简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

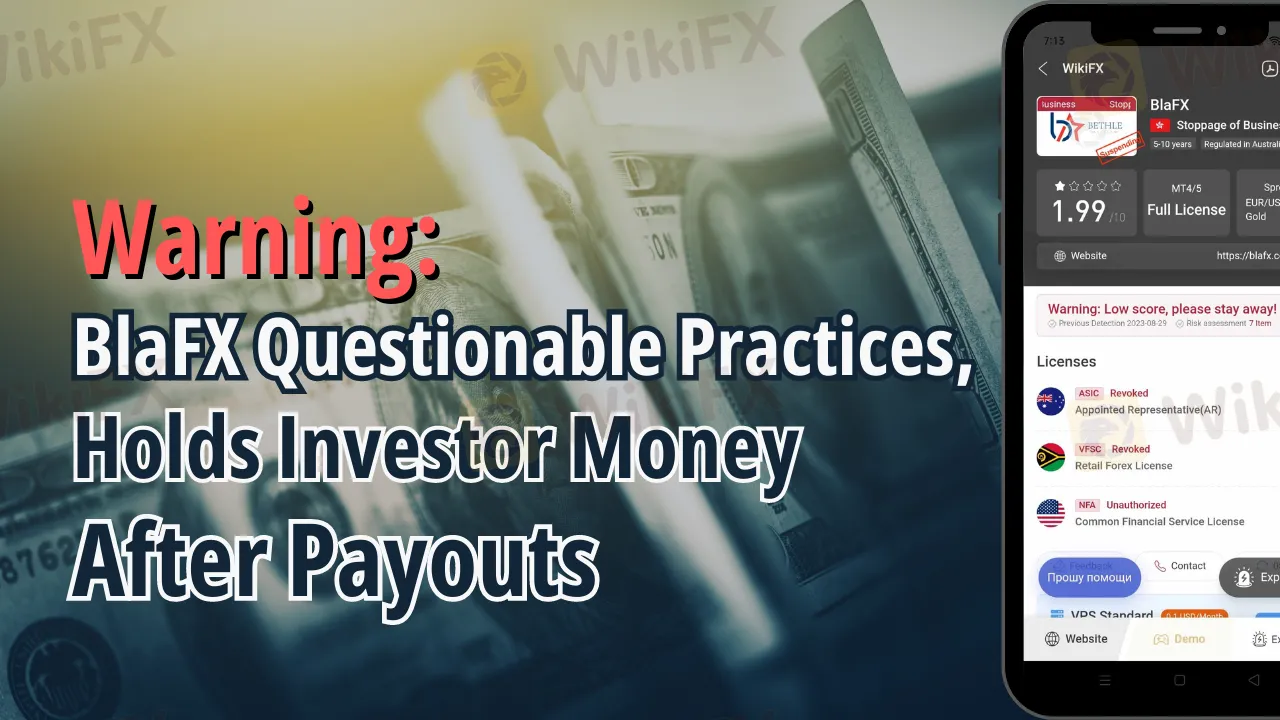

Warning: BlaFX Questionable Practices, Holds Investor Money After Payouts

Abstract:BlaFX faces scrutiny for withholding investor funds after payouts and questionable affiliations. Ensure broker reliability with WikiFX's thorough vetting and reviews.

Introduction:

The trading world has been buzzing with discussions regarding Bethel Aster Global Investment Limited, popularly known as BlaFX. There's growing concern that this broker might be involved in practices that border on scams or fraud. Here's an overview of the situation.

The Case:

One investor's experience has shed light on BlaFX's questionable practices. After depositing a sum of 837 USD on 7/23/2023, this investor faced issues while trying to withdraw his funds. His initial withdrawal request of 220 USD was processed successfully. However, his attempt to retrieve the rest of his funds hit a brick wall. It appears that BlaFX holds onto the remaining funds, leaving the investor powerless to claim his own money.

BlaFX Overview & Regulation:

Turning to their official website, Bethle Aster Global Investment Limited or BlaFX claims affiliations with both ASIC (an Australian Financial Regulator) and VFSC. This would typically reassure potential investors about the legitimacy of the broker. However, a deeper look paints a different picture. Verification attempts on the regulator's official sites show that while Bethle Aster Global Investment Limited is registered under ASIC, there's no record of them being associated with VFSC.

BlaFX Official Website

ASIC

You can access more of the complaints from BlaFX through the link below.

https://www.wikifx.com/en/dealer/9111629541.html

Further Insights:

A closer look at BlaFX's offerings shows that they limit their investors to Copy-Trading. This restricted trading method, combined with their questionable withdrawal practices, raises several red flags.

WikiFXs Role in Safeguarding Investments:

WikiFX serves as a comprehensive tool for investors navigating the ocean of brokers. Here's how it supports investors:

Vetted Broker Listings: WikiFX lists numerous brokers, but not without a thorough check. It verifies broker credentials against official records, like how BlaFX was found registered with ASIC but not with VFSC.

Up-to-date Reviews: The platform offers the latest reviews from other investors and traders. These first-hand experiences give invaluable insights into the brokers' practices, helping newcomers make informed decisions.

Alerts on Questionable Practices: WikiFX isnt just about showcasing reliable brokers; it also flags off those with dubious operations. This preventive measure ensures that investors are forewarned about potential scams.

Awareness:

For those looking to safeguard their investments and avoid falling prey to unreliable brokers, WikiFX serves as a valuable tool. It helps investors identify and choose regulated brokers. A well-informed investor is a protected one.

Conclusion:

It's essential to stay updated about brokers and their practices. The WikiFX App offers the latest updates and reviews about various brokers, ensuring you make informed decisions. To keep yourself in the loop, download the WikiFX App here: https://www.wikifx.com/en/download.html. Remember, it's not just about growing your funds, but also ensuring their safety.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

UK FCA Fines Barclays £40 Million Over 2008 Deal

The UK FCA imposes a £40 million fine on Barclays for failing to disclose critical information about its 2008 capital raising with Qatari entities.

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Crypto company World Liberty Financial, backed by Donald Trump, secures a $30M investment from Justin Sun, making him its largest investor.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator