简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IG Group Expands U.S. Presence with Acquisition of Small Exchange

Abstract:IG Group has announced the acquisition of Small Exchange, a Chicago-based futures exchange, as part of its expansion strategy in the US. The move will broaden IG Group's range of products and services available to retail investors and traders, and it plans to expand the Small Exchange's offerings further. The acquisition has been positively received by industry experts, who see it as a strategic move to expand its footprint in the US futures market.

The purchase of Small Exchange, a Chicago-based futures exchange, has been revealed by IG Group, a global leader in computerized trading. Since its 2019 debut, The Small Exchange has developed a cutting-edge dealing system, risk-monitoring system, and matching engine. Prior to March 2022, IG Group owned a share in the Small Exchange, which was later purchased by Foris DAX Markets, the parent firm of Crypto.com.

Expansion of Products and Services

The purchase is a component of IG Group's U.S. growth plan and will enable the business to increase the number of goods and services it offers to individual dealers and customers. The Small Exchange's selling system is something else that IG Group is hoping to use to improve its offerings.

Tasty Live's creator, Tom Sosnoff, voiced his delight over the purchase and said that product innovation at the exchange level will play a significant role in how markets are structured in the United States going forward. He is certain that IG Group's control of the Small Exchange will propel it over the next ten years to the top of the market.

IG Group's Expansion in the U.S.

The purchase of Small Exchange is anticipated to strengthen IG Group's product options and assist the company in attracting more individual investors and dealers. IG Group is already well-established in the U.S. and has a footprint through IG North America, tastytrade, tasty live, delicious software solutions, and IG US.

The Small Exchange is renowned for its cutting-edge method of futures dealing, which is intended to be available to a broader variety of buyers. Since its debut, the market has accepted its goods, which are catered to store dealers.

Future Plans for Small Exchange

IG Group intends to broaden the Small Exchange's products after the purchase and increase possibilities for individual dealers. Over the next ten years, the business wants to develop a platform that will grow and dominate its industry.

Sosnoff asserts that a key element in the exchange's performance under IG Group's control is its emphasis on individual dealers. The business will also try to improve the Small Exchange's services by utilizing its current technology and experience.

Industry Response

Industry specialists have responded favorably to the purchase, viewing it as a smart move by IG Group to increase its presence in the U.S. derivatives market. The Small Exchange's creative futures trading methodology and emphasis on private dealers are complementary to IG Group's way of serving individual clients.

The Small Exchange has also won praise from the sector for its avant-garde strategy. At the 2020 Futures and Options World (FOW) Awards for the Americas, it was named “Best New Exchange.”

Conclusion

A smart move by IG Group to increase its product options and broaden its presence in the US derivatives market is the purchase of Small Exchange. The Small Exchange's trading technology and experience will be used by IG Group to improve its services and expand the possibilities available to individual dealers. The action has received positive feedback from the sector, and experts predict that it will stimulate innovation in the American futures market.

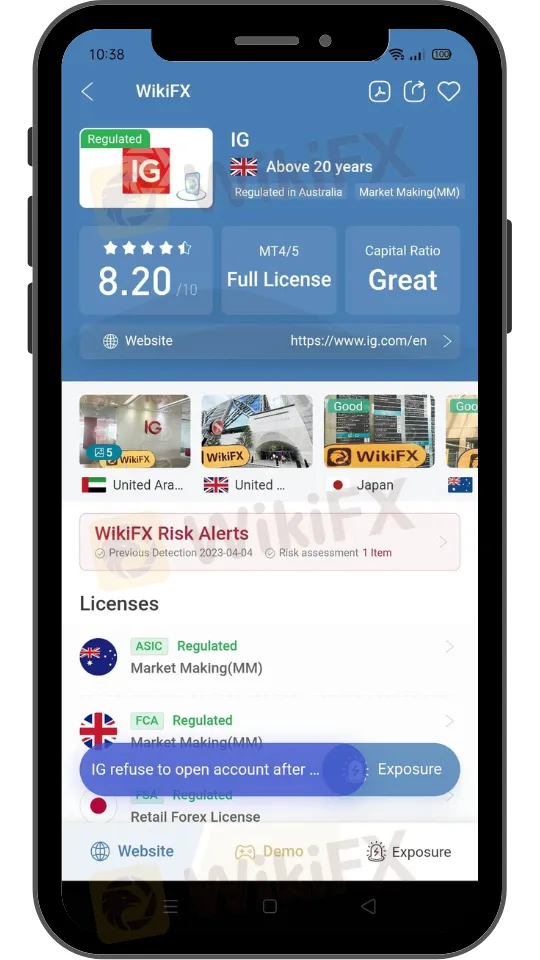

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator