简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

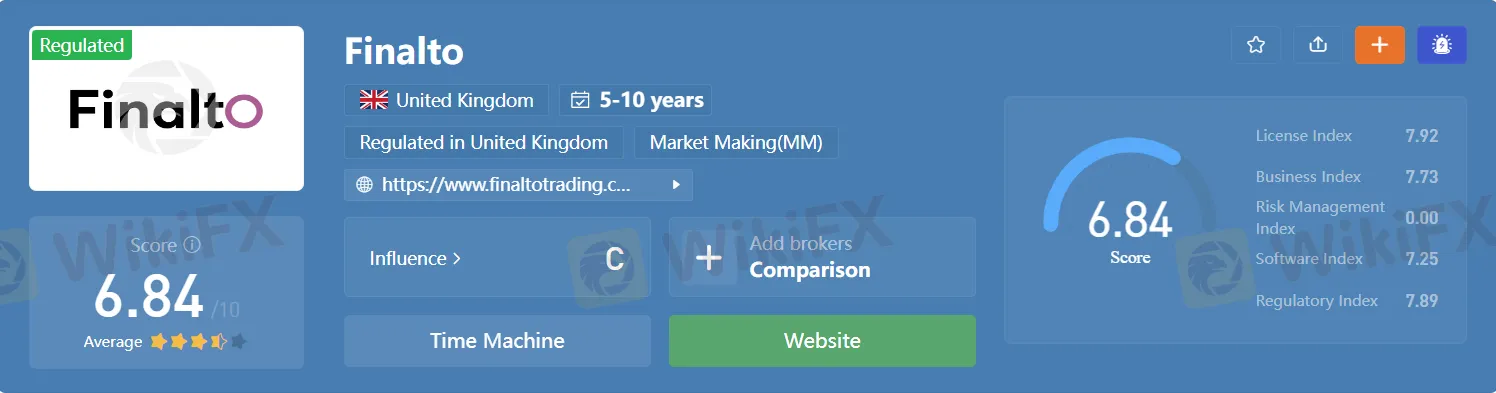

Finalto Pledges to Strengthen Asia Operations for Sustainable Expansion

Abstract:According to Alex Yap, Director of Institutional Sales, Finalto Asia is overcoming global crises and uncertainties with its unique product line and emphasis on local needs (Asia). Finalto is dedicated to innovation and is extending its technology staff from Copenhagen to Singapore in order to increase its regional reach.

According to Alex Yap, Director of Institutional Sales, Finalto Asia is overcoming global crises and uncertainties with its unique product line and emphasis on local needs (Asia). Finalto is dedicated to innovation and is extending its technology staff from Copenhagen to Singapore in order to increase its regional reach.

Yap emphasized the increasing need for low-latency electronic and algorithmic trading in Asia, “which is one of the major issues owing to the physical distance between data centers in London and New York, and Asia. The expansion of data centers in Singapore will be a significant step forward for the area, and Finalto intends to provide liquidity and trading services from its SG3 stack in 2023 to satisfy the rising demand.”

About the economic repercussions of rising US-China relations, Yap warned that this conflict might have a much greater global effect than the Russia-Ukraine conflict. “Finalto is taking steps to prepare for the worst and guarantee that the socioeconomic situation does not impede Finalto Asia's continuing expansion.”

Global economy in rapid inflation

Yap noted that the global economy is still suffering from rapid inflation, which has compelled central banks to try to restrain runaway prices via hefty interest-rate rises. The high-interest-rate environment, on the other hand, will aggravate circumstances, threatening a lengthy period of stagflation. Yap anticipates that this situation would exert pressure on global economic development, not only in the liquidity sector. If a recession occurs before inflation can return to a safe level, the danger of stagflation exists.

Product offers are critical to delivering for customers, and Finalto is aiming to provide the proper sort of offering for Asian clients. Since opening the Finalto office in 2019, the firm has been expanding its regional footprint in order to deliver the finest service to customers.

Finalto Group sees Asia as a critical development zone, and the business recognizes that a one-size-fits-all strategy would not work in the region's very diversified markets. As a result, Finalto Asia and Finalto Australia are growing their teams, which will increase their assistance for customers from Sydney to Tokyo, as well as Singapore and London.

Finalto increased its portfolio to better meet the demands of the markets in Australia, Singapore, China, Hong Kong, the United Arab Emirates, and Turkey. Clients may now hedge gold holdings stated in various weight units and local currencies. With great liquidity and unique pricing, the firm offers a wide selection of gold contracts adapted to local market circumstances.

Finalto Hongkong

In Hong Kong, Finalto provides gold liquidity in kilos versus USD and CNH, as well as taels vs HKD. The business is looking at additional price discovery sources, such as the physical trading area, to solve the jigsaw of delivering dependable pricing and margin facilities. Yap concluded that the year of the rabbit might be a volatile one for Asian markets, but Finalto is committed to its investment in the region. With its Singapore office, the firm has built a team of developers and integration engineers to drive technological innovation and development, working in parallel with the bigger R&D and technology team in Copenhagen, Denmark.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

In the midst of rapid advancements and evolving landscapes in financial technology, financial regulation, and ensuring financial security, WikiGlobal stands at the forefront, closely tracking these transformative trends. As we embark on our series of exclusive interviews focusing on these pivotal areas, we are delighted to have had an in-depth conversation with.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator