简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The CIF Licenses of These 3 Companies were Revoked by CySEC

Abstract:CySec releases a statement about these 3 companies that are not authorized to do financial business under their regulation.

CySec (Cyprus Securities and Exchange Commission), a major financial regulator in Cyprus, expresses its views on the voluntary cancellation of licenses.

In general, CySec requires regulated entities to adhere to certain regulatory requirements, and this includes proper management of licensing and authorizations. If a company or individual holds a license issued by CySec and wants to voluntarily cancel it, they must follow the proper procedures and comply with any regulatory requirements that apply.

Typically, CySec will require written notice of the cancellation request and may conduct an investigation or review to ensure that the company or individual has met all applicable regulatory requirements. This could include conducting an audit of the licensee's financial records or other business operations.

Here is the name of the companies that voluntarily withdrew their CySec licenses.

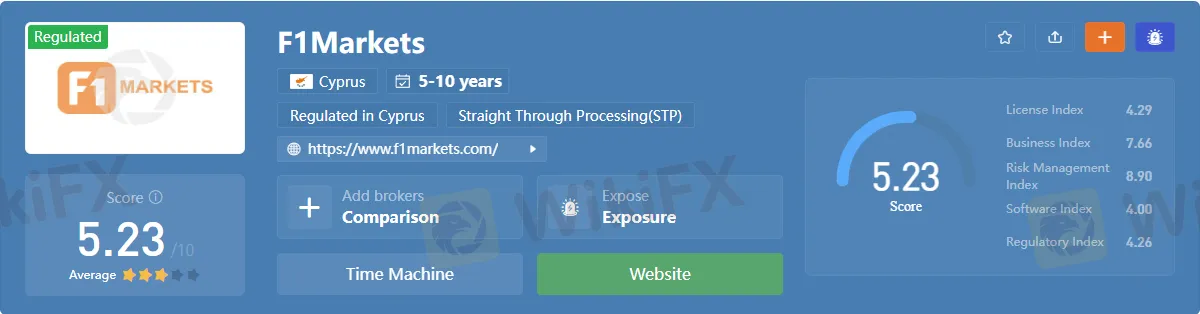

F1Markets LTD

Magnum FX (Cyprus) LTD

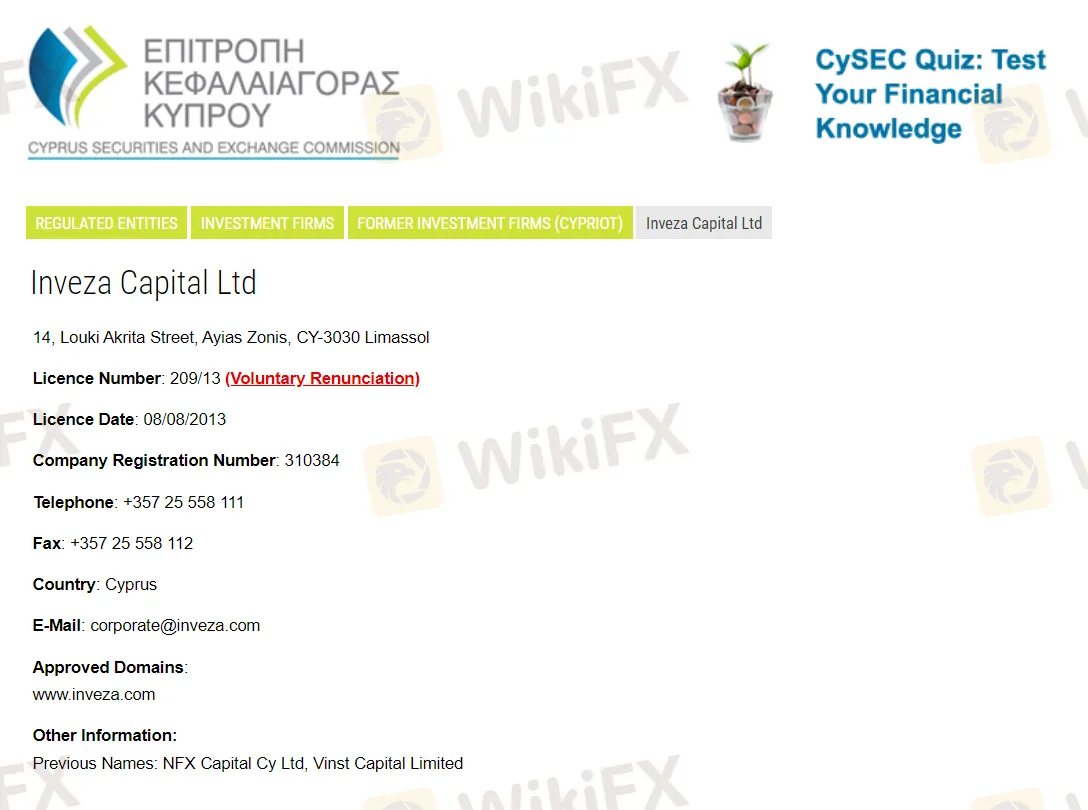

Inveza Capital LTD

It's important to note that voluntarily canceling a license may have implications for the company's ability to operate in the future, particularly if they wish to obtain a similar license in the future. Therefore, it's important to carefully consider the decision to cancel a license and seek legal advice if necessary.

Overall, it's important for licensees to comply with all regulatory requirements and follow the proper procedures when canceling licenses to avoid any potential legal or regulatory issues.

About WikiFX

WikiFX is a platform that provides information about forex brokers and related services. It was founded in Hong Kong in 2014 and has since grown to become one of the largest platforms of its kind, with a presence in over 30 countries and regions.

WikiFX aims to help traders and investors make informed decisions about forex brokers by providing them with accurate and up-to-date information on the brokers' regulatory status, trading conditions, customer support, and more. The platform also features user reviews and ratings of brokers, as well as educational resources to help users improve their trading skills.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

UK FCA Fines Barclays £40 Million Over 2008 Deal

The UK FCA imposes a £40 million fine on Barclays for failing to disclose critical information about its 2008 capital raising with Qatari entities.

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

In the midst of rapid advancements and evolving landscapes in financial technology, financial regulation, and ensuring financial security, WikiGlobal stands at the forefront, closely tracking these transformative trends. As we embark on our series of exclusive interviews focusing on these pivotal areas, we are delighted to have had an in-depth conversation with.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator