Score

Citi Fx

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.citifx.uk/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

CITI FOREX

Citi Fx

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The United KingdomFCA regulation (license number: 488396) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:5000 |

| Minimum Deposit | 10,000 $ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:2100 |

| Minimum Deposit | 5000 $ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:800 |

| Minimum Deposit | 3000 $ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | 1000 $ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Citi Fx also viewed..

XM

FBS

FXCM

IUX

Citi Fx · Company Summary

| Information | Details |

| Company Name | Citi Fx |

| Registered Country/Region | United Kingdom |

| Founded in | Within 1 year |

| Regulation | Not regulated |

| Tradable Instruments | N/A |

| Trading Platforms | MetaTrader5(MT5) |

| Minimum Deposit | $1000 |

| Maximum Leverage | 1:5000 |

| Account Types | N/A |

| Spreads | N/A |

| Commission | N/A |

| Deposit &Withdrawal Methods | N/A |

| Education | N/A |

| Customer Support | N/A |

Overview of Citi Fx

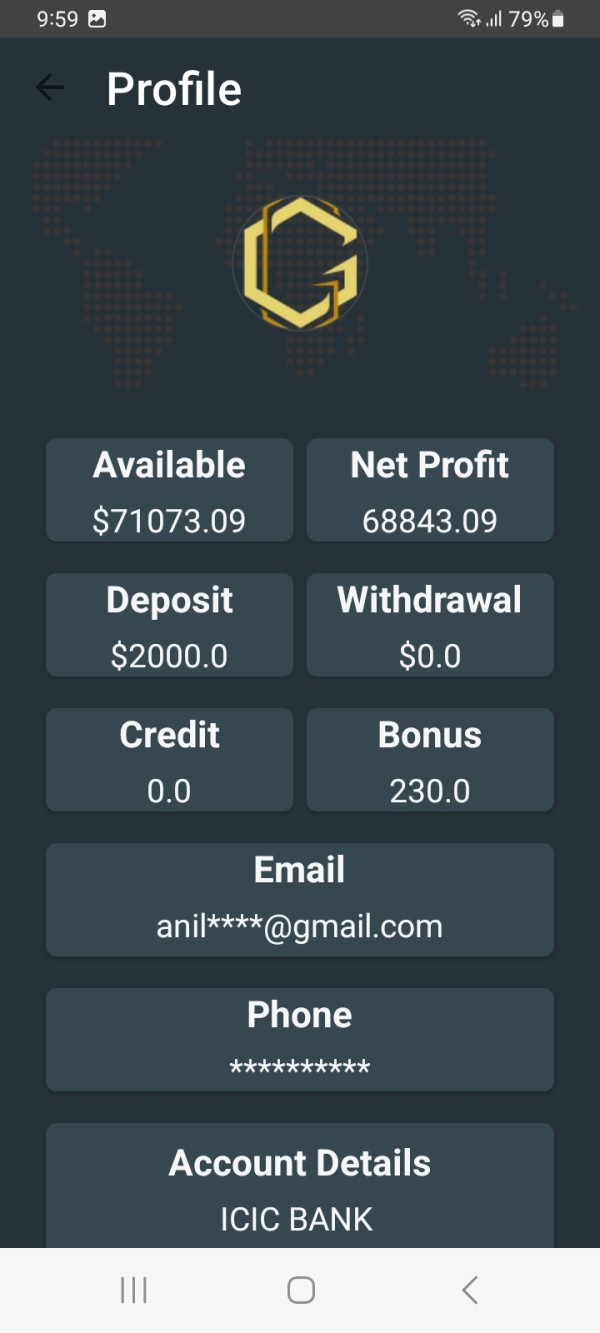

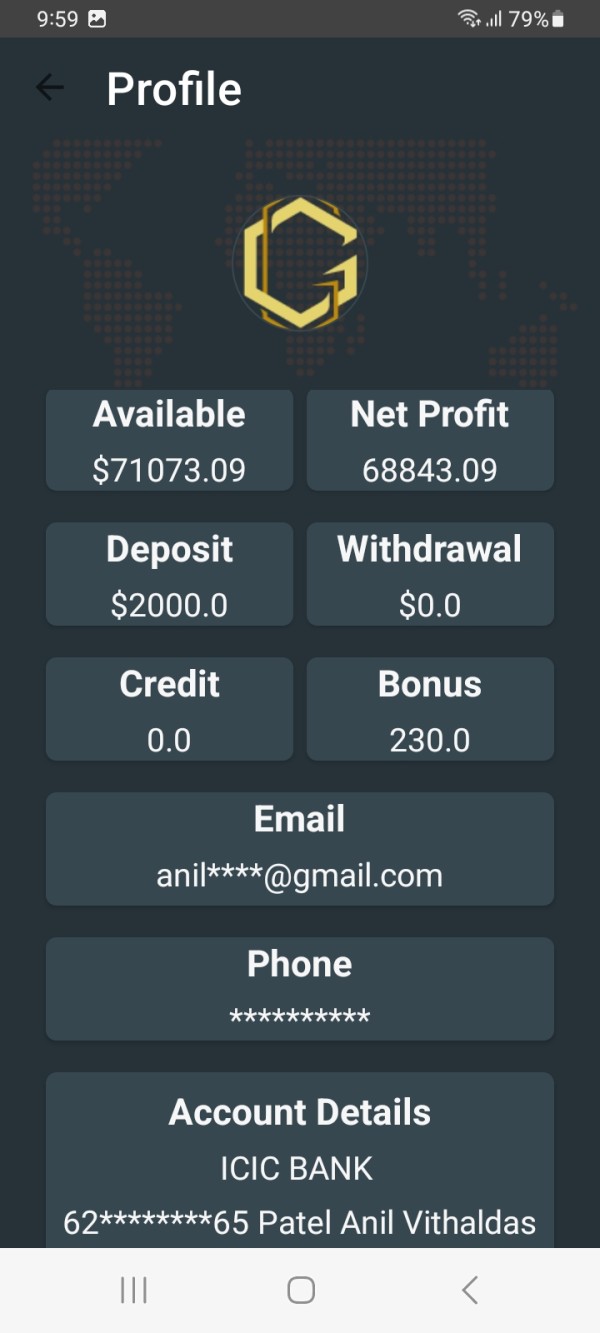

Citi Fx is a forex broker that is registered in the United Kingdom. It was founded within the past year and is currently not regulated by any recognized financial authority. The broker offers the MetaTrader5 (MT5) trading platform, which is known for its advanced features and tools for technical analysis. The minimum deposit required to open an account with Citi Fx is $1000 , and the maximum leverage offered is 1:5000.

However, specific information about the tradable instruments, account types, spreads, and commissions is not available. Details regarding deposit and withdrawal methods, educational resources, and customer support are not provided.

Citi Fx has been associated with fraudulent activities and is widely regarded as a scam broker. They employ deceptive tactics by misusing the license information of another company to create an illusion of legitimacy. Traders have reported encountering extremely unfavorable trading conditions and excessive demands for sensitive personal information during the account opening process. It is strongly advised to avoid any involvement with Citi Fx to protect your funds and personal information from potential loss or misuse.

Is Citi Fx legit or a scam?

Citi Fx's actions of providing false license information and misrepresenting themselves as a regulated broker are clear indications of unethical and potentially fraudulent behavior. The fact that the license number they provided belongs to another company raises serious concerns about their legitimacy.

It is crucial to be extremely cautious when dealing with such unregulated brokers. These companies operate without proper oversight and regulatory compliance, which makes them unreliable and risky to entrust your funds with. Their lack of accountability means that if any issues arise, it may be challenging to seek recourse or recover your investments.

To safeguard your money and avoid falling victim to scams, it is advisable to seek out legitimate and regulated brokers that can provide reassurances regarding the security of your funds. Conduct thorough research, verify their license information with the relevant regulatory bodies, and ensure that their contact details, addresses, and other information match the official records.

Remember that legitimate brokers will never provide false information or mislead their clients about their regulatory status. Always prioritize the safety of your investments by choosing reputable and properly regulated brokers who have a track record of trustworthiness in the industry.

Pros and Cons

Citi Fx offers the popular MT5 trading platform, known for its advanced features and comprehensive tools for technical analysis. One notable drawback of Citi Fx is the lack of specific regulation. As a result, traders may not have the same level of protection and oversight compared to brokers regulated by recognized financial authorities. Additionally, Citi Fx requires a high minimum deposit of $1000, which may not be accessible for all traders, particularly those with limited capital. Another potential drawback is the extremely high leverage offered by the broker, which can amplify both potential profits and losses, increasing the risk for traders.

Moreover, the official website of Citi Fx is inaccessible, which can be frustrating for potential clients looking for essential information. Furthermore, the lack of transparency regarding account types, spreads, and available market instruments can make it difficult for traders to make informed decisions about their trading strategies.

| Pros | Cons |

| MT5 trading platform | No specific regulation |

| High minimum deposit of $1000 | |

| Extremely high leverage | |

| Inaccessible official website | |

| lack of essential information on account types, spreads, and market instruments |

Market Instruments

Trading products include forex currency pairs, indices, commodities, shares, and futures. Citi Fx does not specify what it is offering. Some of the common products offered by other traders, which can serve as a reference, include:

1. Forex Currency Pairs: Traders can take advantage of the dynamic forex market to speculate on currency exchange rate movements and potentially profit from currency fluctuations.

2. Indices: Traders can trade on the price movements of these indices, allowing them to diversify their investments and take positions on broader market trends.

3. Commodities: commodities include precious metals like gold and silver, energy resources like oil and natural gas, agricultural products, and more. Traders can benefit from fluctuations in commodity prices and potentially capitalize on market trends.

4. Shares: This enables traders to participate in the equity markets and take positions based on their analysis of specific companies' performance and market conditions.

5. Futures: Trading futures can offer opportunities for hedging, speculation, or risk management.

Account Types

It did not say what kind of accounts were offered. Other traders, such as AMarkets, are much better, which offer a total of 4 account types, including crypto, fixed, standard, and ECN, with an Islamic account option for traders who adhere to Islamic rules on trading, catering to diverse needs of various traders.

Minimum Deposit

Without an account, we could not see if the trading conditions Citi Fx promises are anywhere close to the ones it actually offers. However, what we can say is that those trading conditions looked far from great. The broker states that you would have to invest at least $1000 in order to open an account. In a time when a ton of legitimate, established brokers would open an account for you for as little as $5, investing so much money into an obvious scam is quite pointless.

Leverage

Citi Fx also promises access to dangerously high leverage – as high as 1:5000 on some account types. Trading with such rates could result in enormous losses, especially if you are a beginner or in volatile market conditions. Moreover, no legitimate UK broker could legally offer such high leverage because of the leverage caps that exist in the UK. Brokers in this country – as well as in all of the EEA and Australia – cannot offer leverage higher than 1:30 to retail traders. These restrictions exist precisely because trading with higher rates can be dangerous.

If you would like to trade with reasonably high leverage and are sure you can handle it, check out some brokers that can legally offer higher rates.

