Broker Information

Nash Markets

Nash Markets

No Regulation

Platform registered country and region

China

--

--

--

--

--

--

--

admin@nashmarkets.com

Company Summary

China|2-5 years|

China|2-5 years| https://nashmarkets.com/

Website

Influence

C

Influence index NO.1

United States 3.61

United States 3.61No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Danger

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Nash Markets Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | China |

| Regulation | No license |

| Market Instruments | 138 forex pairs, 47 stocks/indices, 8 commodities, cryptocurrencies |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | 0.5 pips (Std) |

| Trading Platforms | MT4/5 |

| Minimum deposit | $10 |

| Customer Support | 24/7 live chat, email, request a callback |

Nash Markets is an unregulated forex broker that engages in providing clients with a variety of financial products and services. As an STP (straight-through processing) brokerage company, it aims to provide traders with efficient data regarding their results. However, it currently has no valid regulation.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Nash Markets offers a wide range of financial instruments for trading, competitive spreads, MT4/5 platforms, which can appeal to traders looking for diverse investment opportunities. The availability of multiple types of trading accounts and a user-friendly trading experience further enhances the flexibility and convenience for traders. Additionally, the 24/7 customer support availability is a positive aspect, ensuring assistance when needed.

However, it's important to note that Nash Markets is unregulated. Conducting further research and contacting Nash Markets directly for up-to-date and comprehensive information is advisable before making any decisions.

| Pros | Cons |

| • Wide range of financial instruments available for trading | • No valid regulation |

| • Multiple types of trading accounts | • US clients are excluded |

| • MT4 and MT5 supported | • Limited trading tools and educational resources |

| • Low minimum deposit | |

| • 24/7 customer support availability |

There are many alternative brokers to Nash Markets depending on the specific needs and preferences of the trader. Some popular options include:

FBS - offers a diverse range of trading instruments and a user-friendly platform, making it a recommended choice for traders seeking variety and ease of use.

Tasman FX - with its reliable MT4 platform and competitive trading conditions, Tasman FX is a recommended option for traders looking for a trusted and feature-rich brokerage.

TeraFX - the offering of multiple trading platforms and competitive pricing make it a recommended choice for traders seeking flexibility and competitive trading conditions.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

The lack of valid regulation for Nash Markets raises concerns about its safety and legitimacy as a broker. Regulation provides oversight and protection for traders, ensuring that certain standards and guidelines are followed. Without valid regulation, there is an increased risk of potential fraudulent activities or unscrupulous practices. It is crucial for traders to exercise caution and thoroughly research and assess the risks before engaging with an unregulated broker. It is recommended to consider regulated alternatives that offer the necessary safeguards and investor protection measures.

Nash Markets offers a diverse range of market instruments, catering to traders with varying investment preferences. With 138 forex pairs, traders can access a wide array of currency combinations to capitalize on global exchange rate fluctuations. The availability of 47 stocks/indices provides an opportunity to invest in popular companies or track market trends through diversified portfolios.

Furthermore, the inclusion of 8 commodities allows traders to participate in the commodities market, which encompasses assets like gold, oil, and agricultural products. Lastly, the inclusion of cryptocurrencies reflects the growing popularity of digital assets, enabling traders to engage with the dynamic world of cryptocurrencies.

Nash Markets offers a range of account types designed to cater to different trading needs and investment levels. The Standard, Pro, Var, and Mini accounts provide options for traders with varying experience and capital requirements. With a recommended minimum deposit of $200 for Standard, Pro and Var accounts, and $50 for Mini accounts, traders can access a range of features and services tailored to their trading preferences.

Additionally, the availability of the Cryptos account, with a recommended minimum deposit of $10, caters specifically to cryptocurrency traders, providing a low-entry point for those interested in the digital asset market.

Nash Markets provides traders with leverage options of up to 1:500. Leverage is a powerful tool that enables traders to amplify their trading positions and potentially enhance their profit potential. With a leverage ratio of 1:500, traders can control a larger position in the market relative to their invested capital. This high leverage option allows for greater flexibility in trading strategies and the ability to take advantage of smaller market movements.

However, it's crucial to note that while leverage can magnify potential profits, it also amplifies the risk of losses. Traders should exercise caution and have a thorough understanding of leverage and risk management techniques before utilizing such high leverage ratios.

Nash Markets offers competitive spreads and commissions across its various account types. The Standard account features spreads starting from 0.5 pips, providing traders with relatively tight pricing for popular currency pairs. In the Var account, traders can benefit from incredibly low spreads starting from 0.0 pips, which indicates the potential for highly competitive pricing on their trades. The Pro account offers spreads starting from 1.0 pips, while the Mini account provides traders with spreads starting from 1.2 pips. These options allow traders to choose an account type that aligns with their trading preferences and cost considerations. For the Cryptos account, spreads are variable, reflecting the dynamic nature of the cryptocurrency market.

Specifically, the EUR/USD spread floating around 0.8 pips indicates the tight pricing available for this popular currency pair.

In terms of commissions, the Standard account incurs a commission of $5 per lot, while the Pro and Cryptos accounts have a commission of $10 per lot. The Mini account has a lower commission rate of $1 per lot, and the Var account does not have any commission charges. This structure allows traders to select the account type that best suits their trading style and cost expectations, with transparency regarding both spreads and commissions.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per lot |

| Nash Markets | 0.8 pips | $5 (Std) |

| FBS | 0.2 pips | $20 (Std) |

| Tasman FX | 0.0 pips | $7 (Classic) |

| TeraFX | 1.0 pips | $5 (Std) |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Nash Markets provides traders with a choice of robust trading platforms to suit their preferences and devices. One of the platform options is TradeLocker, a proprietary platform developed by Nash Markets. TradeLocker offers a user-friendly interface and a range of advanced trading tools and features. With TradeLocker, traders can access real-time market data, execute trades efficiently, and monitor their positions and account activity.

Additionally, Nash Markets supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are widely recognized in the industry. These platforms are available for Mac, Windows, Android, and iOS devices, ensuring seamless accessibility across a range of operating systems. MT4 and MT5 are known for their comprehensive charting capabilities, extensive technical analysis tools, and the ability to use automated trading strategies through expert advisors (EAs). Traders can benefit from the wide range of indicators, charting options, and customization features offered by these platforms.

By offering TradeLocker and supporting MT4/MT5, Nash Markets caters to traders' diverse needs and preferences, whether they seek a proprietary platform or prefer the familiarity and functionality of the MetaTrader platforms. This flexibility allows traders to choose the platform that aligns with their trading strategies, preferences, and the devices they use.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Nash Markets | TradeLocker, MT4/MT5 |

| FBS | FBS Trader, MT4/MT5 |

| Tasman FX | MT4, WebTrader |

| TeraFX | MT4, MT5, cTrader |

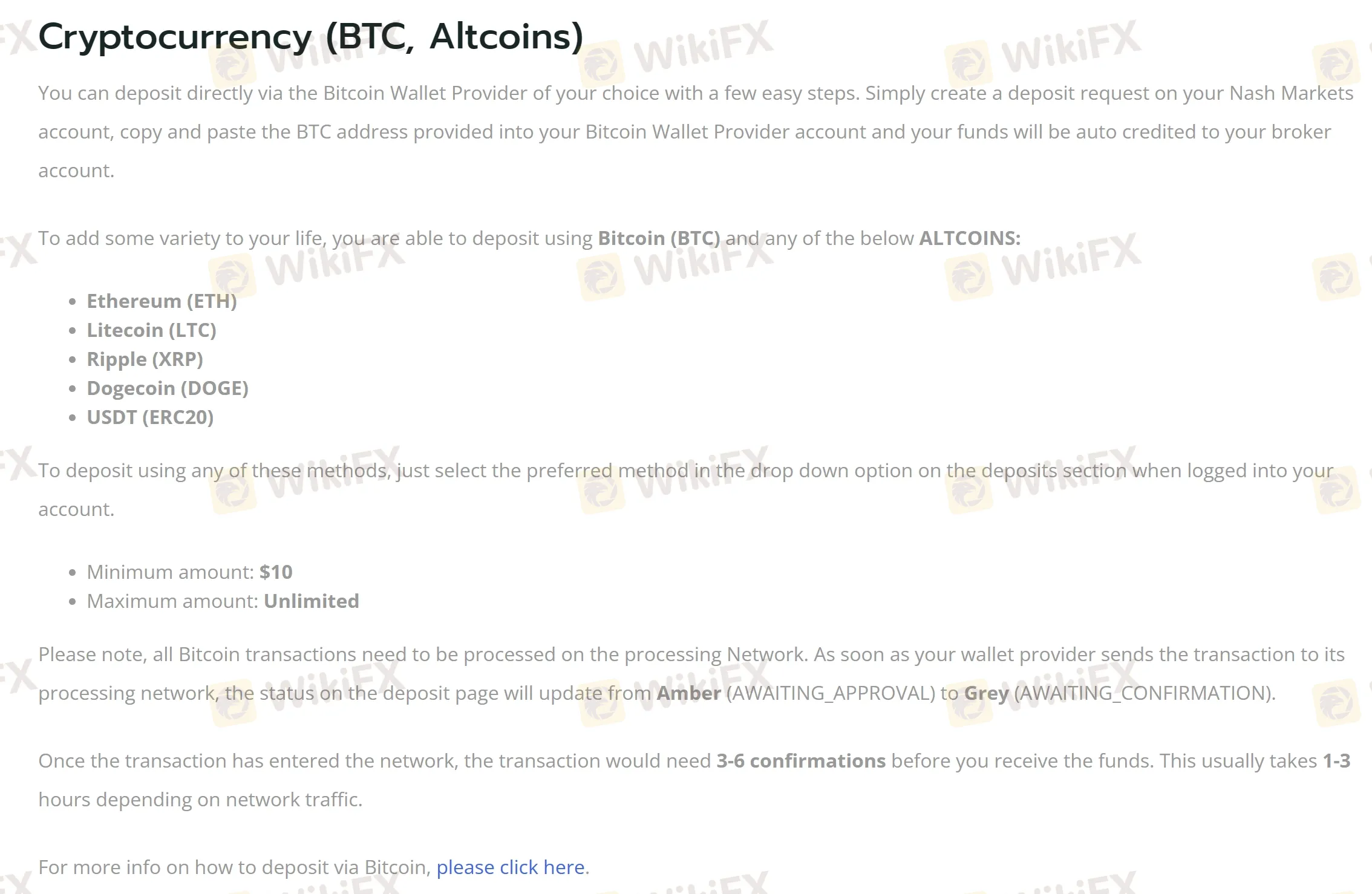

Nash Markets offers a variety of deposit and withdrawal options to facilitate seamless transactions for its clients. For cryptocurrency enthusiasts, Nash Markets accepts Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Dogecoin (DOGE), and USDT (ERC20) as deposit options. This allows traders to fund their accounts directly using these popular cryptocurrencies. In addition, Nash Markets accepts deposits via Credit/Debit Card and Wire Transfer, providing more traditional payment methods for traders.

| Nash Markets | Most other | |

| Minimum Deposit | $10 | $100 |

The minimum deposit amounts vary depending on the chosen method. For cryptocurrency deposits, the minimum amount is $10, providing a low entry point for those utilizing digital currencies. Credit/Debit Card deposits have a minimum requirement of $25 for USD/EUR and BTC wallets, while it is $50 for USD/GBP/EUR and BTC wallets for Debit/Credit Card and Wire Transfer deposits.

When it comes to withdrawals, the minimum amount for all methods is $50. Nash Markets aims to process withdrawal requests within one workday, indicating a commitment to prompt and efficient transaction processing.

Nash Markets prioritizes responsive and accessible customer service to assist its clients effectively. Traders can reach out to the support team 24/7 through various channels, including live chat, email, or by requesting a callback. The availability of live chat ensures immediate assistance, enabling traders to have their queries addressed in real-time. Additionally, the option to communicate via email allows for more detailed inquiries or support requests. The ability to request a callback offers convenience for traders who prefer direct communication.

To further support its clients, Nash Markets provides an FAQ section where traders can find answers to common questions and gain insights into various aspects of trading with the broker. This comprehensive resource helps users find information quickly and empowers them to make informed decisions.

Furthermore, Nash Markets maintains an active presence on popular social networks such as Twitter, Facebook, and Instagram. By following the broker on these platforms, traders can stay updated with the latest news, promotions, educational content, and engage with the community.

Overall, Nash Markets' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/7 availability for customer support | N/A |

| • Multiple channels for communication | |

| • Responsive live chat support | |

| • FAQ section for quick reference | |

| • Active presence on social media platforms |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Nash Markets' customer service.

We have not received any reports of fraudulent activity at this time. It is a positive sign, but it's important to remain vigilant and exercise caution when dealing with any financial broker or platform. While there may not be specific reports of fraudulent activity related to Nash Markets, it's always advisable to conduct thorough research, review customer feedback, and consider the regulatory status of the broker. It's essential to stay informed, make informed decisions, and consult with a financial advisor if needed, to ensure the safety and security of your investments.

As of now, the information provided suggests potential advantages such as a diverse range of financial instruments, competitive spreads, multiple trading account options, and user-friendly MT4/5 trading platforms. The availability of 24/7 customer support is also a positive aspect. However, Nash Markets does not hold any valid regulatory licenses at this stage. Please be aware of the risk!

| Q 1: | Is Nash Markets regulated? |

| A 1: | No. It is currently not effectively regulated and you are advised to be aware of its potential risks. |

| Q 2: | At Nash Markets, are there any regional restrictions for traders? |

| A 2: | Yes. Their website is not directed at or intended to elicit citizens and/or residents of the USA and is not intended for distribution to or use by any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. |

| Q 3: | Does Nash Markets offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT4 and MT5. |

| Q 4: | What is the minimum deposit for Nash Markets? |

| A 4: | The minimum initial deposit to open an account is $10. |

| Q 5: | Is Nash Markets a good broker for beginners? |

| A 5: | No. It is not a good choice for beginners. Though it advertises well, it lacks valid regulation at this stage. |

Nash Markets

Nash Markets

No Regulation

Platform registered country and region

China

--

--

--

--

--

--

--

admin@nashmarkets.com

Company Summary

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now