简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

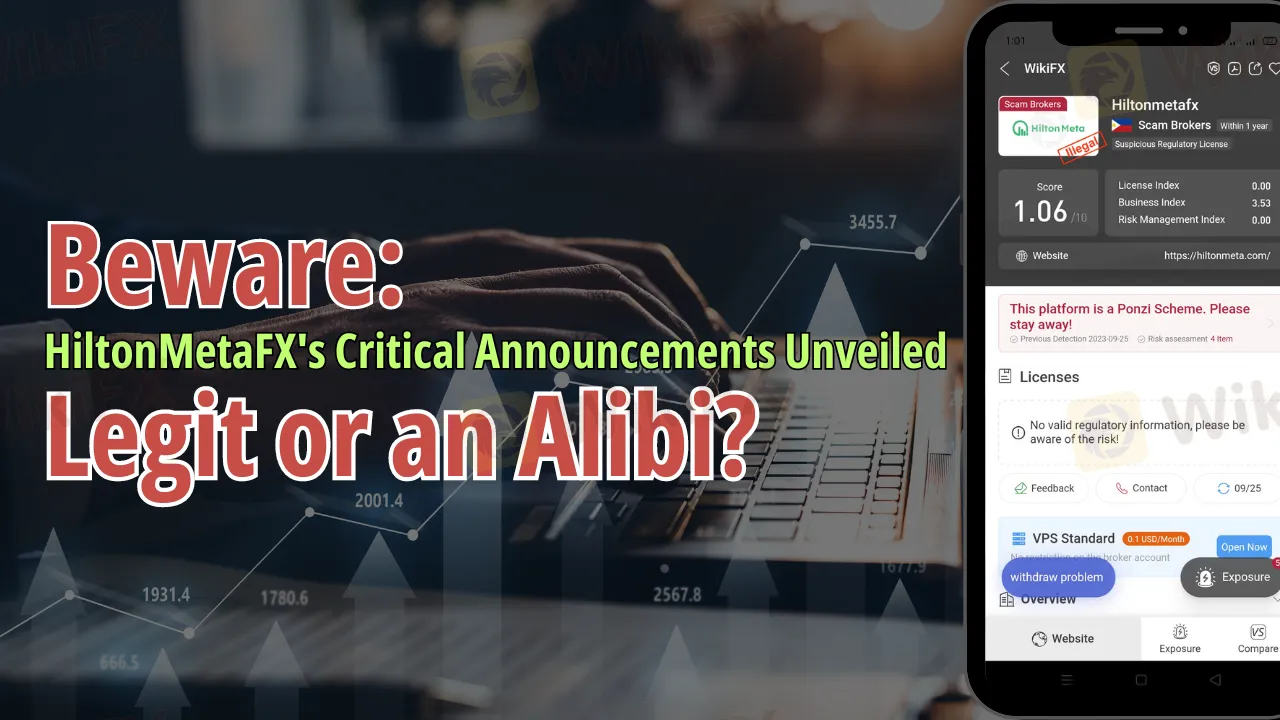

Beware: HiltonMetaFX's Critical Announcements Unveiled - Legit or an Alibi?

Abstract:Is HiltonMetaFX's System Update Trustworthy? Investor Concerns and Risks Explored. Stay Informed!

Introduction

In recent times, HiltonMetaFX has been in the spotlight due to an ongoing system update that has left many investors with questions and concerns. The latest announcement from HiltonMetaFX hinted at a 10 to 12-day integration process, raising concerns about the impact on investors' accounts and the reasons behind such a prolonged maintenance period. In this article, we will delve into the situation, shed light on the possible implications for investors, and explore the regulatory status of HiltonMetaFX.

Latest update dated September 25, 2023

According to HiltonMetaFX's latest statement on its official community channel, the company has been making strides in improving its system's reliability and security. They claim to have successfully completed 70% of the data recovery process and are actively working on finalizing the remaining 30%. While the company thanks its community for its patience and support, the fact remains that any online trading platform is susceptible to unexpected glitches, data losses, and other operational hiccups.

The Uncertainty Surrounding the System Update

The recent statement from HiltonMetaFX outlined an exciting upcoming integration with their API aimed at enhancing services and user experience. However, what caught the attention of many investors was the unexpected timeframe mentioned – a 10 to 12-day period. This deviation from the previous announcement, which did not specify any downtime, has sparked concerns and uncertainties among the user base.

Last September 10, HiltoMetaFX CEO spoke about the system maintenance rolled out and he said that it will be fine in 15 days. On September 25, the broker again announced another System update that was never stated that it would be done in days.

See the news below:

Investor Panic and Withdrawal Dilemma

The sudden extension of the system update timeline has raised questions about how investors can manage their funds during this period. Investors typically rely on a broker's platform to access and manage their accounts, but with the system in maintenance mode, this becomes challenging. The fear of losing access to their investments or encountering delays in withdrawals has led some investors to consider withdrawing their funds prematurely.

Urgent Considerations for HiltonMetaFX Users

If you are a HiltonMetaFX user, it is crucial to be proactive about the safety and security of your account. Keep an eye out for updates from the company regarding system improvements and make backup plans for your investments.

System Maintenance: Legit or Alibi?

One of the critical questions that arise is whether this extended maintenance is a legitimate technical necessity or an alibi to deter massive withdrawals. It's essential to understand that HiltonMetaFX is not a regulated broker. The absence of regulation can raise doubts among investors about the broker's intentions, particularly when significant changes or updates to the system are announced.

The lack of regulation means that HiltonMetaFX operates without oversight from financial authorities, potentially allowing them more flexibility in managing user accounts and funds. This raises concerns about the safety and security of investors' assets, especially during system maintenance.

The Risks of Trading with an Unregulated Broker

Despite ongoing system improvements, it is vital to note that HiltonMetaFX is not a regulated broker. This means that the platform doesn't adhere to the regulations and guidelines that provide a safety net for investors' accounts on many other platforms. Here are some potential risks:

- Lack of Investor Protections: Regulated brokers typically offer a form of investor protection, but this is not the case with unregulated platforms like HiltonMetaFX.

- Data Security Concerns: The absence of regulatory oversight could mean fewer security protocols, thus making your data and investment vulnerable.

- Account Instability: Your trading account is subject to unexpected closures, loss of funds, or other adverse occurrences without the regulatory safety nets in place.

The Importance of Transparency

In situations like this, transparency becomes paramount. Investors have a right to know why system maintenance is required, how it impacts their accounts, and what measures are in place to safeguard their funds during this period. HiltonMetaFX should provide clear and detailed explanations to address investor concerns and ensure trust remains intact.

Conclusion

The ongoing system update at HiltonMetaFX has left investors with a sense of uncertainty and concern. The extended maintenance period and the lack of regulatory oversight have raised questions about the broker's intentions and the safety of investor funds. It is crucial for HiltonMetaFX to maintain transparency and provide reassurance to its user base.

Investors should stay informed, exercise caution, and consider their options while the system update progresses. As always, being vigilant and informed is key to making sound financial decisions in the world of online trading and investment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Google Warns of New Deepfake Scams and Crypto Fraud

Google exposes deepfake scams, crypto fraud, and app cloning trends. Learn how to spot these threats and safeguard your data with expert tips and advice.

Why Is UK Inflation Rising Again Despite Recent Lows?

October inflation rises to 2.3%, driven by energy costs. Renters face 8% annual hikes, while house price inflation climbs. Interest rates stay elevated.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

GCash, Government to Launch GBonds for Easy Investments

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator