简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Top 8 Most Exposed Forex Brokers In The Philippines For July 2023

Abstract:Discover the most exposed Forex brokers in the Philippines for July 2023. This article highlights brokers and offers insights to help traders make informed decisions.

Introduction

The Philippines has seen tremendous growth in Forex trading. With this surge comes the emergence of brokers, some of whom are less than reliable. This article focuses on the most exposed Forex brokers in the country for July 2023, as documented by WikiFX. By highlighting these brokers, we aim to help traders make well-informed decisions.

Most Exposed Forex Brokers according to WikiFX for July 2023

V5 Forex Global:

V5 Forex Global, a well-known broker in the Philippines, offers free daily trading signals. They promise that you'll make money without losing any. However, they've been exposed for scamming people.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/2482079142.html

Xtrade:

XTrade lets you trade different things online like stocks and currencies. But be careful, they've had some warnings and scrutiny before.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/0361406199.html

HiltonmetaFX:

HiltonmetaFX and V5 Forex Global are similar and attract investors with good offers. People say they're a scam and are involved in a scheme to take your money.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/1074126853.html

BDSwiss:

BDSwiss is a legal online trading service that's been around since 2012. They offer trading in things like cryptocurrencies and stocks.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/1541601770.html

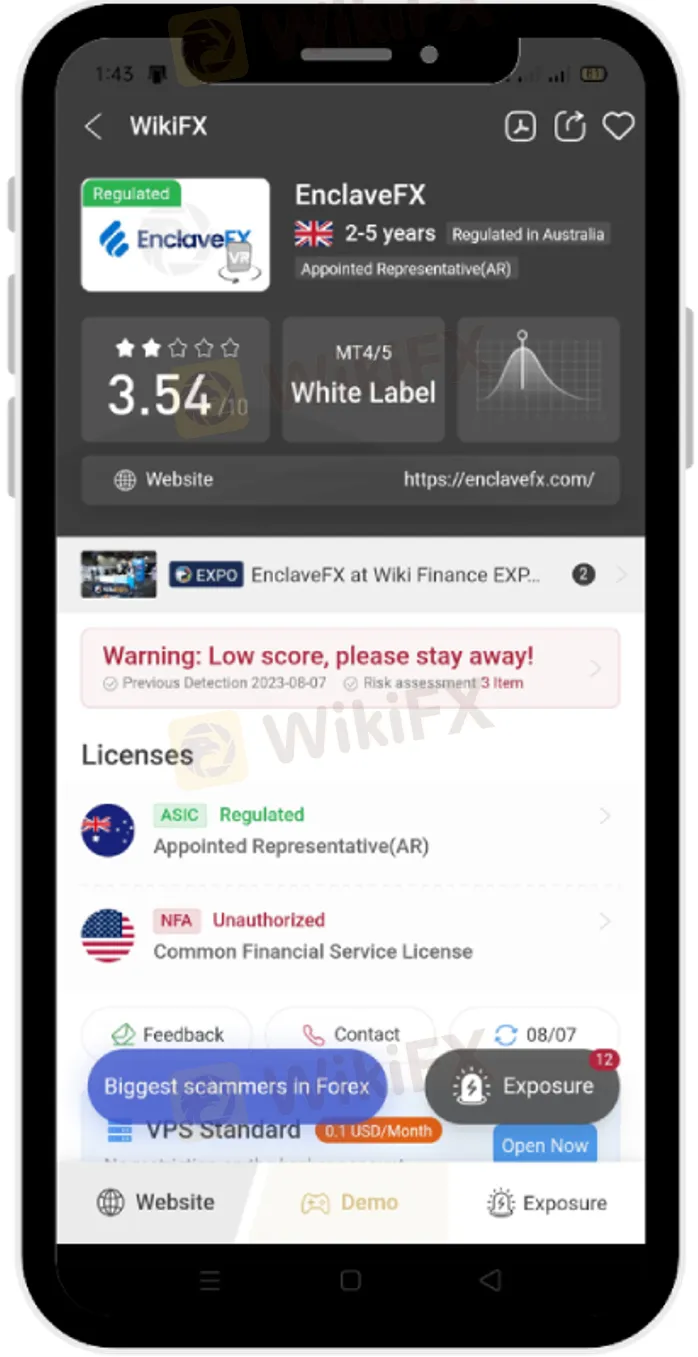

EnclaveFX:

EnclaveFX has been operating since 2018 and offers trading in various markets like Forex and Crypto. They're regulated by ASIC.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/3301616985.html

Trade Nation:

Trade Nation is a regulated company that offers online trading in different markets. They focus on helping traders make good decisions.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/5411633122.html

ForexEasyOnlineTrading:

This is a non-regulated broker that offers trading in crypto and forex.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/6017477420.html

Chaos:

Chaos, founded in 2016, is part of a bigger company and provides services like global stocks and futures. They aim to be a top firm in Hong Kong.

You can check the complaints through the link: https://www.wikifx.com/en/dealer/9321919990.html

While it's beyond our scope to list all the exposed Forex brokers in detail here, it is worth noting that the WikiFX app has compiled exposure data for July 2023 that reveals some of the most prominent and exposed brokers in the Philippine market. This data highlights the brokers that have been deemed unreliable, unregulated, or risky for other reasons.

Protecting Yourself from Exposed Brokers: Awareness

The rise in popularity of Forex trading in the Philippines has led to an increase in unregulated, cloned, and fake brokers claiming to be regulated. Here's how you can protect yourself:

· Verify Regulation: Always check if the broker is regulated by a reputable financial authority. In the Philippines, legitimate Forex brokers are regulated by the Securities and Exchange Commission (SEC).

· Check Reviews and Ratings: Look for customer reviews and ratings. If something seems off, it probably is. Websites like WikiFX provide valuable insights.

· Avoid Promises That Sound Too Good to Be True: If a broker is offering returns that sound unrealistically high, it may be a red flag.

· Use Trusted Sources: The WikiFX app is a trustworthy source that can help you in identifying exposed Forex brokers in the Philippines.

Conclusion

The world of Forex trading can be both rewarding and risky. By being aware of the most exposed Forex brokers in the Philippines and understanding how to avoid falling victim to unregulated or fake ones, you can trade more confidently and securely.

The WikiFX App is always there to guide you to the right broker for your trading journey. It's a valuable tool that provides updated data and can significantly minimize risks.

How to Avoid Landing on Fake URLs from Fake or Cloned Brokers

It's essential to be aware of cloned or fake brokers mimicking regulated ones. For instance, let's use IG broker as an example:

· Check the Official Website: Always log in through the official website, which you can verify through the regulatory body's site or trusted review sites like WikiFX.

· Use Security Measures: Consider using browser extensions that detect and block fake URLs such has WikiFX App Chrome Plugin.

· Consult with Experienced Traders or Financial Advisors: If in doubt, consult with those who have experience and can guide you to legitimate brokers.

In the ever-changing and dynamic field of Forex trading, education, awareness, and diligence are your best allies. Use tools like the WikiFX app and the guidelines shared above to steer clear of the most exposed Forex brokers in the Philippines. Trade wisely and stay informed!

Related news:

To stay current with the latest news, download and install the WikiFX App on your smartphone. You can download the App at this link: https://www.wikifx.com/en/download.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

UK FCA Fines Barclays £40 Million Over 2008 Deal

The UK FCA imposes a £40 million fine on Barclays for failing to disclose critical information about its 2008 capital raising with Qatari entities.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator