Score

WeTrade

Saint Vincent and the Grenadines|5-10 years| Benchmark B|

Saint Vincent and the Grenadines|5-10 years| Benchmark B|https://www.wetradefx.com

Website

Rating Index

Benchmark

Benchmark

B

Average transaction speed (ms)

MT4/5

Full License

WeTrade-Demo

Influence

B

Influence index NO.1

United States 8.05

United States 8.05Benchmark

Speed:A

Slippage:A

Cost:B

Disconnected:C

Rollover:C

MT4/5 Identification

MT4/5 Identification

Full License

China

ChinaInfluence

Influence

B

Influence index NO.1

United States 8.05

United States 8.05Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 9 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed WeTrade also viewed..

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

HoChiMinh HoChiMinh | 115*** | AUDCAD.s | 01-17 17:30:00 |

Seoul Seoul | 621*** | EURUSD.s | 01-17 17:50:01 |

Seoul Seoul | 868*** | EURUSD.s | 01-17 17:45:00 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

wetradevn.com

Server Location

United States

Website Domain Name

wetradevn.com

Server IP

172.67.193.129

wetradechina.net

Server Location

United States

Website Domain Name

wetradechina.net

Server IP

104.21.92.123

forexwetrade.com

Website Domain Name

forexwetrade.com

Server IP

104.21.80.199

Company Summary

Company Summary

Company profile

Note: WeTrades official site - https://www.wetradefx.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Information |

| Registered Country/Region | United Kingdom |

| Found | 2015 |

| Regulation | unregulated |

| Market Instrument | forex, indices, energies, precious metals |

| Account Type | STP, VIP, ECN and Affiliate |

| Demo Account | N/A |

| Maximum Leverage | 1:1000 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MT4 |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | USDT, bank wire transfers |

WeTrade, a trading name of WeTrade International Limited, is a forex broker founded in 2015 and based in London, UK.

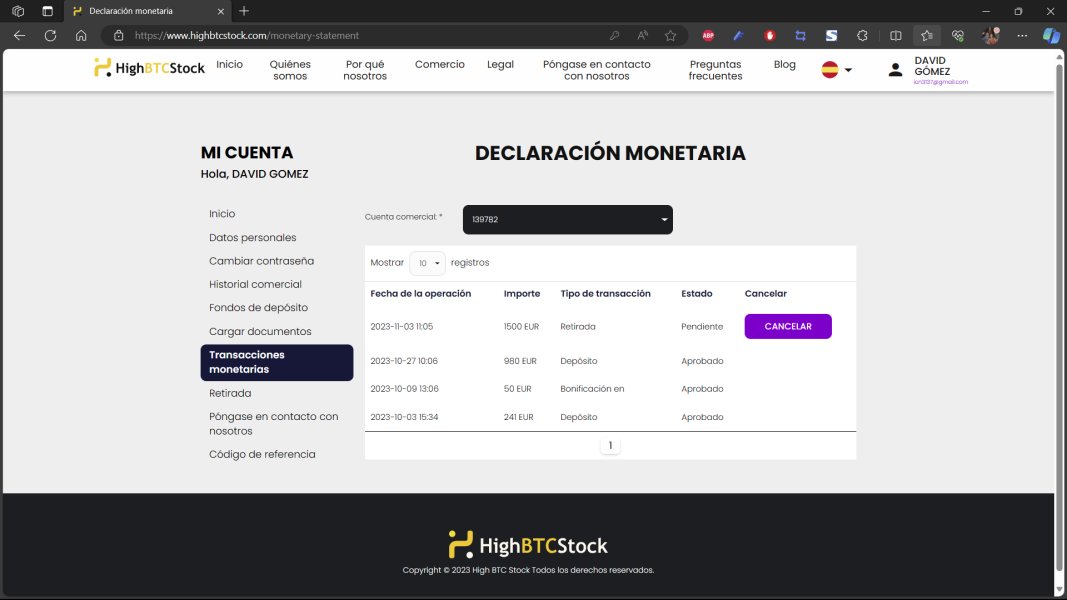

As for regulation, WeTrade holds a revoked (United Kingdom) Financial Conduct Authority license and an offshore regulated (Saint Vincent and the Grenadines) Financial Services Authority license. That is why its regulatory status on WikiFX is listed as “Offshore Regulatory” and receives a relatively low score of 4.48/10. Please be aware of the risk.

Note: The screenshot date is February 3, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

The company offers a wide range of trading products, including forex, indices, energies, precious metals, four trading categories in total, and more than 60 kinds of trading products.

Account Types

WeTrade has set up four types of accounts for investors with various investment needs and strategies, including the STP (minimum deposit of $100), VIP (minimum deposit of $1000), ECN (minimum deposit of $3000), and Affiliate accounts (minimum deposit of $100).

Leverage

When it comes to trading leverage, the maximum leverage is up to 1:1000 for Forex trading, which sounds incredibly high. Inexperienced traders are advised not to use such high trading leverage in case of fund losses.

Spreads

Spreads vary depending on the different account types chosen. The minimum spread for the STP account is 1.8 pips for EUR/USD, with no trading commission. The minimum spread for the VIP account is 1.0 pips for EURUSD, with no trading commission. The minimum spread for the ECN account is 0, charging a commission of 7 USD per lot. The minimum spread for the Affiliate account is 2.3 pips for EURUSD, requiring no trading commission.

Trading Platform

WeTrade offers its clients the advanced and popular MT4 trading platform, MAM and Multi-Account Management Tool (MAM). MT4 comes with robust charting and data analysis functions, available for PC, iOS, and Android versions. The MAM and multi-account management tools are two types of multi-account management systems that allow traders to trade for multiple accounts simultaneously.

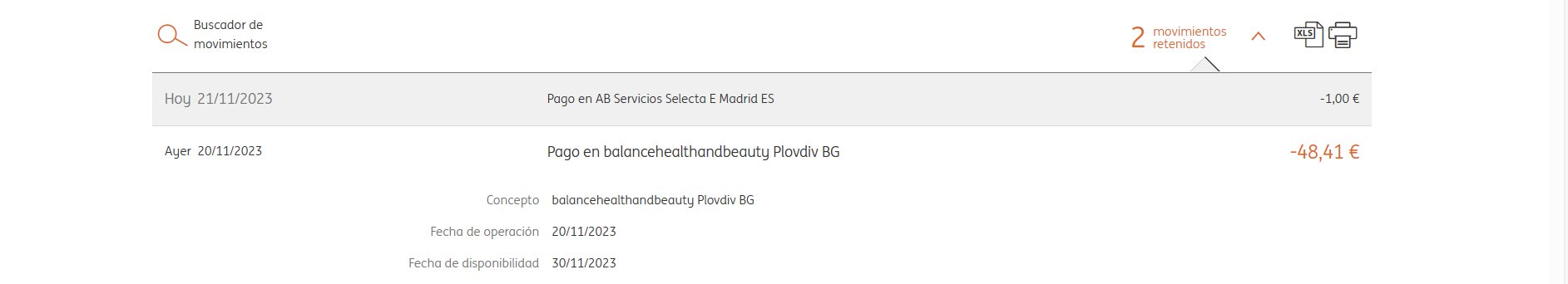

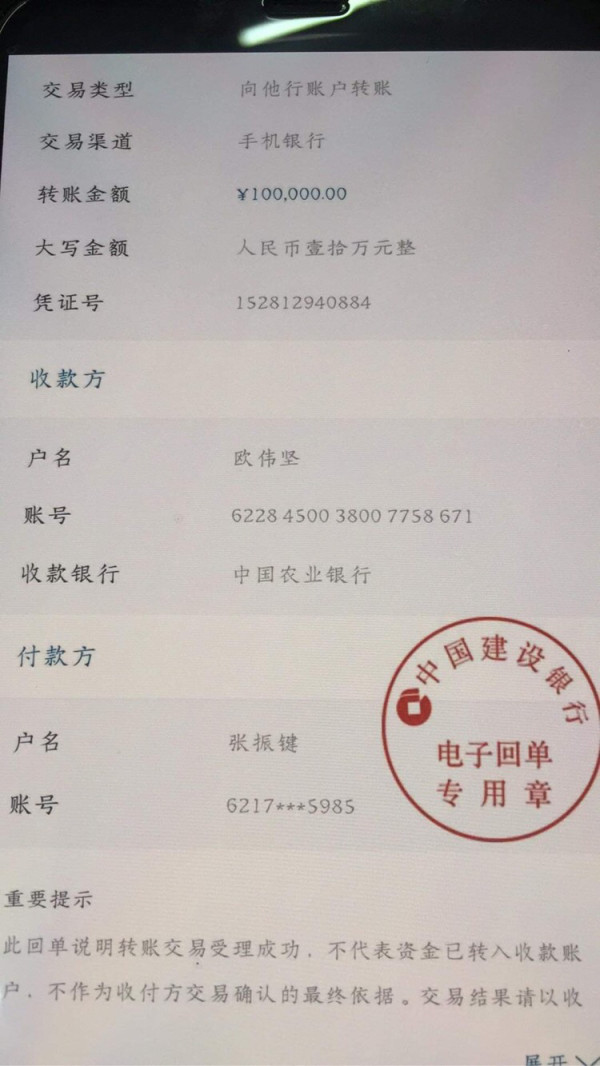

Deposit & Withdrawal

Deposit methods support USDT, wire transfer, no commission for USDT deposit, support any bank, and instant payment. For wire transfers, the bank will charge a fee, and the time of arrival is subject to the bank. Withdrawal methods are CUP and wire transfer. The bank will charge a fee for wire transfers, and the time of arrival will be determined by the bank.

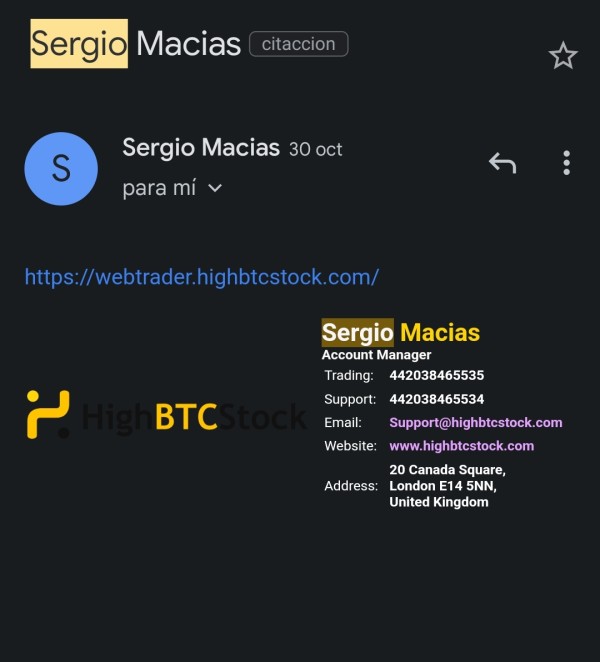

Customer Support

The WeTrade customer support team can be contacted through email: globalsupport@wetradefx.com, chinasupport@wetrade.net, support@wetradefx.com. You can also follow this broker on social networks such as WeChat: wolovewetrade, Facebook, and YouTube.

Pros & Cons

| Pros | Cons |

| • Wide range of trading assets and account types | • No regulation |

| • MT4 supported | • Website inaccessible |

| • Limited funding options |

Frequently Asked Questions (FAQs)

| Q 1: | Is WeTrade regulated? |

| A 1: | No. WeTrade holds a revoked (United Kingdom) Financial Conduct Authority license and an offshore regulated (Saint Vincent and the Grenadines) Financial Services Authority license. |

| Q 2: | Does WeTrade offer the industry-standard MT4 & MT5? |

| A 2: | Yes. WeTrade supports MT4. |

| Q 3: | What is the minimum deposit for WeTrade? |

| A 3: | The minimum initial deposit to open an account is $100. |

| Q 4: | Is WeTrade a good broker for beginners? |

| A 4: | No. WeTrade is not a good choice for beginners. Though it advertises very well, it lacks legitimate regulations. |

Keywords

- 5-10 years

- Regulated in Malaysia

- Regulated in Saint Vincent and the Grenadines

- Straight Through Processing(STP)

- Business Registration

- MT5 Full License

- White label MT4

- Self-developed

- High potential risk

- Offshore Regulated

| Registered in | United Kingdom |

| Regulated by | LFSA, FSA |

| Year(s) of establishment | 2015 |

| Trading instruments | Forex pairs, metals, energies, indices, stocks, cryptocurrencies… 120+ instruments |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:2000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, WeTrade APP |

| Deposit and withdrawal method | Bank wire transfer, USDT, local deposit, union pay |

| Customer Service | 24/7 Email, live chat, YouTube, Facebook, LINE, WeChat public account,Little Red Book, and BiliBili |

| Fraud Complaints Exposure | No for now |

General information of WeTrade

WeTrade is a UK registered forex broker that is regulated by the Financial Services Authority (FSA) and the Labuan Financial Services Authority (LFSA) in Malaysia. The FSA is one of the most reputable financial regulatory bodies in the world, and its oversight ensures that WeTrade operates according to strict standards of transparency and fairness. The LFSA is also a well-respected regulator and its oversight provides an additional layer of protection for traders. WeTrade's regulatory status is a significant advantage as it offers traders a level of protection and reassurance that their funds are safe and that the broker is operating within the law.

Regulatory Status

WeTrade is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under a Straight Through Processing (STP) model, ensuring adherence to local financial regulations. Additionally, it holds offshore regulatory status with the Financial Services Authority (FSA), which includes business registration for broader operational compliance. These regulatory frameworks ensure that WeTrade maintains high standards of transparency and security, providing a reliable trading environment for its clients.

Pros and Cons of WeTrade

Pros:

- Regulated by FSA and LFSA, ensuring client fund safety

- Wide range of instruments including forex, metals, energies, indices, stocks, and cryptocurrencies

- Multiple account types to suit different traders, including a demo account

- Competitive spreads and high leverage of up to 1:2000

- Educational resources available to traders, including an economic calendar and video tutorials

Cons:

- Limited deposit and withdrawal options, with only USDT, bank wire, and local deposit accepted for deposit and union pay and bank wire for withdrawal

- Customer support with only email and social media channels for communication

- Limited information available about the company's background and history

- ECN account requires a minimum deposit of $1000 and charges a commission of $7 per lot traded.

Pros Cons Regulated by FSA and LFSA Limited deposit/withdrawal options Wide range of instruments Customer support limited to email and social media Multiple account types, including demo Limited company background information Competitive spreads; high leverage up to 1:2000 ECN account: $1000 minimum deposit, $7/lot commission Educational resources available

Market Instruments

WeTrade offers its traders a wide range of 120+ instruments to choose from, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. This provides traders with a great opportunity to diversify their trading portfolio and access a variety of markets and assets. Additionally, the selection of cryptocurrencies offered by WeTrade is somewhat limited compared to some other brokers in the market.

Spreads and Commissions

WeTrade offers a variety of account types, including ECN, Standard, and STP, each with different spreads and fees. The ECN account offers zero spreads but charges a $7 commission per lot traded, making it suitable for high-volume traders. The Standard account provides lower EUR/USD spreads starting from 1.0 pips with no commission, making it ideal for advanced traders. The STP account offers EUR/USD spreads starting from 1.8 pips with no commission, making it a good choice for beginner traders. Overall, WeTrades spreads and commission rates are competitive and cater to different trading needs.

Trading Accounts

WeTrade offers three account types to meet the needs of traders. The ECN account requires a higher minimum deposit of $1,000 but offers spreads as low as 0.0 pips, with a $7 commission per lot traded. Both the Standard and STP accounts have a minimum deposit of $100 and offer commission-free trading. Additionally, traders can use demo accounts to practice their strategies without risking real capital. A high leverage of 1:2000 is available across all account types, although some traders may prefer lower leverage.

Trading Platform(s)

WeTrade offers clients the MetaTrader 4 (MT4) platform, a widely used and user-friendly trading platform in the forex industry, also available in a mobile version. MT4 is known for its extensive technical analysis tools, indicators, and support for algorithmic trading via Expert Advisors (EAs).

However, MT4 has some limitations, such as limited customization options, lack of an integrated economic calendar, and no mobile push notifications. Additionally, its backtesting timeframes are restricted, which may hinder traders who need thorough strategy testing.

In addition to MT4, WeTrade also offers its mobile app as an alternative trading platform.

Maximum Leverage

WeTrade offers a maximum leverage of up to 1:2000, which is relatively high compared to other forex brokers. This allows traders to potentially increase their profits with a smaller capital investment and have greater market exposure. However, high leverage also increases the risk of significant losses and margin calls, especially for inexperienced traders who may misuse it or engage in overtrading or emotional trading. Experienced traders with solid risk management strategies may find high leverage useful, but regulated brokers have limits on maximum leverage, which may restrict traders from taking advantage of higher leverage ratios.

Deposit and Withdrawal

WeTrade offers its clients multiple deposit options, including USDT, bank wire, and local deposits. Clients can withdraw funds via union pay and bank wire. WeTrade does not charge any extra fees for deposits or withdrawals. Additionally, there is no minimum account required, making it accessible for traders with different budgets. However, there is limited information provided about the deposit/withdrawal processing time. While WeTrade provides a safe and secure transaction environment, it offers limited withdrawal options compared to other brokers.

Educational Resources

WeTrade offers various educational resources to its clients to enhance their trading skills and knowledge of the financial markets. The resources include an economic calendar, market reports, video tutorials, analyst views, indicators, and TV channels. The economic calendar keeps clients informed about important upcoming events that could affect the markets, while the market reports and analyst views provide up-to-date information on market trends. The video tutorials cover a range of topics from the basics of trading to advanced strategies, and clients can access a variety of indicators and TV channels for technical analysis. The educational resources are available in multiple languages to cater to clients from different parts of the world.

Customer Service of WeTrade

WeTrade offers a comprehensive customer care service that is available 24/7 through various communication channels such as email, YouTube, Facebook, and LINE. This provides customers with multiple options to reach out to the support team and get their queries resolved in a timely manner. Additionally, the support team has a reputation for providing quick response times, which ensures that customers' issues are resolved efficiently. However, WeTrade does not offer phone support, which may be inconvenient for some customers who prefer to speak with a representative directly. Moreover, the response time may vary based on the communication channel used, and the nature of the query may also impact the response time.

Conclusion

In conclusion, WeTrade is a UK-based forex broker that is regulated by FSA and LFSA. The broker offers various account types, including ECN, Standard, and STP, with competitive spreads and high leverage up to 1:2000. The broker supports various trading instruments, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. Overall, WeTrade has some advantages such as competitive trading conditions, a wide range of tradable instruments, and excellent customer support, which make it an attractive option for traders.

However, there are also some drawbacks such as lack of a proprietary trading platform, and no negative balance protection. Therefore, traders should carefully consider their options and weigh the advantages and disadvantages before choosing WeTrade as their preferred forex broker.

Frequently asked questions about WeTrade

- What is the minimum deposit required to open an account with WeTrade?

- The minimum deposit required to open a WeTrade account varies depending on the account type. The minimum deposit for an ECN account is $1,000, while the minimum for a Standard and STP account is $100.

- What trading platforms does WeTrade offer?

- WeTrade offers the popular MetaTrader 4 (MT4) platform for desktop, web, and mobile devices. MT4 is well-known for its advanced charting features, customization options, and automated trading capabilities. In addition to the regular MT4 platform, the WeTrade APP is also one of the trading platforms that WeTrade clients can choose from.

- What are the maximum leverage levels offered by WeTrade?

- WeTrade offers a maximum leverage of up to 1:2000 for all account types, which means that traders can open positions that are up to 2000 times the size of their account balance.

- What instruments can I trade with WeTrade?

- WeTrade offers a variety of financial instruments for trading, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. In total, there are over 120 instruments available for trading.

- How can I contact WeTrade customer support?

- WeTrade offers 24/7 customer support via email, YouTube, Facebook, Line, WeChat public account, Little Red Book, BiliBili, and more. Traders can reach out to the support team at any time for assistance with their account or trading-related questions.

Disclosure

INVESTOR ALERT: WeTrade

Country/Region

MU FSC

Disclosure time

2023-01-12

Disclose broker

Ministry of Trade Blocks 1,222 Illegal Commodity Futures Trading Websites

Country/Region

ID BAPPEBTI

Disclosure time

2022-02-02

Disclose broker

INVESTOR ALERT LIST

Country/Region

MY SCM

Disclosure time

2022-01-01

Disclose broker

Review 29

Content you want to comment

Please enter...

Review 29

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Sky9548

Vietnam

More than 200 US dollars was deducted as a handling fee for withdrawing money. It's so disgusting. Deduct for deposits and withdrawals.

Exposure

2024-03-25

Sky9548

Vietnam

There is a handling fee of US$50 for deposits, USDT to USD is 1:1, and a 1% deduction for withdrawals, and then the exchange rate is 4%. $430 was deducted. The withdrawal is $9149. I contacted customer service and they said they couldn't see it.

Exposure

2024-03-21

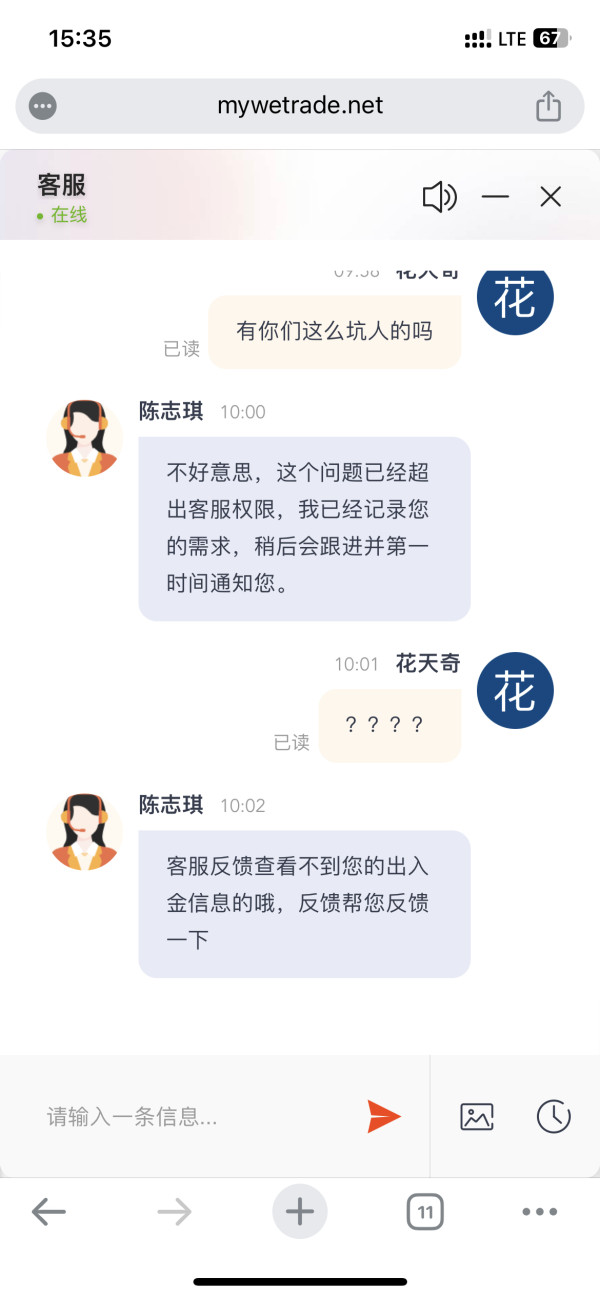

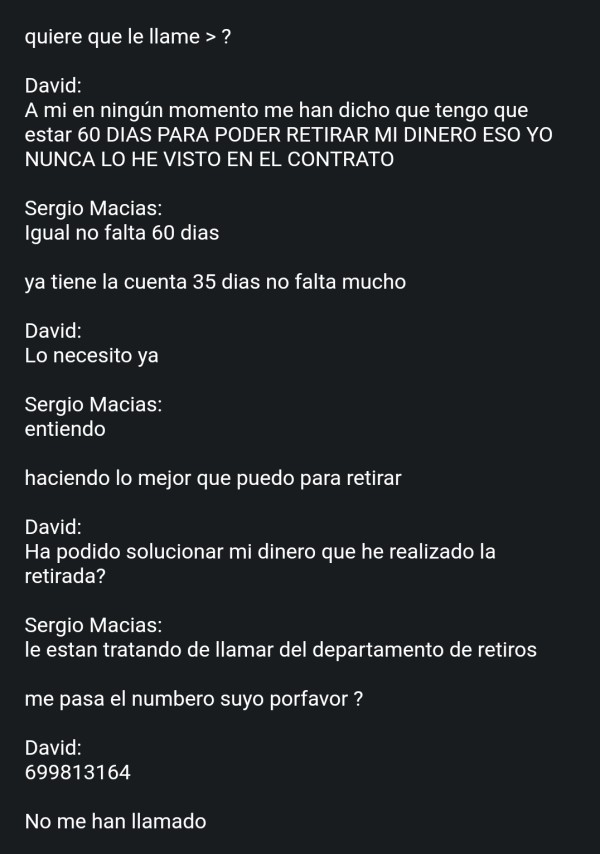

icn31

Spain

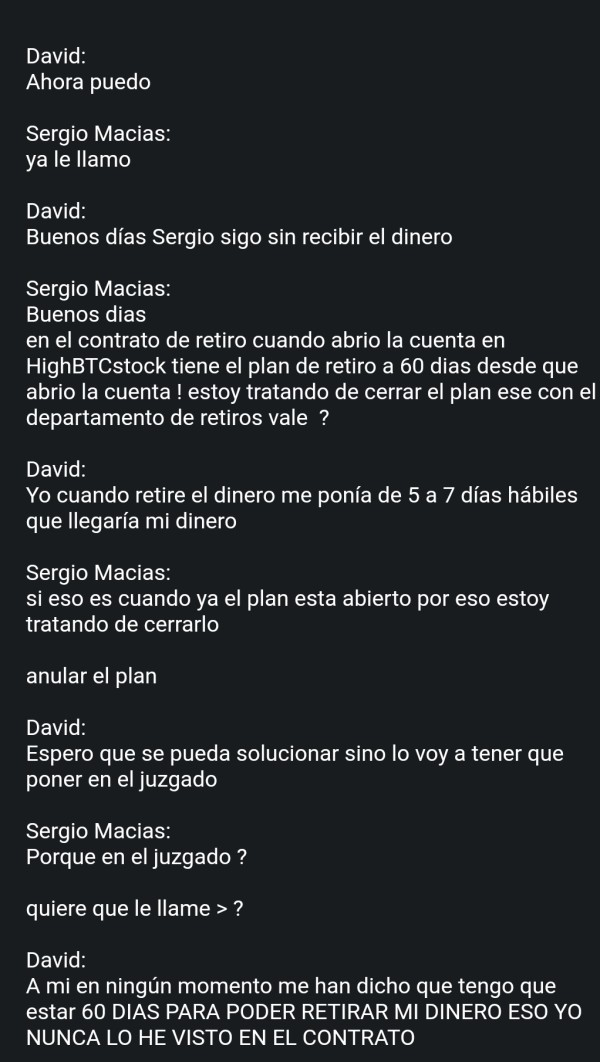

I CANNOT WITHDRAW MY MONEY I FOUND IN A VIDEO PUBLISHED IN MICROSOFT NEWS A FAMOUS MAN EARNING A LOT OF MONEY AND I DECIDE TO REGISTER AT THE BEGINNING I INCOME ABOUT 250 EUROS AND LATER ABOUT 1000 MORE ALWAYS HARASSING ME IN CALLS SO THAT I ENTER MORE MONEY I DECIDE TO WITHDRAW AND IT IS IMPOSSIBLE TELLS ME IF I WANT TO WITHDRAW I HAVE TO MAKE A TRANSFER TO THEM IN THE CONCEPT OF INTEREST AND COMMISSIONS OF ABOUT 3,500 EUROS. DOING A LITTLE RESEARCH THERE ARE MORE PEOPLE THE SAME AND IT IS A SCAM AND I DON'T DO IT AND ON SOME OCCASIONS THEY MAKE WITHDRAWAL OF MY BANK CARDS. I DECIDE TO REPORT THE CASE. AND MY BANK CANNOT GIVE ME A REFUND OF MY TRANSFERS BECAUSE ACCORDING TO THEM I DID IT ON MY OWN ACCOUNT AND NOBODY FORCED ME TO DO IT

Exposure

2023-11-26

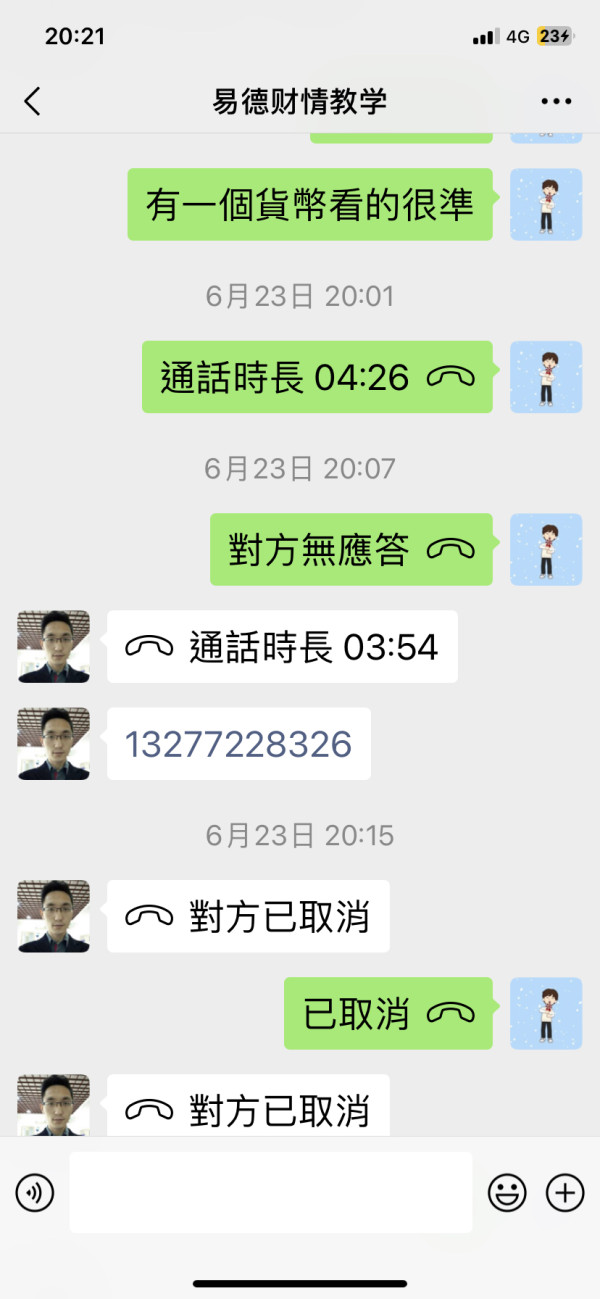

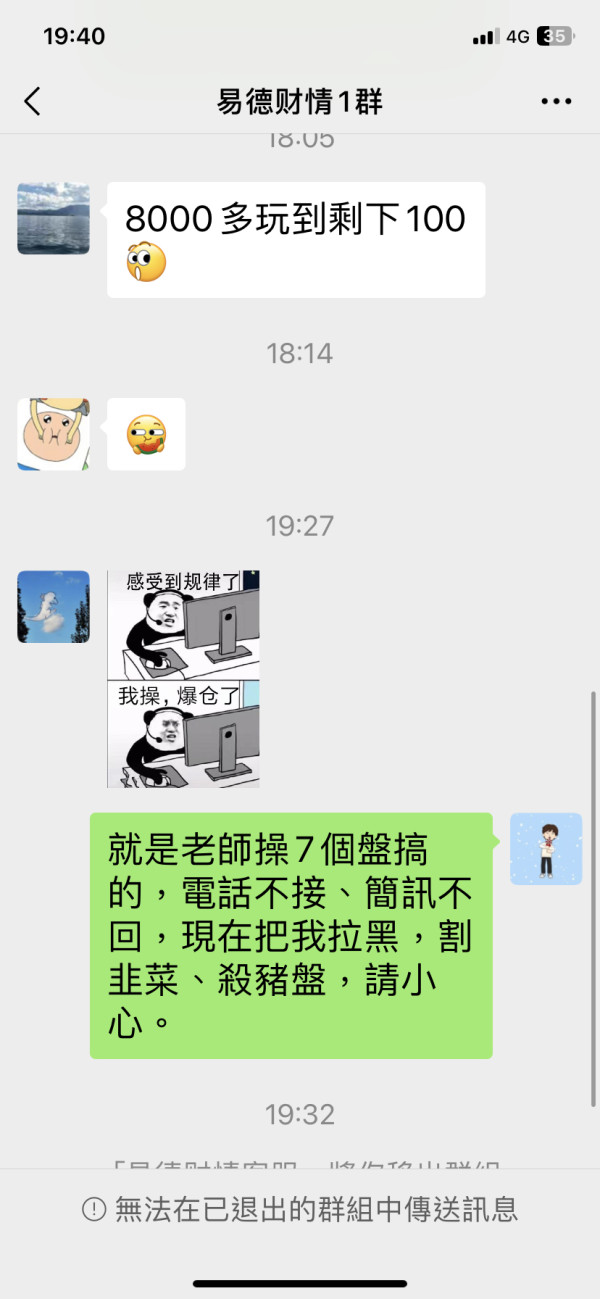

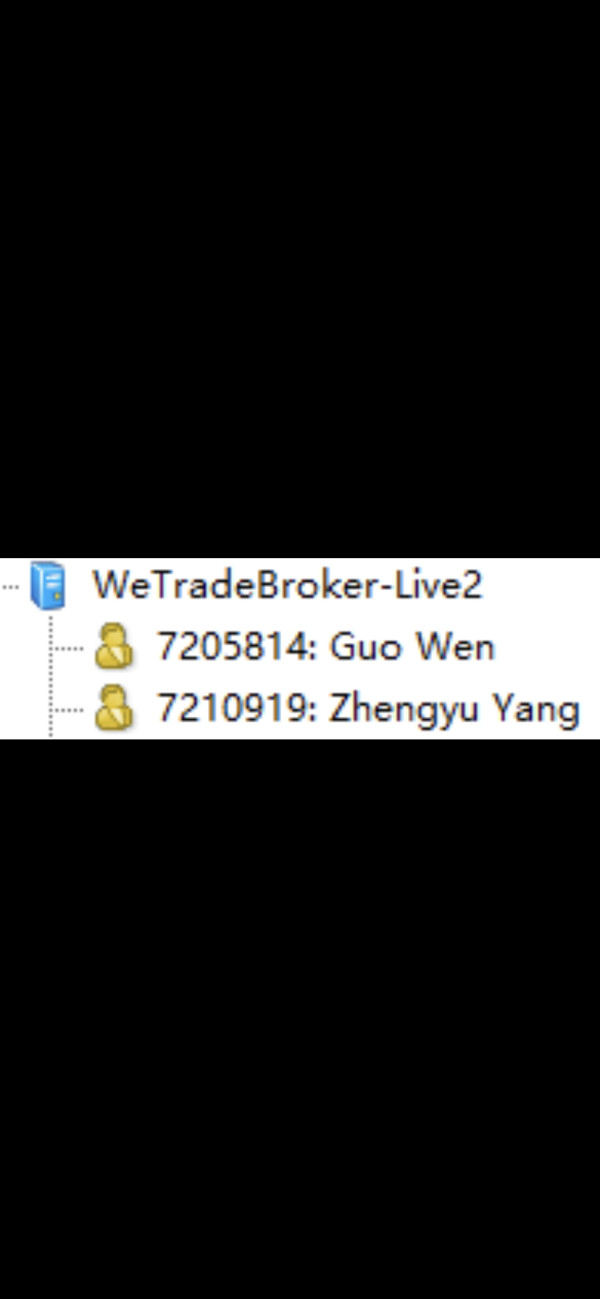

黑皮二哥

Taiwan

I met a man on the Internet who encouraged me to change platform. I deposited 5,000 US dollars, and after operation reached 8,000 yuan, I lost 6,000 yuan. When I reached 6,000 yuan, I lost 700 yuan a day. When I got back, I lost more than 700 yuan. Before saying that the agent helped me pay 4280 yuan. After that, I couldn’t contact anyone and they didn’t reply. Finally, I left a message in chat group, and he replied. Told me where the money came from and block me. My account number in Zhonghui is 7210919.

Exposure

2023-11-10

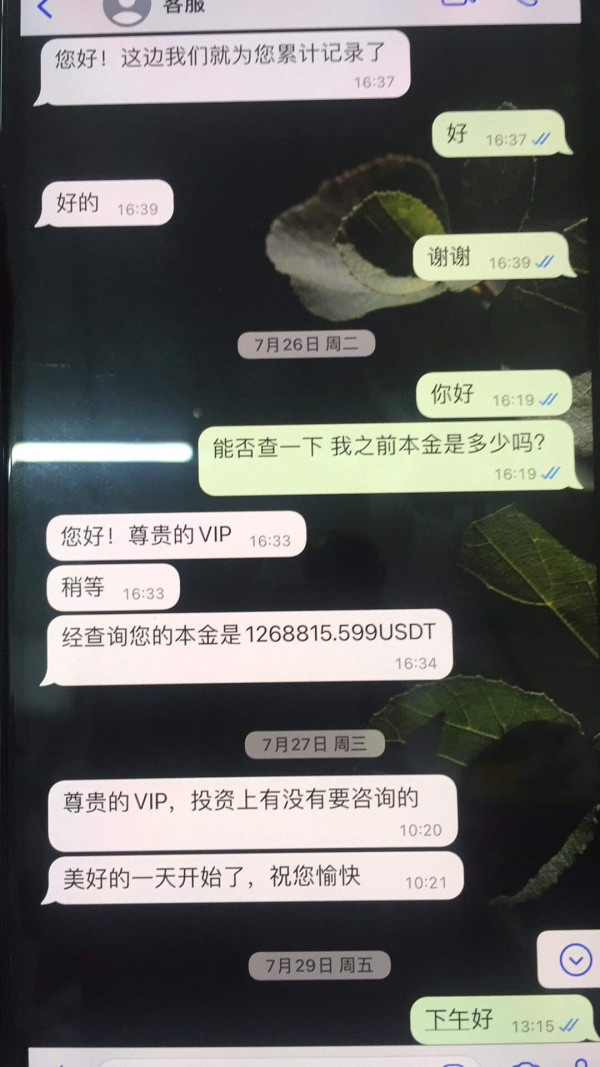

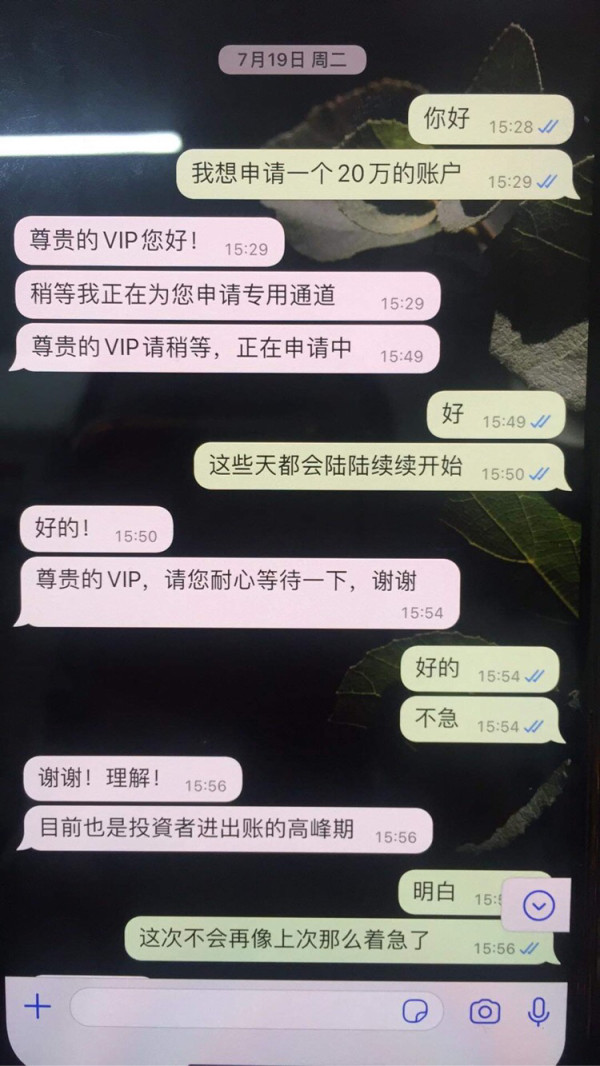

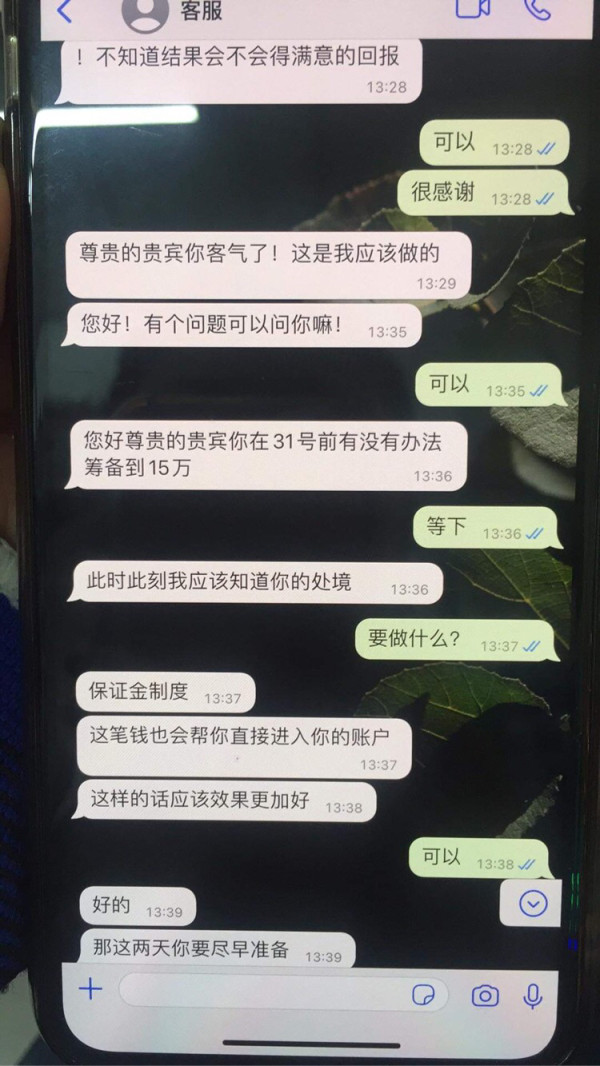

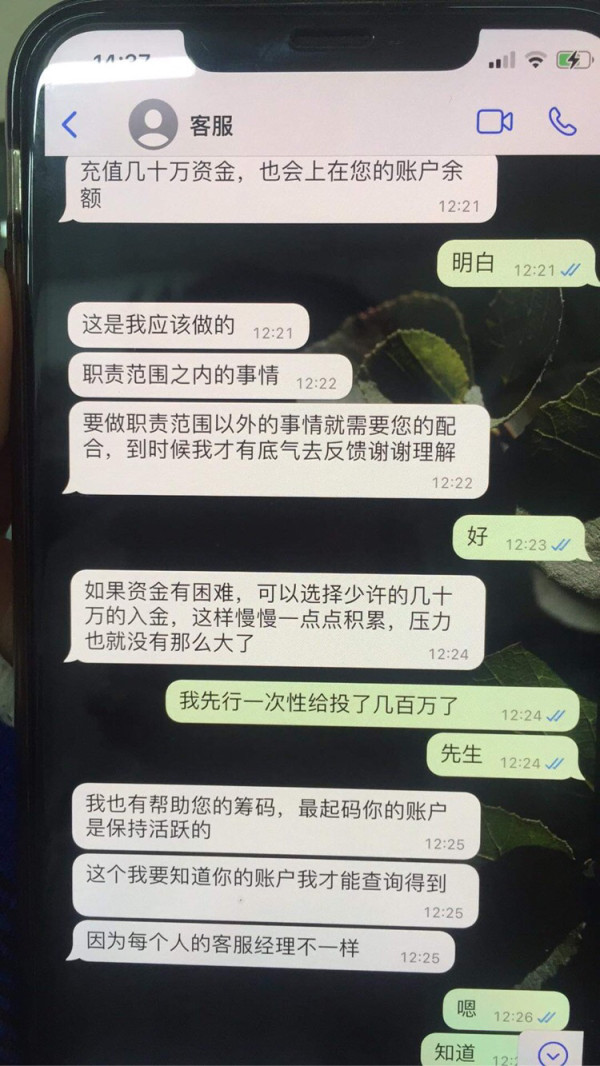

Ye YUN

Greece

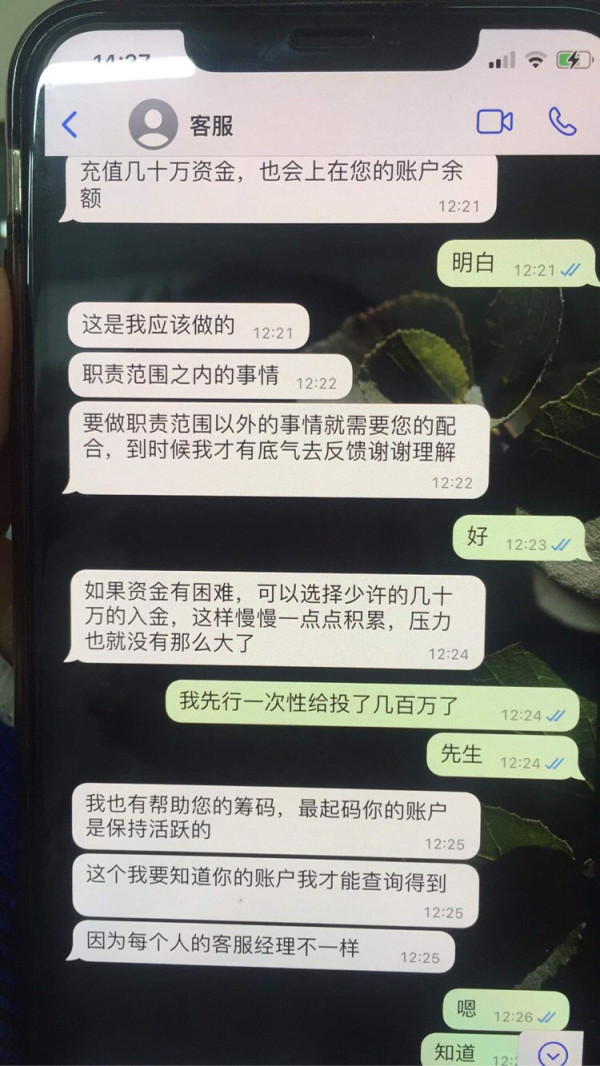

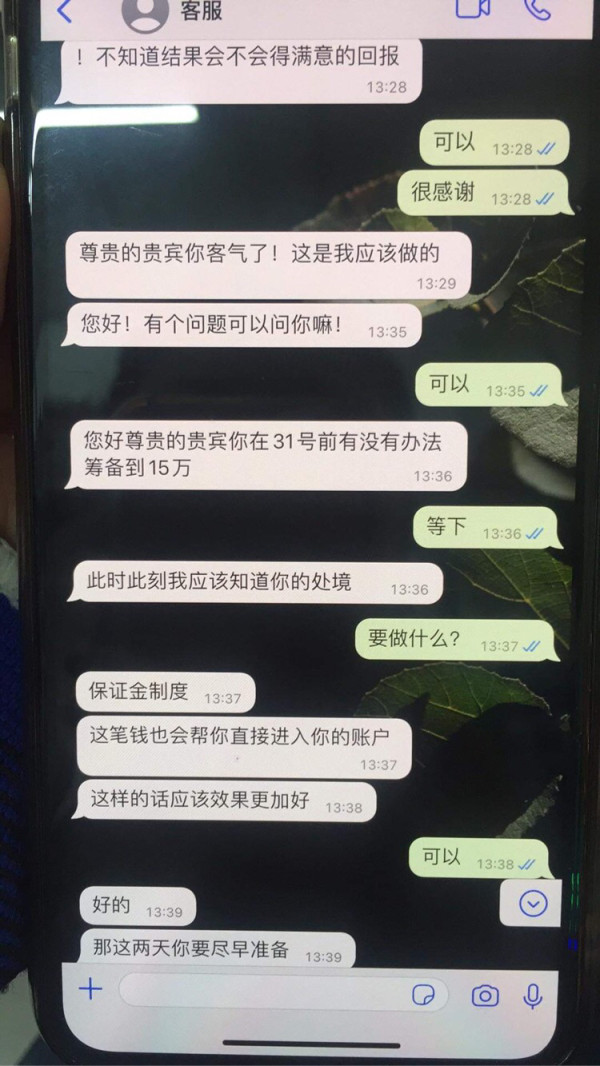

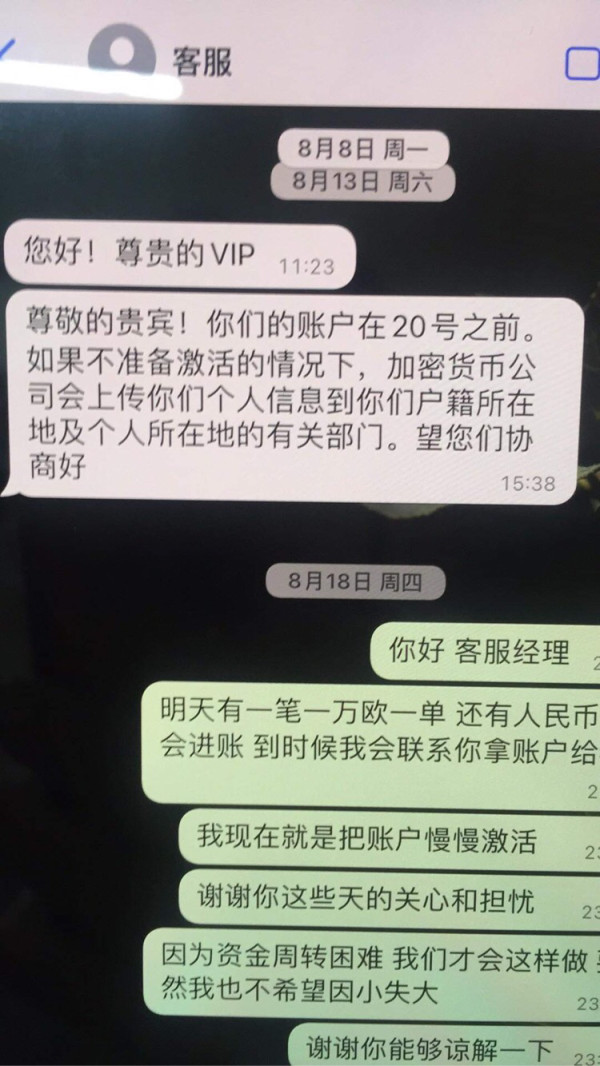

If the account is frozen, do I need to deposit funds to unfreeze it? After all the money has been deposited, they all ran away and can’t be contacted. These are the chat records of the platform.

Exposure

2022-12-28

Syed Mohammad Rizwan

India

I have deposited 250 dollars on 8-september 2022 but not credited yet to my trading account. Zero support from customer care.. seems it's a fraud broker.

Exposure

2022-09-11

Vanessa789

Taiwan

When you open an account from the fraudulent platform Poipex, the account opening platform of WeTrade pops out. When you look at the license application of the two companies, you will understand.

Exposure

2022-08-07

FX4137271032

Japan

When you make a deposit, the platform will tell you that you need to upgrade to a Gold VIP, and you can withdraw normally. When you have paid, you can withdraw it again. The platform will tell you that you need to activate and then say that you need to pay taxes where you are. If you don’t pay, you can’t withdraw the money and you will keep saying a word to you. Please pay within a fixed time, otherwise the account will become unmanaged. At that time, you need to pay a deposit to reflect it! When I finished paying everything, I estimated that there were 50,000 Canadian dollars, and I thought I could finally withdraw cash. The platform gave me another reason to say that my account has been identified by Asia Pacific Anti-Money Laundering and I am a suspect of money laundering. I have to pay a 30% deposit of the principal to confirm that I have no relationship with the money. No matter what you do, this money has never been paid out. This money comes and goes. I invested about 200,000 Canadian dollars!

Exposure

2021-03-21

禅81704

Malaysia

It’s normal on other platforms.

Exposure

2021-01-07

jewhdi

New Zealand

High Fees and Commission rates. You are technically forced to make 3 trades per quarter to avoid any fees - which is ok for me, maybe not for some. £8 per trade is high, although maybe lower than other sites.

Neutral

2024-05-17

董98129

India

I used to have my best trading experience with WeTrade for 5 years, but I cannot open its official website now. I tried to contact my previous account manager, but I failed…

Neutral

2023-02-24

Dellry

Peru

WeTrade is fantastic! Their spreads are tight and competitive, and their customer support is second to none. They're always quick to respond and help you out with any issues you may have. If you're looking for a reliable and supportive broker, WeTrade is definitely worth considering.

Positive

2024-07-22

不负

Vietnam

Zhonghui's fees are quite transparent, there are no hidden fees, and there are a lot of educational resources and related support, which is very friendly to novices. The trading environment is not bad, and the account manager is quite professional.

Positive

2022-12-14