Score

MEDE Company

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://medes.cc

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

MEDE Global Limited

MEDE Company

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 5 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

Users who viewed MEDE Company also viewed..

XM

FXCM

HFM

CPT Markets

MEDE Company · Company Summary

Note: MEDE Companys official site - https://medes.cc is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| MEDE Company Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | NFA (Unauthorized) |

| Market Instruments | More than 350 trading instruments in financial markets, including forex and CFDs trading |

| Demo Account | Unavailable |

| Leverage | 1:500 |

| EUR/ USD Spreads | Around 0.5 pips |

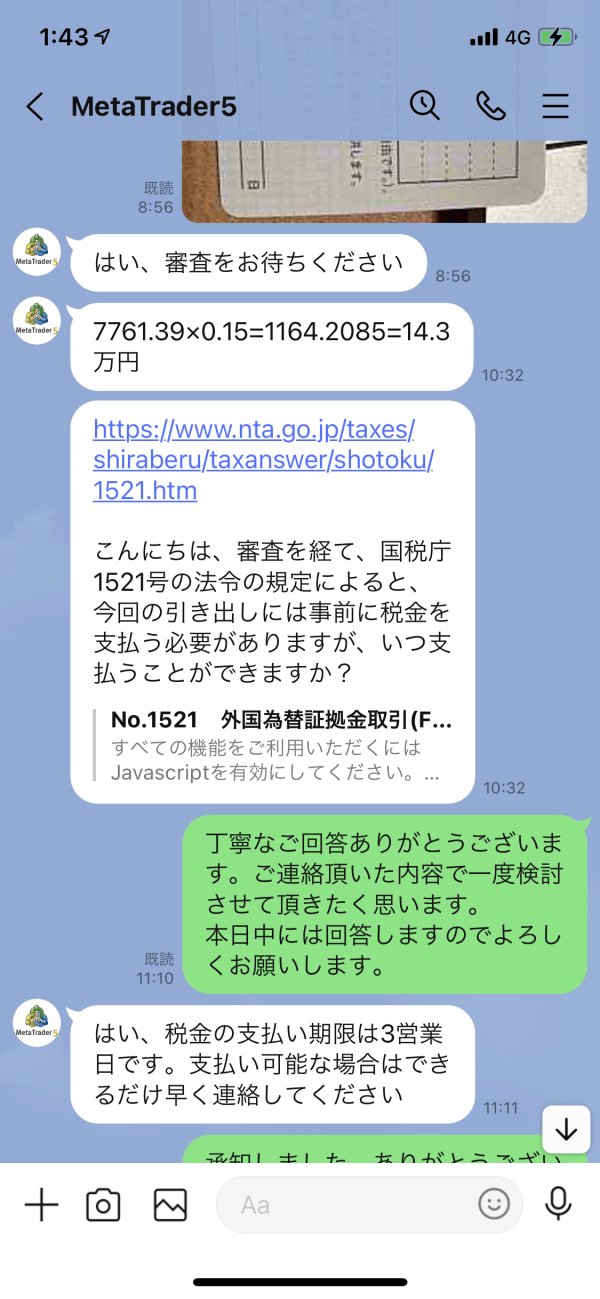

| Trading Platforms | MT5 |

| Minimum Deposit | $200 |

What is MEDE Company?

MEDE Company, based in the United Kingdom, offers a wide range of trading instruments, including forex and CFDs, to its clients. Despite offering a maximum leverage of 1:500 and competitive spreads of around 0.5 pips, the company's regulatory status is abnormal and officially unauthorized. This means that MEDE Company currently operates without government or financial authority oversight. Additionally, the official website of MEDE Company is inaccessible, raising concerns about the company's reliability and suggesting a potential absence of the trading platform. Reports of being unable to withdraw funds and instances of scams further highlight the risks associated with investing with MEDE Company.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • MT5 supported | • Website is unavailable |

| • Tight spreads | • Not regulated |

| • A range of trading instruments | • No demo accounts |

| • High minimum deposit | |

| • Reports of scams and unable to withdraw |

MEDE Company Alternative Brokers

There are many alternative brokers to MEDE Company depending on the specific needs and preferences of the trader. Some popular options include:

LIGHT FX - An innovative online brokerage that prides itself on offering competitive trading conditions, cutting-edge technology, and a user-friendly interface to empower traders of all levels.

Valutrades- It provides competitive spreads, reliable trade execution, and a range of trading platforms, making it a solid choice for traders looking for a reliable brokerage.

eToro - A popular social trading platform that allows traders to follow and copy the trades of other successful traders.

Is MEDE Company Safe or Scam?

United States NFA (license number: 0545139) The regulatory status is abnormal and the official regulatory status is unauthorized. MEDE Company currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. Besides, the official website of MEDE Company is inaccessible, indicating that the trading platform may have absconded. These make investing with them risky.

If you are considering investing with MEDE Company, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Market Instruments

MEDE Company offers more than 350 trading instruments in financial markets, including forex and CFDs trading.

- Forex: MEDE Company offers a comprehensive range of Forex pairs for traders to invest in, including major, minor, and exotic currency pairs. Foreign exchange, or Forex refers to the trading of currencies. Countries, businesses and individuals all participate in this market, making it the most heavily traded market.

- CFDs : CFDs, or Contract for Difference, are a type of trading instrument that allows traders to speculate on price movements of various financial assets without owning the underlying asset.

Leverage

MEDE Company offers a maximum leverage of 1:500 to its clients. Leverage is essentially a tool that allows traders to amplify their trading positions by borrowing funds from their broker. This means that with a 1:500 leverage, traders can control a position that is 500 times larger than their actual investment.

The availability of high leverage, such as 1:500, can be appealing to traders as it allows them to potentially generate larger profits from smaller initial investments. However, it is important to note that leverage is a double-edged sword. While it can enhance profits, it can also magnify losses in the same proportion.

Spreads & Commissions

MEDE Company strives to provide competitive spreads to its clients, offering spreads around 0.5 pips for their accounts. Spreads refer to the difference between the buying (ask) and selling (bid) prices of a particular trading instrument. It is essentially the cost of trading and represents the profit that the broker earns. Lower spreads, like the ones offered by MEDE Company, are generally favorable for traders as they can minimize the cost of executing trades.

Besides, due to the unavailable website, there is no access to find out the commission ofMEDE Company.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| MEDE Company | Around 0.5 pips | N/A |

| LIGHT FX | 0.5 pips | None |

| Valutrades | 0.0 pips | None |

| eToro | 3 pips | $3.50 per lot |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

MEDE Company offers its clients the popular trading platform MetaTrader 5 (MT5). MT5 is a powerful and comprehensive trading platform that provides traders with a wide range of features and tools to effectively analyze and execute trades in the financial markets.

One of the key advantages of MT5 is its user-friendly interface, which makes it accessible to both beginner and experienced traders. The platform offers a customizable layout that allows traders to arrange and prioritize the information and tools according to their preferences. Traders can access real-time market quotes, interactive charts with various technical indicators, and a wide range of analytical tools for in-depth market analysis.

Furthermore, MT5 is available on multiple devices, including desktop computers, web browsers, and mobile devices. This enables traders to stay connected to the markets and manage their trades anywhere, anytime, making it convenient and flexible for modern traders.

See the trading platform comparison table below:

| Broker | Trading Platform |

| MEDE Company | MT5 |

| LIGHT FX | MT5 |

| Valutrades | MT4, MT5 |

| eToro | Proprietary |

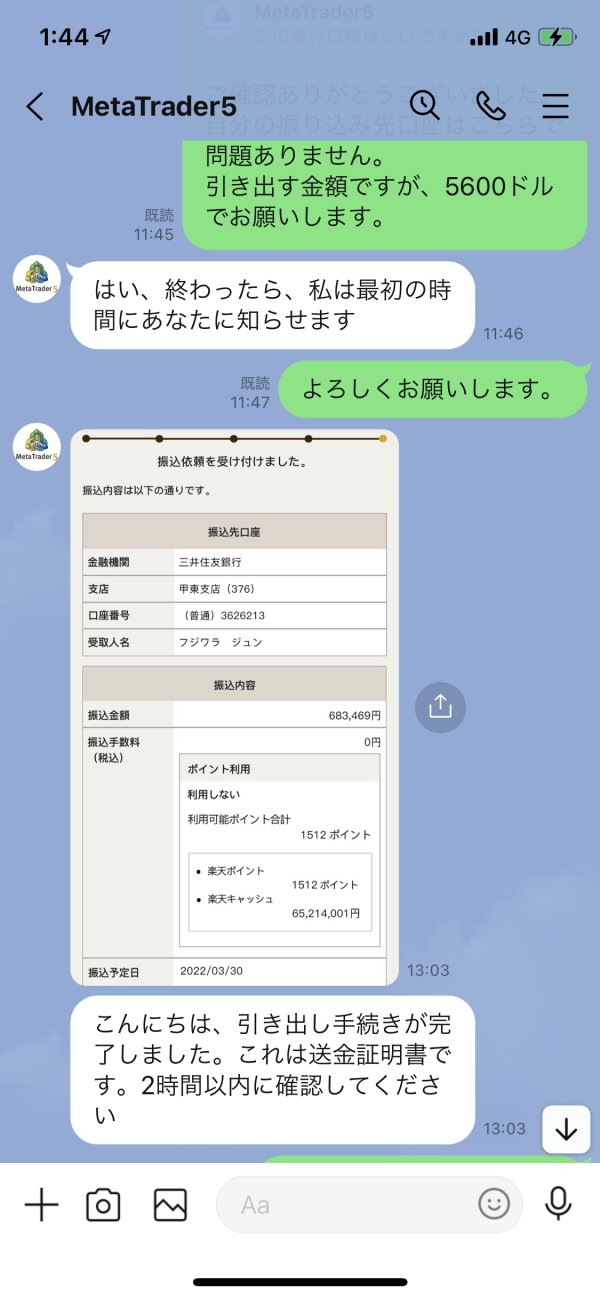

Deposits & Withdrawals

MEDE Company accepts deposits and withdrawals via credit cards like Visa and MasterCard, bank transfers and popular e-wallets such as Skrill, Neteller, FasaPay and POLi.

Credit card deposits and withdrawals are widely accepted by MEDE Company, with options such as Visa and MasterCard. This allows clients to fund their trading accounts or withdraw funds using their preferred credit card, providing a quick and hassle-free transaction process.

Bank transfers are also available as a deposit and withdrawal method, providing a secure and straightforward way for clients to transfer funds between their bank accounts and their trading accounts.

MEDE Company supports popular e-wallets like Skrill, Neteller, FasaPay, and POLi. These e-wallets offer clients the convenience of making instant deposits and withdrawals, avoiding the need for traditional banking methods.

MEDE Company minimum deposit vs other brokers

| MEDE Company | Most other | |

| Minimum Deposit | $200 | $100 |

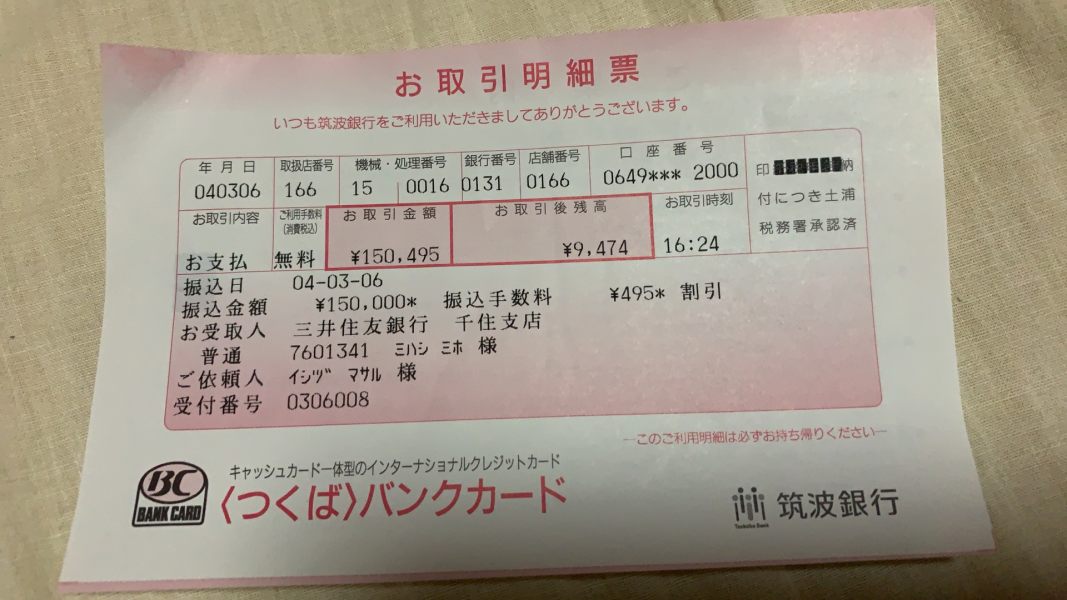

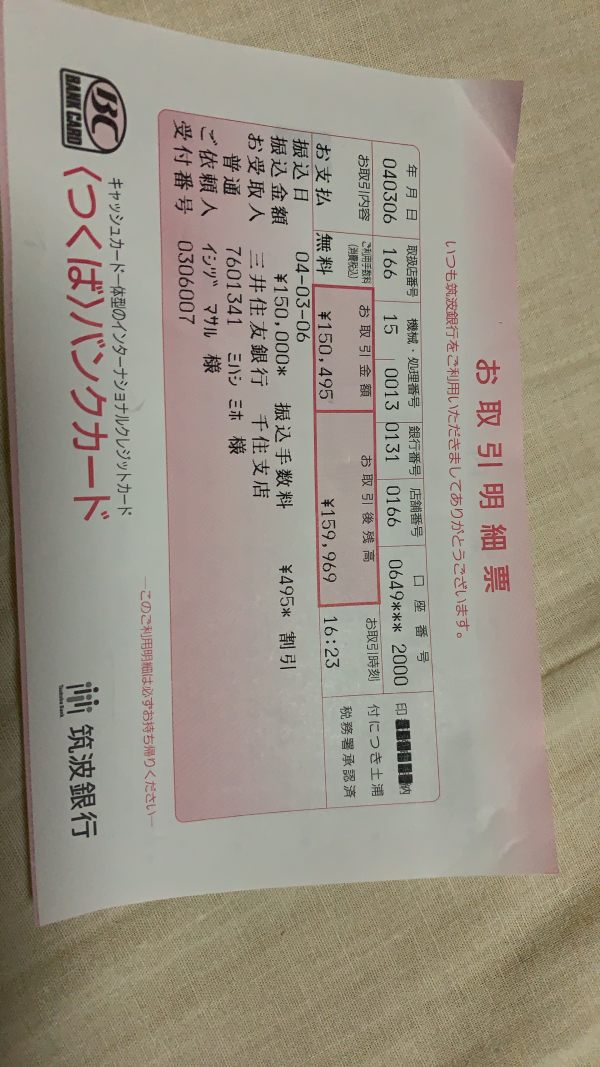

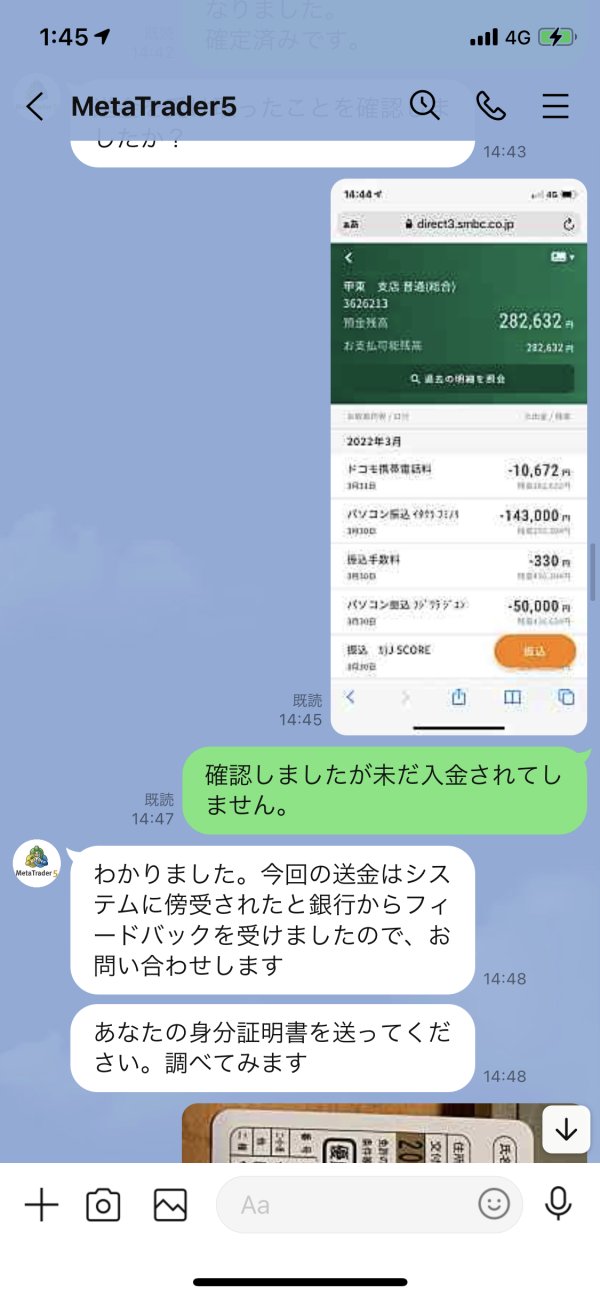

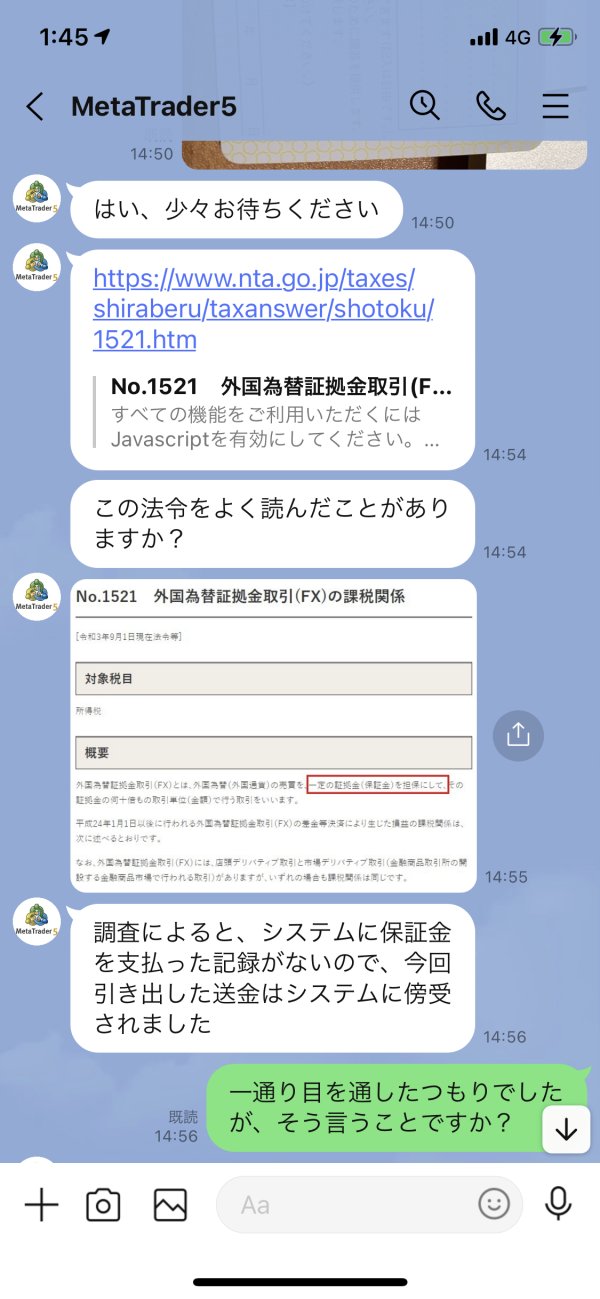

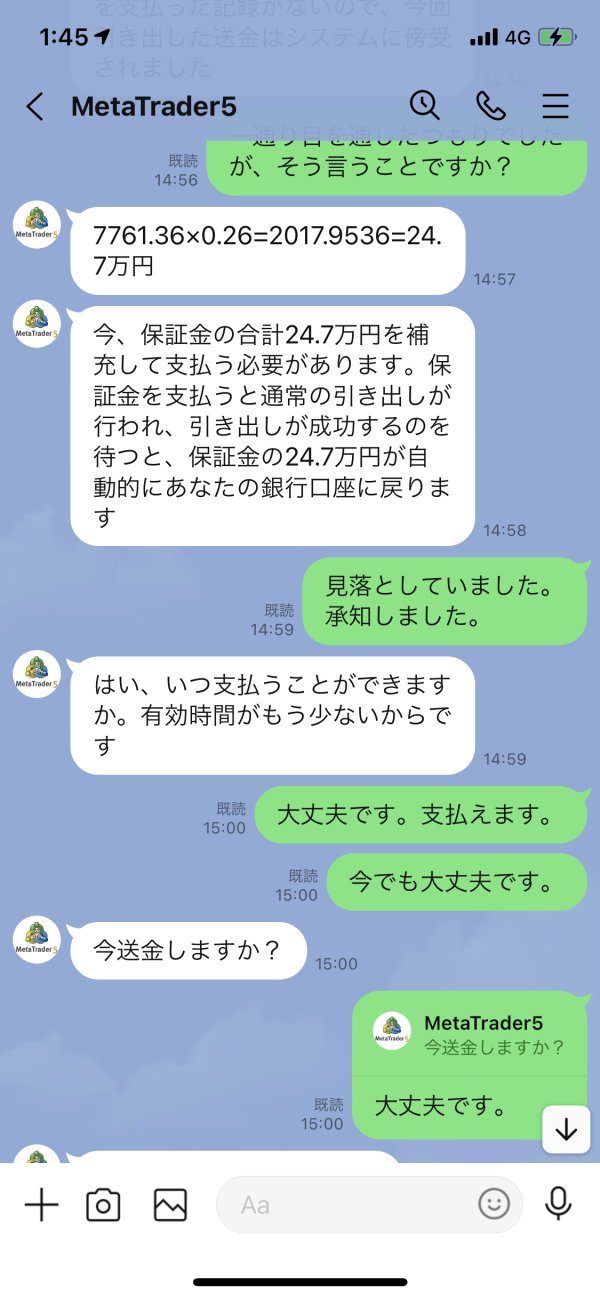

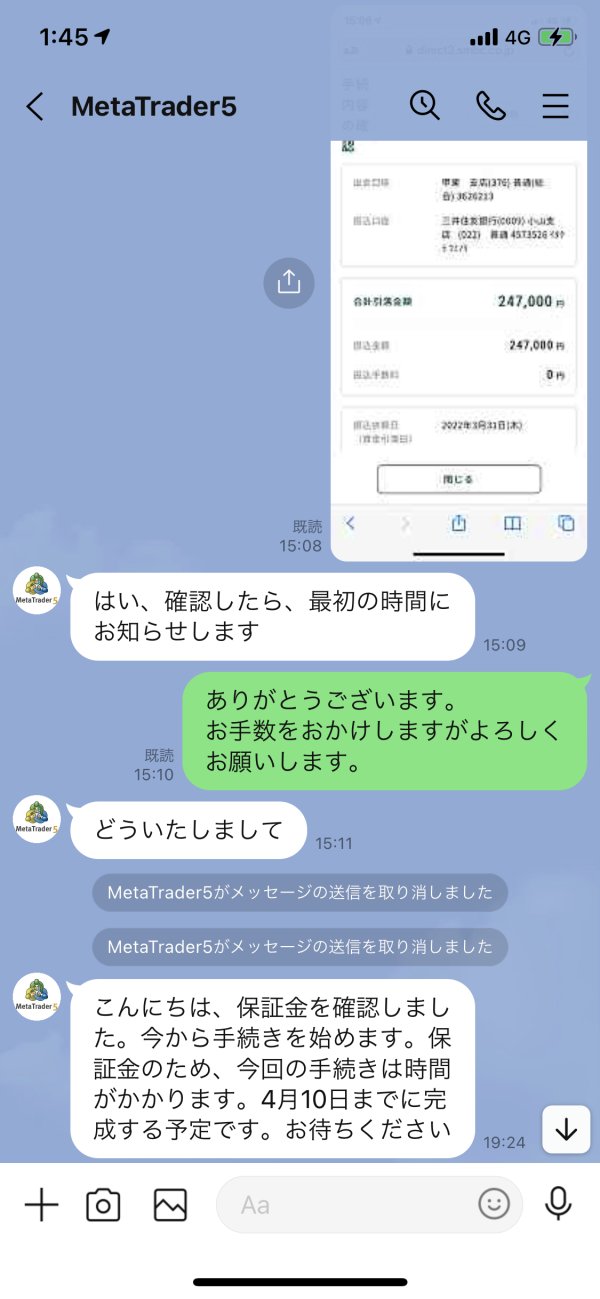

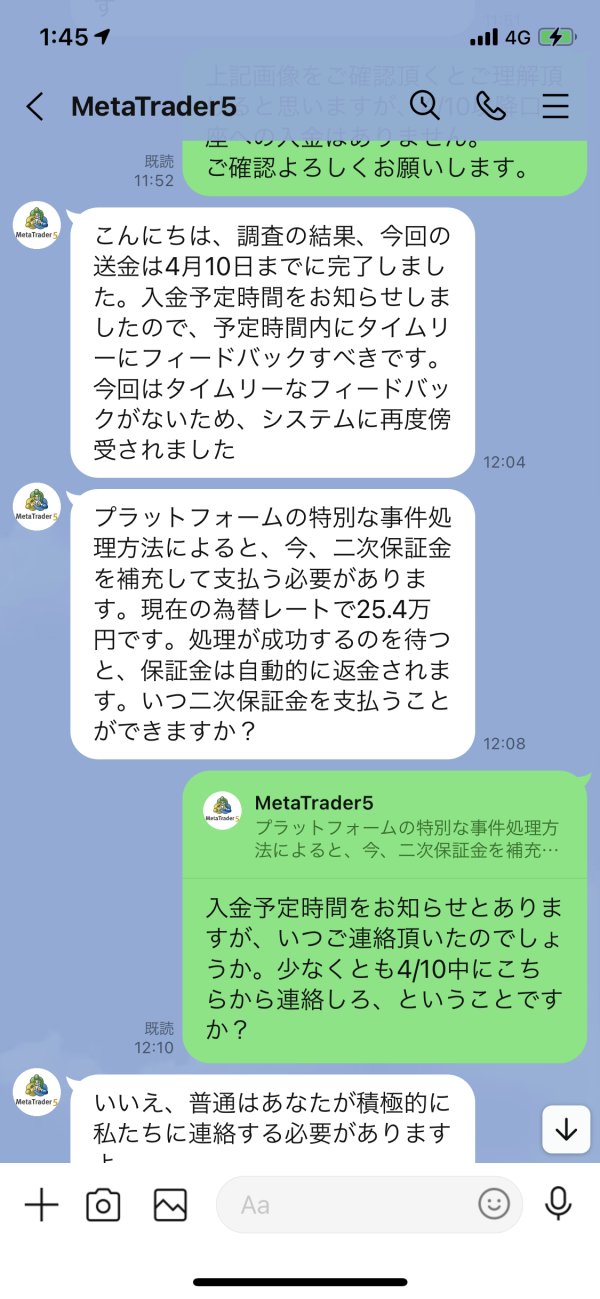

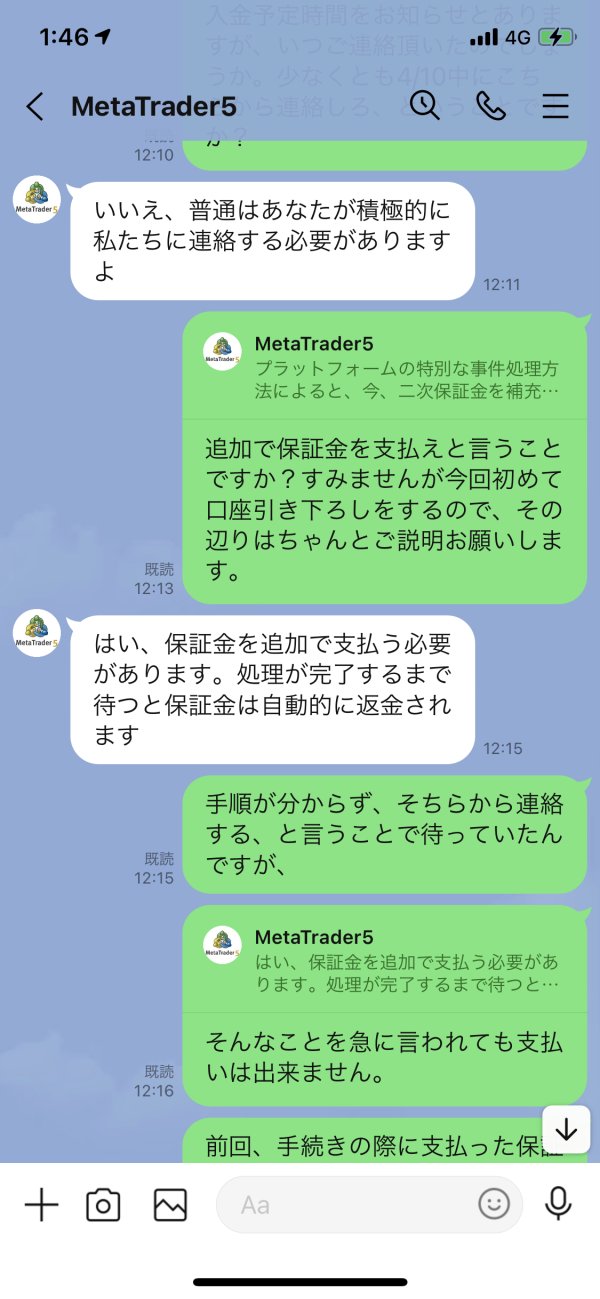

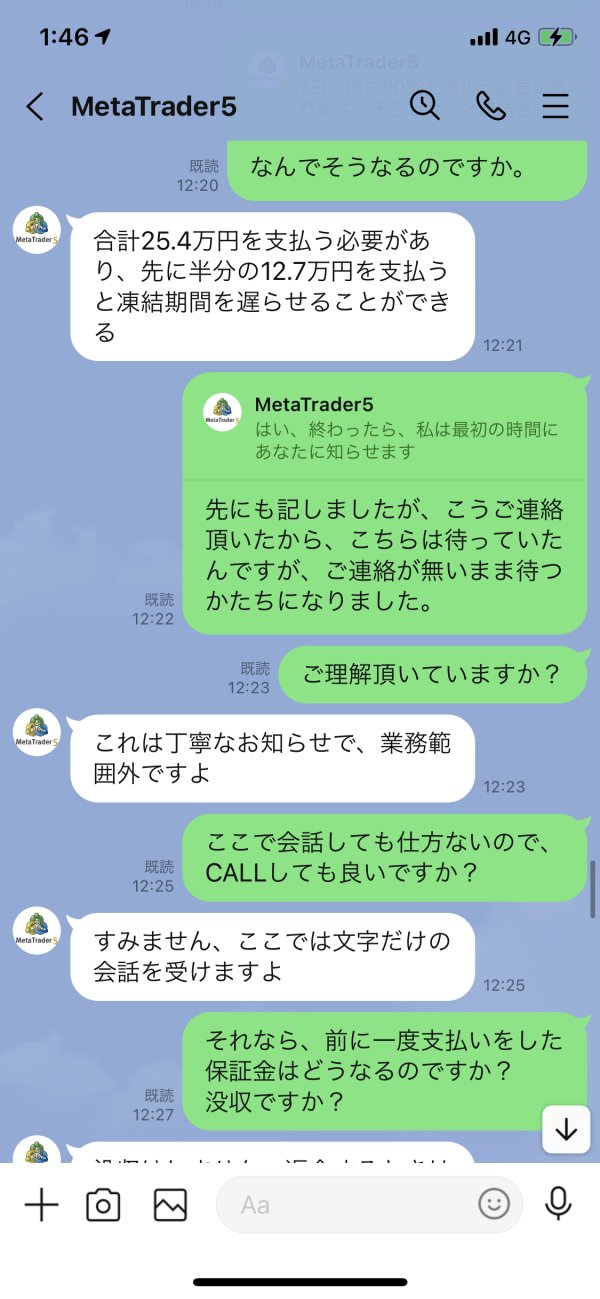

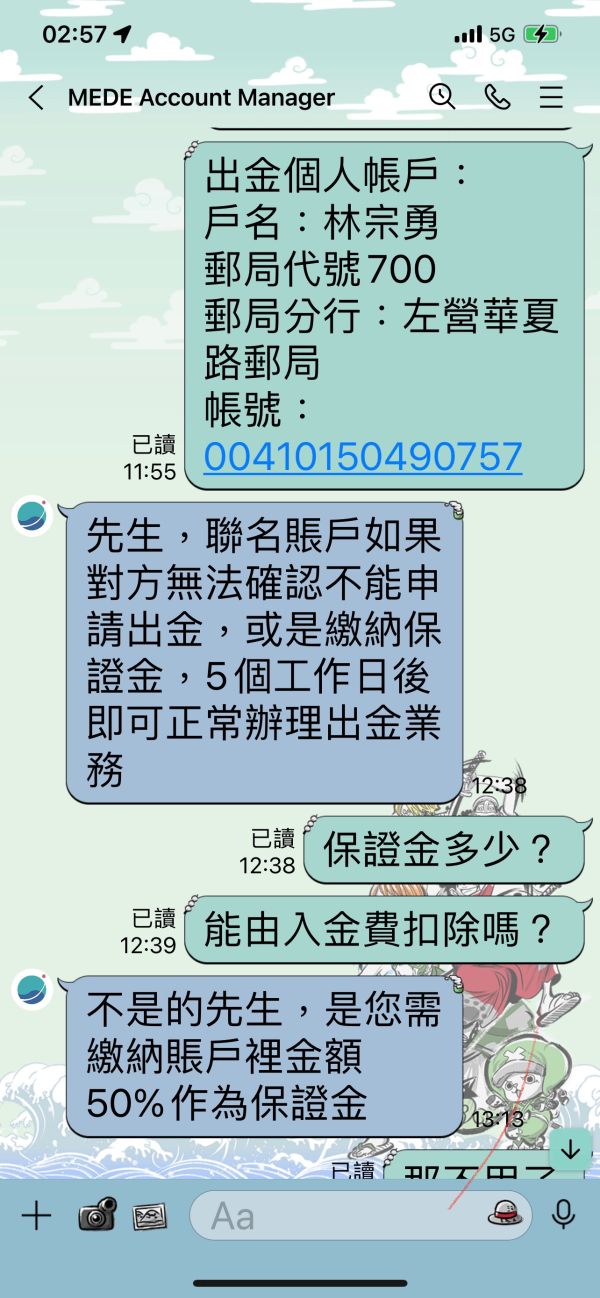

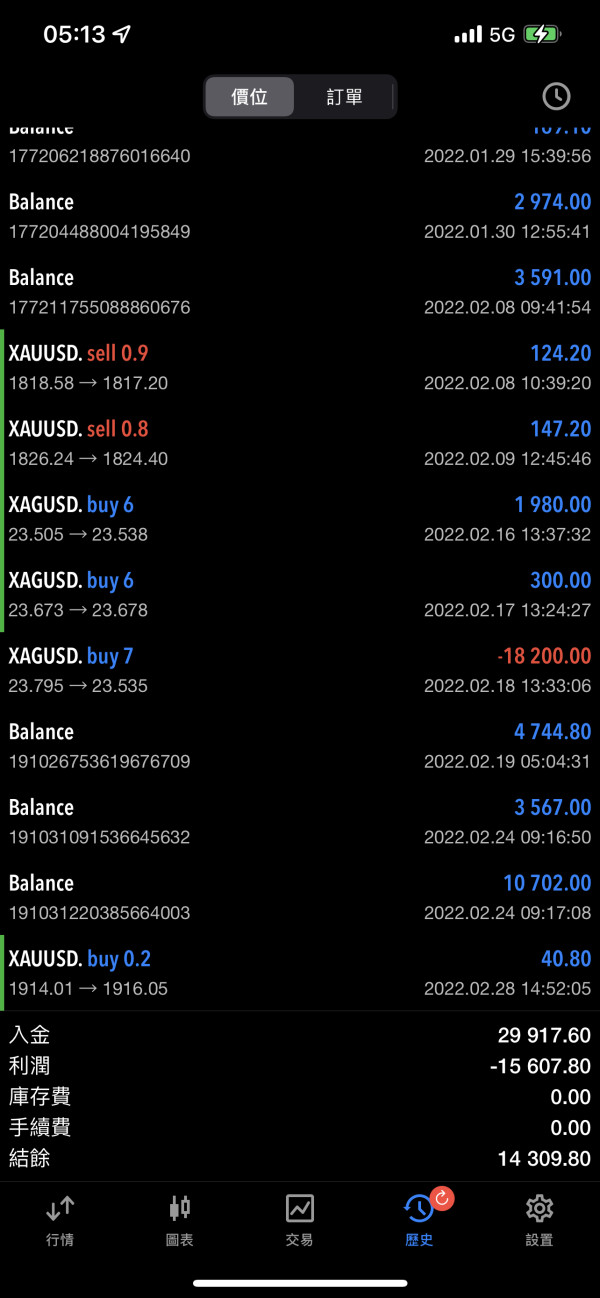

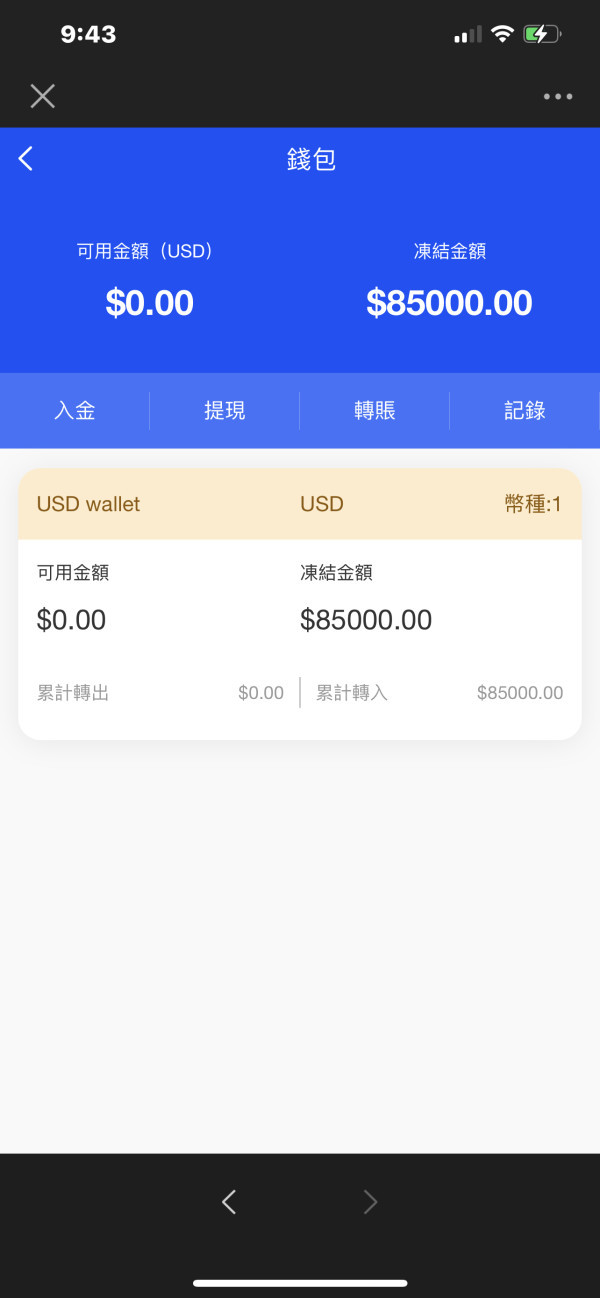

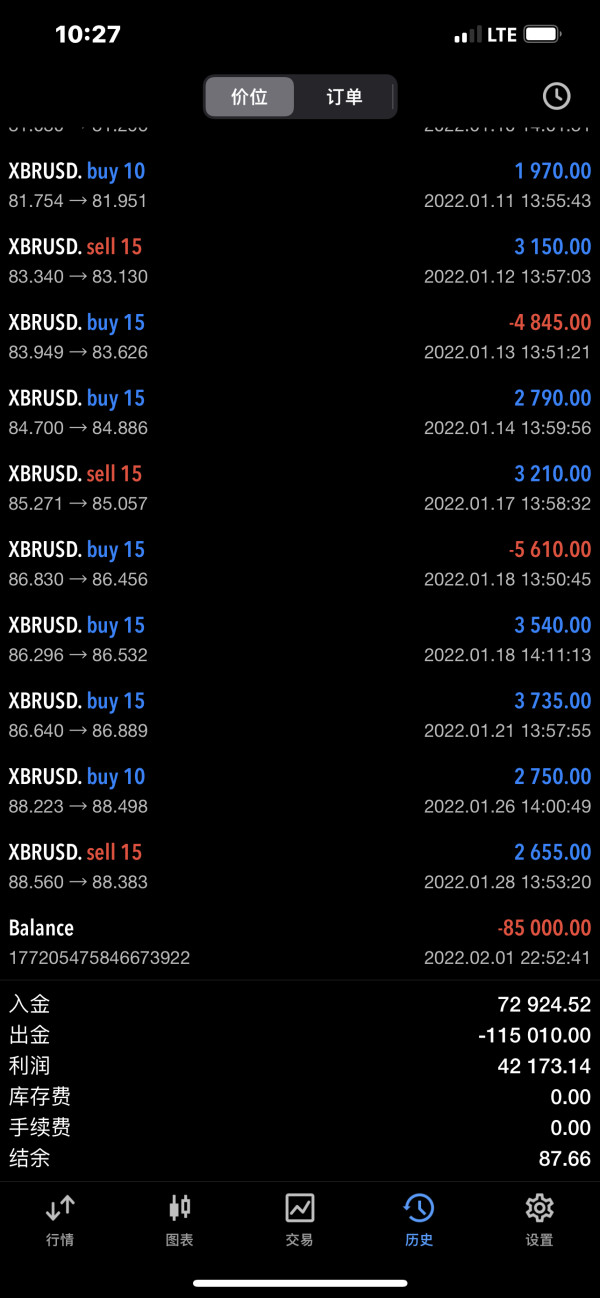

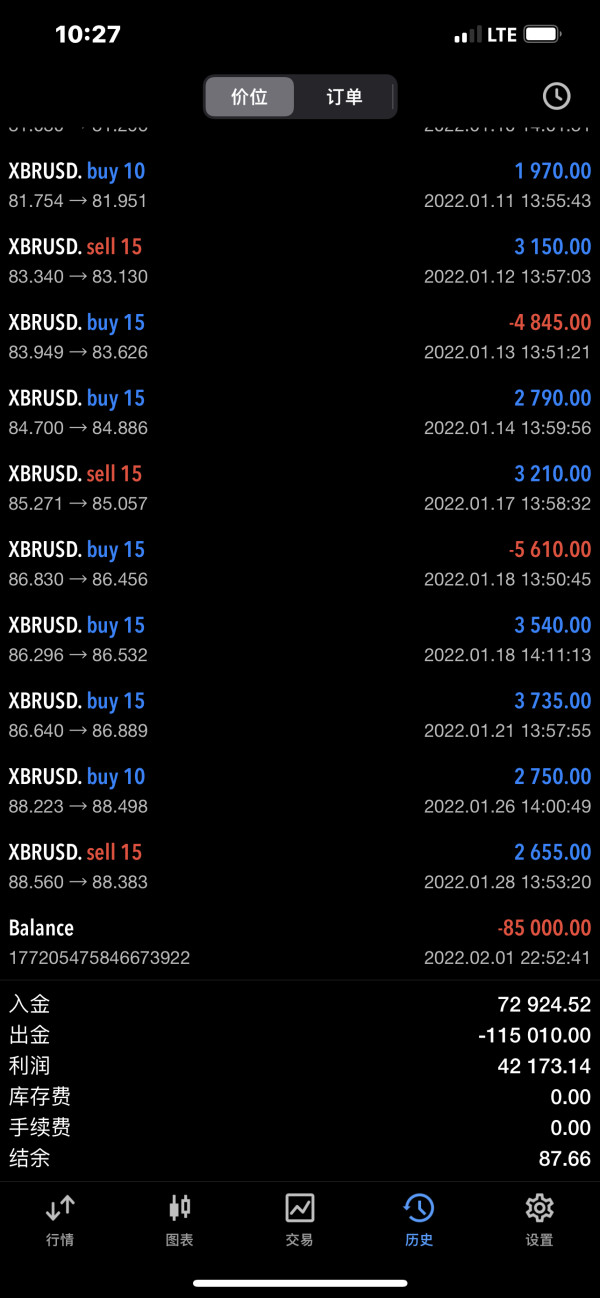

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Address: 291 Brighton Road, South Croydon, Surrey, CR2 6EQ, United Kingdom

Conclusion

In conclusion, MEDE Company is a trading platform that offers a range of services to its clients. The platform provides access to various financial markets, allowing traders to diversify their portfolios and capitalize on different trading opportunities. With its user-friendly interface and advanced charting tools, MEDE Company's trading platform, MT5, caters to the needs of both beginner and advanced traders.

However, MEDE Company has many problems. First, it doesn‘t have regulation. Second, it is because the official website of MEDE Company is inaccessible that the relevant information doesn’t be provided, which makes trade not transparent enough. Therefore, traders should verify the regulatory status of MEDE Company or any broker they choose to work with to ensure compliance with industry standards and regulatory requirements.

Frequently Asked Questions (FAQs)

| Q 1: | Is MEDE Company regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does MEDE Company offer demo accounts? |

| A 2: | No. |

| Q 3: | Does MEDE Company offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT5. |

| Q 4: | What is the minimum deposit for MEDE Company? |

| A 4: | The minimum initial deposit to open an account is $200. |

| Q 5: | Is MEDE Company a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

News

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now