Score

AGlobalTrade

Saint Lucia|1-2 years|

Saint Lucia|1-2 years| https://aglobaltrade.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+1 8007570137

Other ways of contact

Broker Information

More

AGlobalTrade

AGlobalTrade

Saint Lucia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 1,000,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 500,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 250,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 100,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 50,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 20,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 5,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed AGlobalTrade also viewed..

XM

IC Markets Global

MiTRADE

FXCM

AGlobalTrade · Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Lucia |

| Founded Year | Not specified |

| Company Name | AGlobalTrade |

| Regulation | Operates outside regulatory framework |

| Minimum Deposit | Varies by account type |

| Maximum Leverage | Up to 1:400 |

| Spreads | Not specified on the website |

| Trading Platforms | State-of-the-art trading platform |

| Tradable Assets | Currency pairs, commodities, indices, individual stocks, digital currencies |

| Account Types | Beginner, Basic, Trader, Premium, Premium Pro, Investor, Expert, VIP |

| Customer Support | Email, Phone, Live Chat |

| Payment Methods | Crypto,bank transfer,credit card |

| Educational Tools | Articles and videos on trading |

Overview

AGlobalTrade is an online trading company based in Saint Lucia, offering a wide range of market instruments such as currency pairs, commodities, indices, individual stocks, and digital currencies. Traders can choose from multiple account types tailored to their experience and financial resources, with a maximum leverage of up to 1:400. The company provides a state-of-the-art trading platform equipped with advanced tools and offers customer support through email, phone, and live chat. Payment methods include cryptocurrency, bank transfers, and credit cards, while educational resources such as articles and videos are available to assist traders in their trading journey.

Regulation

AGlobalTrade operates outside the regulatory framework of a broker. This means they are not subject to the stringent rules and oversight that typically govern brokerage firms. While this may offer them more operational flexibility, it also implies that they do not have to adhere to certain standards of transparency, investor protection, and financial reporting that regulated brokers must follow. Therefore, clients and investors dealing with AGlobalTrade should be aware that they might not be afforded the same level of protections and safeguards that are standard in the regulated brokerage environment.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

AGlobalTrade offers a range of advantages, including access to various market instruments such as currencies, commodities, indices, stocks, and digital currencies. It provides multiple account types to accommodate traders of different experience levels and capital sizes. The platform offers high leverage for potential profits and a comprehensive trading platform with educational resources to support trader learning. Responsive customer support is available through email, phone, and live chat. However, AGlobalTrade operates outside the regulatory framework, potentially impacting transparency and investor protection. Specific details on spreads, commissions, and deposit/withdrawal methods are limited on their website, which may raise concerns for potential traders.

Market Instruments

AGlobalTrade appears to be a platform or brokerage that offers a range of market instruments for trading. Here's a breakdown of the market instruments mentioned in the provided information:

Currency Pairs

Commodities

Indices:

Individual Stocks:

Digital Currencies:

