简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

No Regulation: VRN Capitals' Equivocation does not Hide the Truth of Illegitimacy

Abstract:In recent years, thanks to public warnings from regulators and increased awareness among general investors, fraudulent brokers are not as easy to get away with as they once were.

A few scammers will steal regulatory information from legitimate brokers and falsely claim to be regulated. But many more scammers, like VRN Capitals, try to obfuscate when asked regulatory-related questions.

No regulatory information found

VRN Capitals shows very attractive trading conditions on its webpage - low spreads, high leverage, and a minimum deposit of even $10. The company also claims that clients' funds are protected by “Solid Regulatory Protection”. But in this dazzling pile of information, only the most important regulatory information for investors can not be found, neither the regulatory number nor the regulator.

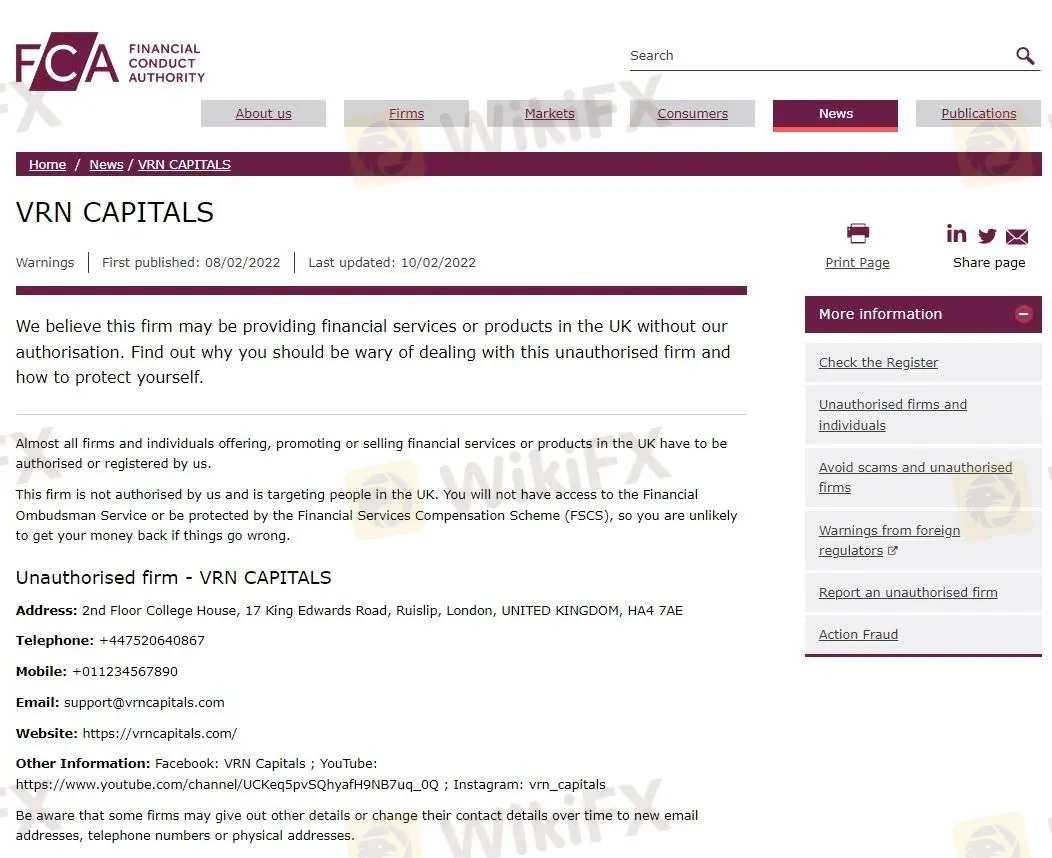

We had no choice but to trace the regulation of the broker through its contact information. The website shows that the company's address is in the UK, and the contact number is also a UK phone number. So we tried to find the license of this company in the FCA. Unfortunately, all we could find was a warning against the company, stating that it provided financial products and financial services to UK citizens without authorization. Obviously, this is not legal.

There are more and more scammers on the market like VRN Capitals, with the attitude of trying to muddle through and never mentioning anything related to regulation. For professionals, this is an obvious red flag, and it is often possible to find the appropriate regulator for a license search through the country where the company is based.

But for the newbies who are distracted from regulation by such a scammer, and, at the same time, are caught by the attractive trading conditions, there is a high risk of falling for it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The January Effect of 2025 in Forex Markets

Like other financial markets, the forex market is influenced by various factors, including economic data, geopolitical events, and market sentiment. However, one often overlooked factor is seasonality—patterns that recur at specific times of the year. One such seasonal phenomenon is the "January Effect," which can have a notable impact on currency trading.

Just2Trade: SAFE or SCAM?

Just2Trade, founded in 2016, is from Cyprus. CYSEC currently regulates it and offers trading services for Forex, Stocks, Futures, CFDs, Bonds, Metals, Options, CFDs, etc. There are four trading platforms and three accounts for traders to choose from. In addition, this brokerage also supports commission and spread 0 starts.

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

A lawsuit alleges PayPal’s Honey extension redirected affiliate commissions from YouTube creators, sparking a $5M legal battle.

OPEC's Profound Influence on the Oil Market

At present, oil prices remain relatively stable, but global economic recovery and shifting market demands continue to drive price fluctuations. Amid an uncertain global economic and geopolitical landscape, OPEC’s policies and actions remain key determinants of oil prices.

WikiFX Broker

Latest News

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

What Are The Top 5 Cryptocurrency Predictions For 2025?

Lawsuit Filed Against PayPal Over Honey’s Affiliate Fraud

OPEC's Profound Influence on the Oil Market

Just2Trade: SAFE or SCAM?

The January Effect of 2025 in Forex Markets

New York becomes first US city with congestion charge

Currency Calculator