简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews AUS GLOBAL in Depth

Abstract:In this article, we'll look in-depth at AUS GLOBAL, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at AUS GLOBAL, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

AUS GLOBAL is an online brokerage firm that is regulated by both the CySEC and ASIC. The company has offices in many countries worldwide, including Cyprus, London, Dubai, Turkey, Seychelles, Mauritius, Thailand, Malaysia, Vanuatu, Melbourne, Vancouver, Wellington, India, South Africa, Nigeria, Taiwan, and Vietnam.

AUS GLOBAL prides itself as a provider of safe, reliable, and convenient financial services. The company offers a wide range of trading products, including 10000+ Derivatives products, US & EU Stocks, futures, forex, precious metals, commodities, stock indices and cryptocurrencies.

In addition, AUS GLOBAL is a corporate social responsibility (CSR)-oriented company. In December 2022, the company reached a cooperation agreement with UNICEF. For every standard lot global investors trade, AUS GLOBAL will donate 0.02 US dollars to work with UNICEF for safety, health, and education.

The broker achieved recognition on an internal scale, having secured several awards, including “Best STP Forex Broker”, “Best Trading Environment Award” in 2023, “Best Customer Service Broker”, “Best Forex Trading Team” in 2022, and many more.

AUS GLOBAL offers 4 different types of accounts with up to 500x leverage, while spreads start from as low as 0.0 pip.

The availability of deposit and withdrawal methods depends on the trader's country of residence, such as Visa, MasterCard, Amex, UnionPay, and Wire Transfer.

AUS GLOBAL offers three trading platforms: MetaTrader 4, MetaTrader 5, and CTrader.

All three platforms are fully functional and customizable, offering a wide range of features for traders of all levels.

MetaTrader 4 is the most popular platform, known for its ease of use and wide range of charting tools.

MetaTrader 5 is a newer platform that offers more advanced features, such as algorithmic trading and copy trading.

CTrader is a unique platform that is designed for high-frequency trading.

These platforms also support expert advisors (EAs) for automated trading. Meanwhile, WikiFX also verified the stability of AUS GLOBALs trading environment.

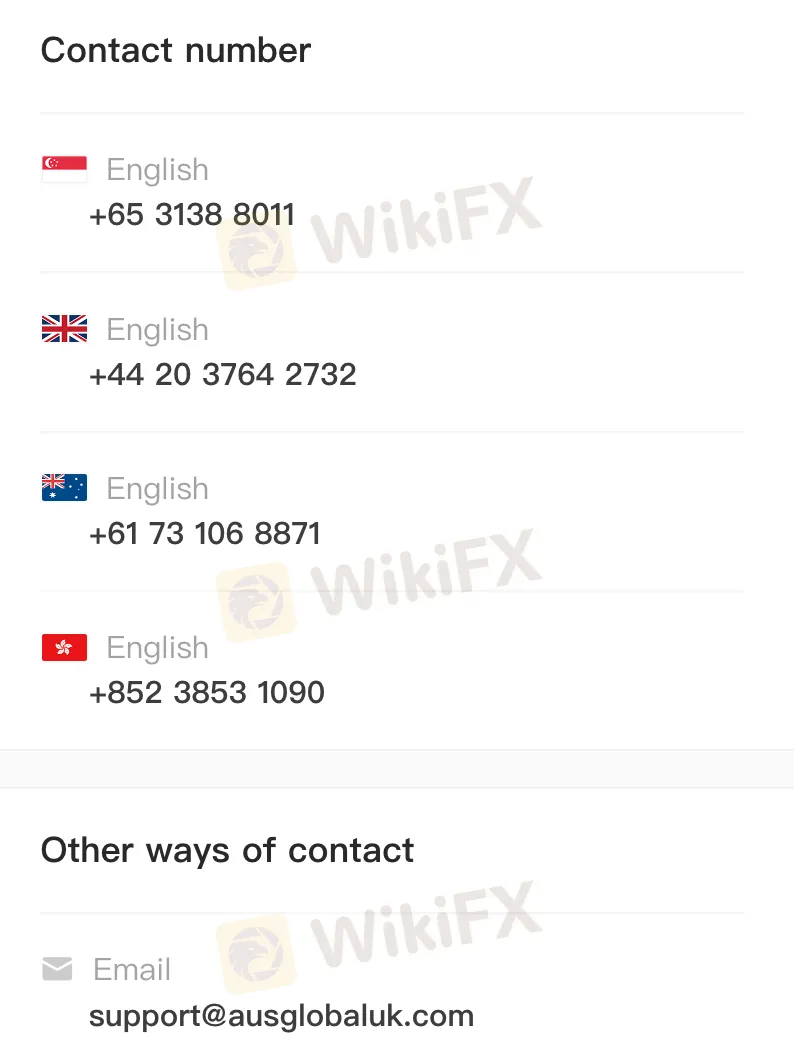

AUS GLOBAL has a dedicated support team of over 300 trained professionals available 24/7 to assist and guide trading clients in various languages. Alternatively, clients can also reach AUS GLOBAL through the following mediums below:

To summarize, here's WikiFXs verdict:

WikiFX, a global forex broker regulatory platform, has given AUS GLOBAL a WikiScore of 7.52 out of 10, indicating that it is a reasonably reliable broker in the forex trading industry.

WikiFX has also verified the legitimacy of the licenses that are held by AUS GLOBAL.

Therefore, it can be concluded that AUS GLOBAL is a trustworthy broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SFC Freezes $91M in Client Accounts Amid Fraud Probe

SFC freezes $91M in client accounts at IBHK, SBI, Monmonkey, and Soochow over suspected hacking and market manipulation during unauthorized online trades.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Currency Calculator