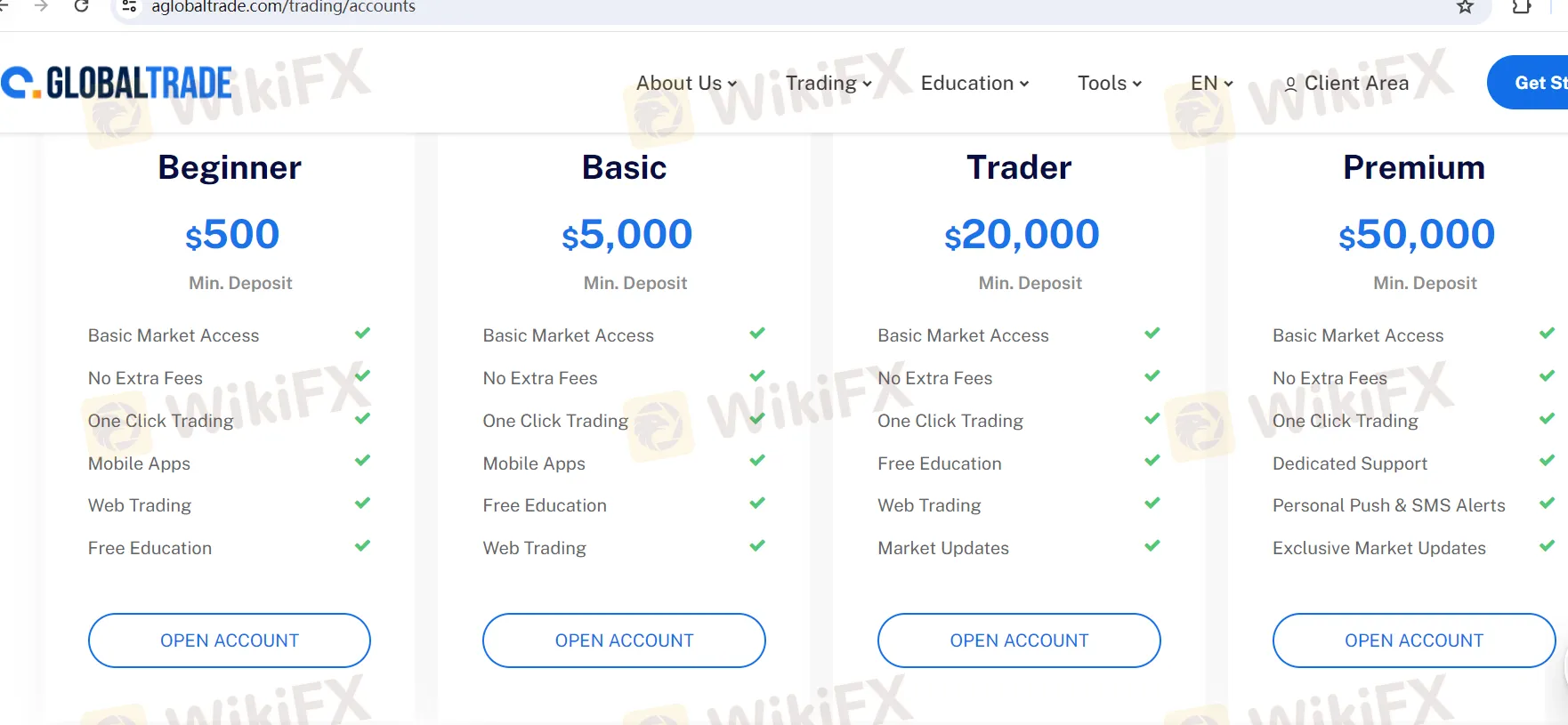

Account Types

AGlobalTrade offers a range of account types to cater to traders and investors with varying experience levels and capital sizes. Here's a description of each account type:

Beginner:

Minimum Deposit: $500

Features: Basic Market Access, No Extra Fees, One-Click Trading, Mobile Apps, Web Trading, Free Education

The Beginner account is designed for those who are new to trading and want to start with a smaller investment. It offers essential trading features and educational resources to help beginners get started.

Basic:

Minimum Deposit: $5,000

Features: Basic Market Access, No Extra Fees, One-Click Trading, Mobile Apps, Free Education, Web Trading

Description: The Basic account is suitable for traders with a bit more capital who still want access to essential trading tools and educational materials.

Trader:

Minimum Deposit: $20,000

Features: Basic Market Access, No Extra Fees, One-Click Trading, Free Education, Web Trading, Market Updates

The Trader account is designed for more experienced traders with a larger capital base. It offers market updates in addition to the basic features.

Premium:

Minimum Deposit: $50,000

Features: Basic Market Access, No Extra Fees, One-Click Trading, Dedicated Support, Personal Push & SMS Alerts, Exclusive Market Updates

The Premium account caters to traders who require personalized support and exclusive market updates. It offers enhanced services and features for a higher minimum deposit.

Premium Pro:

Minimum Deposit: $100,000

Features: Full Market Access, No Extra Fees, One-Click Trading, Daily Analysis, Private Account Manager, Free Installment

Description: The Premium Pro account provides full market access and daily analysis. It includes a private account manager to assist with trading decisions and a free installment option.

Investor:

Minimum Deposit: $250,000

Features: One-Click Trading, Dedicated Support, Personal Push & SMS Alerts, Exclusive Market Updates, Full Market Access, No Extra Fees

The Investor account is suitable for more serious traders and investors. It offers an array of features, including personalized support, alerts, and full market access.

Expert:

Minimum Deposit: $500,000

Features: Talk to specialists for personalized details.

The Expert account is for high-net-worth individuals and professional traders. It provides personalized service and likely includes advanced features, although specific details require consultation.

VIP:

Minimum Deposit: $1,000,000

Features: Access to new features, best prices, priority support, and exclusive events from a VIP account manager.

The VIP account is the highest tier and offers exclusive benefits, including priority support and access to special events. Traders interested in this account type can consult with specialists for more details.

These account types are designed to accommodate a range of traders and investors, from beginners to experts, with varying levels of capital and trading needs. Traders can choose the account that best aligns with their experience and financial resources.

Leverage

AGlobalTrade offers a maximum trading leverage of up to 1:400. This means that traders using AGlobalTrade's services can control a position in the financial markets that is up to 400 times the size of their initial capital.

Here's a practical example to illustrate how leverage works:

If a trader has $1,000 in their trading account and uses the maximum leverage of 1:400, they can open a position equivalent to $400,000 in the market.

While leverage magnifies potential profits, it also amplifies potential losses. If the market moves against the trader's position, they could lose more than their initial $1,000 investment.

It's important to emphasize that while high leverage can increase the potential for both gains and losses, it also carries higher risk. Traders should exercise caution, have a well-defined risk management strategy in place, and only use leverage that they are comfortable with and can afford to lose. It's crucial to fully understand the implications of leverage before engaging in leveraged trading.

Spreads and Commissions

The absence of specific information regarding spreads and commissions on AGlobalTrade's website can be a cause for concern for potential traders and investors. These details are essential for individuals looking to make informed decisions about their trading activities. It is generally recommended that reputable brokers provide transparency in these areas to build trust with their clients. Traders should exercise caution when dealing with brokers who do not provide clear and detailed information about these aspects of their services, as it may raise questions about the broker's credibility and transparency.

Deposit & Withdrawal

AGlobalTrade provides convenient options for both depositing funds into your trading account and withdrawing funds when needed. Here's a description of their deposit and withdrawal processes:

Depositing Funds:

To fund your AGlobalTrade account, you have several straightforward options:

A. Through Your Account:

Log in to your account on the AGlobalTrade platform.

Click on the “Deposit Funds” option.

Enter the desired deposit amount and select the preferred currency.

Choose your preferred deposit method to complete the transaction.

B. Financial Analyst Assistance:

You can contact your financial analyst and request assistance with the deposit process.

A representative from the company's financial department will then contact you to guide you through the deposit procedure.

C. Email Request:

Write a deposit request from your registered email address to the company's email.

A representative from the financial department will reach out to assist you with the deposit process.

D. Online Chat Request:

You can submit a deposit request by contacting the company via the online chat feature on their website.

It's worth noting that AGlobalTrade offers the advantage of avoiding conversion fees on deposits, making it more cost-effective for traders.

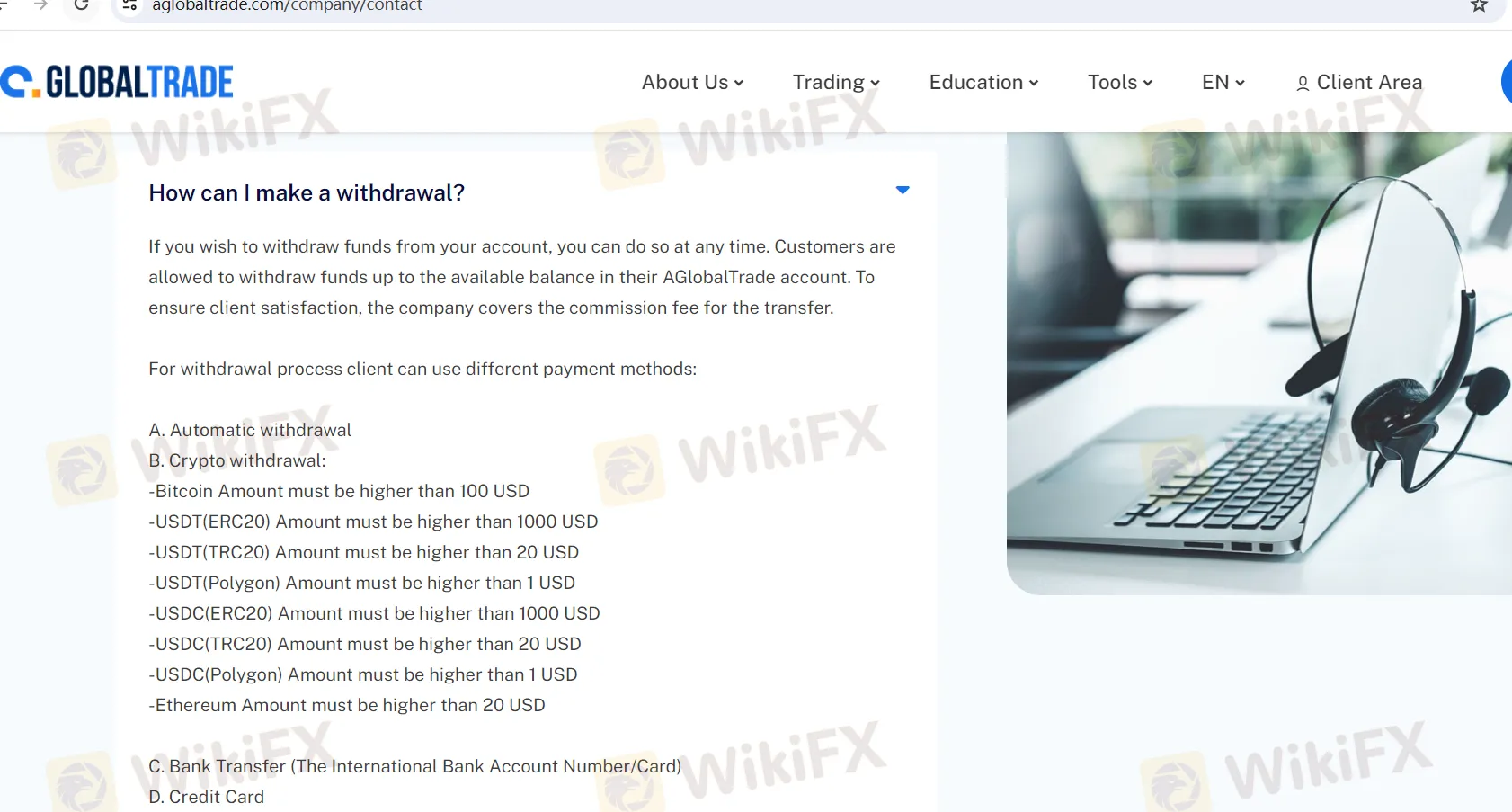

Withdrawing Funds:

AGlobalTrade allows clients to withdraw funds from their accounts with ease. Here are the available withdrawal options:

A. Automatic Withdrawal:

Clients can set up automatic withdrawals from their accounts.

B. Crypto Withdrawal:

Clients can choose to withdraw funds in cryptocurrencies, including Bitcoin, USDT (ERC20, TRC20, Polygon), USDC (ERC20, TRC20, Polygon), and Ethereum, subject to minimum withdrawal amounts for each.

C. Bank Transfer (International Bank Account/Card):

Bank transfer is available as a withdrawal option for clients.

D. Credit Card:

Clients can also withdraw funds using a credit card.

AGlobalTrade covers the commission fees for the transfer, ensuring client satisfaction. However, it's important to note that if the company is unable to return funds using the original deposit method or specified data, they may request an alternative payment method. Additional information and verification may be required if the trading account is not already verified.

In summary, AGlobalTrade provides multiple deposit and withdrawal options, including cryptocurrency withdrawals, bank transfers, and credit card withdrawals, giving clients flexibility in managing their funds. The company's commitment to covering commission fees and assisting clients with the process adds to the convenience of these transactions.

Trading Platforms

AGlobalTrade offers a state-of-the-art trading platform that is designed to meet the evolving needs of traders and investors. AGlobalTrade's trading platforms cater to a diverse range of traders, whether they prefer trading on desktop computers, web browsers, or mobile devices. The inclusion of specialized apps for Mac and Linux users ensures that traders on different operating systems can access the platform with ease. The combination of full market access, advanced tools, and user-friendly features aims to provide traders with a comprehensive and efficient trading experience.

Customer Support

AGlobalTrade offers a responsive and accessible customer support system, allowing clients to reach out for assistance via email, phone, or live chat. With an email support option at customerservice@aglobaltrade.com, traders can submit inquiries and receive written responses. For more immediate assistance, a phone support line at +18007570137 is available, ensuring that clients can speak directly with customer service representatives. Additionally, the live chat feature allows for real-time interaction with support agents, providing prompt and convenient assistance to address any trading-related queries or concerns. This multi-channel approach ensures that traders have options to access help and guidance, enhancing the overall customer experience.

Educational Resources

AGlobalTrade's dedication to trader education is evident through its comprehensive 'Education' section on its website. This section serves as a valuable resource for traders of all experience levels, offering a wealth of educational materials such as articles and videos covering various aspects of trading. Whether you're a novice seeking to learn the basics or an experienced trader looking to refine your strategies, these resources can provide valuable insights, tips, and techniques to enhance your trading knowledge and skills. AGlobalTrade's commitment to trader education underscores its mission to empower clients with the knowledge needed to make informed trading decisions and succeed in the financial markets.

Summary

AGlobalTrade is a trading platform that offers a diverse range of market instruments, including currency pairs, commodities, indices, individual stocks, and digital currencies, catering to traders and investors with varying experience levels. They provide several account types with varying minimum deposit requirements to suit different trading needs. While the platform offers leverage of up to 1:400, traders should be mindful of the associated risks. Notably, AGlobalTrade operates outside the regulatory framework of a broker, which may impact transparency and investor protection. The absence of detailed information on spreads and commissions on their website may raise concerns for potential traders. However, the platform offers a range of deposit and withdrawal options, covering commission fees for transfers. AGlobalTrade also provides a state-of-the-art trading platform with advanced tools and mobile compatibility, along with a comprehensive 'Education' section for trader learning. Customer support is accessible via email, phone, and live chat to assist clients with their trading queries and concerns.

FAQs

Q1: What financial markets can I trade on AGlobalTrade?

A1: AGlobalTrade offers access to a wide range of financial markets, including currency pairs, commodities (both hard and soft), stock indices, individual stocks, and digital currencies like Bitcoin and Ethereum.

Q2: How can I deposit funds into my AGlobalTrade account?

A2: You can deposit funds into your AGlobalTrade account by logging in, clicking “Deposit Funds,” and selecting your preferred deposit method. You can also request assistance from a financial analyst or use the online chat feature.

Q3: What is the maximum leverage offered by AGlobalTrade?

A3: AGlobalTrade offers a maximum trading leverage of up to 1:400, allowing traders to control positions up to 400 times the size of their initial capital.

Q4: Is AGlobalTrade a regulated broker?

A4: No, AGlobalTrade operates outside the regulatory framework of a broker, which means they do not adhere to the strict rules and oversight typically applied to regulated brokerage firms.

Q5: Where can I find educational resources on AGlobalTrade's website?

A5: You can access educational materials, including articles and videos about trading, in the 'Education' section of AGlobalTrade's website. These resources cater to traders of all experience levels and cover various aspects of trading.

Review 18

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now