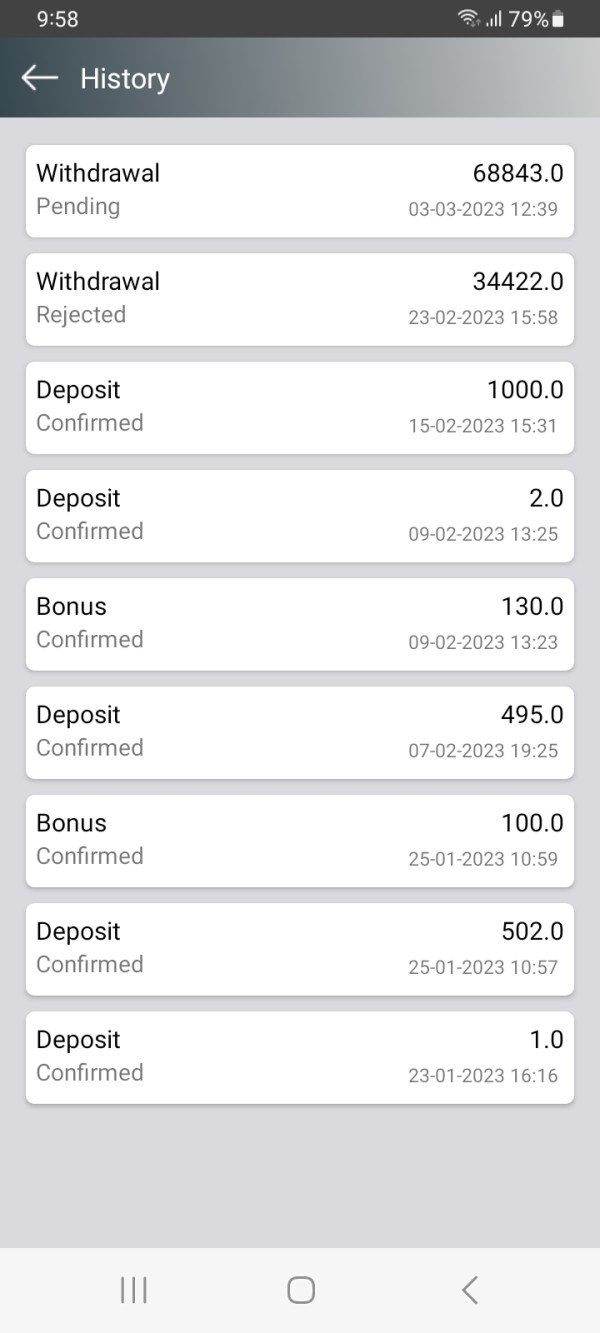

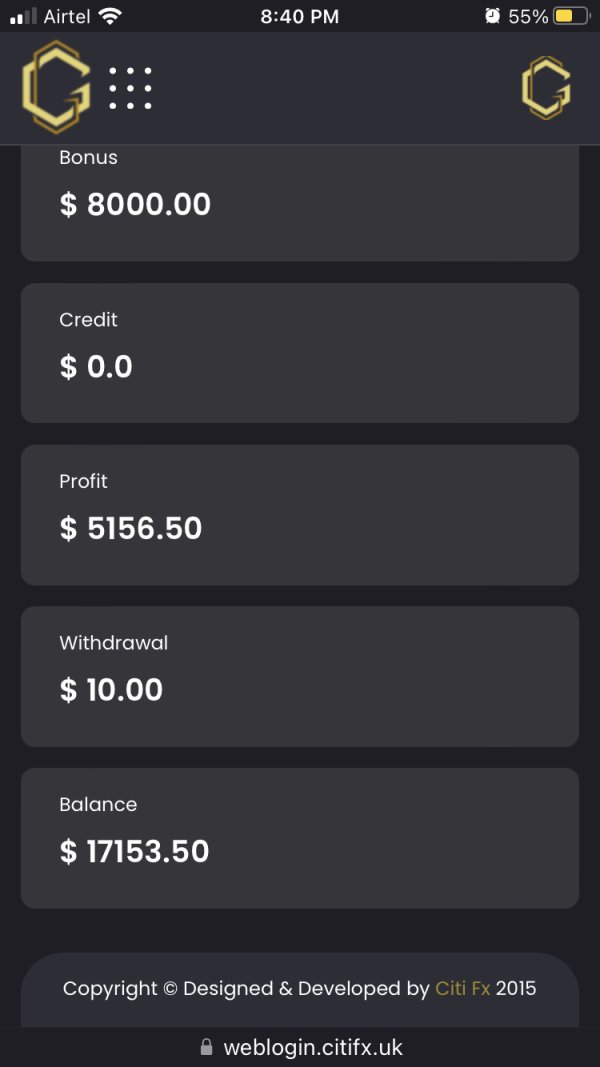

Withdrawal fees

Scammers often employ deceptive tactics to lure unsuspecting individuals into their fraudulent schemes. One common tactic is to create the illusion of profits and guarantee high returns on investments. However, when it comes to withdrawing these supposed profits, scammers make it difficult or impossible for individuals to access their funds. They may impose exorbitant withdrawal fees or create various obstacles that prevent withdrawals altogether. This ultimately leads to further financial losses for the victims.

Legitimate brokers do not guarantee profits, as trading in financial markets inherently carries risks. They are required to provide accurate information about the potential risks involved and the percentage of traders who experience losses. Reputable brokers adhere to regulations and prioritize transparency, providing clear warnings and disclaimers about the risks associated with trading. If a broker promises quick and effortless profits with minimal risk, it is a major red flag that indicates a potential scam. It's crucial to exercise caution and skepticism when encountering such promises and to conduct thorough research on any broker before making investments.

Trading Platforms

Citi Fx seemed to provide access to its own trading platform, and it also allows us to install MetaTrader5 – a well-known trading platform. In fact, the only way to open an account with this broker is to request such by contacting them via e-mail. The broker required you to send your details – only then could open an account. This is quite unusual, and if you would actually like to try MT5, there are much better brokers that offer the platform.

MetaTrader5 (MT5) is one of the most popular platforms in the world of trading since its release in 2010. MT5 is a multi-asset platform designed not only for trading forex but also commodities, CFDs, stocks, futures, and indices. The software offers not only an abundance of robust tools for technical and fundamental analysis but also a huge number of useful additional functions. MT5 is available in a desktop and web version as well as an app for Android and iOS. MT5 features an extensive charting and analysis package – 80 built-in technical indicators and analytical objects, and 21 time-frames (from one minute to one month). Up to 100 charts can be opened simultaneously. The fundamental analysis tools – financial news and an economic calendar – allow you to try and predict price movements.

MT5 supports One Click Trading which allows you to make offers with just one click while the Stop Loss and Take Profit feature help to prevent losses and secure the profits you have already made. The option of algorithmic option is a very important advantage of using MT5. This feature lets you employ Expert Advisors (trading robots) to track and analyze markets and trade automatically. MT5s ever-growing popularity among traders is a true testament to how efficient and powerful this platform truly is.

Deposit & Withdrawal

Since we were not given the chance to open an account, we are also unable to say which deposit methods this broker accepts. That is not information they have provided on the website either. Whatever the case is, we would not advise you to deposit money with fraudulent brokers.

Legitimate brokers usually accept all sorts of payment solutions such as credit or debit card, wire transfer, electronic payment solutions like Skrill and Neteller, and often enough, even crypto.

Customer Support

Regrettably, Citi Fxs customer support contact is not specific. This limited contact information raises concerns. In the event that traders encounter any difficulties or need assistance during their trading journey, the absence of proper channels for communication may hinder their ability to address and resolve these issues promptly.

Maintaining effective communication channels is of utmost importance for a trustworthy broker. It enables traders to seek guidance, resolve concerns, and ensure a smooth trading experience. Therefore, it is advisable for traders to consider brokers that prioritize transparent and accessible communication, providing reliable channels for support and assistance.

Risk Warning & Conclusion

Most scam brokers offer bonuses. And while many legitimate companies can also present you with certain bonus schemes and promotions, the main objective of fraudulent brokers is not to help you trade more effectively or even to make their offer seem more attractive. Scam brokers always attach additional conditions to their bonuses – most often related to the trading volume requirements you would need to reach in order to withdraw the bonus money. Those thresholds are usually so high that they cannot be reached even by the best traders – especially when there is some sort of time limit.

