简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Who is Shaun Etou? The Man is Reportedly Behind Ponzi Scheme V5 Forex Global Markets.

Abstract:In the ongoing exposure of V5 Forex Global Markets, questions have arisen about the identity of the mastermind behind the operation. While WikiFX has been actively uncovering the truth about V5, one name that has recently surfaced is Shaun Etou. But who exactly is Shaun Etou?

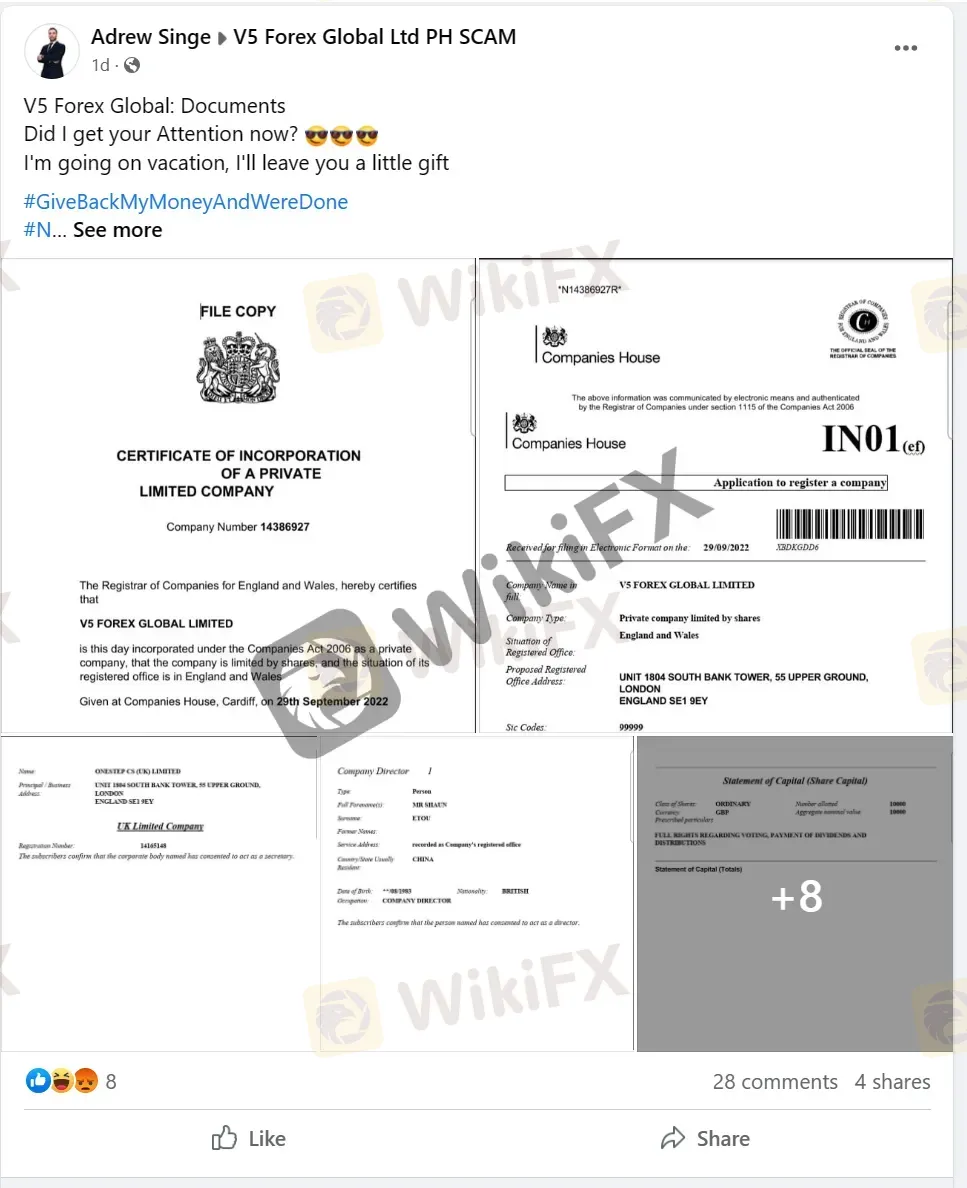

While WikiFX has been exposing V5 Forex Global markets, questions have arisen about the identity of the mastermind behind the operation. one thing we have been missing is who owns this broker and who is the man behind V5 Forex Global Markets. An individual on Facebook named Adrew Singe gives us a name called “ Shaun Etou”. But who is Shaun Etou exactly?

Who is this Shaun Etou?

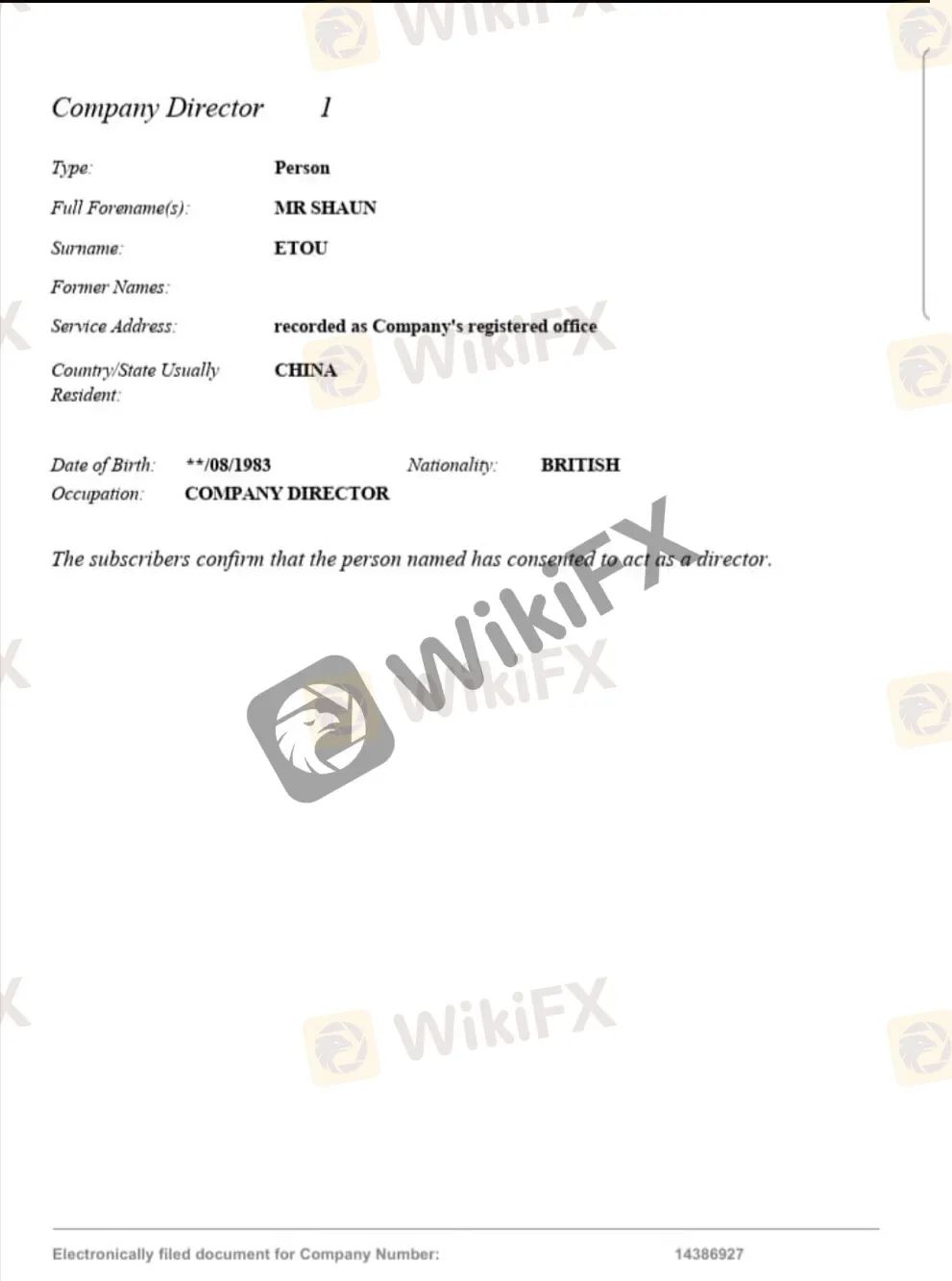

The revelation of Shaun Etou's involvement in V5 Forex Global Markets came to light through official documents shared by an individual named Adrew Singe on June 13. These documents contained crucial registration information, including the company's registered address and director details. According to these records, the director of V5 is Shaun Etou, a British national who is also a resident of China. Born in August 1983, Shaun Etou's identity raises several intriguing questions.

A Puzzling Identity

Upon initial examination, Shaun Etou's name appears to be an English translation of a Chinese name. However, Chinese individuals typically use pinyin to translate their names into English, and Shaun Etou's name deviates from this convention. Furthermore, the name does not align with the spelling patterns commonly seen among Hong Kong and Taiwanese individuals. This observation adds to the mystique surrounding Shaun Etou and his association with V5 Forex Global Markets. Shaun Etou is actually a Western name.

Adrew Singe also states that the mentors of V5 Forex Global like to use different photos to gain attention on the Internet, which shed light on the dubious practices of V5 Forex Global Markets' mentors. The real identities of these V5 staff operating behind the veil of the Internet remain unknown. These revelations add another layer of complexity to the ongoing investigation surrounding V5 and its dubious operations.

Persistent doubts

Although V5 asks clients to remain calm and says it will take three to five days to allow clients to withdraw. But that has not stopped victims from questioning the broker. There are already investors who doubt that V5 is gone with the money they defrauded.

Persistent Doubts and Withdrawal Delay:

Although V5 asks clients to remain calm and says it will take three to five days to allow clients to withdraw, doubts continue to plague the minds of victims. Reports from investors indicate that they have yet to receive their funds. There are already investors who doubt that V5 is gone with the money they defrauded.

Another victim said her withdrawal application had been approved, but she still hadn't received her funds.

The previous statement of V5 indicated that due to the large amount of exposure to V5, caused great harm to V5. At present, a large number of traders who invest in V5 choose to withdraw their funds, causing great pressure and damage to V5. However, some investors said that the money belongs to the investors themselves, V5 is only a broker, and it is reasonable for investors to get their money back. V5 should not face substantial losses if they have not engaged in fraudulent activities.

Conclusion

As victims express their doubts and anxieties over withdrawal delays, the truth behind V5's operations continues to be unveiled. More shocking revelations are set to be revealed in the coming days. Stay tuned for tomorrow's update, where we will provide further insights into the unraveling web of V5's deceitful operations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

In the midst of rapid advancements and evolving landscapes in financial technology, financial regulation, and ensuring financial security, WikiGlobal stands at the forefront, closely tracking these transformative trends. As we embark on our series of exclusive interviews focusing on these pivotal areas, we are delighted to have had an in-depth conversation with.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator