简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Moneta Markets Launches a New Asset Class of 7 Bonds to Their Range of Products

Abstract:Popular Forex and CFD broker, Moneta Markets, has just announced the launch of 7 new bonds to its range of 1000+ tradable products.

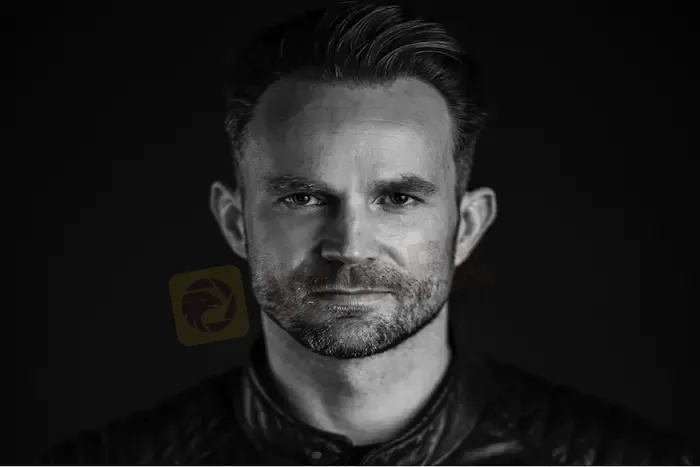

We spoke with Moneta Markets CEO and Founder, David Bily, to find out more.

The introduction of Moneta Markets futures on Bonds follows the launch of a range of ETFs. Has there been an increase in demand to add Bond markets to your portfolio of trading products?

Treasuries and Bonds are some of the largest markets in the world and are a key indicator of an economys health. The past few years have seen a major shift in global economies, and our clients are noticing this, and are increasingly expressing interest in accessing Bond markets with Moneta Markets.

Our objective as a true multi-asset brokerage is to cater to traders of all levels, from the novice trader who is just getting started with Forex, to some of the more astute traders who can tend to want exposure to other markets, like Bonds or ETFs.

“With inflation on the rise and economic uncertainty in general, the introduction of futures on Bonds allows our clients to take advantage of what could be a multi-year investment opportunity, or use Bonds as a hedge or additional vehicle to assist in diversifying their existing trading strategies.”

“We are constantly seeking feedback from our clients and partners, so based on this and the trading volume we see coming into new products, in this instance, Bonds, we will look to expand even further on what we offer. As a client-centric broker, its vital that we provide the products and services that attract demand, so this means that we are in a constant process of evolution to meet and exceed the expectations of our clients. This also has the added benefit of attracting new clients, who are looking to trade markets that many of our competitors fail to offer.”

Fresh off the back of its separation from the Vantage Group, Moneta Markets appears to be moving ahead in leaps and bounds as it attracts more attention from the industry at large, and with the addition of its range of new futures on Bonds that trend looks set to continue into the end of the year and into 2023!

Moneta Markets is a multi-regulated FX and CFD brokerage offering 1000+ FX pairs, Indices, Commodities, Cryptos, Share CFDs, ETFs, and Bonds on the popular MT4, MT5, and PRO Trader platforms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

Elon Musk has issued a stark warning about the US's financial stability, suggesting that the country is heading toward bankruptcy "super-fast" unless drastic measures are taken. The billionaire's financial commentary comes amid Bitcoin's retreat from its anticipated $100,000 milestone. The cryptocurrency recently fell to just above $95,000, down from a high of $99,000.

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

UK FCA Fines Barclays £40 Million Over 2008 Deal

The UK FCA imposes a £40 million fine on Barclays for failing to disclose critical information about its 2008 capital raising with Qatari entities.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator