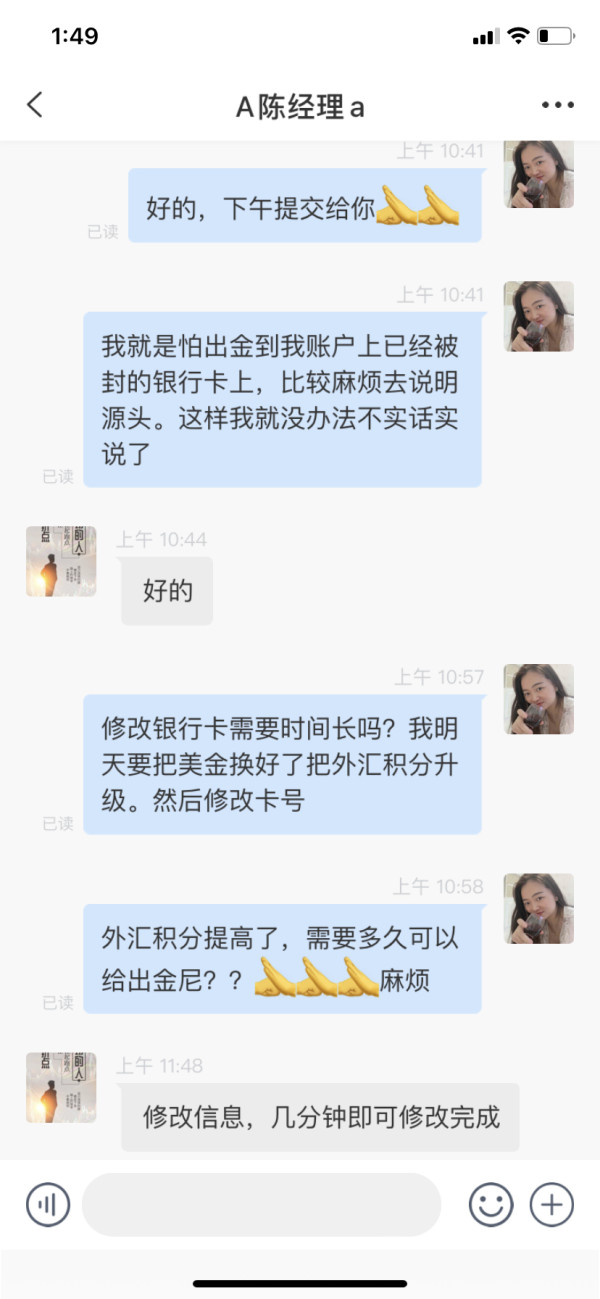

Score

TFI

Cyprus|5-10 years|

Cyprus|5-10 years| https://www.tfimarkets.com

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Cyprus 2.74

Cyprus 2.74Surpassed 15.50% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+357 22 749 800

+30 210 710 20 10

Other ways of contact

Broker Information

More

TFI Markets Ltd

TFI

Cyprus

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- United KingdomFCA (license number: 527167) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- The CyprusCYSEC regulation (license number: 117/10) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

Users who viewed TFI also viewed..

XM

VT Markets

EC Markets

GO MARKETS

TFI · Company Summary

| Feature | TFI Markets |

| Company Name | TFI Markets Ltd |

| Registered In | Cyprus |

| Regulation Status | Regulated by CySEC |

| Years of Establishment | Since 1999 |

| Trading Instruments | Currency pairs |

| Account Types | Corporate account, Personal account |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | From 1:1 |

| Minimum Spread | From $3 |

| Trading Platform | Supports FIX4.4 protocol for automation |

| Deposit and Withdrawal Method | Bank wire transfer |

| Customer Service | Phone, Email; Offices in Cyprus and Greece |

Overview of TFI

TFI Markets Ltd has been in the financial services sector since 1999, initially operating as TFI Public Company Limited before transitioning to its current name. With over two decades in the industry, TFI has carved out a niche, specializing in currency conversions, third-party payments, and risk mitigation solutions primarily aimed at corporate clients.

They offer services like currency payments, currency conversions, and currency risk management. Being licensed by both the Central Bank of Cyprus and the Cyprus Securities and Exchange Commission (CySEC), TFI operates under strict regulatory oversight, ensuring a degree of trust and reliability for its clients. The company also sponsors various financial and business events like the Invest Cyprus CIPA Awards and IN Business Awards, further legitimizing its standing in the financial community.

Is TFI Legit or a Scam?

TFI Markets is a well-established financial services provider that has been in operation for over two decades. The broker is primarily regulated by the Cyprus Securities and Exchange Commission (CySEC) and is also licensed by the Central Bank of Cyprus. These regulatory statuses offer a significant layer of protection and credibility, assuring potential and current clients that TFI Markets operates within the legal frameworks laid out by these bodies.

However, it is worth noting that TFI Markets had a license from the Financial Conduct Authority (FCA) in the United Kingdom, which has been revoked. The revocation of a regulatory license is a serious matter that can raise questions about a broker's legitimacy and reliability. While the broker remains regulated and operational under its CySEC license, the revoked FCA license could be a point of concern for traders and corporate clients alike, particularly those based in the United Kingdom or who are particularly cautious about regulatory oversight.

Pros and Cons

| Pros | Cons |

| Physical Office Locations | Corporate-Only Service |

| Multiple Support Channels | Lack of Educational Content |

| No Non-Trading Commissions | Limited Deposit/Withdrawal Options |

| Free Multi-Currency Account | |

| Risk-Management Tools |

Pros:

Physical Office Locations: TFI Markets has real offices in Cyprus and trading branches in Greece, providing a tangible point of contact for clients.

Multiple Support Channels: The company offers multiple methods for customer service, including phone and email.

No Non-Trading Commissions: TFI Markets does not charge any non-trading commissions, reducing overall costs for clients.

Free Multi-Currency Account: Every client is offered a free multi-currency account, facilitating seamless international transactions.

Risk-Management Tools: TFI provides specialized tools for managing currency risk, aiding businesses in reducing their exposure to currency volatility.

Cons:

Corporate-Only Service: TFI Markets exclusively serves legal entities, excluding individual traders from its services.

Lack of Educational Content: The company's website doesn't offer educational resources, making it less beginner-friendly for clients new to currency trading.

Limited Deposit/Withdrawal Options: The only available method for deposits and withdrawals is through bank wire transfers, which may not be convenient for all clients.

Market Instruments

TFI Markets specializes in dealing with currency pairs, focusing on corporate clients with unique requirements for hedging and risk mitigation. While the brokerage doesn't offer a broad spectrum of instruments like commodities, stocks, or indices, it excels in its niche. The emphasis is on providing businesses with comprehensive solutions to manage currency exposure effectively.

The limited but highly specialized offering aligns with their business model, which aims to serve corporate clients with advanced needs, including extended payment cut-off times and 24-hour access to currency market pricing. The absence of an extensive range of trading instruments may deter some traders; however, TFI's expertise in currency markets makes it a strong contender for businesses looking to focus exclusively on currency trading.

Account Types

TFI Markets primarily serves corporate clients, and its account features reflect this focus. With a minimum deposit requirement of just $1, it offers a low barrier to entry for businesses of all sizes.

However, it's important to note that the company deals solely with legal entities like corporates, companies, partnerships, and agencies. It's not designed for individual traders or retail investors. Two types of accounts are primarily offered: Corporate accounts and Personal accounts, both having a minimum spread of $3. Withdrawal fees differ based on the method and amount but are generally cost-effective. Although the broker doesn't offer accounts with varying features or tailored options, its standard account is robust enough to meet the needs of most corporate clients.

How to Open an Account?

Opening an account with TFI Markets is a straightforward process but does require some standard due diligence given the corporate focus.

Visit the Website: Start by navigating to the TFI Markets official website: TFI Markets.

Register for an Account: Locate and click on the “Open Account” or “Register” button, usually found at the top right corner of the homepage. Fill in your personal details and other required information to initiate the registration process.

Submit Identification Documents: To comply with financial regulations and due diligence requirements, you'll be asked to submit identification documents. This often includes a government-issued ID and proof of residence.

Review and Accept Terms: Read through the terms and conditions, as well as any trading policies. Confirm and accept these terms to proceed. In some cases, you might also be asked to complete a questionnaire to assess your trading knowledge and experience.

Fund Your Account: Once your account is verified, you can proceed to fund it. TFI Markets generally accepts funds via bank wire transfer. Follow the instructions on the platform to complete your initial deposit.

Leverage

Leverage at TFI Markets starts from 1:1, a conservative level that aligns with the company's risk-mitigating philosophy. Since TFI primarily serves corporate clients who may not be interested in high-risk, high-reward trading strategies, the leverage options are tailored to suit more cautious trading approaches. This conservative leverage offering is beneficial for corporate clients seeking stability and risk minimization in their trading activities. It may not appeal to traders looking for high leverage to maximize returns, but it aligns well with the brokerage's broader focus on providing stable and secure trading environments.

Spreads & Commissions

TFI Markets operates with a floating spread model. The minimum spread starts from $3 for both corporate and personal accounts. Importantly, there is no commission charged for currency conversions. The broker is transparent about its non-trading fees, and there are no hidden charges.

Internal transfers and account opening or maintenance fees are free of charge. For inactive accounts extending beyond five years, an account maintenance fee of €80 is levied. This transparent fee structure suits businesses that require clear and predictable trading costs for budgeting and financial planning.

Trading Platform

TFI Markets offers a sophisticated trading platform that integrates seamlessly with the FIX4.4 protocol, enabling automation for frequent currency conversions. This feature-rich platform caters to a variety of trading needs by providing real-time account balance updates as well as facilitating a smooth flow of trading orders. Through the “Quotes” session, clients have the advantage of accessing the company's real-time pricing data. This real-time information can be fed into the client's own trading systems 24/7, ensuring they have the most up-to-date market data at their fingertips.

To further cater to different trading strategies and requirements, the platform provides multiple types of trading sessions. The “Market Trade” session allows for the immediate execution of currency conversion orders at market prices.

Deposit & Withdrawal

The primary method for funding accounts at TFI Markets is via bank wire transfers. While secure, wire transfers may not be the quickest or most convenient method for all clients. Deposit to any TFI Markets account is free, but withdrawal fees depend on the method and amount. For example, the fee is €10 if the transfer amount is less than €10,000. This may not offer the flexibility that some businesses are looking for but aligns with the broker's focus on providing a secure trading environment.

Customer Support

TFI Markets Ltd prioritizes customer support with its multiple avenues for contact. The head office is strategically located in Nicosia, Cyprus, at 27 Pindarou, Alpha Business Center, Block A, 3rd Floor. They can be reached by phone at (+357) 22 749 800 or by fax at (+357) 22 817 496. For postal correspondence, the P.O Box is 16022, 2085, Nicosia, Cyprus.

In addition to the main office in Nicosia, TFI Markets also has a representative office in Limassol, Cyprus, located at 3 Krinou, The Oval, 9th floor, Office 901, Ayios Athanasios, with the contact phone number being (+357) 25 749 800. They also have a branch in Athens, Greece, situated at 166 A Kifissias Avenue & Sofokleous 2 Str., Office 004, Marousi. The Athens office can be reached at (+30) 210 710 20 10. These multiple locations and varied contact options underscore TFI Markets' commitment to accessible and comprehensive customer service.

Brokers Comparison

| Criteria | TFI Markets | eToro | Interactive Brokers |

| Regulatory Authorities | CySEC, Central Bank of Cyprus | FCA, CySEC, ASIC | SEC, CFTC, FCA |

| Account Types | Corporate | Retail, Professional | Individual, Joint, Corporate |

| Minimum Deposit | $1 | $200 | $0 |

| Instruments Offered | Currency pairs | Stocks, Forex, Crypto, Commodities | Stocks, Forex, Options, Futures |

Conclusion

TFI Markets has established itself as a reliable and specialized broker in the forex market, particularly serving corporate clients. With a focus on risk management, transparency in pricing, and strong customer support, the broker holds considerable appeal for businesses looking for stable and secure trading environments. The broker may not offer a wide range of trading instruments or deposit methods, but its specialized focus on forex and corporate clients makes it an attractive choice for businesses with specific trading needs.

FAQs

Q: What are the advantages of trading with a regulated broker like TFI Markets?

A: Trading with a regulated broker ensures compliance with financial laws, providing a layer of security for your investment. It also ensures transparent operations and access to legal recourse in case of disputes.

Q: How does TFI Markets handle customer funds?

A: TFI Markets keeps client funds in segregated accounts, separate from the company's own operational funds, thereby enhancing the safety and security of client assets.

Q: Can I automate my trading activities on TFI Markets' platform?

A: Yes, TFI Markets' platform integrates with the FIX4.4 protocol, allowing automated order submission and real-time account updates.

Q: What leverage does TFI Markets offer?

A: TFI Markets offers leverage starting from 1:1, but the exact amount may depend on the type of trading instrument and account conditions.

Q: Is there a minimum deposit requirement for opening an account with TFI Markets?

A: Yes, TFI Markets has a very low minimum deposit requirement of just $1, making it accessible for traders of all levels.

Q: How can I reach customer support at TFI Markets?

A: TFI Markets offers multiple channels for customer support, including phone and email. They have offices in Cyprus and Greece, enhancing local access for European clients.

News

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now