You would not be allowed to withdraw the bonus or any profits it helped you generate before meeting the brokers obscene trading volume requirements. Some scammers go as far as to deny all sorts of withdrawals – even your deposits and all your profits. Even if this is not the case, you will find that distinguishing between profits generated because of the bonus and those that were the results of your own investments is impossible – the broker will simply claim that all the money in your account is “non-deposited funds” and prevent you from withdrawing your money.

Please note that trading with an unregulated broker carries inherent risks, and it's essential to conduct thorough research and due diligence before engaging with any broker.

News

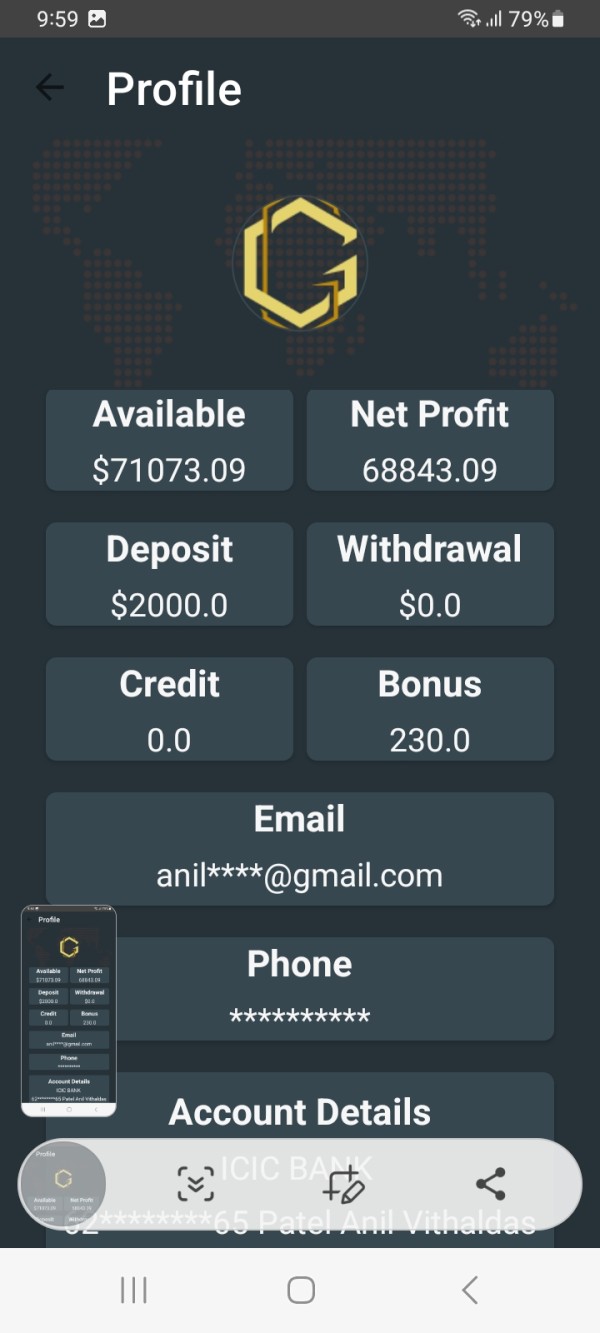

NewsSwindlers defrauded 36.50 lakh on the name of Citifx

A 34-Year-old Resident of Ahmedabad, India complained of four persons who defrauded him of Rs. 36.50 lakh by false promise of lucrative returns on investments.

WikiFX

WikiFX

ExposureIt's Risky to invest your hard- earned Money with Citifx

A user from India filed a complaint against the CITIFX broker on May 5, 2023 on wikifx . In his complaint, User stated that on January 3, 2023, he invested 3,88,000 Rupees with Citifx broker.

WikiFX

WikiFX

NewsBeware of CitiFx, not a trustworthy broker

On April 5, 2023 A user of Maharashtra, India Complaint against a broker named CitiFx regarding Withdrawal issue.

WikiFX

WikiFX

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now