Score

ARGUS

Cyprus|Above 20 years|

Cyprus|Above 20 years| http://www.argus.com.cy/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Latvia 2.54

Latvia 2.54Surpassed 54.60% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+357 (22)717000

Other ways of contact

Broker Information

More

Argus Stockbrokers Ltd

ARGUS

Cyprus

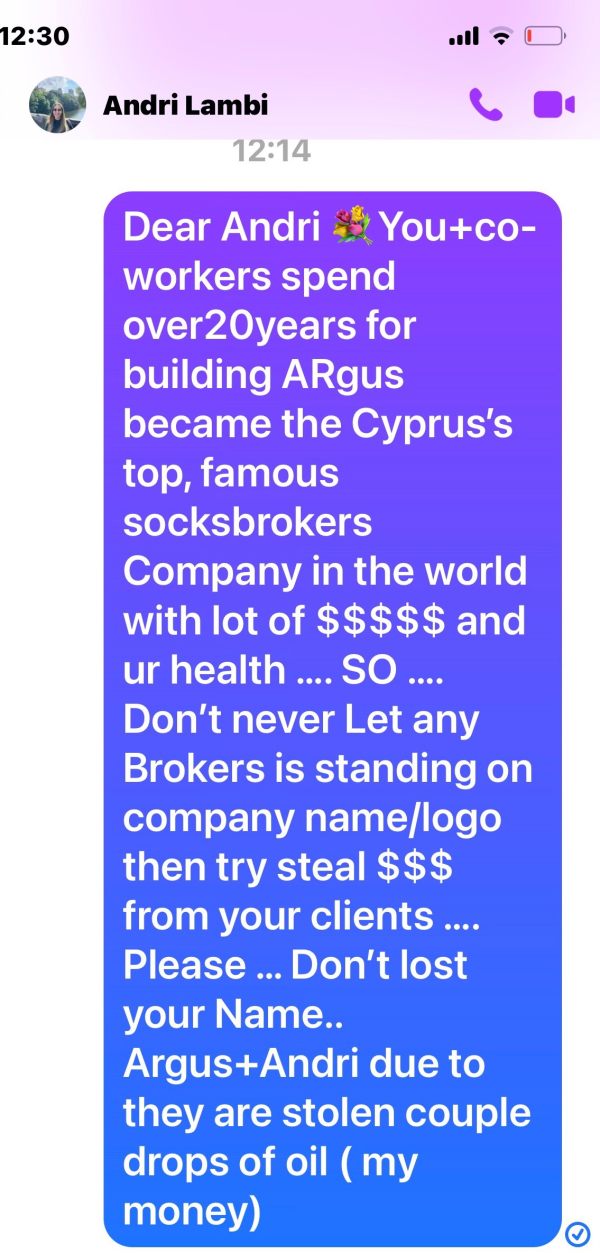

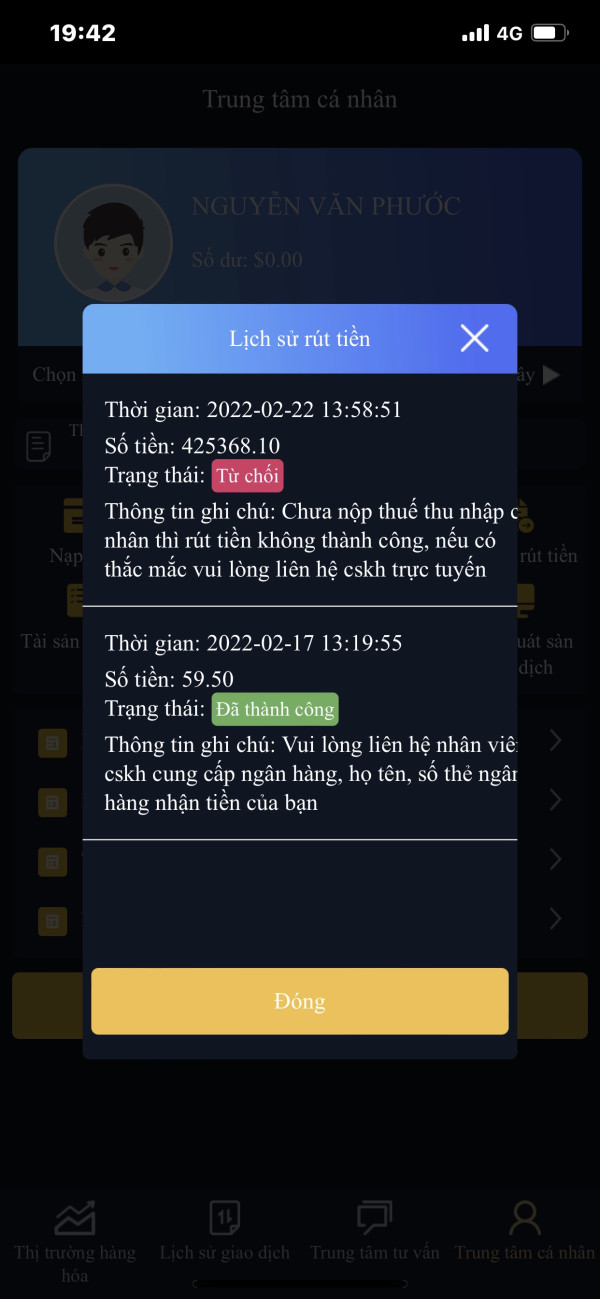

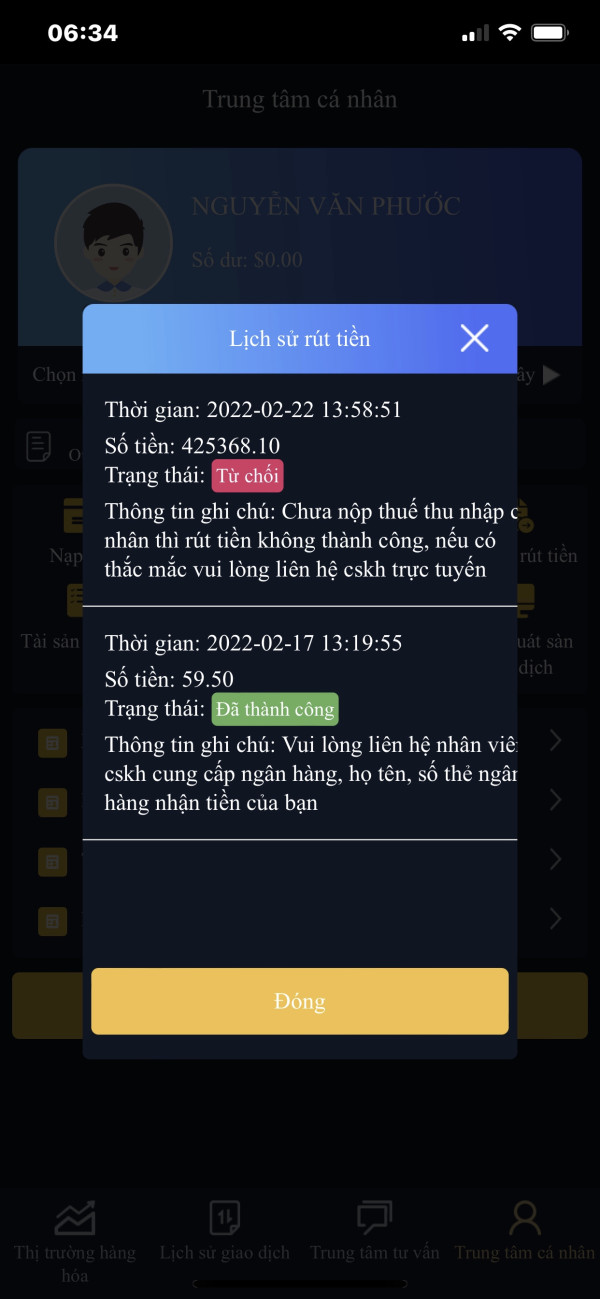

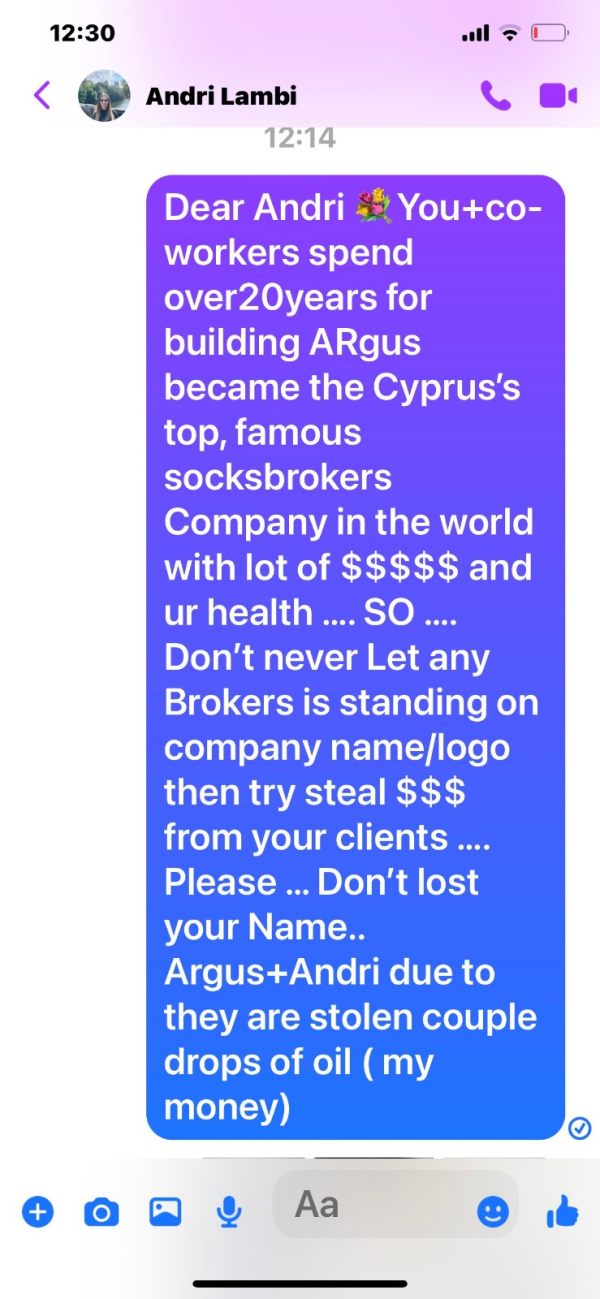

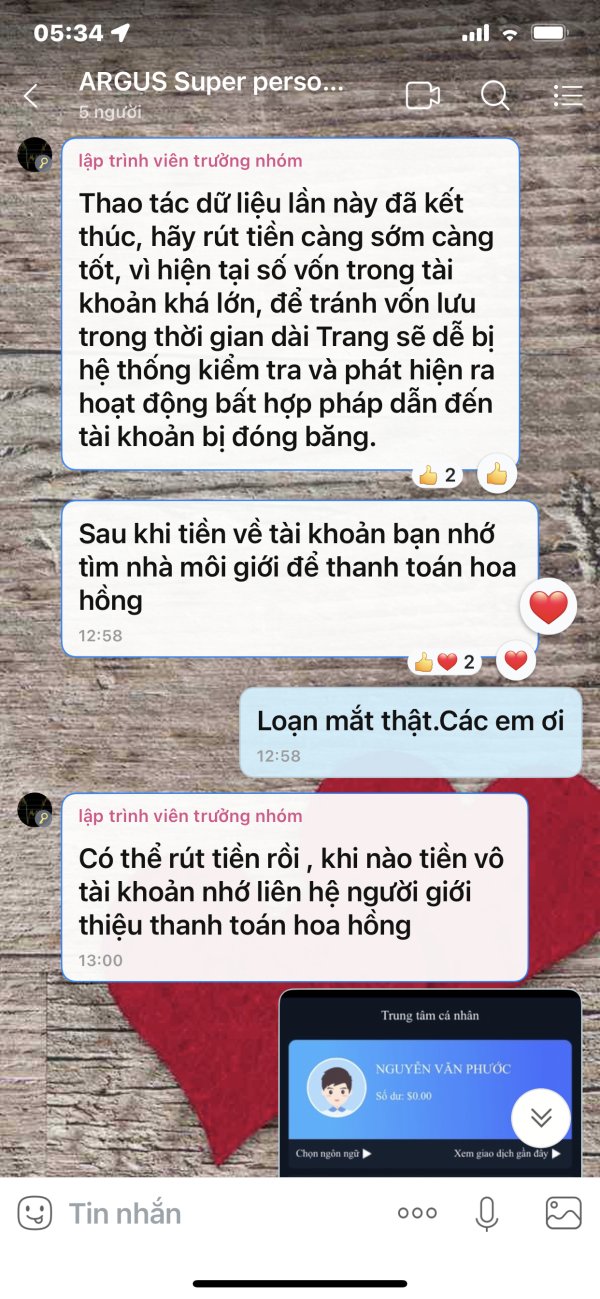

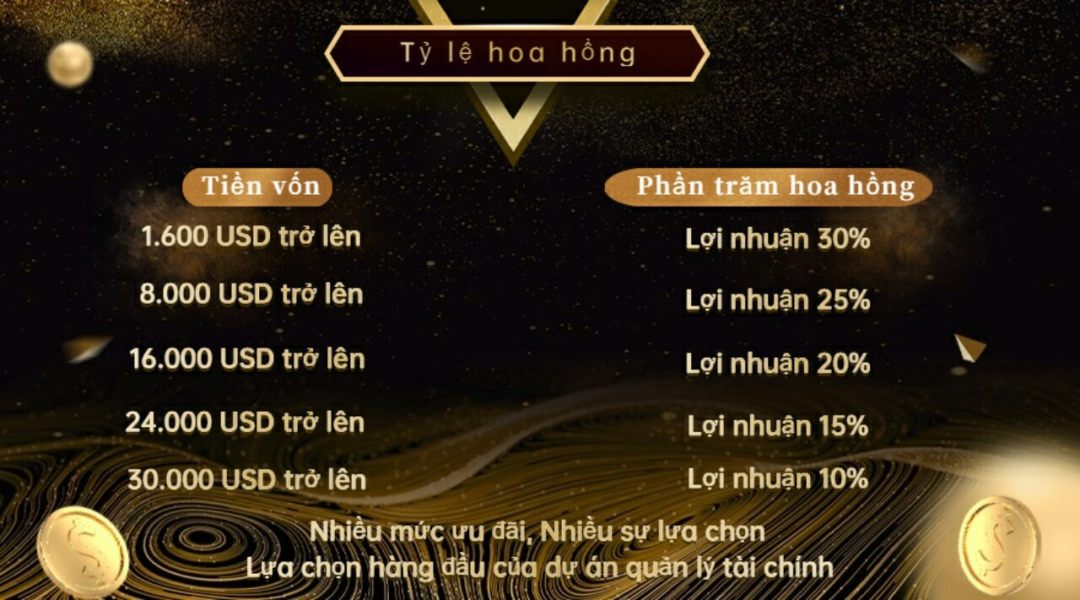

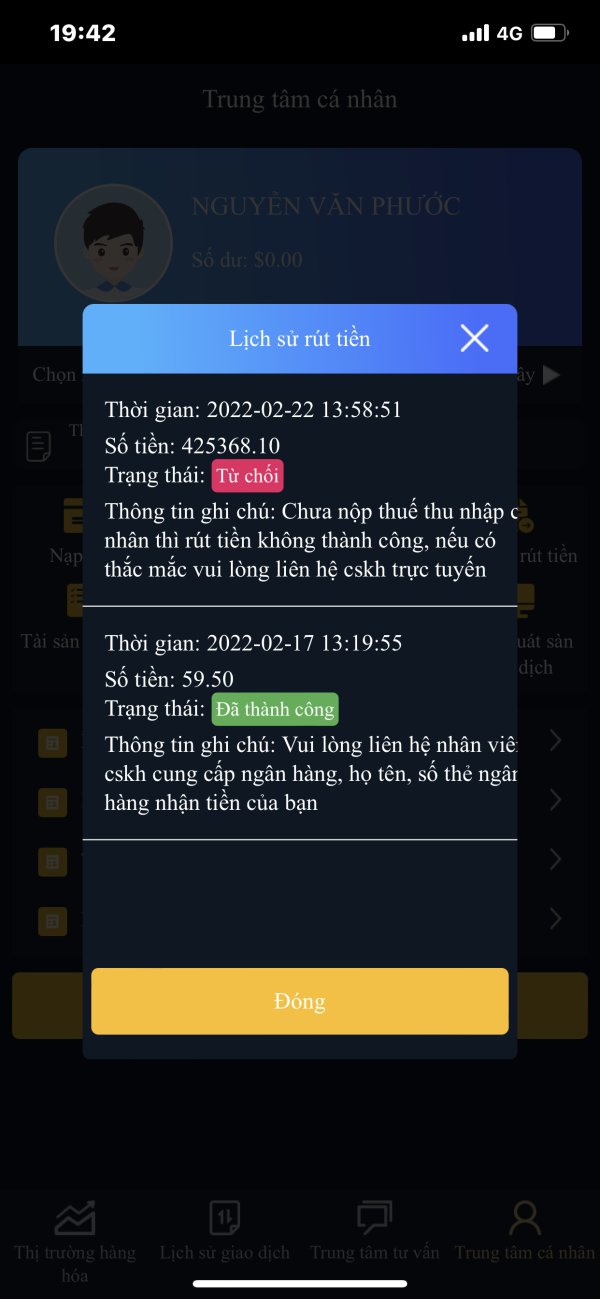

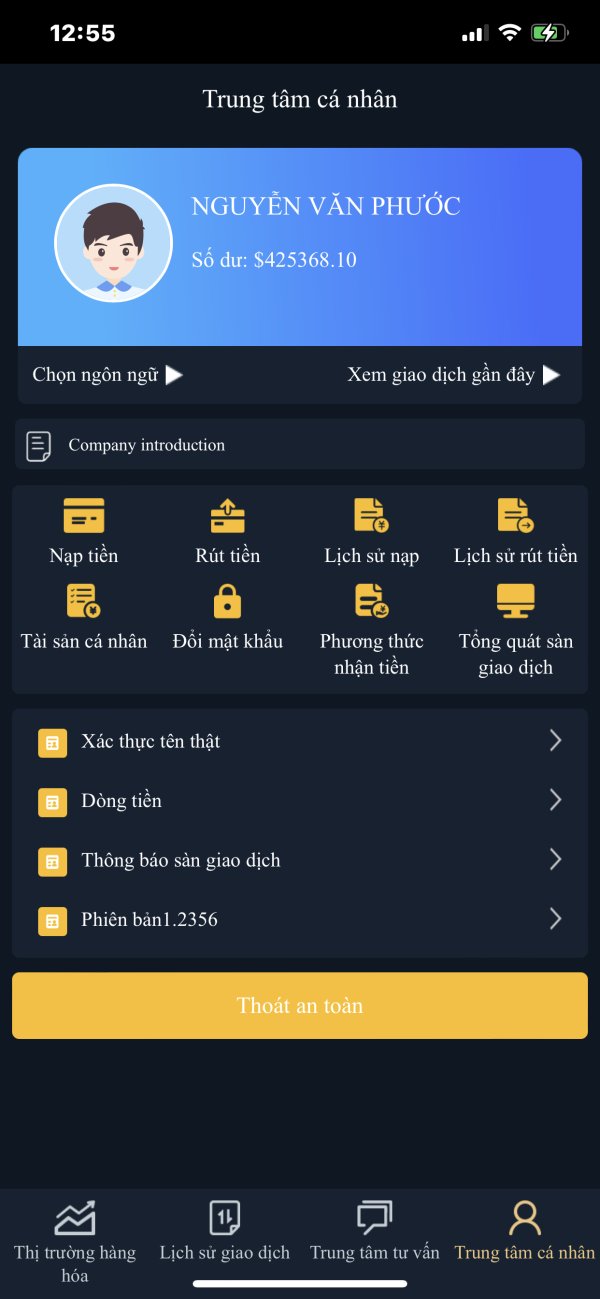

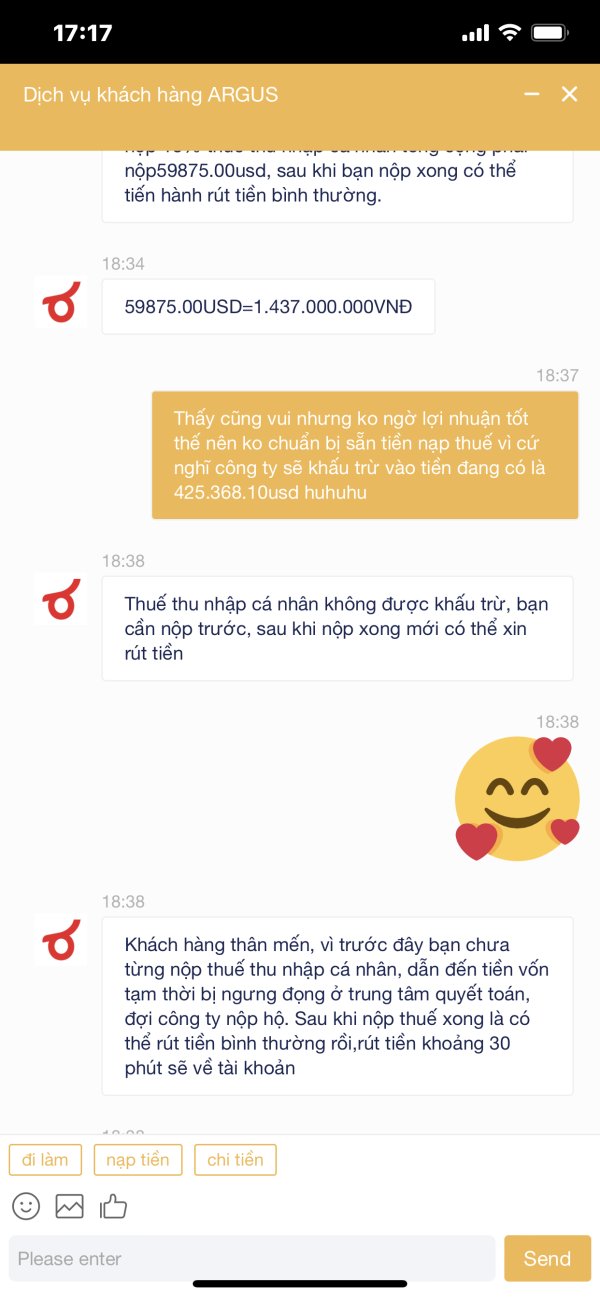

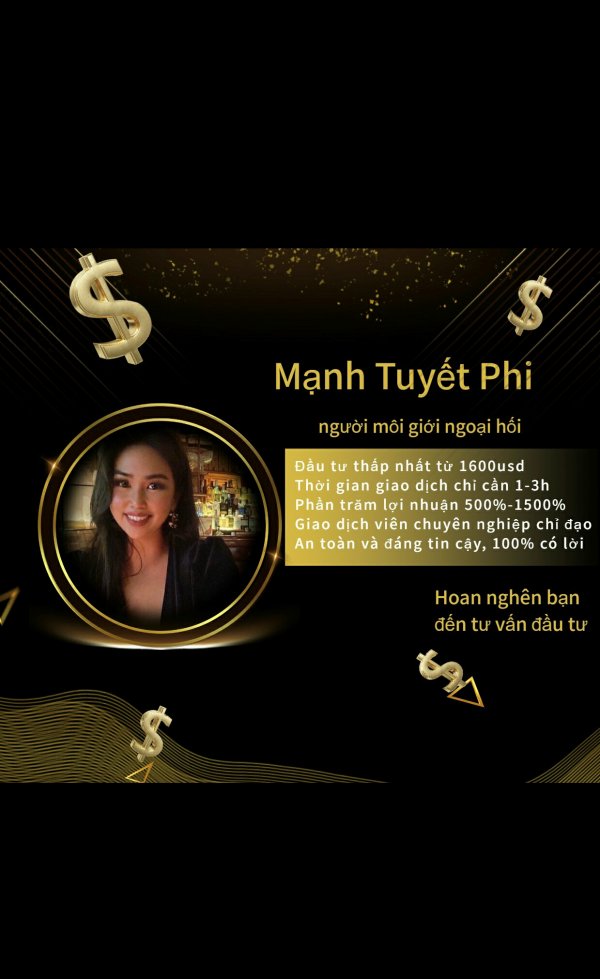

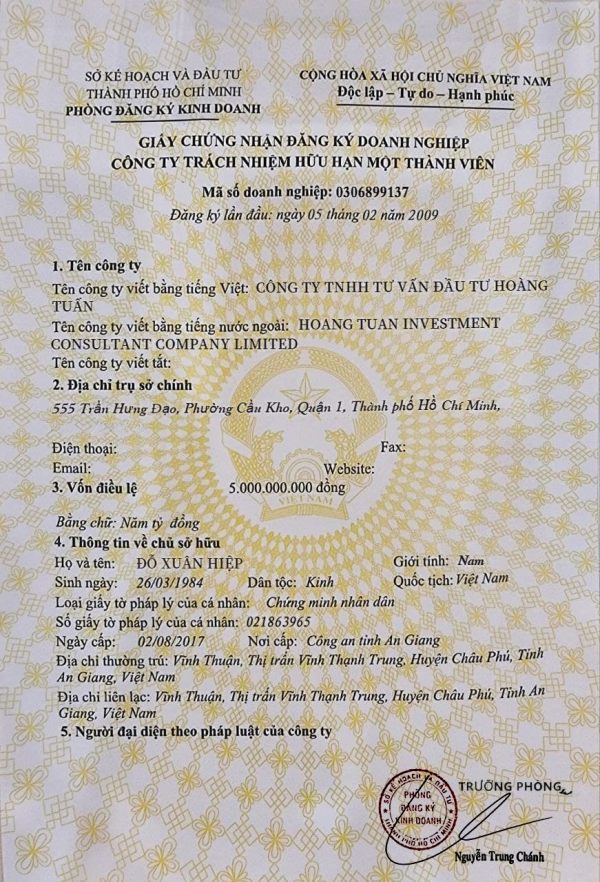

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed ARGUS also viewed..

XM

HFM

CPT Markets

FP Markets

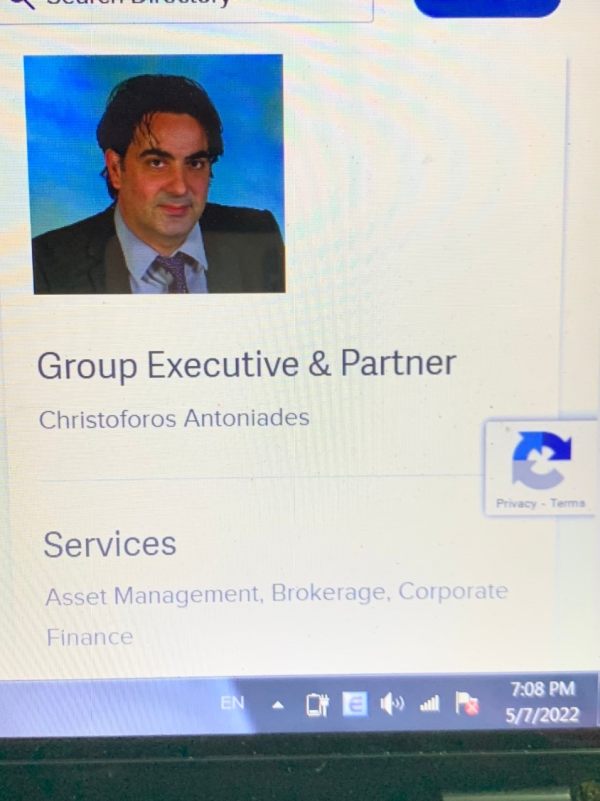

ARGUS · Company Summary

| Aspect | Information |

| Company Name | ARGUS |

| Registered Country/Area | Cyprus |

| Founded Year | above 20 years |

| Regulation | Regulated by CySEC (Cyprus Securities and Exchange Commission) |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Variable |

| Trading Platforms | Argus Global Trader Platform and the CSE-ASE Trading Platform |

| Tradable Assets | Equities, Bonds, ETFs, CFDs, Futures, Forex |

| Account Types | Standard, ECN |

| Customer Support | 24/5 live chat and email support |

| Deposit & Withdrawal | Bank transfer, credit/debit card, Skrill |

| Educational Resources | N/A |

Overview of ARGUS

ARGUS is a financial brokerage firm based in Cyprus, operating within the regulatory framework of the Cyprus Securities and Exchange Commission (CySEC). Established with a focus on providing accessible trading services, ARGUS caters to a diverse range of traders, offering competitive features and trading opportunities.

One of the notable aspects of ARGUS is its commitment to accessibility, evident in its low minimum deposit requirement of just $100. This allows traders with varying capital levels to participate in the financial markets. Moreover, ARGUS offers a high maximum leverage of up to 1:1000, providing traders with the flexibility to control larger positions relative to their initial deposits. However, traders should exercise caution when using high leverage, as it can amplify both profits and losses.

ARGUS provides a range of tradable assets, including Equities, Bonds, Exchange Traded Funds (ETFs), CFDs (Contracts for Difference), Futures, and Forex. This diverse offering enables traders to explore various financial markets and diversify their portfolios.

Is ARGUS Legit or a Scam?

ARGUS, operating under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), is a regulated entity with a Straight Through Processing (STP) license.

Founded in 2003, Argus Stockbrokers Ltd has been providing financial services with a commitment to transparency and efficiency. This regulatory framework ensures that ARGUS adheres to the necessary financial and operational standards to offer a secure trading environment for its clients.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Limited educational resources |

| High maximum leverage (1:1000) | Variable spreads may not be suitable for all traders |

| Competitive commission rates for Standard accounts | Limited market analysis and insights |

| Low minimum deposit ($100) | Limited payment methods for withdrawals |

| Accessible 24/5 live chat and email support |

Pros:

Regulated by CySEC: Being regulated by the Cyprus Securities and Exchange Commission (CySEC) provides a level of trust and assurance to traders, ensuring compliance with regulatory standards.

High maximum leverage (1:1000): The availability of high leverage allows traders to control larger positions with a relatively small amount of capital.

Competitive commission rates for Standard accounts: Standard account holders can benefit from competitive commission rates, reducing the overall cost of trading.

Low minimum deposit ($100): The low minimum deposit requirement makes it accessible for traders with varying levels of capital.

Accessible 24/5 live chat and email support: The availability of customer support through live chat and email ensures assistance is readily accessible.

Cons:

Limited educational resources: The platform lacks comprehensive educational materials, which can be a drawback for traders looking to improve their trading skills.

Variable spreads may not be suitable for all traders: The variability of spreads may pose challenges for traders who prefer fixed spreads for consistent trading costs.

Limited market analysis and insights: Traders may have limited access to market analysis and insights to aid their decision-making.

Limited payment methods for withdrawals: The platform may offer limited options for withdrawal methods, potentially inconveniencing some traders.

Market Instruments

ARGUS provides a wide range of trading assets, catering to diverse investment preferences. Here's a concrete description of the trading assets offered by ARGUS:

Equities: ARGUS offers a comprehensive selection of equities, allowing traders and investors to participate in the global stock markets. Clients can trade shares of publicly listed companies, providing opportunities for ownership in various corporations. Equities enable clients to potentially benefit from capital appreciation and dividends.

Bonds: ARGUS facilitates the trading of bonds, which are debt securities issued by governments, corporations, or other entities. Bonds offer fixed-income investment opportunities and may provide periodic interest payments to investors. Trading bonds can help diversify portfolios and manage risk.

Exchange Traded Funds (ETFs): ARGUS allows clients to trade ETFs, which are investment funds traded on stock exchanges. ETFs provide exposure to a wide range of asset classes, including stocks, bonds, commodities, and more. They offer a cost-effective and diversified way to invest in various markets.

CFDs (Contracts for Difference): ARGUS offers Contracts for Difference as a trading asset. CFDs enable clients to speculate on the price movements of various financial instruments without owning the underlying assets. This allows for leveraged trading and the potential to profit from both rising and falling markets.

Futures: ARGUS provides access to trading futures contracts. Futures are derivative financial instruments that involve the obligation to buy or sell an asset at a predetermined price on a specified future date. Futures trading can be used for hedging or speculative purposes in various markets, including commodities and indices.

Forex: ARGUS offers access to the Forex market, the largest and most liquid financial market globally. Forex trading involves the exchange of currencies, and clients can trade a wide range of currency pairs. This asset class provides opportunities for currency speculation and trading strategies based on exchange rate movements.

Account Types

ARGUS offers two distinct account types, Standard and ECN, each catering to different trading preferences and strategies:

Standard Account:The Standard account option provided by ARGUS is a versatile choice suitable for a wide range of traders. With a relatively low minimum deposit requirement of $100, it offers accessibility to traders who may be starting or prefer to manage lower capital.

One notable feature of the Standard account is that it does not incur any commission per lot, making it an attractive option for those who prefer commission-free trading. This account type operates with variable spreads, which means that the spread cost may fluctuate based on market conditions. Traders using the Standard account can leverage their positions up to 1:1000, offering flexibility in their trading strategies.

ECN Account:For traders seeking enhanced execution speeds and market depth, ARGUS offers the ECN (Electronic Communication Network) account. This account type is known for its direct access to interbank liquidity, resulting in tighter spreads. Traders using the ECN account can benefit from spreads that can be as low as 0 pips due to the variable spread model.

However, it's important to note that the ECN account charges a commission of $0.03 per lot traded. This commission-based structure is common among ECN accounts and ensures transparency in trading costs. With leverage of up to 1:1000, ECN account holders have the opportunity to manage larger positions. Additionally, ARGUS supports various withdrawal methods, including bank transfers, credit/debit card transactions, and Skrill. Both Standard and ECN account holders can access a demo account for practice and learning.

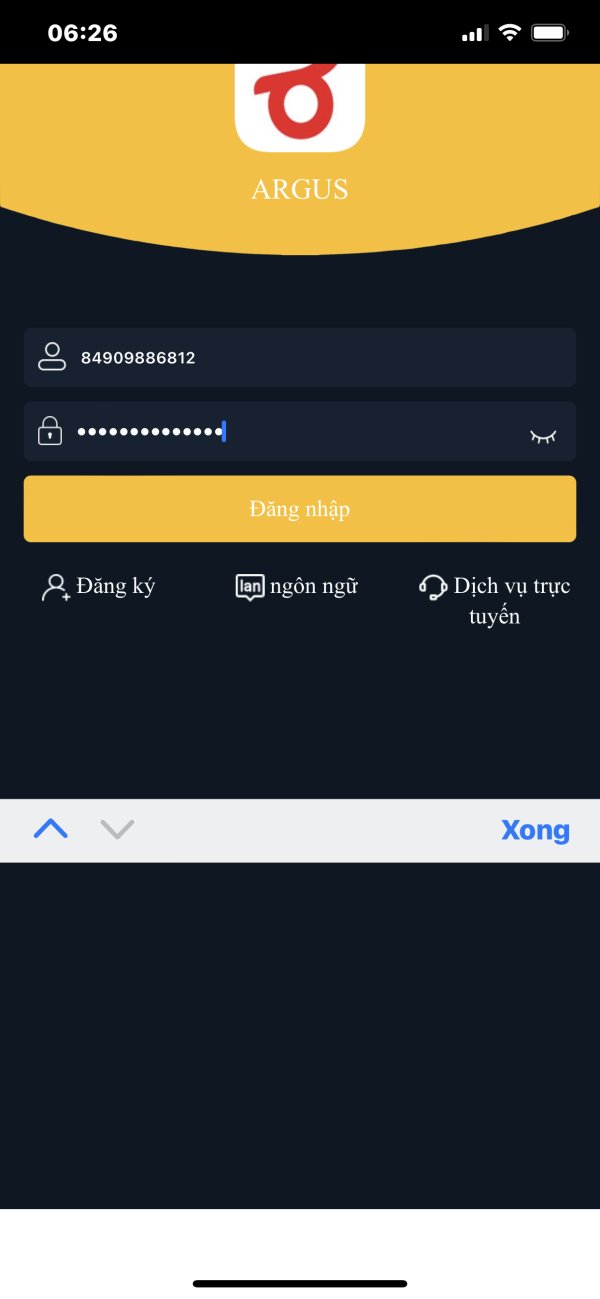

How to Open an Account?

Opening an account with ARGUS involves several straightforward steps. Here's a concrete guide broken down into six key points:

Visit the ARGUS Website:

Start by accessing the official ARGUS website through your web browser. You can do this by entering the URL: https://www.argus.com.cy/.

Account Registration:

On the website's homepage, you should find a section or button that allows you to initiate the account registration process. Click on the “Register” or “Open an Account” option.

Complete the Registration Form:

You'll be directed to a registration form where you'll need to provide your personal information. This typically includes your full name, contact details, date of birth, and residential address. Ensure that all information is accurate, as it will be used for account verification.

Verification Documents:

Most reputable brokers, including ARGUS, require Know Your Customer (KYC) verification. This involves submitting identification documents such as a government-issued ID (passport or driver's license) and proof of address (utility bill or bank statement). Follow the instructions provided for document submission.

Fund Your Account:

After successful registration and KYC verification, you can proceed to fund your trading account. ARGUS likely offers various deposit methods, which may include bank transfers, credit/debit card payments, and potentially other options. Select your preferred payment method and follow the deposit instructions.

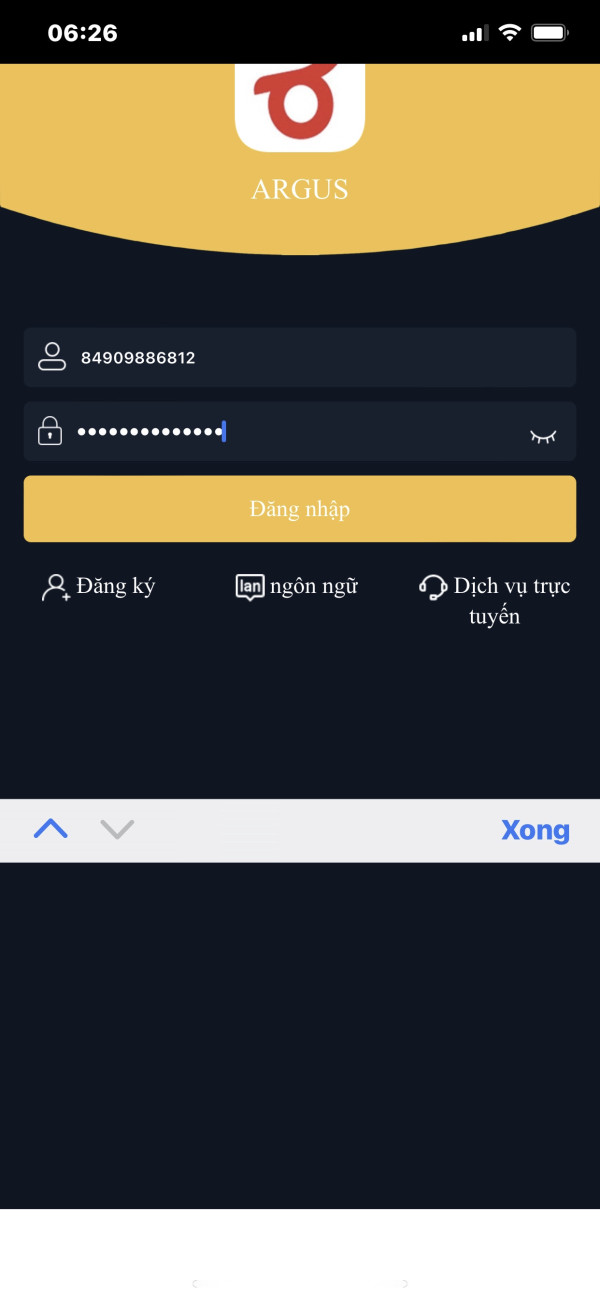

Access the Trading Platform:

Once your account is funded, you can log in to the trading platform provided by ARGUS. Depending on your preference, you can choose either the Argus Global Trader Platform or the CSE-ASE Trading Platform, as described earlier. You're now ready to start trading a variety of assets, including equities, bonds, ETFs, CFDs, futures, and forex.

Leverage

ARGUS offers a maximum leverage of up to 1:1000. Leverage is a financial tool that allows traders to control a larger position size than their initial capital. In this case, with a maximum leverage of 1:1000, traders can potentially control a position worth up to 1000 times their deposited capital. This high leverage can amplify both potential profits and losses.

While it provides traders with the opportunity to trade larger positions with a relatively small amount of capital, it's essential to exercise caution and implement sound risk management strategies when using high leverage, as it can also lead to significant financial risks. Traders should be aware of the potential consequences of high leverage and only use it in line with their risk tolerance and trading strategy.

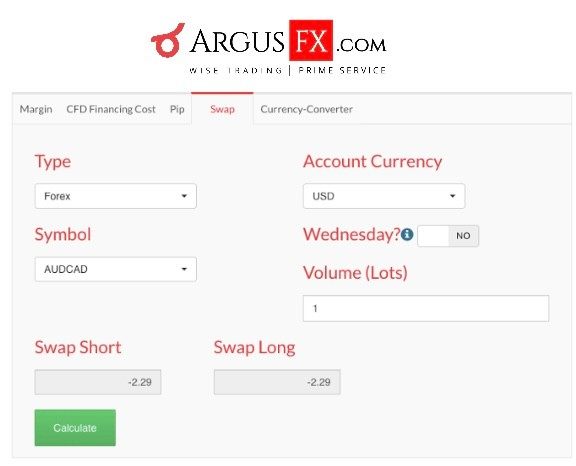

Spreads & Commissions

ARGUS offers variable spreads and commission structures for different types of accounts:

Standard Account:

Spreads: The spreads for the Standard account are variable, meaning they can fluctuate based on market conditions.

Commission: There is no commission charged for Standard accounts, making it a commission-free option. Traders using this account type pay for their trades through the variable spreads.

ECN (Electronic Communication Network) Account:

Spreads: Similar to the Standard account, ECN account spreads are variable and subject to market conditions. The exact spread values are not specified but may vary depending on liquidity and market volatility.

Commission: For ECN accounts, there is a commission of $0.03 per lot traded. This means that traders are charged a fixed commission fee for each lot they trade in addition to the variable spreads. The commission fee is applied to both opening and closing trades.

Trading Platform

ARGUS offers two trading platforms to cater to the needs of its clients, including the Argus Global Trader Platform and the CSE-ASE Trading Platform.

Argus Global Trader Platform:

The Argus Global Trader Platform is available online and provides a convenient way for clients to engage in online trading. Traders can access this platform by registering for a trial account, making it accessible for both experienced traders and those looking to explore the world of online trading.

This platform offers a user-friendly interface, allowing clients to execute orders and manage their investments efficiently. It is designed to streamline the trading process, offering real-time market data and order execution capabilities.

The online Argus Global Trader Platform is accessible from various devices with internet connectivity, providing flexibility to trade from desktops, laptops, and mobile devices.

CSE-ASE Trading Platform:

ARGUS Stockbrokers Ltd, as a member of the Cyprus Stock Exchange (CSE) and Athens Stock Exchange (ASE), provides clients with full electronic automated order execution services on both of these exchanges. This service is facilitated through the use of the ARGUS Trader platform.

Investors can access and trade on the Cyprus Stock Exchange and Athens Stock Exchange using the ARGUS Trader platform. This platform is equipped with features and tools necessary for executing orders on these exchanges efficiently.

To use the CSE-ASE Trading Platform, clients can simply log in and trade online. ARGUS offers support for clients trading on these exchanges, and they can reach out for assistance by calling +357 22 717000.

Both trading platforms aim to enhance the trading experience for ARGUS clients. The online Argus Global Trader Platform provides accessibility and ease of use, while the CSE-ASE Trading Platform caters to clients interested in trading on the Cyprus Stock Exchange and Athens Stock Exchange, offering electronic order execution services. These platforms are designed to meet the diverse trading needs of investors and traders.

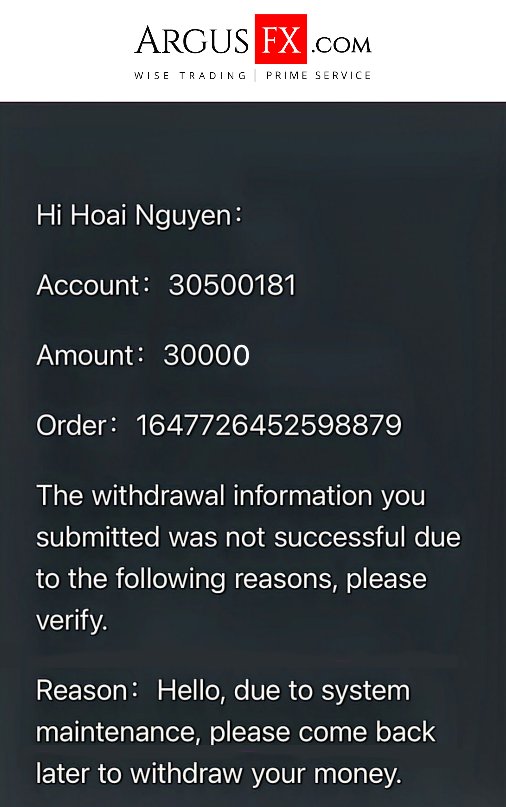

Deposit & Withdrawal

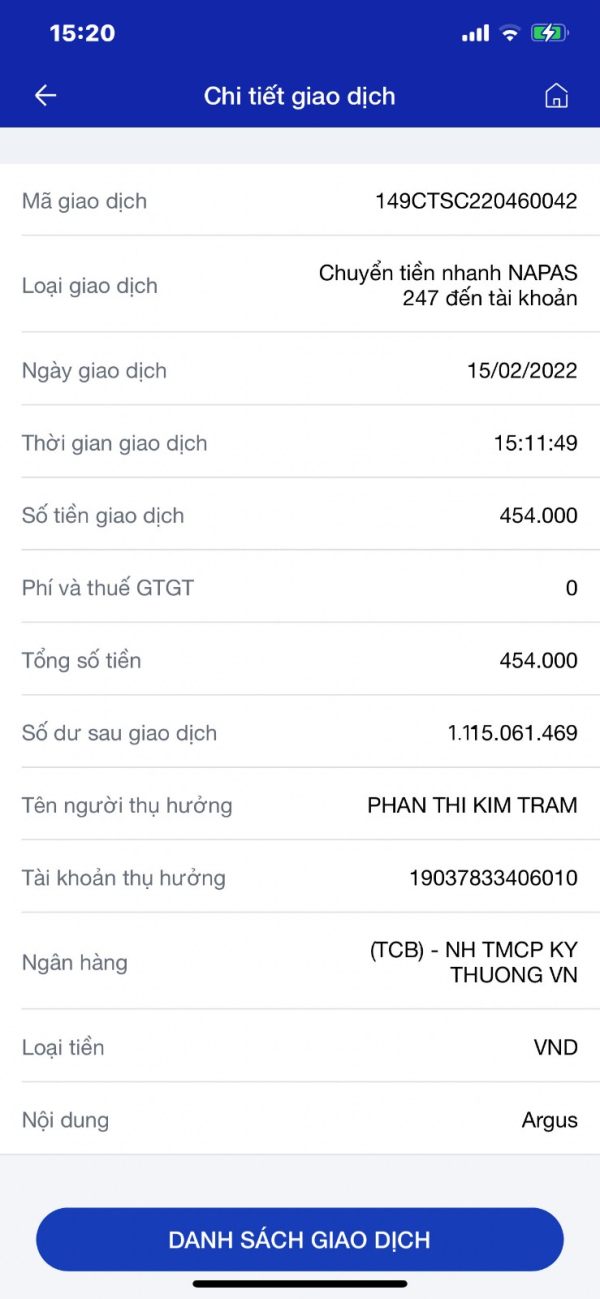

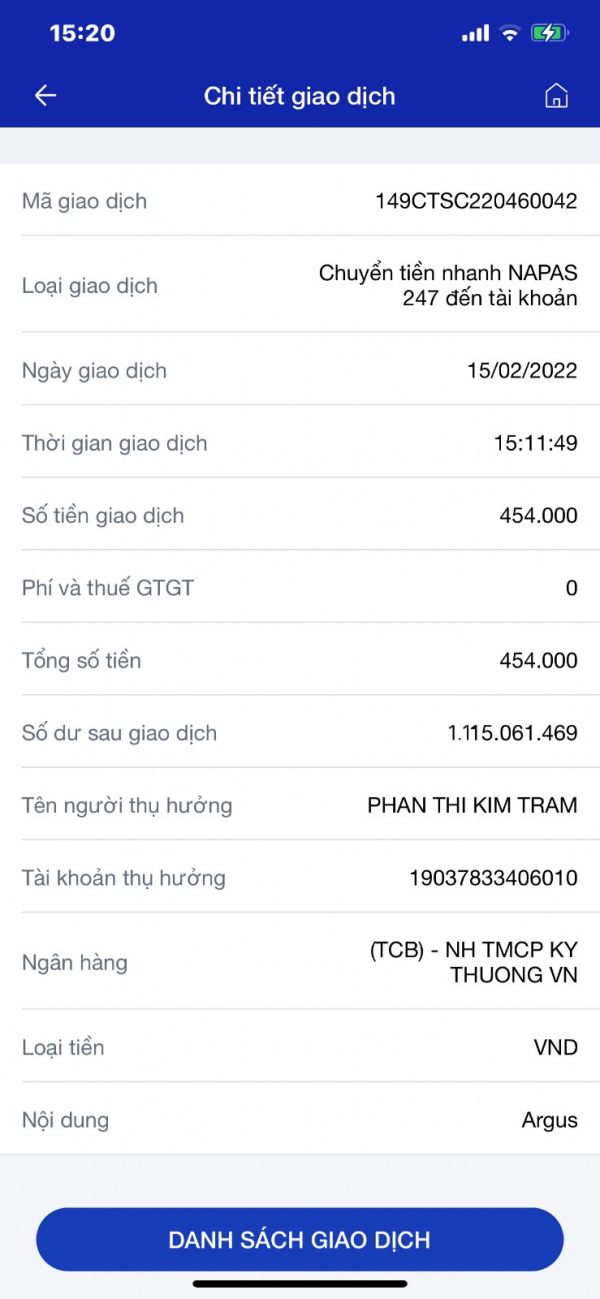

ARGUS offers multiple payment methods for deposits and withdrawals, along with specific details regarding minimum deposits and payment processing times:

Payment Methods:

Bank Transfer: You can fund your ARGUS trading account through a bank transfer. This method allows you to transfer funds directly from your bank to your trading account.

Credit/Debit Card: ARGUS also supports credit and debit card payments. You can use your credit or debit card to deposit funds into your trading account.

Skrill: Skrill is another payment option available for deposits and withdrawals. It provides a secure and convenient way to manage your funds.

Minimum Deposit:

The minimum deposit requirement for an ARGUS trading account is $100. This means that you need to deposit at least $100 to start trading on their platform. It's essential to note that this minimum deposit may vary depending on the account type you choose.

Payment Processing Time:

ARGUS aims to provide efficient payment processing. However, the processing time for deposits and withdrawals can vary based on the payment method you choose and other factors:

Bank Transfer: The processing time for bank transfers may take a few business days, typically 2-5 business days, depending on your bank's procedures.

Credit/Debit Card: Credit and debit card payments are usually processed relatively quickly. Funds can appear in your trading account shortly after the payment is made.

Skrill: Skrill transactions are generally processed swiftly, ensuring that you have timely access to your funds.

Customer Support

ARGUS provides comprehensive customer support with contact details and office locations in Cyprus. Here's the information on their customer support:

Contact Information:

Telephone: +357 22 717000

Fax: +357 22 717070

Email: argus@argus.com.cy

ARGUS's main office is situated in Nicosia, Cyprus, providing traders with a physical location where they can contact the company. The provided contact numbers for telephone and fax offer additional means of communication for traders with inquiries or issues related to their trading accounts or services.

Furthermore, the provided email address, argus@argus.com.cy, serves as a direct contact point for traders to reach out to the support team via email. This email support channel allows traders to send detailed inquiries and receive responses from the support staff.

Educational Resources

ARGUS lacks educational resources, which can make it difficult for new users to learn how to use the platform and trade cryptocurrencies.

Some of the educational resources that are missing from ARGUS include: a comprehensive user guide, video tutorials, live webinars, blogs and etc.

The lack of educational resources on ARGUS can make it difficult for new users to learn how to use the platform and trade cryptocurrencies. This can lead to mistakes and losses, which can discourage new users from trading.

Conclusion

In conclusion, ARGUS offers a trading platform regulated by CySEC, providing traders with high maximum leverage, competitive commission rates for Standard accounts, and a low minimum deposit requirement of $100. The accessibility of 24/5 live chat and email support enhances the overall trading experience.

However, it's important to note that the platform lacks comprehensive educational resources, and its variable spreads may not be suitable for all traders. Additionally, limited market analysis and insights, as well as a restricted range of payment methods for withdrawals, may be considered disadvantages by some users. Traders should carefully assess their trading preferences and needs when considering ARGUS as their trading platform.

FAQs

Q: Is ARGUS regulated by any financial authority?

A: Yes, ARGUS is regulated by CySEC (Cyprus Securities and Exchange Commission).

Q: What is the maximum leverage offered by ARGUS?

A: ARGUS offers a maximum leverage of up to 1:1000 for trading.

Q: Are there any commissions for Standard accounts on ARGUS?

A: Standard accounts on ARGUS do not have commissions, making it a cost-effective option for traders.

Q: What is the minimum deposit required to open an account with ARGUS?

A: The minimum deposit requirement for an ARGUS account is $100.

Q: What payment methods are available for withdrawals on ARGUS?

A: ARGUS supports withdrawals via bank transfer, credit/debit card, or Skrill.

Q: Is there a demo account option on ARGUS?

A: Yes, ARGUS offers a demo account for traders to practice and familiarize themselves with the platform before trading with real funds.

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now