Score

Ring Financial

China|2-5 years|

China|2-5 years| https://ring-forex.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 7846150132

Other ways of contact

Broker Information

More

Ring Forex Ltd

Ring Financial

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 39 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

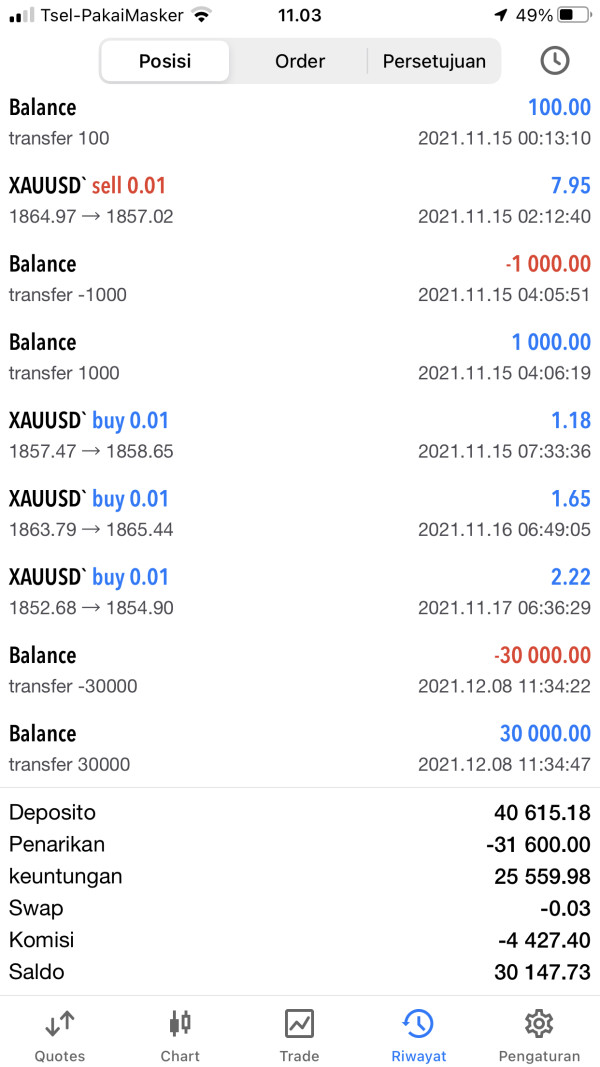

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | $ 1,000 |

| Minimum Spread | -- |

| Products | Foreign exchange, commodities, CFDs |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 lot |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Ring Financial also viewed..

XM

FP Markets

VT Markets

EC Markets

Ring Financial · Company Summary

| Aspect | Information |

| Company Name | Ring Financial |

| Registered Country/Area | United Kingdom |

| Founded year | 2012 |

| Regulation | Unregulated |

| Minimum Deposit | £100 |

| Maximum Leverage | 1:30 |

| Spreads | Variable |

| Trading Platforms | MetaTrader 4 |

| Tradable assets | Forex, CFDs on stocks, indices, commodities |

| Account Types | Standard, ECN |

| Demo Account | Yes |

| Customer Support | 24/5 live chat, email, phone |

| Deposit & Withdrawal | Credit/debit cards, bank wire transfer, e-wallets |

| Educational Resources | Webinars, e-books, video tutorials |

Overview of Ring Financial

Ring Financial is a UK-based online trading broker that was founded in 2012. It is an unregulated broker, which means that it is not subject to any government oversight or regulation. This can be a risk for traders, as it means that there is no one to protect their interests if something goes wrong.

It offers a variety of trading products, including forex, CFDs on stocks, indices, and commodities. The broker also offers two types of trading accounts: Standard and ECN. Standard accounts have higher spreads but lower commissions, while ECN accounts have lower spreads but higher commissions. It's minimum deposit is £100, and its maximum leverage is 1:30. The broker's trading platform is MetaTrader 4, which is a popular platform that is used by traders all over the world.

In conclution, Ring Financial is a relatively new and unregulated online trading broker. The broker offers a variety of trading products and a popular trading platform. However, traders should be aware of the risks associated with trading with an unregulated broker.

Pros and Cons

| Pros | Cons |

| Lower fees and spreads | Higher risk of fraud |

| More flexible trading conditions | No government oversight or protection |

| Wider range of trading products | Less likely to resolve disputes fairly |

| Easier to open an account | More difficult to withdraw funds |

Pros:

Lower fees and spreads: Unregulated brokers often offer lower fees and spreads than regulated brokers. This is because they do not have to comply with the same regulatory requirements, which can be costly.

More flexible trading conditions: Unregulated brokers may also offer more flexible trading conditions, such as higher leverage and wider trading hours. This can appeal to traders who are looking for more aggressive trading opportunities.

Wider range of trading products: Unregulated brokers may offer a wider range of trading products than regulated brokers. This is because they are not subject to the same regulatory restrictions.

Easier to open an account: It is often easier to open an account with an unregulated broker than with a regulated broker. This is because unregulated brokers do not have to comply with the same KYC/AML requirements.

Cons:

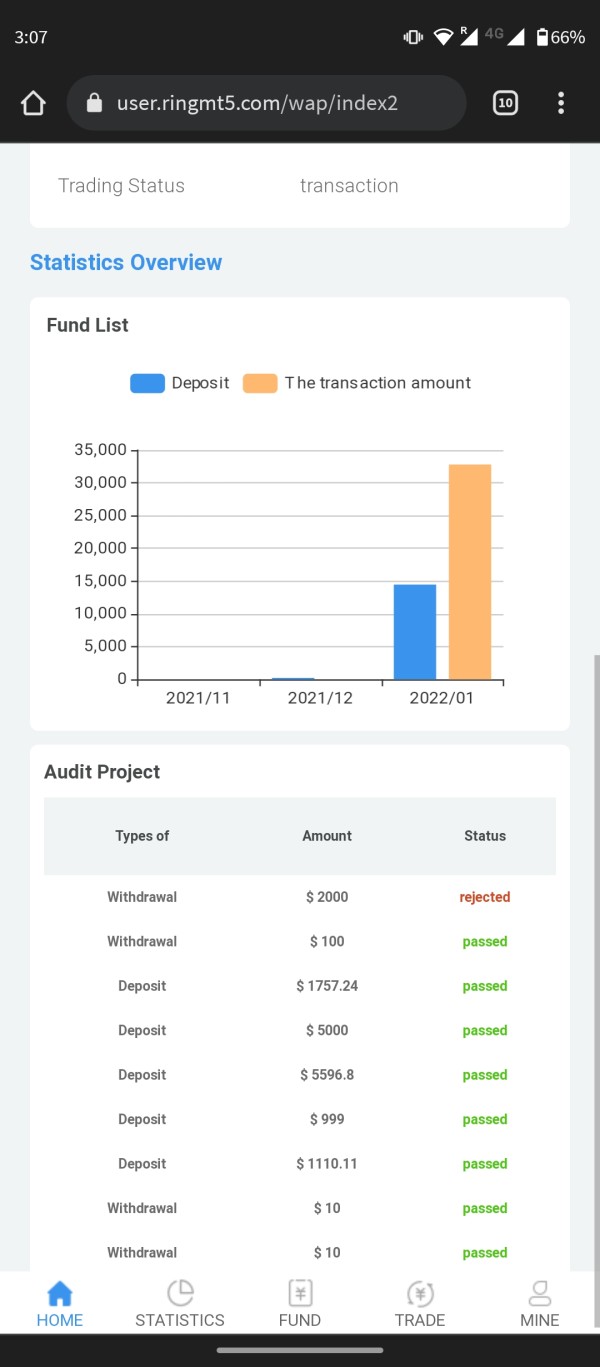

Higher risk of fraud: Unregulated brokers are more likely to engage in fraudulent or unethical activities than regulated brokers. This is because there is no one to oversee their activities.

No government oversight or protection: Unregulated brokers are not subject to any government oversight or regulation. This means that there is no one to protect traders' interests if something goes wrong.

Less likely to resolve disputes fairly: If a trader has a dispute with an unregulated broker, they are less likely to have it resolved fairly. This is because unregulated brokers are not subject to the same regulatory requirements as regulated brokers.

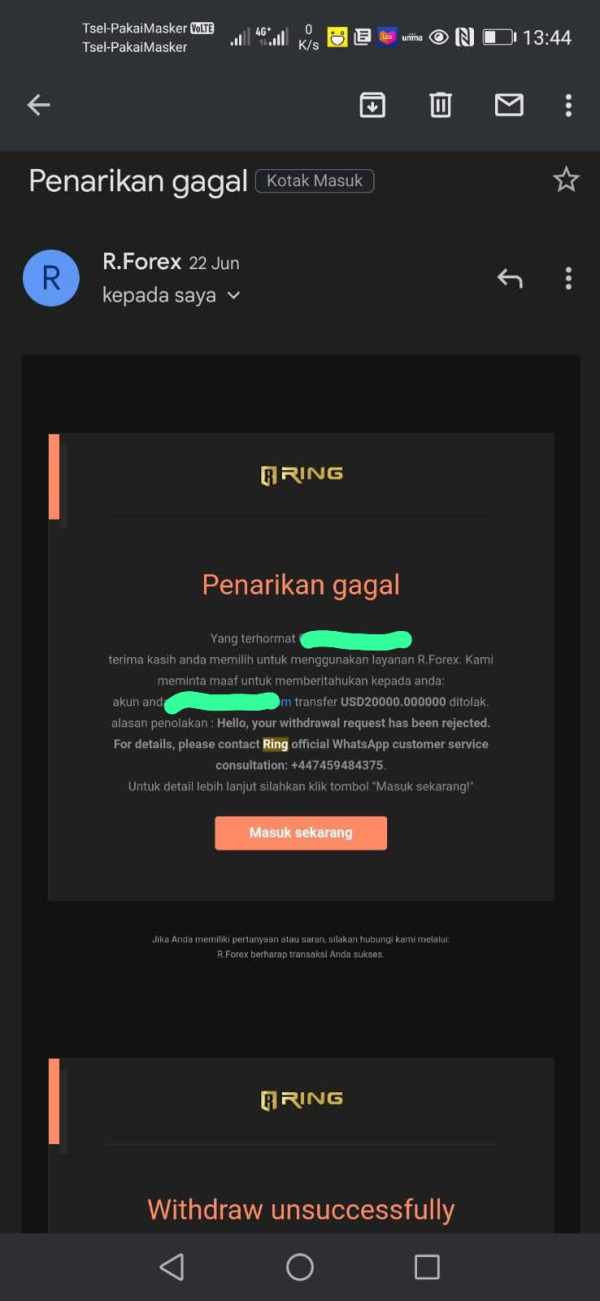

More difficult to withdraw funds: It may be more difficult to withdraw funds from an unregulated broker than from a regulated broker. This is because unregulated brokers may not have the same financial resources or safeguards in place.

Regulatory Status

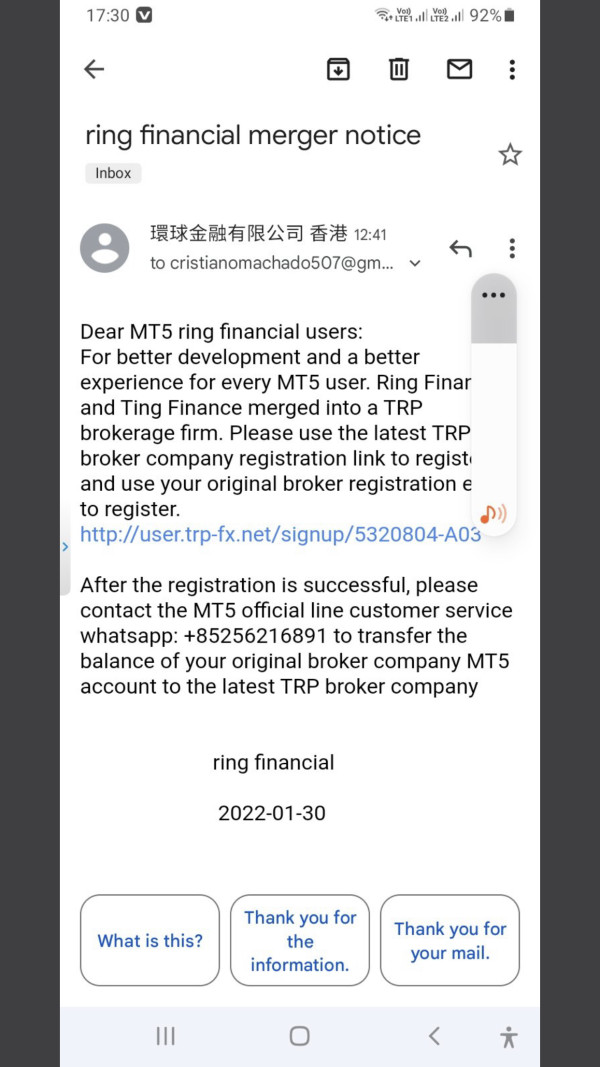

Ring Financial is an unregulated broker, which means that it is not subject to any government oversight or regulation. This means that the broker is not required to meet any specific financial requirements or to follow any set of rules or guidelines.

The lack of regulation is a significant risk for traders. If something goes wrong with the broker, there is no one for traders to turn to for help. For example, if the broker goes bankrupt, traders may lose all of their money. Additionally, unregulated brokers are more likely to engage in fraudulent or unethical activities.

Overall, I would strongly recommend that traders avoid trading with unregulated brokers. There are many other regulated online trading brokers that offer similar trading products and platforms, so I would recommend that traders choose one of those brokers instead.

Market Instruments

Ring Financial offers a wide range of market instruments for traders to choose from, including:

Forex: Ring Financial offers a wide range of forex currency pairs to trade, including majors, minors, and exotics.

CFDs on stocks: Ring Financial offers CFDs on a wide range of stocks from major stock exchanges around the world, including the US, UK, Europe, and Asia.

CFDs on indices: Ring Financial offers CFDs on a wide range of stock market indices, including the S&P 500, Dow Jones Industrial Average, Nasdaq 100, FTSE 100, DAX, and CAC 40.

CFDs on commodities: Ring Financial offers CFDs on a wide range of commodities, including gold, silver, oil, gas, and agricultural products.

This wide range of market instruments gives traders the flexibility to trade a variety of different assets, depending on their trading style and risk tolerance.

Account Types

Ring Financial offers two types of trading accounts:

Standard account: This account type is designed for beginners and intermediate traders. It has higher spreads but lower commissions.

ECN account: This account type is designed for experienced traders. It has lower spreads but higher commissions.

Traders can choose the account type that best suits their trading style and needs. For example, beginners and intermediate traders may prefer the Standard account due to its lower commissions. Experienced traders may prefer the ECN account due to its lower spreads.

Here is a table comparing the two account types:

| Feature | Standard account | ECN account |

| Spreads | Higher | Lower |

| Commissions | Lower | Higher |

| Minimum deposit | £100 | £100 |

| Maximum leverage | 1:30 | 1:30 |

How to Open an Account?

To open an account with Ring Financial, follow these steps:

Go to the Ring Financial website and click on the “Open Account” button.

Fill out the account opening form. This includes providing your personal information, such as your name, address, and contact information. You will also need to create a username and password.

Choose an account type. Ring Financial offers two types of trading accounts: Standard and ECN. Choose the account type that best suits your trading style and needs.

Make a deposit. The minimum deposit is £100. You can deposit funds using a variety of methods, including credit/debit cards, bank wire transfer, and e-wallets.

Verify your account. Ring Financial requires all traders to verify their identity and address before they can start trading. You can do this by uploading copies of your government-issued ID and proof of address.

Once your account has been verified, you can start trading immediately.

Leverage

The maximum leverage offered by Ring Financial is 1:30. This means that traders can control a position that is 30 times larger than their account balance. For example, if a trader has an account balance of £1,000, they can control a position worth up to £30,000.

High leverage can amplify profits, but it can also amplify losses. Therefore, it is important to use leverage responsibly and to understand the risks involved.

Traders should only use leverage that is appropriate for their trading experience and risk tolerance. It is also important to have a risk management plan in place to limit losses.

Spreads & Commissions

Ring Financial offers variable spreads on all of its trading instruments. This means that the spread will vary depending on the market conditions and the asset being traded.

For example, the spread on the EUR/USD currency pair may be 1 pip during normal market conditions, but it may widen to 3 pips during periods of high volatility.

Ring Financial also charges commissions on all trades. The commission rate depends on the account type and the asset being traded.

For example, the commission rate for Standard accounts is 0.05% per trade, while the commission rate for ECN accounts is 0.03% per trade.

Here is a table comparing the spreads and commissions for the two account types:

| Feature | Standard account | ECN account |

| Spreads | Variable | Variable |

| Commissions | 0.05% per trade | 0.03% per trade |

It is important to note that spreads and commissions can be a significant cost of trading. Traders should carefully consider the spreads and commissions charged by a broker before opening an account.

Trading Platform

Ring Financial offers the MetaTrader 4 (MT4) trading platform. MT4 is a popular trading platform that is used by traders all over the world. It is known for its user-friendly interface and its wide range of features.

Some of the features of MT4 include:

A variety of technical analysis tools

A wide range of order types

The ability to backtest and optimize trading strategies

The ability to automate trading with Expert Advisors

MT4 is available for download on both desktop and mobile devices. This makes it easy for traders to trade from anywhere in the world.

Overall, the MT4 trading platform is a good choice for traders of all experience levels. It is easy to use and has a wide range of features.

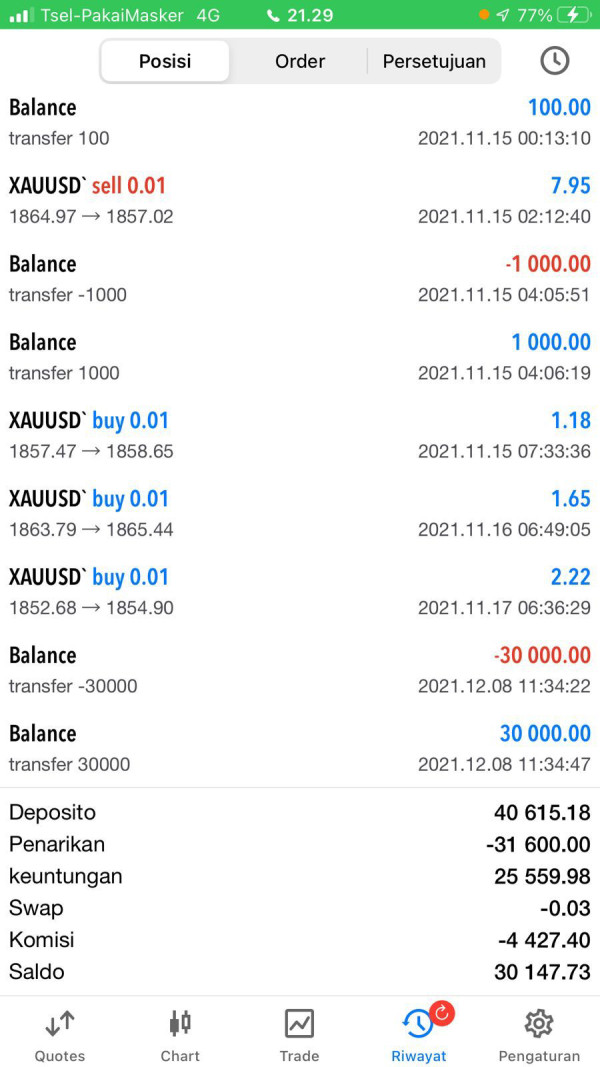

Deposit & Withdrawal

Ring Financial offers a variety of payment methods for traders to deposit and withdraw funds. These include:

Credit/debit cards

Bank wire transfer

E-wallets (such as PayPal and Skrill)

Ring Financial does not charge any fees for deposits or withdrawals. However, traders should be aware that their bank or e-wallet provider may charge their own fees.

Here is a table summarizing the payment methods and fees offered by Ring Financial:

| Payment method | Deposit fee | Withdrawal fee |

| Credit/debit cards | Free | Free |

| Bank wire transfer | Free | Free |

| E-wallets | Free | Free |

It is important to note that the processing times for deposits and withdrawals may vary depending on the payment method used. For example, bank wire transfers can take several days to process.

Customer Support

Ring Financial offers customer support via 24/5 live chat, email, and phone.

Live chat

Ring Financial's live chat support is available 24/5. To start a live chat session, simply click on the “Live Chat” button on the Ring Financial website. A customer support representative will typically respond within a few minutes.

Ring Financial's email support is available 24/5. To send an email to Ring Financial customer support, simply go to the “Contact Us” page on the Ring Financial website and fill out the contact form. A customer support representative will typically respond within 24 hours.

Phone

Ring Financial's phone support is available 24/5. To call Ring Financial customer support, simply call the number listed on the “Contact Us” page on the Ring Financial website. A customer support representative will typically answer your call immediately.

Overall, Ring Financial offers good customer support. Live chat support is particularly convenient, as it is available 24/5 and allows you to get a response from a customer support representative very quickly.

Educational Resources

Ring Financial offers a variety of educational resources to help traders learn about the financial markets and how to trade. These resources include:

Webinars: Ring Financial hosts regular webinars on a variety of trading topics. These webinars are free to attend and are a great way to learn from experienced traders.

E-books: Ring Financial offers a variety of free e-books on trading topics such as forex trading, CFD trading, and technical analysis.

Video tutorials: Ring Financial offers a variety of free video tutorials on trading topics such as how to use the MT4 trading platform and how to execute different types of trades.

In addition to these educational resources, Ring Financial also offers a demo account. A demo account is a virtual trading account that allows traders to practice trading without risking any real money. This is a great way for traders to learn how to use the MT4 trading platform and to test out different trading strategies.

Overall, Ring Financial offers a variety of educational resources to help traders learn about the financial markets and how to trade. These resources are free to use and are a great way for traders of all experience levels to improve their trading skills.

Conclusion

Ring Financial is a UK-based online trading broker that provides two account types, Standard and ECN, offering access to forex, CFDs on stocks, indices, and commodities. They use MetaTrader 4 as their trading platform and offer educational resources. However, it's crucial to note that Ring Financial is unregulated, lacking government oversight or protection for traders' interests. This poses significant risks, and traders should exercise caution when considering this broker.

FAQs

Q: What is Ring Financial?

A: Ring Financial is a UK-based online trading broker that offers a wide range of trading products and services, including forex, CFDs on stocks, indices, and commodities.

Q: Is Ring Financial a regulated broker?

A: No, Ring Financial is an unregulated broker. This means that the broker is not subject to any government oversight or regulation.

Q: What trading platforms does Ring Financial offer?

A: Ring Financial offers the MetaTrader 4 (MT4) trading platform. MT4 is a popular trading platform that is used by traders all over the world.

Q: What educational resources does Ring Financial offer?

A: Ring Financial offers a variety of educational resources to help traders learn about the financial markets and how to trade. These resources include webinars, e-books, and video tutorials.

Review 40

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now