on the “Open Demo Account” or “Open Live Account” button to begin the account creation process. You have the option to open a free demo account for practice or a live account for real trading. Fill in the required information, including your name, phone number, city, zipcode, deposit amount (for live account), email address, address, state, country, and leverage (for live account).

3. Register, Verify, and Fund: Complete the registration process by providing the necessary details. You may be required to verify your identity and account through a verification process, which may involve submitting identification documents. Once your account is verified, you can proceed to fund your account using the available deposit methods supported by IVISION MARKET.

4. Start Trading: Once your account is funded, log into the platform (IVISION MARKET's proprietary platform or MT5) using your newly created account credentials. Familiarize yourself with the platform, add your desired financial instruments, and start trading on the global markets.

It's important to note that the provided steps are a general overview based on the available information. The actual account opening process may involve additional steps or requirements. For more accurate and detailed instructions, it's recommended to visit the IVISION MARKET website or contact their customer support for assistance.

Leverage

IVISION MARKET offers leverage to its clients, allowing them to trade larger positions in the market with a smaller amount of capital. Leverage is a common feature in the financial markets and can amplify both potential profits and losses.

The leverage provided by IVISION MARKET may vary depending on the account type and the financial instrument being traded. In the information provided, the leverage options mentioned for different account types are as follows:

- Micro Account: Maximum leverage up to 1:1000

- Standard Account: Maximum leverage up to 1:500

- Spread Account: Maximum leverage up to 1:300

The leverage ratio represents the multiple by which a trader can increase their exposure to the market compared to the amount of capital they have in their account. For example, with a leverage of 1:1000, a trader can control a position size 1000 times larger than their account balance. This can potentially amplify profits if the trade moves in their favor, but it also increases the risk of losses.

Traders interested in using leverage should familiarize themselves with IVISION MARKET's specific leverage policies, as they may have certain restrictions or requirements in place. It's always advisable to review the leverage terms and conditions provided by IVISION MARKET and seek professional advice if needed.

Pros and Cons

Spreads

IVISION MARKET offers tight floating spreads across its different account types, ensuring that traders can enter and exit positions at competitive prices. The spreads vary depending on the account type and the financial instrument being traded. The Micro Account provides spreads starting from 1.9 pips, while the Standard Account offers spreads starting from 1.4 pips. The Spread Account is designed for traders who want to trade with zero spreads or very low spreads, and as such, it provides spreads starting from 0 pips.

It's important to note that trading conditions are subject to change and may vary depending on market volatility and liquidity. Traders should stay up-to-date with the latest market news and announcements to make informed trading decisions.

Fees & Commissions

IVISION MARKET has a policy of NO commissions on trading and only charges spreads on trades. Spreads are the difference between the bid and ask price, and the amount of spread depends on the trading account type and market conditions.

The deposit and withdrawal fees vary depending on the payment method and currency used. Bank wire transfers are free for both deposit and withdrawal, but they may take 1-5 business days to process. Credit/debit cards and digital payment methods have NO deposit fees and are instant, but some withdrawal methods may have fees, and the processing time may vary.

IVISION MARKET offers a range of local payment methods that have no deposit fees and fast processing times. The withdrawal fees for local payment methods are also free, and the processing time is usually within an hour.

Pros and Cons

| Pros | Cons |

| Free deposits and withdrawals | Limited information provided |

| No fees/commissions for most payment methods | Processing time for bank transfers may take longer |

| Limited currency options for certain payment methods |

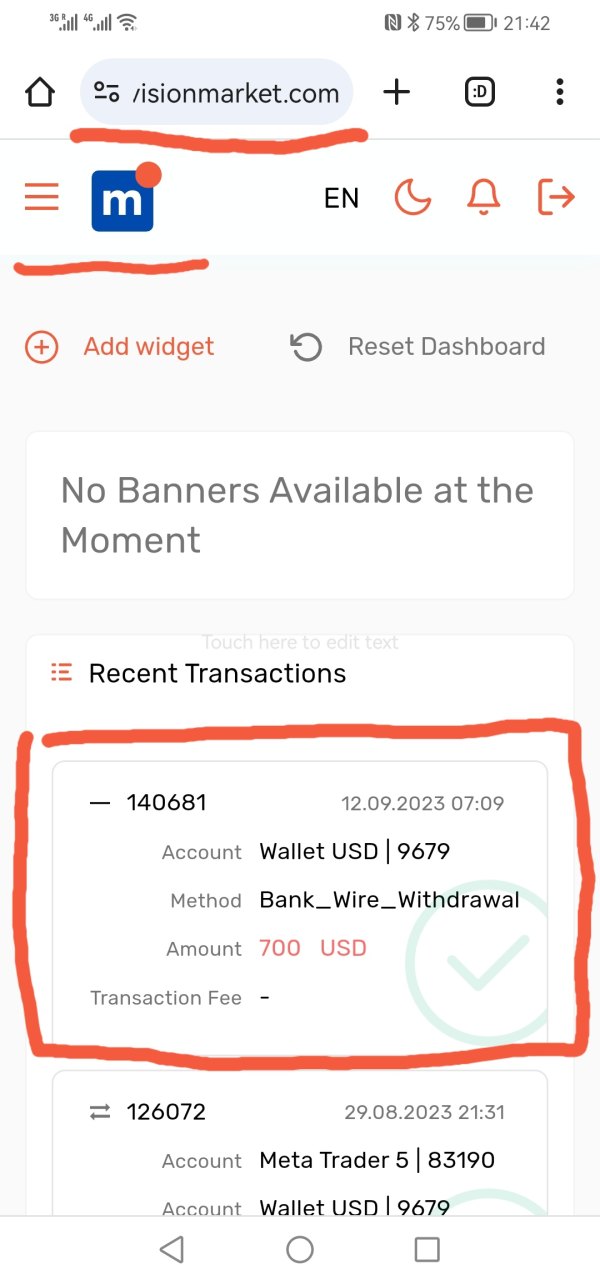

Deposit & Withdraw

IVISION MARKET offers a variety of deposit and withdrawal options for its clients. The broker provides different methods to suit the needs of traders in various countries, including digital wallets, credit/debit cards, bank transfers, and local payment options.

Depositing funds into an IVISION MARKET account is straightforward and can be done through multiple methods. Clients can use bank transfers or credit/debit cards such as Visa, Mastercard, and Maestro to deposit funds instantly. The broker offers zero deposit fees for all deposit methods, and the processing time is almost instant for digital wallet deposits. However, bank transfer deposits can take up to five business days to process.

For withdrawal, IVISION MARKET offers the same range of payment options as deposits, and the processing time is also generally quick. Withdrawal requests are processed within 24 hours of the request, but the actual time it takes for the funds to reach the client's account can vary depending on the payment method used. IVISION MARKET does not charge withdrawal fees, but it is worth noting that fees may be incurred by the payment provider or bank.

However, it is essential to keep in mind that processing times and fees may vary depending on the payment method used and the trader's location.

Pros and Cons

| Pros | Cons |

| Multiple deposit options | Potential processing time for bank transfers |

| Instant deposits with credit/debit cards | Limited local deposit options for specific currencies |

| Free deposits and withdrawals | Withdrawal processing time of 1-5 business days for bank transfers |

| Convenient digital payment methods | Limited currency options for certain methods |

| User-friendly and secure transfer of funds |

Trading Platforms

IVISION MARKET offers a range of trading platforms to cater to the diverse needs of its traders. The primary trading platform is MetaTrader 5 (MT5), which is available for Windows, Mac OS, Android, and iOS devices. Additionally, IVISION MARKET provides its own proprietary trading platform, Ivision Market Mobile App.

MT5 for Windows and Mac OS offers a comprehensive set of tools and features for traders. It allows traders to access a wide range of financial instruments, including forex, stocks, commodities, and indices. The platform provides advanced charting capabilities, over 80 technical indicators, and various timeframes for in-depth technical analysis. Traders can execute market, limit, stop, and OCO (One-cancels-the-other) orders to manage their trades effectively. The platform ensures a fast and secure transfer of funds to traders' accounts, providing a seamless trading experience.

MT5 for Android and iOS enables traders to access the financial markets on their mobile devices. The mobile app offers a user-friendly and intuitive interface, allowing traders to trade on the go. Traders can monitor their positions, analyze charts, and execute trades directly from their mobile devices. The app provides real-time quotes, customizable price alerts, and push notifications to keep traders informed about market movements. Additionally, traders can access free resources such as daily technical analysis, an economic calendar, and more to stay updated on market events.

In addition to MT5, IVISION MARKET also offers its proprietary trading platform, Ivision Market Mobile App. This platform is designed to provide traders with a seamless trading experience across different devices, including mobile, desktop, and web. The platform offers a wide range of trading instruments, advanced charting tools, and semi-automatic trading functionality. Traders can customize their trading environment, set up their preferred indicators, and execute trades with ease.

Overall, IVISION MARKET's trading platforms, including MT5 and Ivision Market Mobile App, provide traders with a comprehensive set of tools, advanced features, and a user-friendly interface. Whether traders prefer trading on their desktop or mobile devices, IVISION MARKET offers flexible and reliable platforms to meet their trading needs.

Pros and Cons

| Pros | Cons |

| 1. Proprietary platform with advanced tools | 1. Limited platform options (only IVISION Market and MT5) |

| 2. Over 80 technical indicators available | 2. Limited platform support (no web version for MT5) |

| 3. Semi-automatic trading functionality | 3. Learning curve for new users |

| 4. Mobile, desktop, and web versions | |

| 5. User-friendly interface |

Trading Tools

IVISION MARKET offers a range of trading tools to assist traders in making informed decisions:

1. Economic Calendar: Stay updated on important economic events and news releases that can impact the markets.

2. Live Charts: Analyze real-time price movements and trends using customizable charts and technical analysis tools.

3. Live Prices: Access real-time market quotes to monitor bid and ask prices, enabling timely trading decisions.

4. News & Analysis: Stay informed with market insights, expert analysis, and the latest financial news for informed trading strategies.

Payment Methods

IVISION MARKET offers a variety of payment methods to cater to the diverse needs of its clients. These payment methods include bank wire transfer, credit/debit cards, and digital payment systems.

For bank wire transfers, clients can make deposits and withdrawals in AED, USD, or EUR. The company does not charge any fees or commissions for bank wire transfers, but clients should check with their banks as they may charge fees for such transactions. The processing time for bank wire transfers is usually 1-5 business days.

For credit/debit cards, IVISION MARKET accepts Visa, Mastercard, and Maestro. Clients can deposit funds in EUR, USD, or GBP with no fees or commissions. The processing time for credit/debit card deposits is instant, and clients can start trading immediately. Clients can also withdraw funds using their credit/debit cards, with the processing time being instant as well.

IVISION MARKET also supports digital payment systems such as Paytrust, Fastpay, GB Pay, and more. These payment systems are available for clients in various countries and currencies such as USD, MYR, IDR, THB, VND, and INR. Clients can make deposits and withdrawals using these digital payment systems with no fees or commissions, and the processing time is usually instant.

It's important to note that the availability of payment methods may vary depending on the client's country of residence. Clients are advised to check the IVISION MARKET website or contact customer support for the most up-to-date information on payment methods and their availability.

Customer Support

IVISION MARKET values customer support and aims to provide prompt and helpful assistance to its clients. There are multiple channels available for customers to contact the support team and seek clarification or assistance regarding their trading activities or any other inquiries they may have.

Email: Customers can reach out to IVISION MARKET's customer support team by sending an email to support@ivisionmarket.com. This provides a convenient and direct way to communicate with the support staff. Customers can expect a response to their inquiries within 24 hours.

Phone: IVISION MARKET offers a dedicated contact number for customer support. Customers can dial +971-50-357-1984 during the working hours specified, which are from Monday to Friday. By calling this number, customers can speak directly with a support representative and receive real-time assistance with their queries or concerns.

Registered Office: IVISION MARKET has a registered office located at 71-75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ. This physical address provides customers with a means to reach out to IVISION MARKET via traditional mail or visit the office if necessary.

Representative Oman Office: IVISION MARKET also has a representative office in Oman, located at Block no. 240, Way no. 4003, Building no. 1/A/19, North Alghobra, Muscat, Oman. This presence in Oman allows customers to have local support and assistance when needed.

Overall, IVISION MARKET strives to ensure that customers have access to reliable and responsive customer support. Whether customers prefer to contact the support team via email, phone, or through the registered office or representative office, IVISION MARKET is committed to addressing customer inquiries and providing assistance in a timely manner.

Conclusion

In conclusion, Ivision Market offers a range of advantages for traders, including a wide variety of trading instruments, a user-friendly trading platform, and a range of helpful trading tools and educational resources. The availability of multiple payment methods and low minimum deposit requirements also make it accessible for traders with varying levels of experience and investment capital.

However, there are also some disadvantages to consider. The fees and commissions for certain deposit and withdrawal methods may be higher than those of some competitors, and there may be some limitations in terms of account types and trading conditions. Additionally, the lack of regulation by major financial authorities may be a concern for some traders.

Overall, Ivision Market can be a good choice for traders seeking a diverse range of trading instruments and a user-friendly platform, but it's important to carefully evaluate the fees and conditions before deciding to open an account. Traders should also be aware of the risks involved in trading and take steps to manage their risks effectively.

FAQs

Q: Is IVISION MARKET a legitimate broker?

A: The regulatory status of IVISION MARKET LTD appears to be unauthorized according to the National Futures Association (NFA) in the United States. Further research and consultation with official regulatory sources are recommended to obtain more accurate and up-to-date information on the regulatory status and legitimacy of IVISION MARKET.

Q: What are the market instruments offered by IVISION MARKET?

A: IVISION MARKET offers a diverse range of market instruments, including cryptocurrencies, precious metals, energies, share CFDs, and indices.

Q: What are the advantages and disadvantages of IVISION MARKET?

A: Advantages of IVISION MARKET include a diverse range of market instruments, availability of cryptocurrency trading, option to trade precious metals, opportunity to trade energy commodities, access to global share CFDs, and trading options on various indices. Disadvantages include unauthorized regulatory status, lack of specific regulatory information, limited information on trading conditions and customer support, potential risks associated with unauthorized status, and limited information on margin rates, commissions, and minimum spreads.

Q: What are the different types of trading accounts offered by IVISION MARKET?

A: IVISION MARKET offers Micro, Standard, and Spread accounts. The Micro Account is for traders starting with a smaller initial investment, the Standard Account is suitable for traders with moderate experience, and the Spread Account is for traders who prioritize trading with zero or very low spreads.

Q: What are the pros and cons of IVISION MARKET's trading accounts?

A: Pros of IVISION MARKET's trading accounts include multiple account options, a Micro Account with a low minimum deposit, tight floating spreads, high leverage options, market execution for fast order execution, and availability of 24/7 support. Cons include limited information on specific trading conditions, additional account features, trading platform, and lack of detailed information on account funding and withdrawal methods.

Q: How can I open an account with IVISION MARKET?

A: To open an account with IVISION MARKET, you need to choose a platform (IVISION MARKET's proprietary platform or MetaTrader 5), create your account, register, verify, and fund your account, and then start trading.

Q: What leverage does IVISION MARKET offer?

A: IVISION MARKET offers different leverage options depending on the account type. The maximum leverage mentioned in the provided information is up to 1:1000 for the Micro Account, up to 1:500 for the Standard Account, and up to 1:300 for the Spread Account.

Q: What are the spreads offered by IVISION MARKET?

A: IVISION MARKET offers tight floating spreads. The spreads mentioned in the provided information start from 1.9 pips for the Micro Account, 1.4 pips for the Standard Account, and 0 pips for the Spread Account.

Q: What fees and commissions does IVISION MARKET charge?

A: IVISION MARKET has a policy of no commissions on trading and charges spreads on trades. The deposit and withdrawal fees vary depending on the payment method and currency used. Bank wire transfers are free, but they may take 1-5 business days to process. Credit/debit cards and digital payment methods have no deposit fees and are instant, but some withdrawal methods may have fees, and the processing time may vary.

Q: What are the deposit and withdrawal options provided by IVISION MARKET?

A: IVISION MARKET offers a variety of deposit and withdrawal options, including bank wire transfer, credit/debit cards, and local payment options. The processing times and fees may vary depending on the payment method used and the trader's location.

News

ExposureThe Person Behind Ivision Market Controversy: Exposed

Ivision Markets under scrutiny: Inside the allegations of fraud and investor deception. Learn the facts and figures behind the controversy.

WikiFX

WikiFX

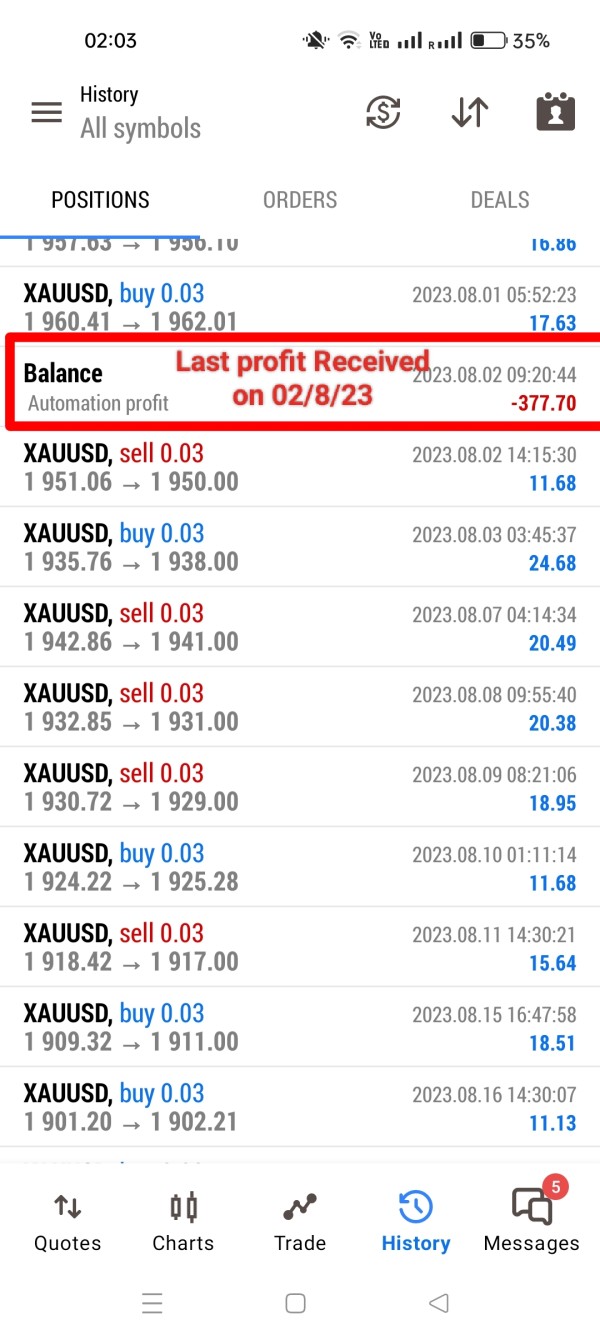

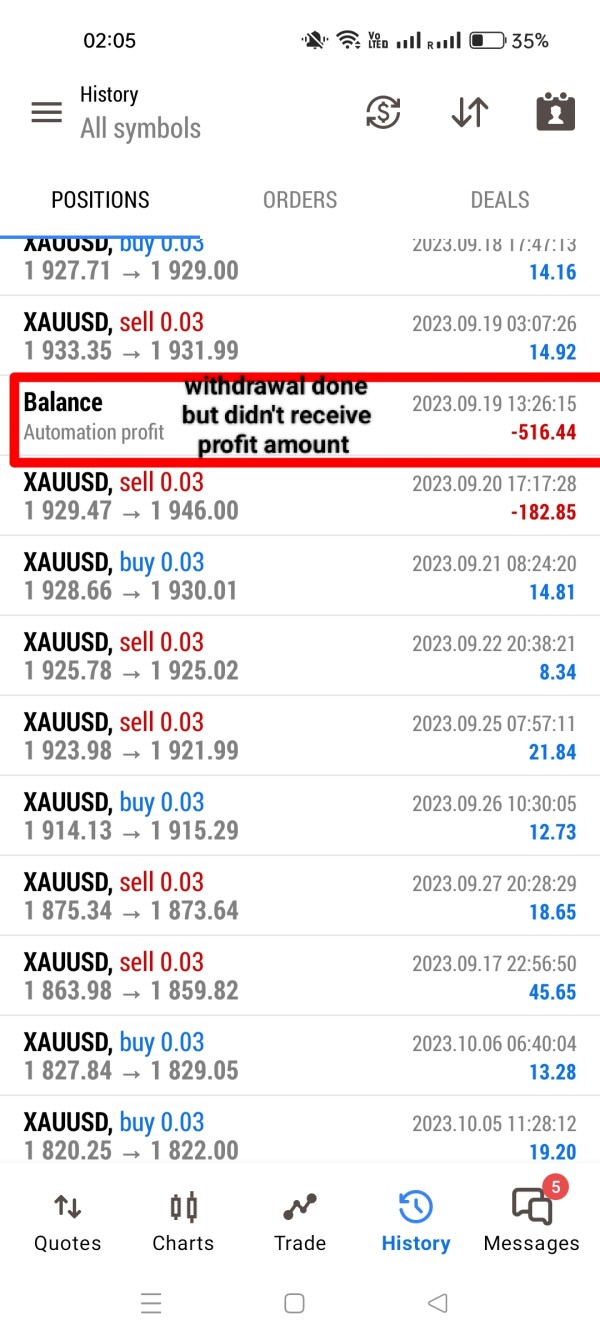

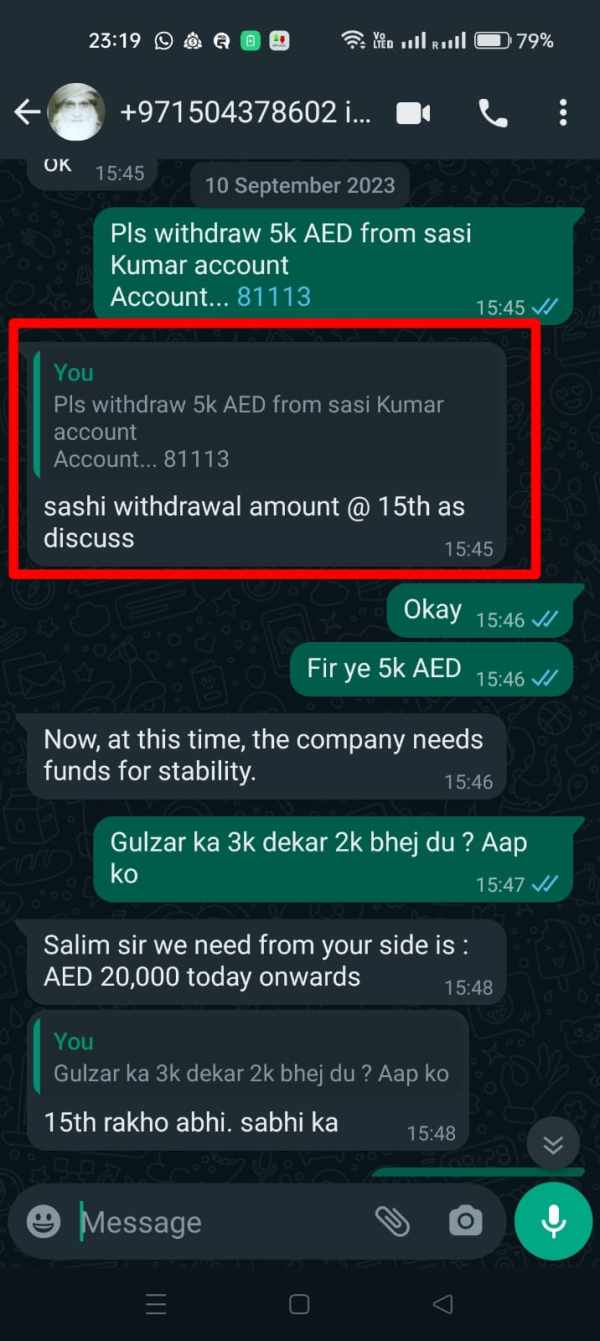

ExposureInvestor Alert: Ivision Market's Dirty Tactics Revealed!

Unmasking Ivision Market's deceit: from withholding funds to coercive review demands, the shocking tactics demand heightened investor vigilance in the online trading realm.

WikiFX

WikiFX

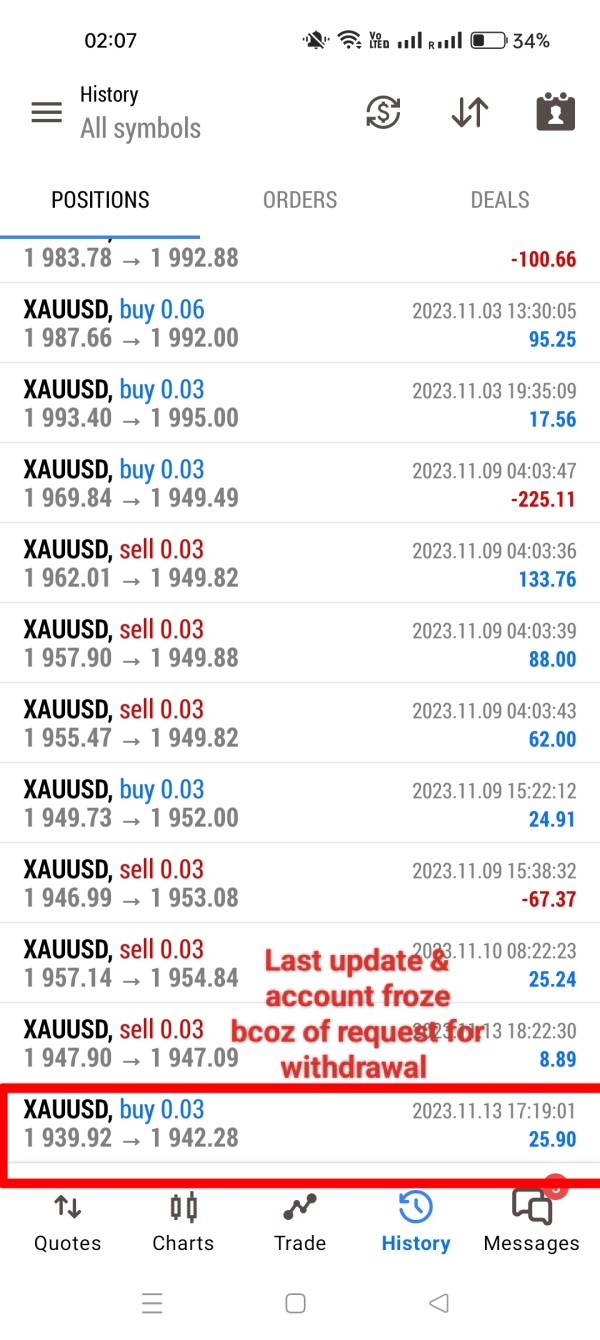

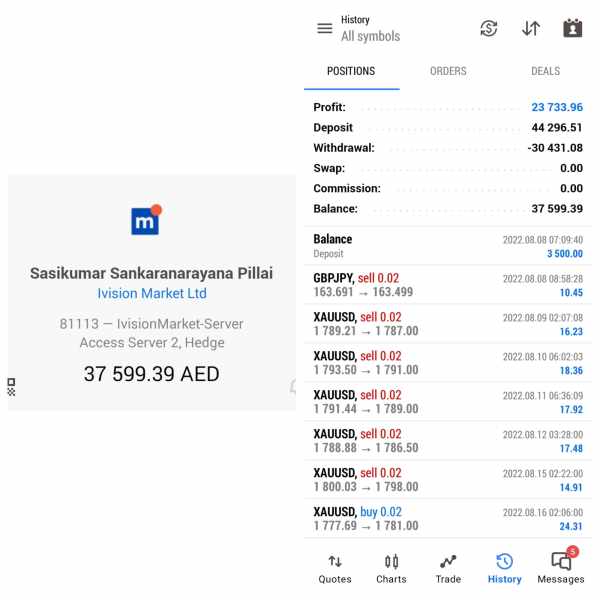

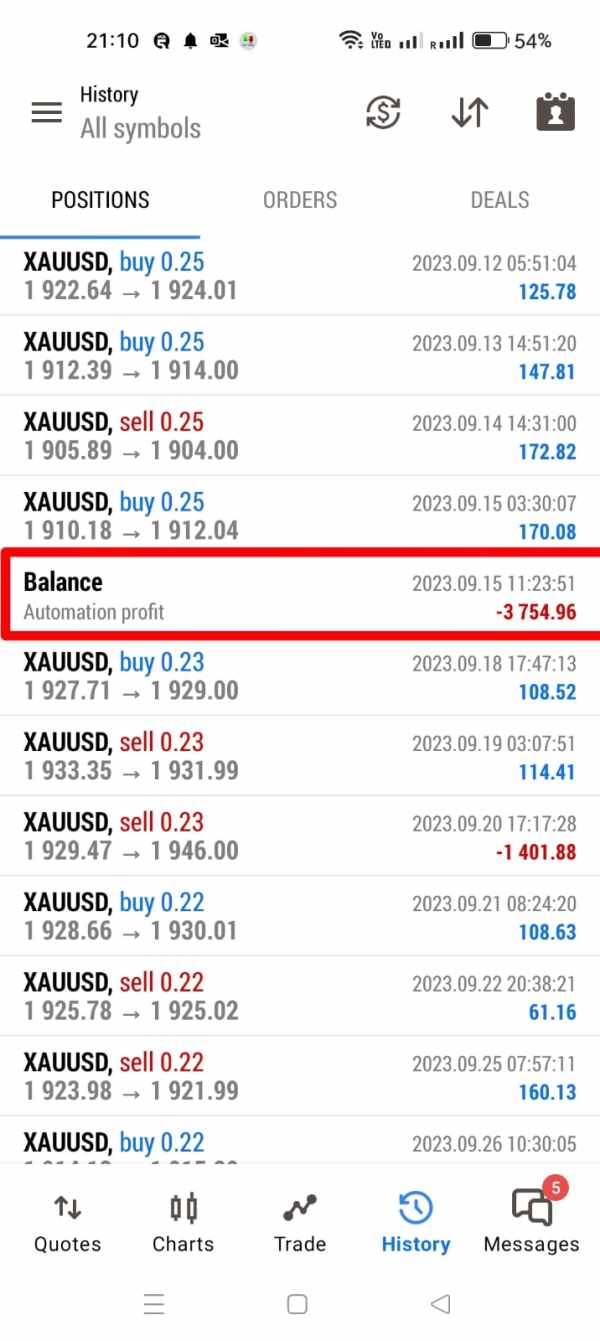

ExposureThe investor accused Ivision Market of blocking his withdrawal request.

One victim, who shared his harrowing experience with WikiFX, sheds light on the dubious practices of Ivision Market, particularly their alarming habit of blocking withdrawal requests.

WikiFX

WikiFX

NewsWikiFX Broker Assessment Series | Is Ivision Market Okay to Invest in?

This article is about a broker called Ivision Market. Is this platform trustworthy? WikiFX made a comprehensive review of this broker, hoping you have a clue to make a wise decision.

WikiFX

WikiFX

Review 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now