Score

Olymp Trade

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://olymptradeidn.com

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Olymp Trade.

Olymp Trade

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

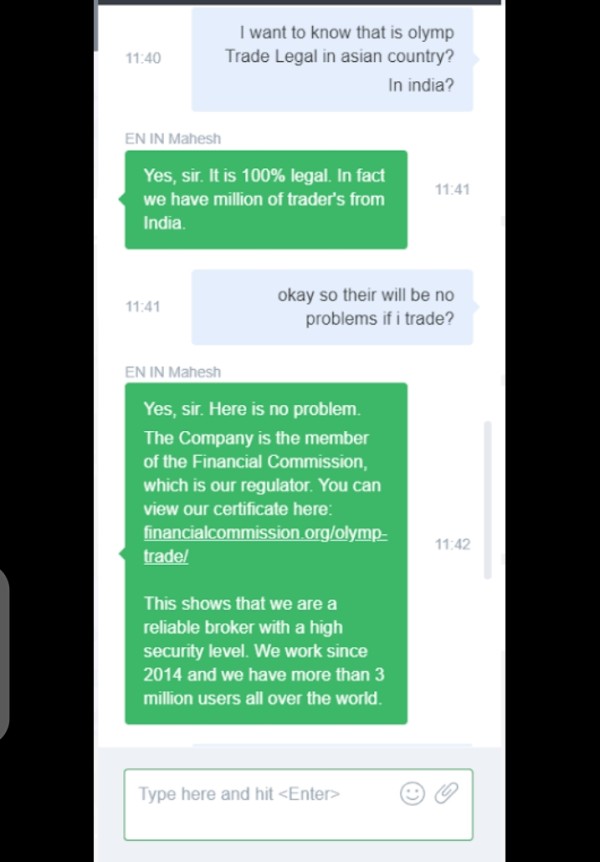

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 5 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

Users who viewed Olymp Trade also viewed..

XM

ATFX

EC Markets

STARTRADER

Olymp Trade · Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | Olymp Trade |

| Regulation | No Regulation |

| Minimum Deposit | $10 |

| Maximum Leverage | Up to 400:1 |

| Spreads | Starts from 1.1 pips for standard accounts |

| Trading Platforms | Web Platform, Mobile App |

| Tradable Assets | Currencies, Stocks, Metals, Indices, Commodities, Cryptocurrencies |

| Account Types | Demo Account, Trading Account, USDT Account, Multi-Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | 24/7 support through email, phone, live chat, and help center |

| Deposit Methods | Bank Cards, Electronic Payment Systems, Cryptocurrencies |

| Withdrawal Methods | Bank Cards, Electronic Payment Systems |

| TradingTools | Candlestick Charts, Indicators, Economic Calendar, Trading Signals, Risk Management Tools, Trading Education, Mobile Trading App |

General Information

Founded in 2014, Olymp Trade is an international Broker for Digital Options and Forex. The company is based in Suite 305, Griffith Corporate Centre P.O. box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines. With a wide range of market instruments, including currencies, stocks, metals, indices, commodities, cryptocurrencies, ETFs, OTC instruments, and composites, traders can diversify their portfolios and explore different trading opportunities. The platform offers multiple account types, such as the Demo Account, Trading Account, USDT Account, Multi-Account, each with its own set of features and benefits to cater to traders of different experience levels.

One of the key advantages of Olymp Trade is its user-friendly interface and intuitive trading platforms. Traders can access the platform through the web-based platform or the mobile app, available for both Android and iOS devices. These platforms provide essential tools and features for trading, including advanced charting tools, technical indicators, economic calendars, trading signals, and risk management tools. Additionally, the platform offers educational resources, such as video tutorials, webinars, and interactive courses, to help traders enhance their trading skills and knowledge.

While there are advantages to trading on Olymp Trade, it's important to be aware of certain considerations. Traders should carefully manage their risks and be mindful of potential fees, such as overnight fees and inactivity fees. Conducting thorough research, practicing with the demo account, and developing a well-defined trading strategy can contribute to a successful trading experience on Olymp Trade. Overall, Olymp Trade provides a comprehensive and accessible platform for individuals to engage in online trading and potentially capitalize on market opportunities.

Pros and Cons

While it is important to consider both the pros and cons of Olymp Trade, please note that I cannot provide real-time information on the platform's current state or recent developments. However, based on general knowledge, here is a conjunctive paragraph highlighting the potential advantages and disadvantages of Olymp Trade:

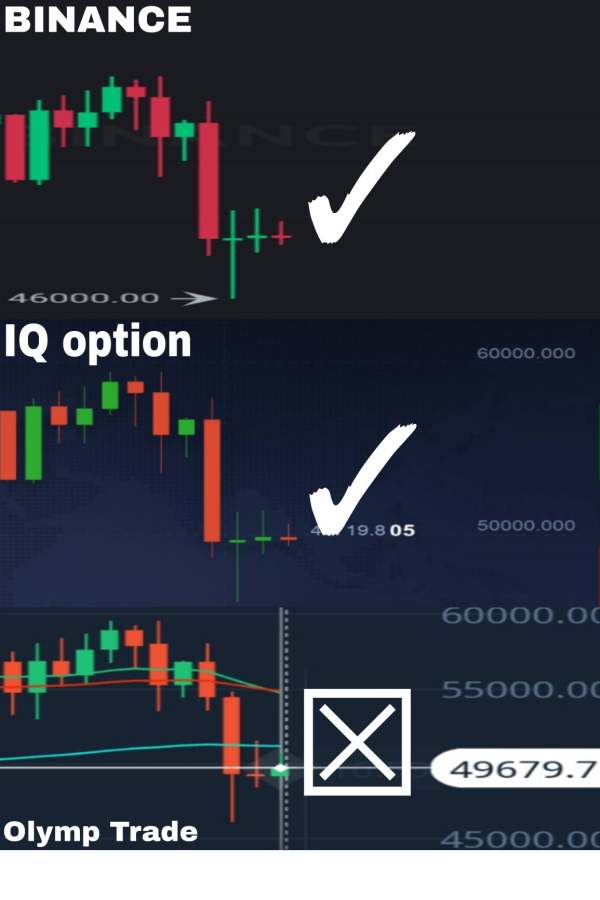

Olymp Trade offers a range of benefits, such as a user-friendly trading platform accessible via web and mobile, providing convenience for traders on the go. The platform offers various market instruments, including currencies, stocks, metals, indices, cryptocurrencies, ETFs, OTC, and composites, providing diverse trading options. Additionally, Olymp Trade offers a demo account for beginners to practice trading without risking real money. However, it is important to consider the potential disadvantages as well. The platform is not regulated, which raises concerns about the lack of oversight and investor protection. Traders should also be cautious about the company's location in Saint Vincent and the Grenadines, known for its lenient regulations. Furthermore, there have been complaints lodged against Olymp Trade, which suggests potential risks and issues that traders should be aware of before engaging with the platform.

Here is a table summarizing the pros and cons of Olymp Trade:

| Pros | Cons |

| User-friendly trading platform | Not regulated |

| Mobile accessibility | Lack of oversight and investor protection |

| Diverse range of market instruments | Location in Saint Vincent and the Grenadines |

| Demo account for practice | Complaints and potential risks |

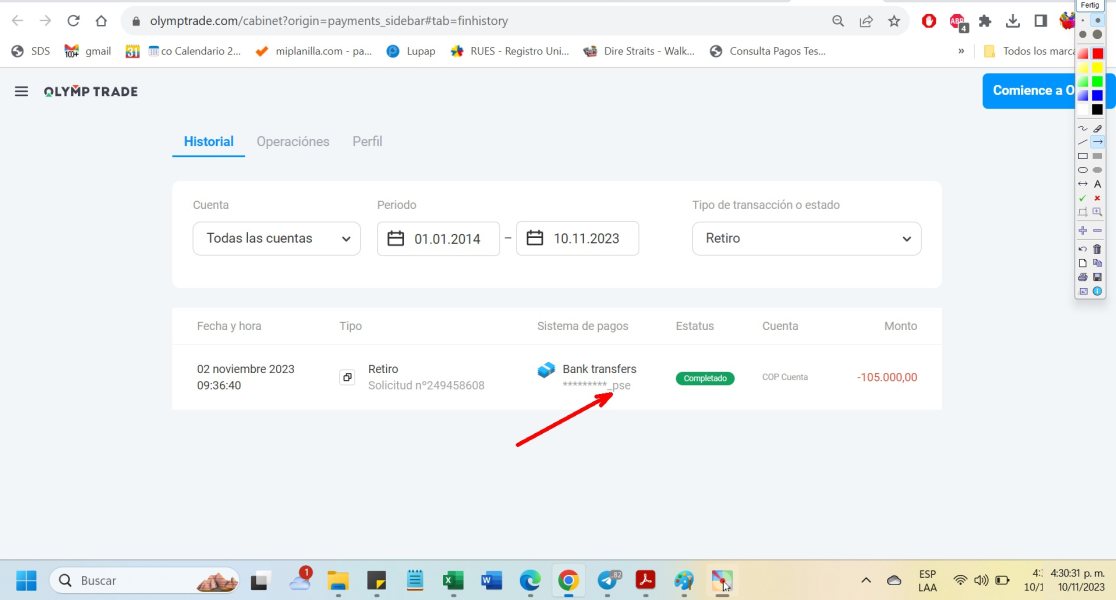

Is Olymp Trade Legit?

It's important to note that Olymp Trade is not regulated, and this lack of valid regulatory information should be a cause for concern. The company claims to be based in Saint Vincent and the Grenadines, which is known for its lenient regulations in the financial industry. The absence of regulation raises potential risks for traders, as there is no overseeing authority to ensure fair practices and protect investor interests. Additionally, the company has received multiple complaints through WikiFX, indicating a higher level of risk associated with trading on the platform. It is crucial for individuals to be cautious and fully aware of the potential risks involved when considering engaging with a non-regulated broker like Olymp Trade.

Market Instruments

Olymp Trade advertises that it offers more than 200 different assets are available to trade on the platform, including forex currency pairs, Cryptocurrencies, Stocks, ETFs, and more.

1. Currencies: Pairs of different currencies such as AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, and more.

2. Stocks: Trading opportunities in various stocks, including popular companies like AMD, Nvidia, Tesla, Netflix, Nike, eBay, and more.

3. Metals: Precious metals like gold, silver, platinum, and others.

4. Indices: Trading on indices such as NASDAQ, S&P 500, and more.

5. Commodities: A range of commodities, though specific examples are not provided.

6. Cryptocurrencies: Trading in popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others.

7. ETFs: Exchange-traded funds that provide exposure to a diversified portfolio of assets.

8. OTC: Over-the-counter instruments that are not traded on formal exchanges.

9. Composites: Composite assets, which are not specified in detail.

| Pros | Cons |

| Diverse selection of market instruments | Potential lack of transparency |

| Opportunity to trade multiple asset classes | Volatility and risk associated with markets |

| Flexibility to adapt to different market trends | Possibility of market manipulation |

| Accessible trading options for various traders | High levels of competition in certain markets |

| Potential for profit in fluctuating markets | Dependency on market conditions and analysis |

Account Types

Olymp Trade offers various account types to cater to the diverse needs of traders.

Demo Account One of the most fundamental types is the Demo Account, which serves as an investor's training tool. With a demo account, traders can simulate real trading conditions without depositing any real money. It allows them to practice trading strategies, test the platform's features, and gain valuable experience before transitioning to a live account.

Trading Account The Trading Account is the primary account used for actual trading on Olymp Trade. Traders can deposit funds into this account and execute real trades across different financial markets. Each trader is assigned a unique Trader's ID, which acts as an identifier for their trading account. Multiple trading accounts can be linked to a Trader's ID, enabling traders to operate in different currencies and manage their trading activities efficiently.

USDT Accounts For those who prefer cryptocurrency trading, Olymp Trade offers USDT Accounts. These accounts facilitate deposits and withdrawals using the USDT cryptocurrency. USDT is a stablecoin pegged to the value of the US dollar, providing stability in transactions and minimizing exposure to cryptocurrency price fluctuations. Traders can enjoy the benefits of using USDT for their trading activities on the platform.

Multi-Accounts Another notable feature of Olymp Trade is Multi-Accounts. This feature allows traders to have up to five interconnected live accounts. Each live account can be denominated in different currencies, such as USD, EUR, or local currencies. Traders have full control over these accounts, enabling them to allocate funds based on different trading strategies, profit management, or specific purposes. Multi-Accounts offer flexibility and organization for traders who want to diversify their trading activities or manage different trading approaches effectively.

| Pros | Cons |

| Provides options for both practice and real trading. | Transition from demo to live trading may involve a learning curve. |

| Allows traders to gain experience and test strategies without risking real money. | Real trading involves the potential risk of financial loss. |

| Multi-Accounts enable traders to diversify their trading activities and allocate funds effectively.d strategies. | 3. Managing multiple accounts can be complex or overwhelming for some traders. |

| USDT accounts provide stability in transactions and minimize exposure to cryptocurrency price volatility. | Limited cryptocurrency options available apart from USDT. |

How to Open an Account?

To open an account on Olymp Trade, follow these steps:

1. Visit the Olymp Trade website or download the mobile app: Go to the official Olymp Trade website or download the mobile app from your device's app store.

2. Click on the “Register” button: Look for the “Register” or “Sign Up” button on the website or app's homepage and click on it to start the registration process.

3. Fill in the registration form: Provide the necessary information in the registration form. This typically includes your full name, email address, and password. You may also be asked to select your preferred currency for trading, such as Euros or Dollars. Make sure to choose a strong password to ensure the security of your account.

4. Verify your details: Once you have filled in the registration form, you may need to verify your email address. Check your email inbox for a verification link or code sent by Olymp Trade. Click on the link or enter the code to confirm your registration.

5. Set up your account preferences: After verifying your details, you may be prompted to set up additional preferences for your account, such as language settings or notification preferences. Adjust these settings according to your preferences.

6. Explore the platform and features: Once your account is set up, take some time to explore the Olymp Trade platform and familiarize yourself with its features. You can also access the demo account to practice trading without risking real money.

7. Consider funding your account: If you decide to start trading with real money, you can fund your account by making a deposit. Olymp Trade offers various payment methods, including credit cards, e-wallets, and cryptocurrencies. Choose your preferred payment method and follow the instructions to complete the deposit process.

8. Start trading: Once your account is funded, you can start trading on Olymp Trade. Explore the available market instruments, analyze charts, and execute trades based on your trading strategy.

Leverage

Olymp Trade offers variable leverage sizes depending on the type of trade the trader is planning to execute. The platform provides a maximum leverage of up to 400:1. Leverage allows traders to control a larger position in the market with a smaller amount of capital. It essentially amplifies the potential profits or losses of a trade.

For popular Forex trading pairs like EUR/USD, Olymp Trade offers leverage of 30:1. This means that for every $1 of the trader's capital, they can control a position of up to $30 in the market. For minor Forex pairs such as NZD/USD, AUD/CAD, and USD/SGD, the leverage offered is 20:1. Other assets like stocks and cryptocurrencies may have different leverage ratios, and these can be viewed on the live trading platform when executing trades on Olymp Trade.

Spreads & Commissions

Olymp Trade only promises that it offers traders low spreads, but does not specify detailed spreads on particular instrument.

Non-Trading Fees

Olymp Trade charges various fees based on different aspects of trading. Here is a brief overview of the fees associated with Olymp Trade:

1. Trading Fees: The trading fees on Olymp Trade vary depending on the specific asset being traded, such as currencies, stocks, cryptocurrencies, commodities, and indices. The fees are typically in the form of spreads, starting from 1.1 pips for standard accounts.

2. Overnight Fee: If trades are left open overnight, Olymp Trade charges an overnight fee, which can be up to 15% of the total investment amount. This fee is applicable in certain cases, particularly for forex trades.

3. Inactivity Fee: Olymp Trade has an inactivity fee of $10 per month if there is no trading activity for 180 days. However, if there are insufficient funds in the account, it may be closed.

4. Deposit and Withdrawal Fee: Olymp Trade does not charge any fees for deposits and withdrawals. However, it's important to note that fees may be imposed by the payment methods or banks used for transactions. Traders should check with their respective banks or payment providers for any applicable fees.

It's recommended to refer to the official Olymp Trade website or consult with their customer support for the most up-to-date and detailed information regarding fees, as they may be subject to change.

Trading Platform Available

When it comes to trading platform available, what Olymp Trade offers is not the MT4 or MT5 trading platform, a proprietary web-trader with some basic functions.

1. Web Platform: Olymp Trade provides a user-friendly web-based platform that can be accessed directly through a web browser. The web platform offers a range of features and tools for trading various financial instruments. It has an intuitive interface, making it suitable for both new and experienced traders. The web platform allows traders to execute trades, access charts and technical analysis tools, set stop-loss and take-profit levels, and manage their accounts.

2. Mobile App: Olymp Trade also provides a mobile trading app that is available for both Android and iOS devices. The mobile app allows traders to access their accounts and trade on the go, giving them the flexibility to monitor the markets and execute trades from anywhere at any time. The app offers a similar set of features as the web platform, including real-time price charts, trading indicators, and order execution capabilities.

Pros and Cons

| Pros | Cons |

| User-friendly web-based platform | Lack of regulation and oversight |

| Access to real-time price charts and indicators | Limited account types and trading options |

| Mobile app for convenient trading on the go | Potential risks associated with unregulated platform |

Trading Tools

Olymp Trade offers a range of trading tools to assist traders in making informed decisions and executing successful trades. Some of the key trading tools provided by Olymp Trade are:

1. Candlestick Charts: The platform offers advanced charting tools, including candlestick charts, which allow traders to analyze price movements and identify patterns for making trading decisions.

2. Indicators: Olymp Trade provides a variety of technical indicators, such as Moving Averages, MACD, RSI, and Bollinger Bands, to help traders analyze market trends, identify entry and exit points, and generate trading signals.

3. Economic Calendar: The platform features an economic calendar that provides information on upcoming economic events, news releases, and important announcements that can impact the financial markets. Traders can use this tool to stay informed and plan their trading strategies accordingly.

4. Trading Signals: Olymp Trade offers trading signals, which are generated by professional analysts and algorithms. These signals provide insights into potential market opportunities and can help traders make informed trading decisions.

5. Risk Management Tools: Olymp Trade provides risk management tools, such as Stop Loss and Take Profit orders, that allow traders to set predetermined levels at which their trades will be automatically closed to limit potential losses or secure profits.

6. Trading Education: The platform offers a range of educational resources, including video tutorials, webinars, and interactive courses, to help traders improve their trading skills and knowledge. These resources cover various topics, including technical analysis, fundamental analysis, risk management, and trading strategies.

7. Mobile Trading App: Olymp Trade offers a mobile trading app for both Android and iOS devices, allowing traders to access the platform and trade on the go. The app provides all the essential trading tools and features available on the web platform.

These trading tools provided by Olymp Trade aim to assist traders in analyzing the markets, identifying trading opportunities, and executing trades with confidence. Traders can utilize these tools based on their trading strategies and preferences to enhance their trading experience.

| Pros | Cons |

| Advanced charting tools | Lack of customization options for tools |

| Variety of technical indicators | Limited availability of advanced analytics |

| Economic calendar for staying informed | Dependence on external trading signals |

| Mobile trading app for on-the-go trading | Limited control over signal accuracy |

| Risk management tools for controlling losses | Limited availability of advanced order types |

| Access to educational resources | Limited depth of educational materials |

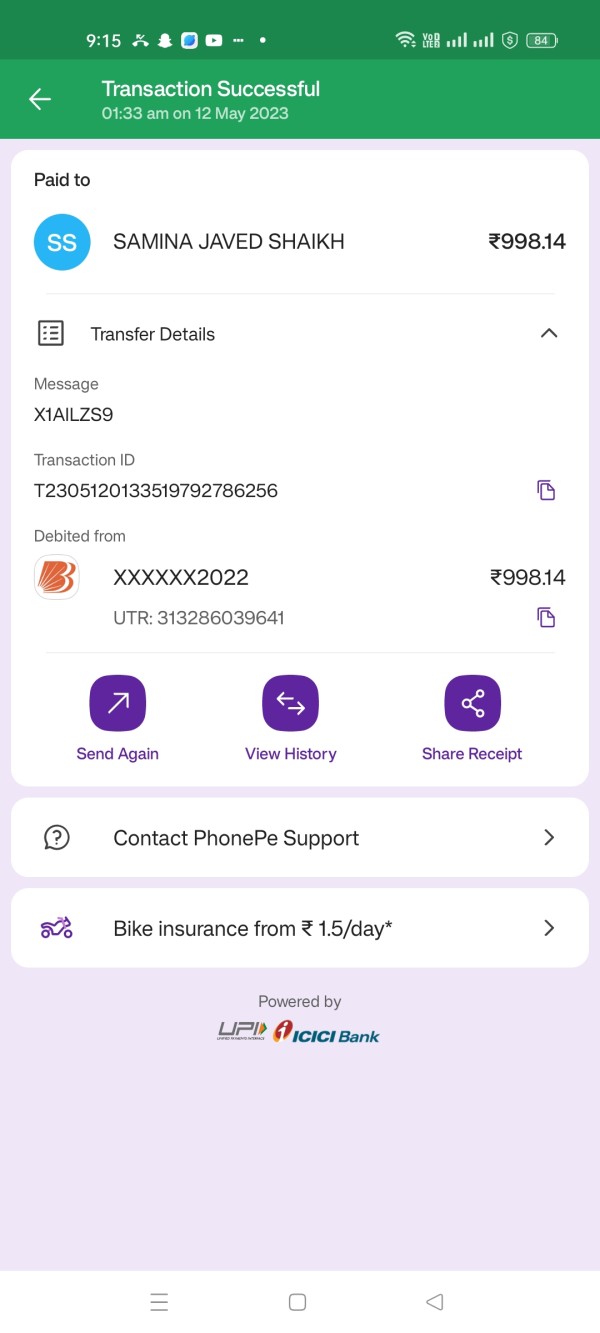

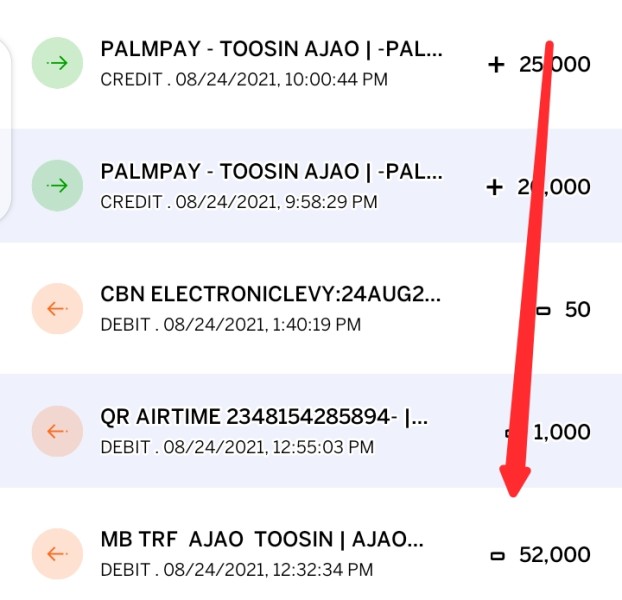

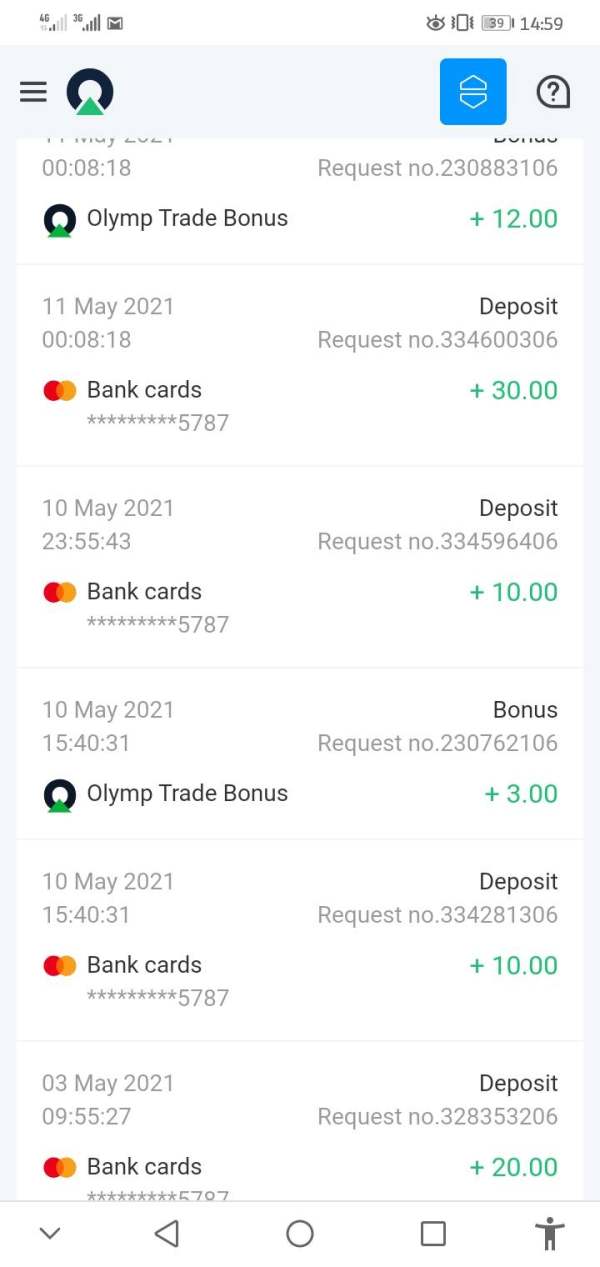

Deposit & Withdrawal

Payment methods working with Olymp Trade include the following options:

Olymp Trade offers a variety of deposit and withdrawal options to cater to the needs of its traders. Here is a brief description of the deposit and withdrawal process:

Deposit Options:

1. Bank Cards: Traders can deposit funds using Visa and Mastercard. The process is simple and secure, allowing for quick access to funds.

2. Electronic Payment Systems: Olymp Trade supports popular electronic payment systems like Skrill, Neteller, and Fasapay. These platforms provide a convenient and secure way to transfer funds.

3. Cryptocurrencies: Traders can also deposit funds using cryptocurrencies such as Bitcoin and Ethereum. This option offers additional flexibility and security for crypto enthusiasts.

Withdrawal Options:

1. Bank Cards: Withdrawals can be made directly to Visa and Mastercard. The process may take a few business days, depending on the bank's processing time.

2. Electronic Payment Systems: Withdrawals can be processed through electronic payment systems like Skrill, Neteller, and Fasapay. The funds are typically transferred within 24 hours.

It's important to note that the availability of deposit and withdrawal methods may vary depending on the trader's location. Olymp Trade strives to offer a wide range of options to ensure convenience and accessibility for its users.

| Pros | Cons |

| Variety of deposit options | Availability may vary depending on location |

| Withdrawals through multiple methods | Withdrawal processing time may vary |

| Support for electronic payment systems | |

| Option to deposit and withdraw using cryptocurrencies |

Customer Service

Olymp Trade provides customer support services to assist traders with their inquiries and concerns. The customer support team is available 24/7 and can be reached through various channels such as email, phone, live chat, and the help center on the Olymp Trade website. This ensures that traders can access assistance whenever they need it.

Additionally, Olymp Trade offers support in multiple languages, including English, Russian, Thai, Portuguese, Indonesian, Turkish, Spanish, Chinese, Vietnamese, Arabic, Malaya, and Hindi. This diverse language support caters to traders from different regions and enhances accessibility for a global user base.

FAQs

Q: What are the market instruments available on Olymp Trade?

A: Olymp Trade offers a diverse range of market instruments for trading, including currencies (forex pairs), stocks, metals, indices, commodities, cryptocurrencies, ETFs (Exchange-Traded Funds), OTC instruments, and composites. These instruments provide traders with ample opportunities to diversify their portfolios and engage in various markets.

Q: How can I open an account on Olymp Trade?

A: To open an account on Olymp Trade, you need to visit the official website or download the mobile app. Click on the “Register” or “Sign Up” button and fill in the registration form with your details, including your name, email address, and password. Verify your email address, set up your account preferences, and explore the platform. You can fund your account and start trading once you are ready.

Q: What leverage is offered on Olymp Trade?

A: Olymp Trade offers variable leverage sizes depending on the type of trade and asset being traded. The maximum leverage provided is up to 400:1. For example, popular forex trading pairs like EUR/USD have a leverage of 30:1, meaning traders can control a position of up to $30 for every $1 of their capital.

Q: What are the spreads and commissions on Olymp Trade?

A: Olymp Trade offers competitive spreads, starting from 1.1 pips for standard accounts. The actual spreads may vary depending on the assets being traded. The platform does not charge any commissions per trade executed on standard accounts. However, an inactivity fee of $10 per month may apply if there is no trading activity for 180 days.

Q: What fees are associated with Olymp Trade?

A: Olymp Trade charges various fees, including trading fees (in the form of spreads), overnight fees for certain trades left open overnight, an inactivity fee of $10 per month if there is no trading activity for 180 days, and potential fees imposed by banks or payment providers for deposits and withdrawals. It's important to refer to the official Olymp Trade website or contact customer support for detailed and up-to-date fee information.

Q: What are the deposit and withdrawal options on Olymp Trade?

A: Olymp Trade provides several deposit and withdrawal options, including bank cards (Visa and Mastercard), electronic payment systems (Skrill, Neteller, Fasapay), and cryptocurrencies (Bitcoin, Ethereum). The availability of options may vary depending on the trader's location. The process for deposits and withdrawals is straightforward and can be done through the platform.

Q: What trading platforms are available on Olymp Trade?

A: Olymp Trade offers two main trading platforms: a web platform and a mobile app. The web platform is accessed through a web browser and provides a user-friendly interface with various features and tools for trading. The mobile app is available for Android and iOS devices, allowing traders to access their accounts and trade on the go.

News

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now