Score

DeltaStock

Bulgaria|5-10 years|

Bulgaria|5-10 years| http://www.deltastock.com/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

DeltaStock-Server

Bulgaria

BulgariaInfluence

C

Influence index NO.1

Colombia 3.10

Colombia 3.10MT4/5 Identification

MT4/5 Identification

Full License

Bulgaria

BulgariaInfluence

Influence

C

Influence index NO.1

Colombia 3.10

Colombia 3.10Surpassed 21.30% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+359 2 811 50 50

Other ways of contact

Broker Information

More

Deltastock AD

DeltaStock

Bulgaria

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by Bulgaria FSC(license number: RG-03-146)Common Financial Service License Non-Forex License. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed DeltaStock also viewed..

XM

FXCM

AUS GLOBAL

CPT Markets

DeltaStock · Company Summary

| Aspect | Information |

| Registered Country/Area | Bulgaria |

| Founded Year | 2-5 years ago |

| Company Name | DeltaStock |

| Regulation | No Regulation |

| Minimum Deposit | Delta Trading: 100 USD, 100 EUR, 100 GBP, 100 CHF, 200 BGN, or 400 RON<br>MetaTrader 5: 100 USD, 100 EUR, or 200 BGN |

| Maximum Leverage | Up to 1:200 for professional clients in Forex 1:30 for major currency pairs and 1:20 for non-major currency pairs for retail clients (Forex) |

| Spreads | Starting from 1 pip |

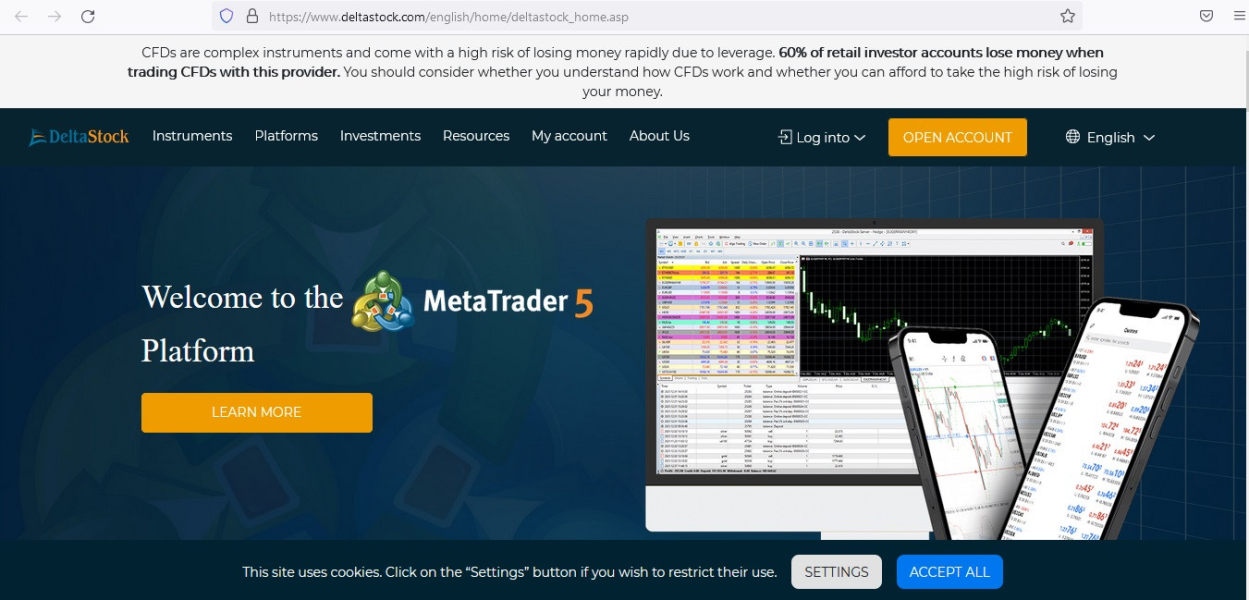

| Trading Platforms | Delta Trading Desktop and Deltastock MetaTrader 5 (available on desktop, web, and mobile) |

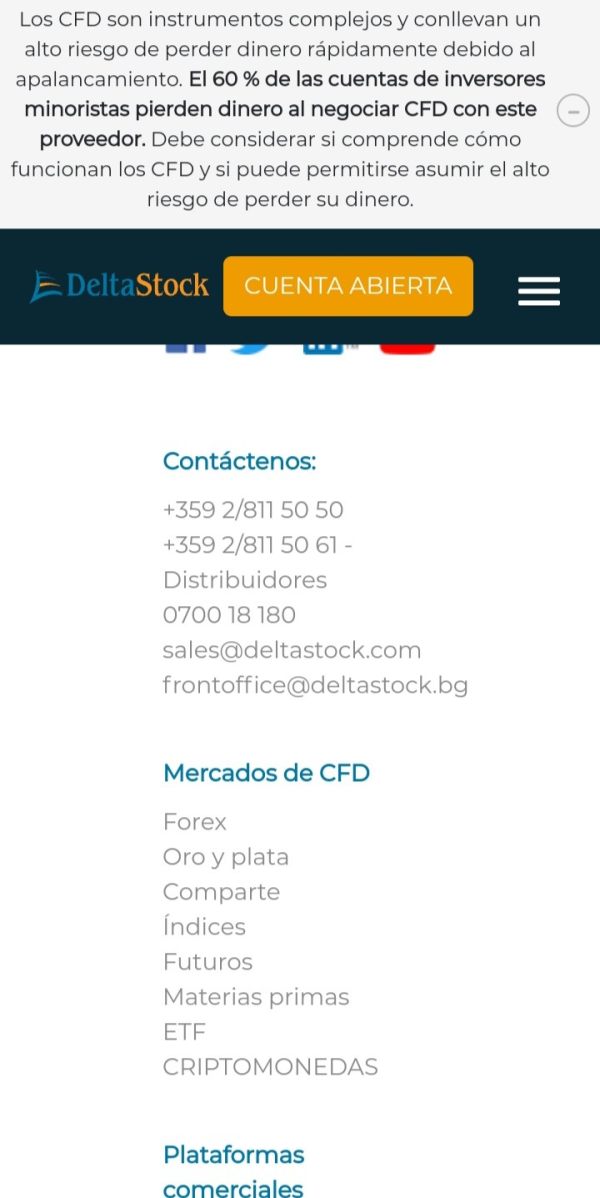

| Tradable Assets | Forex, Gold and Silver, Shares, Indices, Futures, Commodities, ETFs, Crypto CFDs |

| Account Types | Delta Trading Live Account, MetaTrader 5 Live Account, DeltaStock Pro |

| Demo Account | Available |

| Islamic Account | Not mentioned |

| Customer Support | Phone, email, live chat (multilingual support) |

| Deposit Methods | Bank wire transfer, Credit/Debit cards, E-wallets, Online payment systems |

| Withdrawal Methods | Bank wire transfer, Credit/Debit cards |

General Information & Regulation

DeltaStock, incorporated in 1998 and headquartered in Sophia, Bulgaria, is an online Forex and CFD broker regulated under MiFID. DeltaStock offers online trading in more than 1,100 financial instruments as contract for differences (CFDs) through MT4 and their proprietary trading platform. DeltaStock is a brokerage company that provides a comprehensive range of financial services for traders and investors. With a focus on online trading, DeltaStock offers access to various market instruments, including forex, stocks, commodities, indices, futures, ETFs, and crypto CFDs. Traders have the opportunity to engage in multiple markets, diversify their portfolios, and explore different investment opportunities. Whether one prefers trading forex pairs, investing in stocks, or speculating on the price movements of cryptocurrencies, DeltaStock aims to cater to various trading preferences.

Is DeltaStock Legit?

Please note that the information provided indicates that DeltaStock, the company associated with the trading platforms mentioned earlier, currently does not have valid regulation. This means that it is not subject to oversight or supervision by any regulatory authority. Traders should exercise caution and be aware of the risks involved when dealing with an unregulated broker.

It is generally recommended to trade with regulated brokers as they are subject to regulatory requirements and oversight, which helps protect the interests of traders and ensures fair and transparent practices. Regulated brokers often adhere to strict financial standards, maintain segregated client accounts, and provide mechanisms for dispute resolution.

Given that DeltaStock does not have valid regulation, potential clients should carefully consider the associated risks before engaging in any trading activities with the company. It is advisable to conduct thorough research, seek professional advice, and consider alternative regulated brokers that provide a higher level of financial protection and accountability.

Pros and Cons

DeltaStock offers a trading platform system that comes with its own set of advantages and disadvantages. On the positive side, the platform provides access to a diverse range of financial markets, allowing traders to explore various investment opportunities. DeltaStock also offers two trading platforms with useful features, catering to different trading preferences. Additionally, demo accounts are available, enabling users to practice trading strategies without risking real money. The platform boasts low spreads and a commission-free environment, which can be beneficial for cost-conscious traders. Multiple payment methods and customer support in multiple languages contribute to a user-friendly experience.

However, it's important to consider the drawbacks as well. DeltaStock operates without valid regulation, which raises concerns about the security and transparency of the platform. This lack of oversight may expose traders to potential risks. Furthermore, the leverage options provided by DeltaStock are limited based on the instrument and the client, which may not align with the trading preferences of all users. Additionally, there is a minimum deposit requirement to open a live trading account, which might be a barrier for some traders.

To summarize, here is a table outlining the pros and cons of DeltaStock's trading platform system:

| Pros | Cons |

| 1. Diverse range of financial markets available. | 1. Lack of valid regulation, posing potential risks. |

| 2. Two trading platforms with useful features. | 2. Limited leverage options based on instrument and client. |

| 3. Demo accounts for practice trading. | 3. Minimum deposit required to open live trading account. |

| 4. Low spreads and commission-free environment. | |

| 5. Multiple payment methods for deposits/withdrawals. | |

| 6. Customer support in multiple languages. |

Market Instruments

DeltaStock offers a range of market instruments for traders to access. These instruments include:

Forex: DeltaStock provides access to over 80 major and exotic currency pairs with tight spreads.

Gold and Silver: Traders can trade Spot Gold and Silver with attractive commissions, unlimited trade volume, and no hidden fees.

Shares: DeltaStock offers CFDs on stocks, allowing traders to trade shares and cash shares of over 750 global companies.

Indices: Traders can access over 20 indices tracking the performance of economies such as the US, UK, Germany, and others.

Futures: DeltaStock provides the opportunity to trade CFDs on Brent and WTI Crude Oil Futures, as well as a variety of other energy, commodity, and financial futures.

Commodities: In addition to gold and silver, DeltaStock offers trading opportunities in various other commodities.

ETFs: DeltaStock allows trading of Exchange Traded Funds (ETFs) that may include indices, commodities, bonds, or other assets.

Crypto CFDs: Traders can also trade Crypto CFDs, which involve speculating on the price movements of cryptocurrencies.

Each market instrument has its own trading conditions, such as margin requirements, commissions, minimum and maximum order sizes, and trading hours. These conditions can vary depending on the specific instrument and the type of client (professional or retail). DeltaStock also implements measures to automatically close positions if the account balance falls below a certain level.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments available | Lack of regulation may pose risks |

| Access to major and exotic currency pairs | Limited selection of certain commodities and ETFs |

| Speculation on the price movements of cryptocurrencies | Market volatility can lead to potential losses |

| Opportunity to trade stocks of global companies | Additional risks associated with futures trading |

| Access to various indices tracking economies | Limited availability of certain regional indices |

| Trading opportunities in precious metals | Price fluctuations and market uncertainty can impact profitability |

| Ability to trade Exchange Traded Funds | Limited selection of ETFs |

Account Types

DeltaStock offers different types of accounts, including DeltaStock Pro, which is specifically designed for professional clients. Here is an overview of the account types and features:

1. DeltaStock Pro:

- Designed for professional clients who have extensive trading experience and higher risk appetite.

- Offers higher leverage of up to 1:200 (0.5% margin) on certain instruments.

- Trading conditions and margin requirements are different from retail clients.

- Exclusive access to bonus programs, rebate programs, and promotions.

- Premium access to special events and seminars.

- Client funds are kept in segregated bank accounts for safety.

- Continues to benefit from the Best Execution policy.

2. Delta Trading™ Live Account:

- Available for both retail and professional clients.

- CFD trading on Forex (Currency Pairs), Gold and Silver, Shares, Indices, ETFs, Futures, and Crypto CFDs.

- Minimum deposit requirement: 100 USD, 100 EUR, 100 GBP, 100 CHF, 200 BGN, or 400 RON.

- Access to Delta Trading™ platform with intuitive interface, P/L charts, technical indicators, and order types.

3. MetaTrader 5 Live Account:

- Available for both retail and professional clients.

- CFD trading on Forex (Currency Pairs), Gold and Silver, Indices, Shares, Commodities, and Crypto CFDs.

- Minimum deposit requirement: 100 USD, 100 EUR, or 200 BGN.

- Access to MetaTrader 5 platform for trading and analysis.

Please note that professional client status is subject to meeting specific criteria related to trading volume, portfolio size, or professional experience in the financial sector.

If you don't have an account with DeltaStock, you can open an account and choose the appropriate account type based on your trading experience and requirements.

Pros and Cons

| Pros | Cons |

| Professional clients enjoy higher leverage | Restricted access to higher leverage for retail clients |

| Exclusive benefits and unique features | Limited benefits and features for retail clients |

| Access to bonus and rebate programs | Limited participation in bonus programs for retail clients |

| Margin close-out rule for risk management | Potential automatic closure of positions |

| Priority access to special events | No priority access to special events for retail clients |

| Segregated client funds for safety | Segregated client funds also available for retail clients |

| Best execution policy for all clients | Best execution policy applies to all clients |

How to Open an Account?

To open an account with DeltaStock, follow these steps:

1. Choose a Platform:

DeltaStock offers two trading platforms: Delta Trading and MetaTrader 5. Decide which platform suits your trading needs and preferences.

- Delta Trading: This proprietary platform provides over 80 technical indicators and semi-automatic trading functionality. It is available on desktop, web, and mobile versions.

- MetaTrader 5: A popular trading platform known for its extensive tools for technical analysis. It is available on desktop, web, and mobile versions as well.

2. Create Your Account:

To get started, you have the option to open either a free demo account or a live account. A demo account allows you to practice trading with virtual funds, while a live account enables you to trade with real money. Click on the “OPEN DEMO ACCOUNT” button to open a demo account or follow the instructions for opening a live account.

3. Start Trading:

Once you have created your account, log into the chosen platform using your account credentials. Explore the platform and familiarize yourself with its features. You can add your desired financial instruments to your trading interface and start trading on the global markets.

Remember to consider your risk tolerance, set appropriate trading goals, and implement sound risk management strategies while trading. DeltaStock provides resources and support to help you make informed trading decisions.

Minimum Deposit

The minimum deposit requirement for opening an account with DeltaStock depends on the chosen trading platform:

1. Delta Trading:

The minimum deposit for opening a Delta Trading Live Account is 100 USD, 100 EUR, 100 GBP, 100 CHF, 200 BGN, or 400 RON. This amount serves as the initial funding for your trading account.

2. MetaTrader 5:

The minimum deposit for opening a MetaTrader 5 Live Account is 100 USD, 100 EUR, or 200 BGN. This minimum deposit is required to fund your trading account and start trading on the platform.

Keep in mind that the minimum deposit is just the initial requirement, and you can choose to deposit additional funds to your trading account as needed. The deposited funds are used for margin requirements and to support your trading activities on the platform.

Leverage

Deltastock offers different leverage levels based on the account type and the financial instrument being traded. The leverage allows traders to amplify their trading positions by using borrowed funds from the broker. It's important to note that leverage can significantly increase both potential profits and losses.

For professional clients, the leverage available for Forex trading is up to 1:200, which means traders can control a position up to 200 times their account balance. Retail clients have leverage options of 1:30 for major currency pairs and 1:20 for non-major currency pairs.

When it comes to other instruments like CFDs on shares, indices, ETFs, commodities, and cryptocurrencies, the leverage varies depending on the specific instrument and client classification. The leverage for professional clients ranges from 1% to 10%, while for retail clients, it can go up to 5% to 25%. It's important to check with Deltastock for the exact leverage requirements for specific instruments and account types.

It's crucial for traders to carefully consider their risk tolerance and trading strategy when utilizing leverage, as it can amplify both profits and losses. Traders should also be aware of the margin requirements and the potential automatic position close-out if the account balance falls below a certain level, as outlined in Deltastock's trading conditions.

Pros and Cons

| Pros | Cons |

| Amplifies trading positions and potential profits | Increased leverage also increases the risk of potential losses |

| Professional clients have higher leverage options | Inexperienced traders may be more susceptible to losses |

| Can potentially enhance trading strategies and returns | Higher leverage requires careful risk management |

| Allows for trading larger positions with smaller capital | Losses can exceed the initial investment with high leverage |

| Different leverage options available for different clients | Leverage requirements may vary for different instruments |

Spreads & Commissions

Deltastock only mentions that it offers low spreads (from 1 pip), but does not specify its spreads on particular instruments. Besides, Deltastock advertises that it offers a commission free environment.

Trading Platform Available

DeltaStock offers two main trading platforms: Delta Trading Desktop and Deltastock MetaTrader 5.

1. Delta Trading Desktop: This is DeltaStock's proprietary trading platform, available in desktop, web, and mobile versions. It has been developed and continuously improved over 16 years to meet client requirements and keep up with trading trends. The platform offers powerful trading tools, including different order types such as market, limit, stop, OCO (one cancels the other), and trailing stop. Traders can engage in semi-automated trading through conditional orders. Delta Trading Desktop provides professional charts with real-time updates, over 80 technical indicators, and market analysis tools. Traders can access free resources like an economic calendar, statistics, market news, and real-time quotes.

2. Deltastock MetaTrader 5: This is a popular and robust trading platform offered by DeltaStock. It features a user-friendly interface and advanced trading capabilities. Traders can execute trades directly from price charts using one-click trading. The platform supports various order types, including market, stop, and limit orders. It also enables automated trading through the use of Expert Advisors (robots). Deltastock MetaTrader 5 offers professional tools for technical analysis, such as over 80 indicators, graphical objects, and multiple timeframes. Traders can access free resources like an economic calendar, real-time quotes, and financial news (availability may vary).

Both platforms provide traders with comprehensive trading history and account balance details, allowing them to analyze past trades and monitor their account performance. These trading platforms offer a range of features and tools to enhance the trading experience and cater to the diverse needs of traders.

Trading Tools

DeltaStock offers a range of trading tools to assist traders in their decision-making process and enhance their trading experience. Some of these trading tools include:

Economic Calendar: The economic calendar provides a schedule of key global economic events for the next five days. It includes interactive graphs that illustrate historical data, market expectations, actual values, and calculated volatility of economic indicators. Each indicator is accompanied by a brief description, making it useful for both novice and experienced traders.

Daily Technical Analysis: DeltaStock provides daily technical analysis reports. These reports offer insights and analysis on various trading instruments such as currency pairs (e.g., EUR/USD, USD/JPY, GBP/USD), indices (e.g., EUGERMANY40, US30), and more. Traders can stay updated on the market trends, important support and resistance levels, and potential trading opportunities.

Currency Converter: DeltaStock offers a currency converter tool that allows traders to calculate the value of one currency in relation to another. The currency converter utilizes daily exchange rates provided by DeltaStock and data from other market leaders, providing accurate and up-to-date information for currency conversions.

Currency Correlation: The currency correlation tool helps traders assess the relationship between different currency pairs over various timeframes, including one day, one week, one month, three months, six months, one year, and five years. Understanding currency correlations can assist traders in managing risk, diversifying their portfolios, and identifying potential trading opportunities.

These trading tools provided by DeltaStock complement their trading platforms and assist traders in making informed decisions based on economic events, technical analysis, currency conversions, and currency correlations.

Deposit & Withdrawal

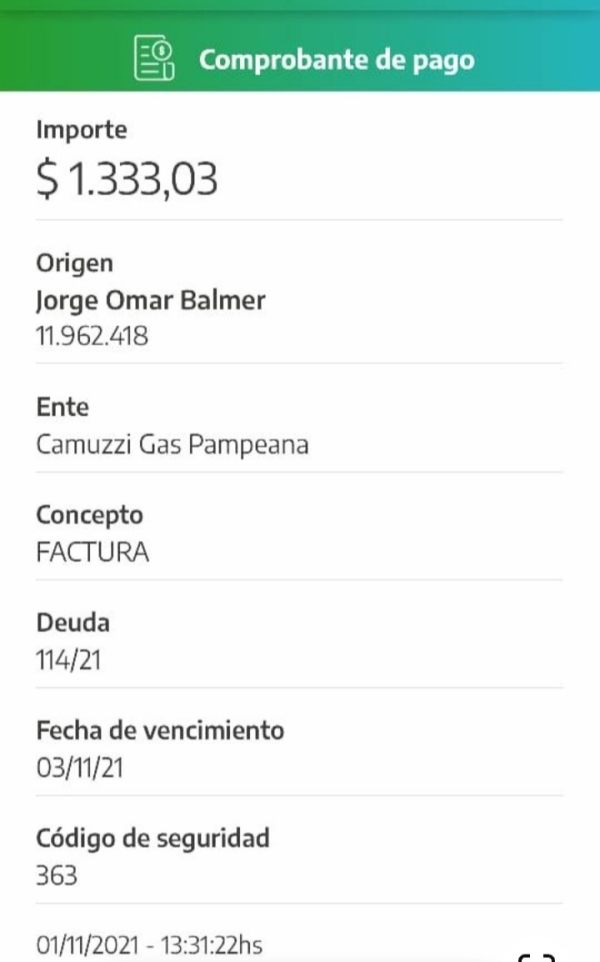

DeltaStock provides multiple methods for depositing and withdrawing funds from your trading account.

To deposit funds, you can choose between a bank wire transfer or using a MasterCard/VISA/Maestro credit/debit card. It's important to note that the first deposit to your trading account can only be made through a bank account in your name. If you wish to make a deposit using a card, the card must be issued in your name by a bank, and you need to provide a copy of the card to DeltaStock for approval. The broker reserves the right to reject funds received from a card that doesn't meet these conditions. Withdrawals of funds deposited via credit/debit card will be transferred back to the same card.

DeltaStock emphasizes that they do not accept payments from third parties, and all payments to and from your account must be performed by sources that legally belong to you as the account holder. Furthermore, depending on your account funding method and agreements with payment institutions, your bank or card operator may charge additional fees.

For withdrawing funds from your trading account, you can use either a bank wire transfer or MasterCard/VISA/Maestro credit/debit cards. DeltaStock provides multiple options to submit a withdrawal request, including through the trading platform or by filling out a withdrawal request form and attaching it through the account menu. It's important to note that you can only withdraw funds that haven't been blocked as margin for open positions. Priority is given to funds deposited via credit/debit cards, followed by deposits via bank wire and/or cash desk.

Similar to the deposit process, DeltaStock emphasizes that all incoming and outgoing payments to and from your account must be performed by sources that legally belong to you as the account holder. Payments from third parties are not accepted.

It's worth mentioning that specific fees and commissions associated with depositing and withdrawing funds may apply. These fees and commissions can vary depending on your account funding method and individual agreements with payment institutions.

| Pros | Cons |

| - User-friendly interface | - Limited platform options |

| - Access to various trading instruments and markets | - Potential learning curve for new users |

| - Robust order execution and trade management | - Possible compatibility limitations |

| - Availability of mobile trading for on-the-go access | - Limited customization options |

Customer Support

Deltastock maintains two offices—one in Sophia, Bulgaria and the other in Bucharest, Romania and traders can reach representative by telephone at either of these two locations. Phone calls can be placed locally between the hours of 9am and 5pm local time. Multilingual (over 28 languages) customer support is offered 24/5 and there is a customer service 24-hour support by phone, email and live chat.

DeltaStock provides comprehensive customer support to assist traders with their inquiries and concerns. Here are the key features of their customer support:

Multilingual Support: DeltaStock prides itself on offering multilingual customer support in over 28 languages. This ensures that traders from various regions can communicate effectively and receive assistance in their preferred language.

24/5 Support: DeltaStock provides customer support for five days a week, 24 hours a day. This means traders can reach out for assistance during the trading week, regardless of their time zone.

Office Address: DeltaStock provides their office address in Sofia, Bulgaria, for those who prefer to visit in person or send physical correspondence.

Conclusion:

DeltaStock is an online trading broker that offers access to various financial instruments, including forex, gold and silver, shares, indices, futures, commodities, ETFs, and crypto CFDs. They provide two main trading platforms, Delta Trading and MetaTrader 5, each with its own set of features and tools. DeltaStock offers a range of trading tools, including an economic calendar, daily technical analysis reports, a currency converter, and currency correlation tools, to assist traders in making informed decisions. They also offer multiple payment methods for depositing and withdrawing funds. However, it's important to note that DeltaStock currently lacks valid regulation, which means they are not subject to oversight or supervision by any regulatory authority. This absence of regulation raises concerns about the level of financial protection and accountability provided by the company. Traders should exercise caution and consider the associated risks before engaging in trading activities with an unregulated broker like DeltaStock. It is advisable to conduct thorough research, seek professional advice, and consider alternative regulated brokers that offer a higher level of financial protection and oversight.

FAQs

Q: Is DeltaStock a regulated broker?

A: DeltaStock is currently not regulated, which means it does not have oversight or supervision from any regulatory authority. This lack of regulation poses risks for traders, and it is generally recommended to trade with regulated brokers that offer financial protection and accountability.

Q: What market instruments are available on DeltaStock?

A: DeltaStock offers a variety of market instruments, including forex (currency pairs), gold and silver, shares, indices, futures, commodities, ETFs (Exchange Traded Funds), and crypto CFDs. Each instrument has its own trading conditions, such as margin requirements, commissions, and trading hours.

Q: What are the account types offered by DeltaStock?

A: DeltaStock offers two main types of live trading accounts: Delta Trading Live Account and MetaTrader 5 Live Account. The Delta Trading Live Account allows trading on various financial instruments, while the MetaTrader 5 Live Account provides access to forex, gold and silver, indices, shares, commodities, and crypto CFDs.

Q: How can I open an account with DeltaStock?

A: To open an account with DeltaStock, you need to choose a trading platform (Delta Trading or MetaTrader 5) and create your account by following the instructions provided. You have the option to open a demo account for practice or a live account for real trading.

Q: What is the minimum deposit requirement for opening an account with DeltaStock?

A: The minimum deposit requirement depends on the chosen trading platform. For the Delta Trading Live Account, the minimum deposit is 100 USD, 100 EUR, 100 GBP, 100 CHF, 200 BGN, or 400 RON. For the MetaTrader 5 Live Account, the minimum deposit is 100 USD, 100 EUR, or 200 BGN.

Q: What leverage is offered by DeltaStock?

A: The leverage offered by DeltaStock varies based on the account type and the financial instrument being traded. For professional clients, the leverage for forex trading can go up to 1:200. Retail clients have leverage options of 1:30 for major currency pairs and 1:20 for non-major currency pairs. Leverage for other instruments depends on the specific instrument and client classification.

Q: What are the spreads and commissions on DeltaStock?

A: DeltaStock advertises low spreads starting from 1 pip, but the specific spreads for individual instruments are not mentioned. They also mention a commission-free environment, indicating that traders do not have to pay additional fees on their trades. However, it's important to check with DeltaStock for the exact spreads and commissions for specific instruments and account types.

News

NewsChanges to trading hours Oct. 29 – Nov. 5, 2023

Please be advised that there will be alterations to the trading hours of select CFD markets during the period of Oct. 29 – Nov. 5, 2023, owing to the transition from Daylight Saving Time (DST) to standard time in Europe.

WikiFX

WikiFX

NewsAn Economic Powerhouse on the Rise

India, having surpassed China as the world's most populous nation, is additionally one of the world's rapidly developing major economies. Endowed with a youthful and expanding population, an exponentially growing middle class, and an expanding pool of skilled workers, India is primed for an era of continuous economic advancement. This article aims to assess the advantageous aspects, potential avenues, and potential drawbacks of the Indian economy and also presents a strategy to access the Indian market. Commencing with an exploration of India's strengths.

WikiFX

WikiFX

NewsFitch Downgrades the U.S. Credit Rating: Unpacking the Implications

Fitch Ratings, in a noteworthy action, has lowered the United States' Long-Term Foreign-Currency Issuer Default Rating (IDR) from 'AAA' to 'AA+'. This announcement, made on August 1, 2023, mirrors apprehensions concerning the nation's fiscal stability, governance norms, and debt handling, consequently indicating to investors and international markets about a heightened risk when lending to the United States. The immediate effect of this downgrade remains uncertain, especially as markets are presently performing poorly.

WikiFX

WikiFX

NewsThe Interest Rate Dilemma: A Week of Reckoning for Central Banks

This attention of investors for this week attention is fixated on the actions of central banks, particularly the Federal Reserve and the European Central Bank (ECB).

WikiFX

WikiFX

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now