简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exposing WingoMarket: A Brokerage Betrayal

Abstract:In the vast landscape of online trading, the promise of financial prosperity often lures individuals seeking to secure their financial future. However, amidst the plethora of brokerage firms, some entities operate not with integrity, but with deceit and betrayal. One such entity is WingoMarket, a broker whose actions have left a trail of shattered dreams and broken trust.

In the vast landscape of online trading, the promise of financial prosperity often lures individuals seeking to secure their financial future. However, amidst the plethora of brokerage firms, some entities operate not with integrity, but with deceit and betrayal. One such entity is WingoMarket, a broker whose actions have left a trail of shattered dreams and broken trust.

In the vast landscape of online trading, the promise of financial prosperity often lures individuals seeking to secure their financial future. However, amidst the plethora of brokerage firms, some entities operate not with integrity, but with deceit and betrayal. One such entity is WingoMarket, a broker whose actions have left a trail of shattered dreams and broken trust.

Alexander, a 35-year-old trader from Germany, found himself ensnared in the web of WingoMarket. With hopes of capitalizing on the lucrative opportunities presented by the financial markets, Eichler deposited $450 into his account, eager to kickstart his trading journey. Little did he know, this decision would lead to a harrowing ordeal that would strip him of both his hard-earned profits and his faith in the integrity of online brokers.

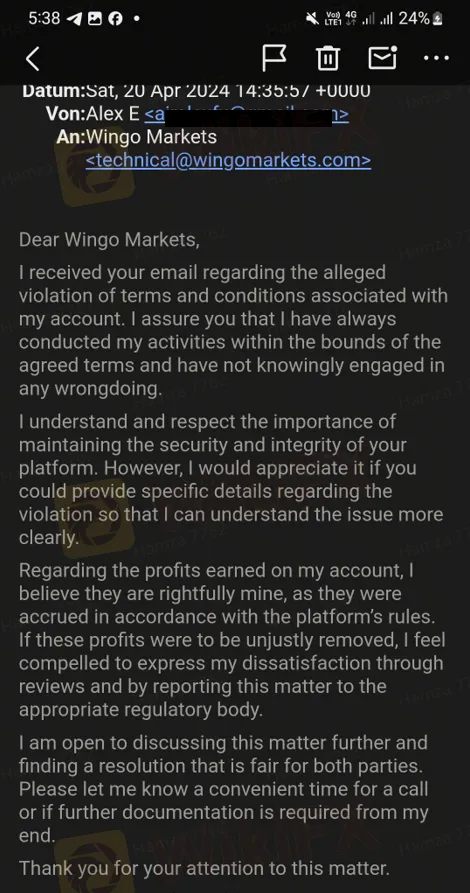

Eichler's initial experience with WingoMarket seemed promising. He diligently executed trades, leveraging his knowledge and expertise to generate a profit of $1200. However, his moment of triumph quickly turned into despair when WingoMarket arbitrarily wiped out his earnings without providing any substantiated reason or evidence. In a cold and impersonal email, WingoMarket cited a vague violation of their terms and conditions as justification for their egregious actions.

The email, devoid of empathy or transparency, reeked of deception. WingoMarket's assertion that Eichler may not have thoroughly read their terms and conditions is not only patronizing but also misleading. Even if Eichler had inadvertently violated a term, the magnitude of the punishment—complete erasure of profits—far outweighs any conceivable transgression.

Worse still, WingoMarket's offer to allow Eichler to withdraw his initial deposit before deactivating his account is a thinly veiled attempt to absolve themselves of accountability. By returning the principal amount, WingoMarket seeks to portray itself as benevolent, masking its malevolent actions behind a facade of faux generosity.

Eichler's plight serves as a cautionary tale for aspiring traders worldwide. The allure of quick profits must not blind individuals to the inherent risks associated with online trading. Moreover, it underscores the urgent need for regulatory oversight to reign in unscrupulous brokers like WingoMarket, who operate with impunity, preying on unsuspecting investors with impunity.

In light of these revelations, it is imperative that the trading community unite to expose WingoMarket's egregious practices and hold them accountable for their actions. Platforms such as WikiFX serve as vital conduits for amplifying the voices of victims like Eichler, providing them with a platform to share their stories and seek justice.

To those who have fallen victim to WingoMarket's deception, know that you are not alone. By standing together and raising awareness of WingoMarket's nefarious activities, we can safeguard others from suffering a similar fate. Let us not allow greed and dishonesty to taint the noble pursuit of financial freedom. Together, we can ensure that brokers like WingoMarket are consigned to the annals of history, where they rightfully belong.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator