简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

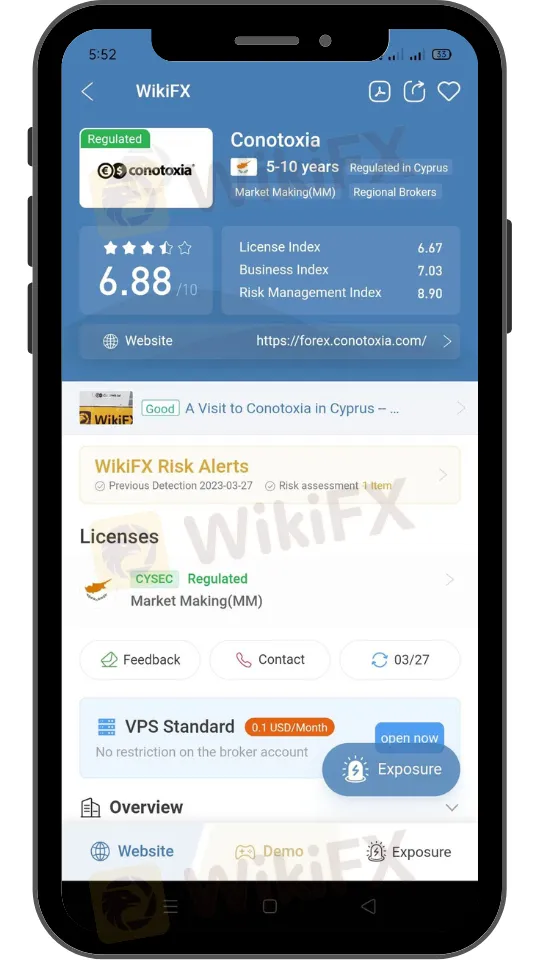

Retail Traders to Benefit from Conotoxia's Investment Advice Offering

Abstract:Conotoxia, the retail trading arm of Poland-based fintech Cinkciarz, has launched an investment advisory service with no entry barriers and a low threshold. It is the first company in the forex and contracts for the different industries to offer the product on a large scale. The service is available to retail traders from Europe and will provide individual investment recommendations on selected financial instruments.

Conotoxia, a retail trading platform under the Polish fintech company, Cinkciarz.pl, has launched a new investment advisory service with a low entry threshold for retail traders in Europe. The service provides individual investment recommendations on selected financial instruments and is available to traders without entry barriers and a minimum capital threshold. Conotoxia believes that this new service could revolutionize how retail brokers build their offerings.

Individualized Investment Advice for Retail Traders

Conotoxia is the first company in the foreign exchange (FX) and contracts for difference (CFD) industry to offer this product to traders on a large scale. The advisory service is not based on simple recommendations for the general public but is tailored to the needs of individual clients, the size of their portfolios, and their risk profiles. The investment advisor identifies opportunities and recommends appropriate moves, but the investor has complete control over the creation of their investment portfolio.

Accessible Investment Advice for European Retail Traders

Conotoxia's investment advice is aimed at European retail traders, specifically from the European Economic Area, including European Union countries, Iceland, Liechtenstein, and Norway. The service will be accessible via paid subscriptions, but the broker has prepared a promotion for users who sign up before June. They will have the chance to try the investment advice for free for a one-month trial period.

Conotoxia CEO, Grzegorz Jaworski, stated that the investment advisory service is a significant step in the development of the Invest & Forex segment and that the knowledge and experience of advisors can help clients build their own professional investment portfolios and make informed decisions. The company unveiled the new service at the Invest Cuffs 2023 conference held in Poland last weekend.

Expanding the Accessibility of Investment Advisory Services

Conotoxia wants to popularize investing with the support of professional advisors and make such services available to small investors. The company believes that investment advice could change individual investors' approach to investing. By providing investors with options to invest independently or with the support of an investment advisor, Conotoxia gives clients a broader package of services than its competitors.

About Conotoxia

Conotoxia is a Polish financial technology business that offers a variety of services such as foreign currency conversion, money transactions, payment handling, and internet dealing. Its currency conversion tool accepts a broad variety of currencies, including main currencies like USD, EUR, GBP, and JPY, as well as many foreign currencies. The website is simple to use and enables customers to conduct transactions swiftly and simply, with the option of locking in currency rates for future purchases.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the app: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

In the midst of rapid advancements and evolving landscapes in financial technology, financial regulation, and ensuring financial security, WikiGlobal stands at the forefront, closely tracking these transformative trends. As we embark on our series of exclusive interviews focusing on these pivotal areas, we are delighted to have had an in-depth conversation with.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator