简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Long weekend air travel in the United States is becoming a new trend! Meanwhile, the US dollar recently turned net short for the first time!

Abstract:According to survey data, this year, many American travelers are opting for air travel over traditional road trips during the Memorial Day long weekend, marking an upward trend! On the other hand, bullish sentiment on the US dollar is beginning to retreat, turning net short for the first time in six weeks!

According to survey data, this year, many American travelers are opting for air travel over traditional road trips during the Memorial Day long weekend, marking an upward trend! On the other hand, bullish sentiment on the US dollar is beginning to retreat, turning net short for the first time in six weeks!

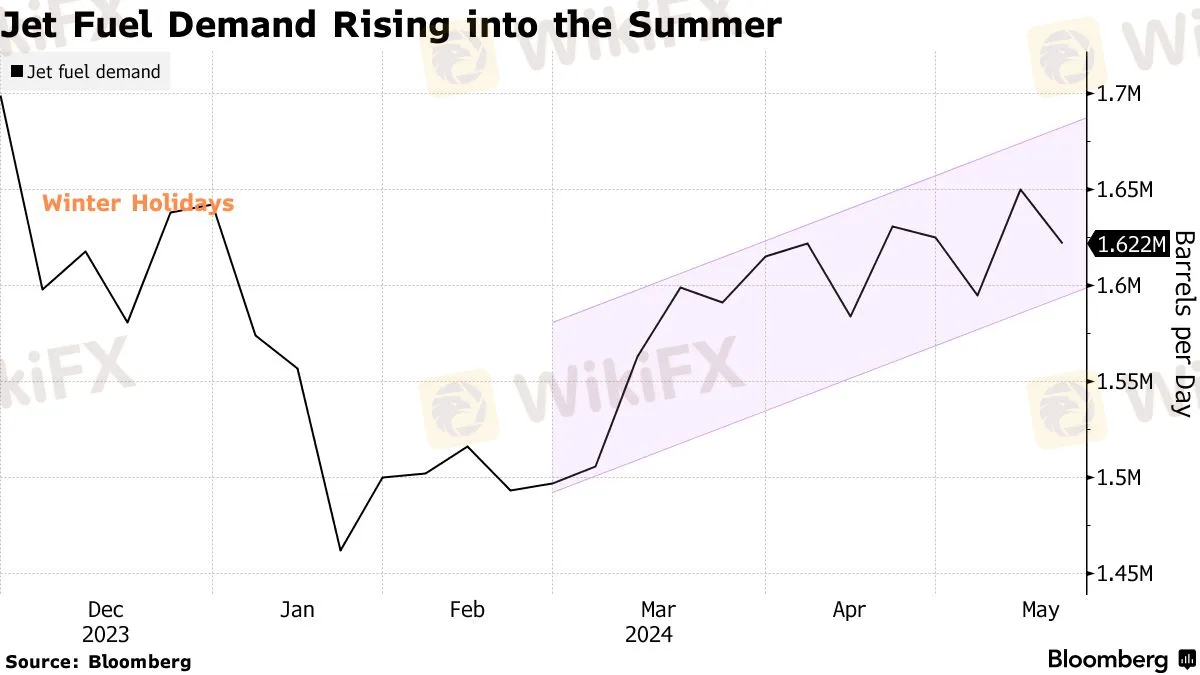

Some travelers mentioned, “Driving would take us two to three days one way, while our entire trip is just two to three days, so we opt for the faster option of flying.” Such sentiments seem to be the choice for the majority, potentially impacting the summer gasoline market, as the growth in demand for aviation fuel is expected to outpace gasoline and become the main driver of growth.

According to the American Automobile Association, the number of passengers traveling by air during this year's Memorial Day weekend is expected to be the highest in nearly 20 years, with a 4.8% increase from last year and a 9% increase from 2019.

As the Memorial Day weekend kicks off the peak driving season in the United States, global crude oil demand is expected to rebound in the coming weeks. JPMorgan forecasts a daily increase of 2.8 million barrels in global crude oil consumption, with aviation fuel seeing a daily increase of 430,000 barrels.

According to US government data, aviation fuel demand has reached its highest level since 2019, and Wood Mackenzie expects a roughly 5% growth in US aviation fuel demand in 2024. OPEC+ is set to meet on June 2nd and is expected to extend production cuts. In stark contrast to aviation fuel, the outlook for gasoline is lackluster. JPMorgan predicts that by 2025, global gasoline demand will decrease by an average of around 100,000 barrels per day.

Contrary to this, CFTC data indicates that although leveraged funds remained bullish on the US dollar last week, asset management companies increased their net short positions.

As of May 21st, asset management companies held net short positions valued at $5.36 billion, compared to net long positions of $2.02 billion a week prior. US monthly inflation data cooled off, with retail sales stagnating in April, increasing the possibility of a Federal Reserve rate cut. Investors will focus on Friday's release of the PCE index, seeking signs of Fed policy easing. The US dollar weakened against G10 currencies, leading to a 0.4% decline in the Bloomberg Dollar Spot Index.

Investors increased net short positions on the US dollar against the euro and reduced bullish bets on the US dollar against the pound, altering overall dollar positioning. Net long positions on the US dollar against the yen continue to rise. A senior foreign exchange strategist at the National Australia Bank noted that PCE data is crucial for determining whether the Fed will cut rates this year.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why Is UK Inflation Rising Again Despite Recent Lows?

October inflation rises to 2.3%, driven by energy costs. Renters face 8% annual hikes, while house price inflation climbs. Interest rates stay elevated.

How Inflation Rates Affect Forex Prices Globally

In this article, we’ll explore how inflation affects forex prices globally, the relationship between inflation and currency value, and why traders monitor inflation closely.

KVB Market Analysis | 30 August: JPY Strengthens Against USD Amid Strong Q2 GDP and BoJ Rate Hike Speculation

The Japanese Yen (JPY) strengthened against the US Dollar (USD) on Thursday, boosted by stronger-than-expected Q2 GDP growth in Japan, raising hopes for a BoJ rate hike. Despite this, the USD/JPY pair found support from higher US Treasury yields, though gains may be capped by expectations of a Fed rate cut in September.

PH Financial Sector Grows to P32.3T, Up 10.5% in June

The Philippine financial sector expanded by 10.5% in June, reaching P32.3 trillion. Bank resources surged, while positive earnings drove stock market gains.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator