Score

N1CM

Vanuatu|5-10 years|

Vanuatu|5-10 years| https://www.n1cm.com/en

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

N1CapitalMarkets-Live

Luxembourg

LuxembourgInfluence

C

Influence index NO.1

Ireland 2.80

Ireland 2.80MT4/5 Identification

MT4/5 Identification

Full License

Luxembourg

LuxembourgInfluence

Influence

C

Influence index NO.1

Ireland 2.80

Ireland 2.80Surpassed 22.80% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+678 750 9214

Other ways of contact

Broker Information

More

Number One Capital Markets Limited

N1CM

Vanuatu

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- VanuatuVFSC (license number: 15035) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- The Vanuatu VFSC regulation with license number: 15035 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $10 |

| Minimum Spread | From 0.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $2,5 Per Side |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $10 |

| Minimum Spread | From 0.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $1 |

| Minimum Spread | From 0.9 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed N1CM also viewed..

XM

Decode Global

AUS GLOBAL

VT Markets

N1CM · Company Summary

| Feature | Information |

| Registered Country/Region | Vanuatu |

| Found | 2017 |

| Regulation | Not regulated |

| Market Instrument | Forex, CFDs on Indices, Commodities, Shares, Cryptocurrencies, and Precious Metals |

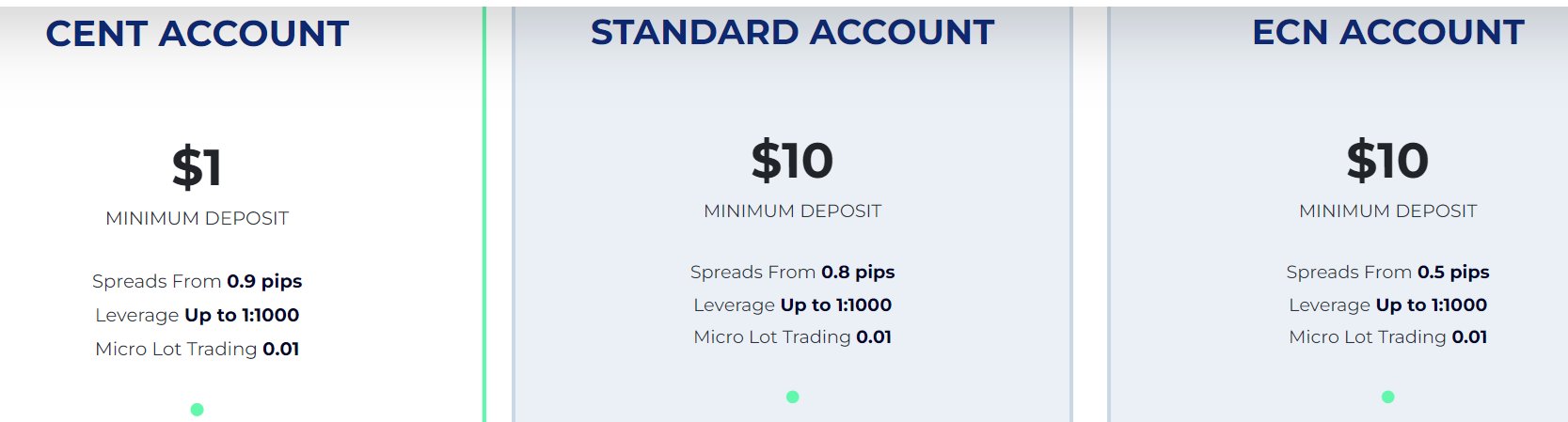

| Account Types | Cent, Standard and ECN |

| Demo Account | Yes |

| Maximum Leverage | 1:1000 |

| Spread | From 0.1 pips |

| Commission | No commissions |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $1 |

| Deposit & Withdrawal Method | Perfect Money, PaymentAsia, Sticpay, coinbase, Fasapay, B2BinPAY, cryptocurrencies |

Overview of N1CM

N1CM, a trading name of Number One Capital Markets, is a forex and CFD brokerage founded in 2017 and registered in Vanuatu, claiming to offer a range of financial instruments such as Forex, CFDs on Indices, Commodities, Shares, Cryptocurrencies, and Precious Metals. It provides three account types: Cent, Standard, and ECN, along with a demo account for practice. With a maximum leverage of 1:1000 and spreads starting from 0.1 pips, N1CM operates on the popular MT4 and MT5 trading platforms. N1CM also has a low minimum deposit requirement of $1 and accepts various deposit and withdrawal methods, including Perfect Money, PaymentAsia, Sticpay, Coinbase, Fasapay, B2BinPAY, and cryptocurrencies. It's important to note that N1CM is not regulated.

Here is the home page of this brokers official site:

Is N1CM Legit or a Scam?

Regarding regulation, N1CM is regulated offshore by the Vanuatu Financial Services Commission (VFSC). It's important to note that online trading carries significant risks, and there is a possibility of losing all invested capital. It may not be suitable for all traders or investors.

Pros & Cons

N1CM is a forex broker that offers several advantages and disadvantages to consider. On the positive side, they provide a wide range of trading assets, allowing traders to access various markets and diversify their portfolios. The availability of demo accounts is another benefit, and it also offers a low minimum deposit requirement of just $1, making it accessible to traders with different budget levels. Furthermore, they support the widely used MetaTrader4 (MT4) platform, which is known for its user-friendly interface and comprehensive trading tools.

However, there are some drawbacks to consider. One notable disadvantage is the lack of popular funding options. This may inconvenience some traders who prefer more widely accepted payment methods. Additionally, while the low minimum deposit is advantageous for beginners or those with limited funds, it may also indicate a potential lack of financial stability or services typically associated with higher deposit requirements.

| Pros | Cons |

| Wide range of trading assets | Not regulated |

| Demo accounts available | No popular funding options are offered |

| Low minimum deposit ($1) | |

| MT4 supported | |

| Generous maximum Leverage of up to 1:1000 |

Market Instruments

The selection of trading products available for clients includes Forex, CFDs on Indices, Commodities, Shares, Cryptocurrencies, and Precious Metals.

N1CM offers a diverse range of trading products to its clients, including:

1. Forex: Clients can trade in the foreign exchange market, which involves buying and selling currency pairs. Forex trading allows participants to speculate on the fluctuations in exchange rates between different currencies.

2. CFDs on Indices: Contract for Difference (CFD) trading on indices enables clients to speculate on the performance of stock market indices, such as the S&P 500, Dow Jones Industrial Average, or FTSE 100.

3. Commodities: N1CM provides CFD trading on various commodities, including agricultural products (such as corn, wheat, and soybeans), energy commodities (such as crude oil and natural gas), and metals (such as gold, silver, and copper).

4. Shares: N1CM offers CFD trading on shares of publicly traded companies. Clients can speculate on the price movements of individual stocks without owning the shares themselves.

5. Cryptocurrencies: Trading in cryptocurrencies has gained significant popularity, and N1CM allows clients to trade CFDs on popular digital currencies such as Bitcoin, Ethereum, Litecoin, and more. This allows traders to take advantage of the volatility in the cryptocurrency market.

6. Precious Metals: Clients can also trade CFDs on precious metals like gold and silver. These metals are considered safe-haven assets and often serve as a store of value during uncertain economic times.

These trading products provide clients with a wide range of options to diversify their portfolios and take advantage of various market opportunities across different asset classes.

Account Types

In addition to demo accounts, N1CM provides three types of live trading accounts: Cent, Standard, and ECN. These accounts have varying features and minimum initial deposit requirements as follows:

1. Cent Account: This account type allows clients to start trading with a minimum initial deposit requirement of $1. It is designed to offer a low-cost entry point for beginners or those who prefer to trade with smaller amounts.

2. Standard Account: The Standard Account requires a minimum initial deposit of $10. It caters to traders who are looking for a more traditional trading experience.

3. ECN Account: N1CM's ECN Account is designed for more advanced traders who require direct access to liquidity providers and want to benefit from tight spreads and fast execution. The minimum initial deposit for the ECN Account is $10.

These different account types and their corresponding minimum deposit requirements provide options for traders with varying levels of experience, risk appetite, and trading capital. Clients can choose the account type that aligns with their trading preferences and financial capabilities.

How to Open an Account?

To open an account with N1CM, please follow these steps:

1. Visit the official website of N1CM at https://www.n1cm.com/.

2. On the homepage, locate and click on the “Open Account”button. This will typically be prominently displayed on the website.

3. You will be redirected to the account opening page. Here, you may need to provide personal information such as your name, email address, phone number, and country of residence.

4. Select the type of account you wish to open. N1CM may offer different account types tailored to the needs of various traders. Choose the one that suits your trading preferences and objectives.

5. Submit your application. Once you have completed all the required information, click on the “Submit” or similar button to send your account opening request to N1CM.

6. Complete the verification process. N1CM may require you to provide additional documents to verify your identity and address. These documents may include a copy of your passport or ID card, proof of address (such as a utility bill or bank statement), and any other documentation requested by the broker.

7. Fund your account. Once your account is approved and verified, you will receive instructions on how to deposit funds into your trading account. N1CM may offer various funding options such as bank transfers, credit/debit cards, or electronic payment methods. Choose the preferred method and follow the provided instructions.

8. Start trading. Once your account is funded, you can access the trading platform provided by N1CM and begin executing trades in accordance with your trading strategy and preferences.

Leverage

N1CM provides a maximum leverage of 1:1000. With bigger accounts, the leverage ratio decreases progressively. Still, 1:1000 is a very high level and may lead to massive losses if used by inexperienced traders.

Spreads & Commissions

All spreads with N1CM are a floating type and scaled with the accounts offered. Specifically, the spread starts from 0.9 pips on the Cent account, from 0.8 pips on the Standard account, and 0.5 pips on the ECN account.

As for the commission, there is no commission on the Cent and Standard accounts, while $2.5 per side is on the ECN account.

N1CM claims to provide its clients with some of the most competitive spreads in the trading industry. The company's primary objective is to offer tight spreads across all available instruments, aiming to minimize trading costs and expenses for their clients. The company does not engage in re-quoting prices, ensuring that the prices displayed to clients are the exact market prices received in real-time from their liquidity providers.

Trading Platform

N1CM has selected MetaTrader4 and MetaTrader5 as their trading platforms, which can be accessed via various operating systems including Web, Mac, Linux, Windows, and Android. These platforms are widely acclaimed and favored by many brokers and traders alike. They are highly regarded for their exceptional charting features and the wide range of add-ons available.

One of the notable advantages of these platforms is the MQL marketplace, an online store independent of any specific broker. Traders can explore and utilize a variety of technical indicators and automated trading robots, commonly referred to as Expert Advisors. These tools can be tested, borrowed, or purchased from the marketplace, allowing traders to enhance their trading strategies and automate certain aspects of their trading activities.

Deposit & Withdrawal

N1CM offers a range of payment options for their clients, including Perfect Money, PaymentAsia, Sticpay, Coinbase, Fasapay, and B2BinPAY. In addition, they accept popular cryptocurrencies such as Bitcoin, Ethereum, USDT, and Litecoin.

One of the advantages of using N1CM is that they do not charge any deposit or withdrawal fees. Deposits are processed instantly, allowing clients to fund their accounts without delay. Withdrawals, on the other hand, are typically processed within the same day, ensuring quick access to funds for clients.

Bonuses

N1CM promotes a first deposit bonus of 35% and a redeposit bonus of 25%, with the maximum bonus amount set at 5,000 USD. However, it is important to exercise caution when considering accepting a bonus. Bonuses are not considered client funds but rather company funds, and they often come with stringent requirements that can be challenging to fulfill. It is worth noting that leading regulators prohibit brokers from utilizing bonuses and promotions.

Therefore, it is advisable to thoroughly understand the terms and conditions associated with any bonus offers before accepting them. It is essential to assess the potential risks and obligations that may come with these bonuses and make an informed decision based on your individual trading needs and preferences.

Customer Support

N1CM provides customer support during the hours of 06:00 - 15:00 GMT from Monday to Friday. They offer various communication channels including live chat, Skype, WhatsApp, Telegram, and online message submissions to assist their clients. Additionally, N1CM can be followed on social networks such as Twitter, Facebook, Instagram, and LinkedIn to stay updated with their latest news and developments.

The registered address of N1CM is POT 615/304 Rock Terrace Building, Kumul Highway, Port Vila, Vanuatu.

Conclusion

In conclusion, N1CM is a forex and CFD brokerage registered in Vanuatu, offering a range of tradable financial instruments with leverage up to 1:1000 and floating spreads from 0.5 pips on the MT4 and MT5 trading platforms. It provides a wide range of trading assets, demo accounts for practice, and a low minimum deposit requirement of $1. The support for the widely used MetaTrader platforms is a notable advantage, offering a user-friendly interface and comprehensive trading tools. However, there are some disadvantages, such as revoked status, limited funding options, and the potential implications of a low minimum deposit requirement.

Frequently Asked Questions (FAQs)

| Q 1: | Is N1CM regulated? |

| A 1: | No. N1CM is offshore regulated by Vanuatu Financial Services Commission (VFSC). |

| Q 2: | Does N1CM offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does N1CM offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available. |

| Q 4: | What is the minimum deposit for N1CM? |

| A 4: | The minimum initial deposit to open an account is $1. |

| Q 5: | Is N1CM a good broker for beginners? |

| A 5: | No. N1CM is not a good choice for beginners. Though it performs well, its license is offshore. Take care! |

News

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now