Score

IBUTOKA

United States|2-5 years|

United States|2-5 years| http://ibutoka.online/en/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

IBUTOKA

IBUTOKA

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The United KingdomFCA regulation (license number: 801701) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The United Arab EmiratesDFSA regulation (license number: F004885) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The South AfricaFSCA regulation (license number: 46632) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The SeychellesFSA regulation (license number: SD015) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The Seychelles FSA regulation with license number: SD015 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed IBUTOKA also viewed..

XM

CPT Markets

IC Markets Global

IUX

IBUTOKA · Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| IBUTOKA Review Summary in 10 Points | |

| Founded | 2018 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Foreign currency, precious metals, energy, index |

| Demo Account | Unavailable |

| Leverage | 1:300 |

| EUR/ USD Spreads | 0.0 pips |

| Trading Platforms | Tradingweb |

| Minimum Deposit | $100 |

| Customer Support | |

What is IBUTOKA?

IBUTOKA LIMITED is a company incorporated in the UK with registration number of 13527087. It is a professional foreign exchange broker providing more than 50 major transaction currency pairs, precious metals, international crude oil and other financial and financial derivatives in the world. The company adopts the most popular and universal TRADINGWEB trading platform in the world to provide different account types to meet the trading needs of different investors. However, it's noted that IBUTOKA has no regulation.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Multiple account types | • Not regulated |

| • Acceptable minimum deposit | • No MT4 supported |

| • A range of trading instruments | • No demo accounts |

IBUTOKA Alternative Brokers

There are many alternative brokers to IBUTOKA depending on the specific needs and preferences of the trader. Some popular options include:

ForexChief – A reputable forex broker known for its transparent trading conditions, diverse account types, and competitive trading platforms.

ForexMart – A well-established brokerage offering a wide range of trading services, including forex, CFDs, and cryptocurrencies, with a focus on excellent customer support and educational resources.

Grand Capital – A multi-asset trading platform that provides traders with access to various financial markets, innovative trading technologies, and an extensive range of investment options.

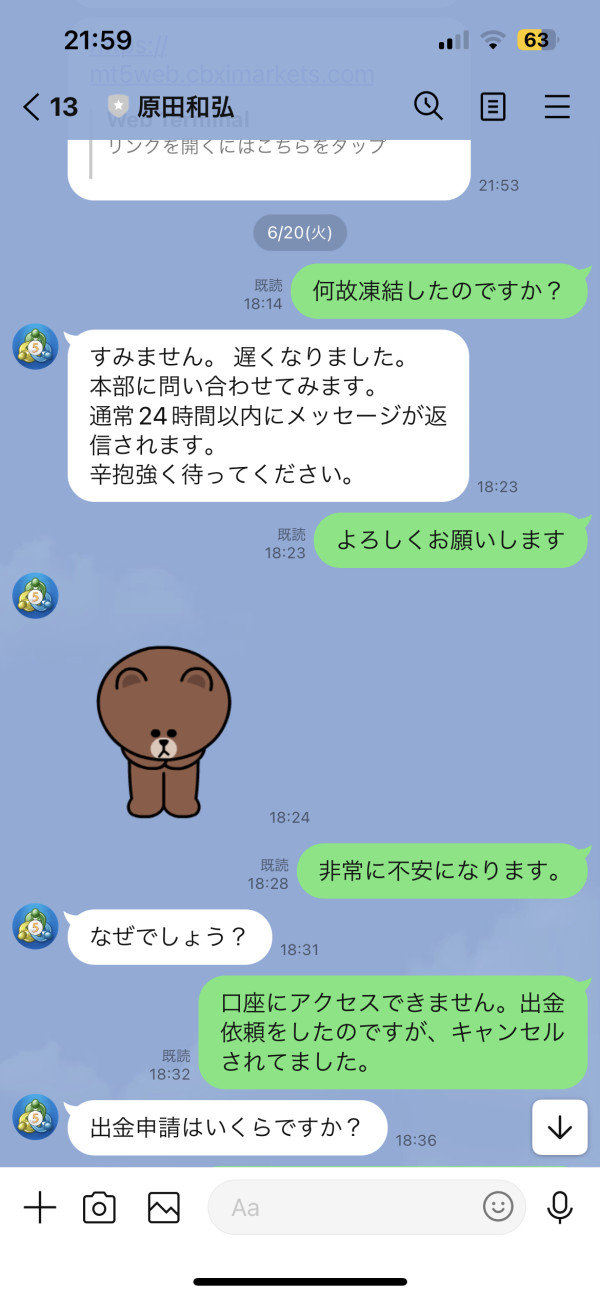

Is IBUTOKA Safe or Scam?

The license of NFA is unauthorized and thus BUTOKA has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky.

If you are considering investing with IBUTOKA, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Market Instruments

IBUTOKA offers a variety of trading instruments across different asset classes, including foreign currency, precious metals, energy, index.

Forex: IBUTOKA offers over 50 currency pairs, including major, minor, and exotic pairs.

Precious metals: IBUTOKA offers trading in gold, silver, platinum, and palladium.

Energy: IBUTOKA offers trading in crude oil, natural gas, and other energy commodities.

Indices: IBUTOKA offers trading in a variety of indices, including the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Accounts

IBUTOKA offers four live account types including Standard account, ECN account, Crypto account and Micro account, with the minimum deposit of $100 each.

Standard Account:

The Standard account is designed for traders who prefer fixed spreads. In this account type, the spreads remain constant regardless of market volatility. Traders using the Standard account will typically experience wider spreads compared to the ECN account but may find it suitable for their trading strategies. This account type is suitable for beginners or traders who do not require extremely tight spreads.

ECN Account:

The ECN account is more suitable for advanced traders who require direct market access and prefer tighter spreads. With the ECN account, traders can benefit from variable spreads that reflect the real-time market conditions. The spreads in this account type can be extremely tight, especially during periods of high liquidity. ECN accounts provide traders with access to deeper liquidity pools and the opportunity to trade at the best available market prices.

Crypto Account:

IBUTOKAs Crypto Account is specifically tailored for trading cryptocurrencies. It allows traders to access a variety of cryptocurrencies and potentially benefit from their price fluctuations. This account type may have its own specific features and trading conditions related to cryptocurrencies.

Micro Account:

The Micro Account is suitable for beginner traders or those who want to trade with smaller positions. This account type typically allows traders to trade with micro-lots, which are smaller trade sizes than standard lots. It can be a good option for traders who want to practice and gain experience with live trading while minimizing risk.

Leverage

IBUTOKA offers a maximum leverage of 1:300, which means that clients can trade with a leverage ratio of up to 300 times their invested capital. Leverage in trading refers to borrowing funds from the broker to amplify potential profits from price movements in financial markets.

The concept of leverage allows traders to control larger positions in the market with a smaller amount of capital. For example, with a leverage ratio of 1:300, a trader can control a position worth $30,000 with just $100 of their own capital. This can provide opportunities for traders to potentially make significant gains from small market movements.

However, it's important to note that while leverage can magnify profits, it can also amplify losses. Trading with high leverage carries a higher level of risk because even small adverse price movements can result in significant losses. Traders need to carefully consider their risk tolerance and implement proper risk management strategies when using leverage.

Spreads & Commissions

IBUTOKAs offering of spreads starting from 0.0 pips for their accounts signifies their commitment to providing competitive pricing to traders. A spread of 0.0 pips means there is no difference between the bid and ask prices, resulting in a tight spread and potentially lower trading costs. Having a low or zero spread can be beneficial for traders as it allows them to enter and exit trades at more favorable prices. It implies that there is minimal interference between the buying and selling prices of financial instruments, which can enhance trading efficiency and potentially increase profitability.

Besides, IBUTOKA charges commissions for their accounts. Commissions are typically associated with ECN accounts where traders gain access to direct market liquidity. The $3 per lot commission mentioned indicates that traders will be charged $3 for each standard lot traded.

It‘s important to note that commission costs may vary depending on the account type, trading instrument, and the specific conditions set by IBUTOKA. Traders should review the broker’s commission structure and consider it alongside the spreads when evaluating the overall cost of trading.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| IBUTOKA | 0.0 pips | $3 per lot |

| ForexChief | 0.3 pips | None |

| ForexMart | 0.0 pips | None |

| Grand Capital | 0.0 pips | None |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

IBUTOKA only offers a Tradingweb platform, which is a web-based trading platform that is accessible through any internet-connected device. The platform offers a variety of features, including:

Real-time market data: Traders can access real-time market data for a variety of assets, including forex, commodities, and indices.

Order execution: Traders can place orders to buy or sell assets. Orders can be placed instantly or on a delayed basis.

Technical analysis tools: The platform offers a variety of technical analysis tools, such as charts, indicators, and oscillators. These tools can be used to analyze market trends and identify trading opportunities.

Charting tools: The platform provides a variety of charting tools, such as candlestick charts, bar charts, and line charts. These tools can be used to track the price movements of assets and identify trading opportunities.

Portfolio management tools: The platform provides portfolio management tools, such as watchlists, positions, and orders. These tools can be used to track your investments and manage your trading activities.

See the trading platform comparison table below:

| Broker | Trading Platform |

| IBUTOKA | Tradingweb |

| ForexChief | Trading software, MT4, MT5 |

| ForexMart | MT4 |

| Grand Capital | iTrade, Webtrade |

Trading Tools

IBUTOKA offers the latest economic news, professional market analysis and foreign exchange calendar.

-Economic News:

IBUTOKA offers traders access to the latest economic news. This includes key announcements, reports, and data releases that have the potential to impact various financial markets. By staying informed about economic events, traders can better understand market dynamics and make more informed trading decisions.

-Professional Market Analysis:

IBUTOKA provides professional market analysis to help traders gain insights into market trends, potential opportunities, and risks. This analysis can include technical analysis, fundamental analysis, and expert opinions on various financial instruments. By accessing this valuable information, traders can enhance their understanding of the market and make more astute trading choices.

-Foreign Exchange Calendar:

IBUTOKA offers a foreign exchange calendar that highlights significant upcoming events related to the currency markets. This calendar may include central bank meetings, interest rate decisions, economic releases, and other events that can impact foreign exchange rates. By having access to a comprehensive calendar, traders can plan their trading strategies accordingly and position themselves for potential market volatility.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Email: support@ibutoka.id

| Pros | Cons |

|

|

|

|

|

Note: These pros and cons are subjective and may vary depending on the individual's experience with IBUTOKA's customer service.

Conclusion

In conclusion, IBUTOKA is a global forex broker that offers a range of trading instruments and account types to suit different trading strategies. Some advantages of IBUTOKA include competitive spreads, a range of trading tools and various accounts for different traders. However, there are also limitations such as lack of regulatory information. The lack of specific information regarding IBUTOKAs regulatory framework may be a concern for traders who prioritize working with regulated brokers. Traders should carefully consider these factors when deciding to trade with IBUTOKA.

Frequently Asked Questions (FAQs)

| Q 1: | Is IBUTOKA regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at IBUTOKA? |

| A 2: | You can contact via email, support@ibutoka.id. |

| Q 3: | Does IBUTOKA offer demo accounts? |

| A 3: | No. |

| Q 4: | Does IBUTOKA offer the industry leading MT4 & MT5? |

| A 4: | No. Instead, it offers Tradingweb. |

| Q 5: | What is the minimum deposit for IBUTOKA? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is IBUTOKA a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners because of its unregulated condition. |

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now