简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

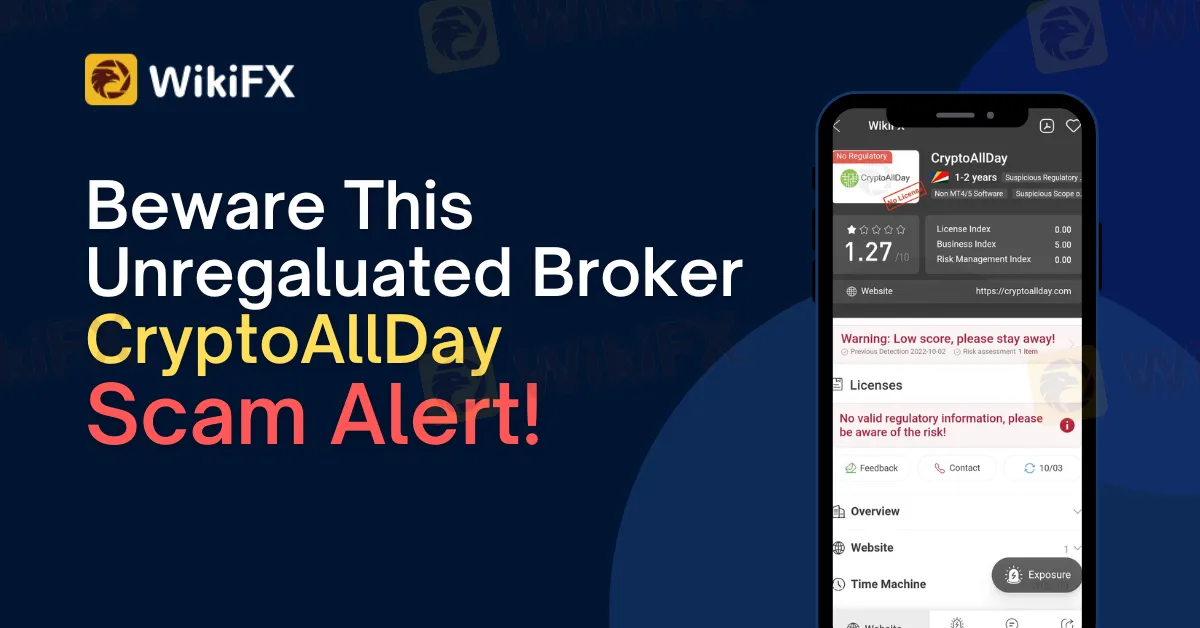

Beware This Unregaluated Broker CryptoAllDay - Scam Alert!

Abstract:The concept of digital currencies is still foreign to many people even though they have been around for more than a decade. Because of their lack of familiarity with the decentralized economy, customers are an easy target for fraudsters. This piece exposes CryptoAllDay, a fraudulent broker, and warns readers to stay away.

Despite the fact that digital currencies have been available for over a decade, the notion is still unfamiliar to many. Clients are particularly exposed to scammers since they have little or no understanding of the decentralized economy. This article identifies a fraud broker, CryptoAllDay, and advises investors to avoid joining up with it.

A Brief Overview of CrytpoAllDay

CryptoAllDay (https://cryptoallday.com/) is an offshore firm established in Seychelles. The company offers cryptocurrency trading services. It provides an investment wallet rather than a trading platform. The firm invites customers to deposit Bitcoins in its “safe and secure wallet,” which is linked to various exchanges globally and provides deep liquidity. Flexible account kinds and an educational facility are also part of the company's services. While live chat is not accessible, the firm provides a phone number and an email address for contact.

Is CryptoAllDay regulated?

No, CryptoAllDay is not a regulated firm. The company claims to be a subsidiary of Petrasoul Ltd., which is based in Seychelles. However, it has not disclosed any information other than the company's office location. Importantly, we could not identify it in The Seychelles Company Register.

Client Response

Client feedback on CryptoAllDay has been negative. Clients have complained to WikiFX and other sites that the site is fake. Customers allege the firm has no investment strategy and does not reimburse the money. Let us share some screenshots with you below.

Based on WikiFX's analysis and complaints from CryptoAllDay traders all around the world, it was determined that this broker is absolutely a scam.

Customers allege the firm has no investment strategy and does not reimburse the money.

See the complaints below.

What Makes CyptoAllDay a Scam?

First, the company's website's bad design indicates the company's ability level. Except for a landing page, everything seems to be a shambles. Even a novice may readily deduce that the folks behind the website are not pros.

Second, the organization claims to have employed a team of qualified fund managers to oversee your asset portfolio but does not reveal the list of instruments available for investment.

Third, the firm purports to provide hedging insurance, despite the fact that the platform's activities are not overseen by anybody. As a result, the platform in issue may be participating in offensive activities.

How Does CryptoAllDay Scam Their Customers?

This service functions as a cryptocurrency wallet into which interested parties may send their cryptocurrency. Following that, the organization purports to pool customers' money with those of other investors and invest them in different high-yield investment vehicles.

According to customers, the organization entices clients with tempting incentive offers attached to unclear terms and conditions, knowing that no one bothers to read.

It makes no difference how often you seek a withdrawal after joining the firm. Before you may pay out, the firm requires that you reach a certain trading volume.

CryptoAllDay may occasionally release tiny amounts of money to develop customers' confidence and urge them to contribute additional monies. When the firm discovers you've hit your limit, it either ceases communicating with you or restricts your access to your investment account.

With all of the given information, CryptoAllDay gets a score of 1.27 on the WikiFX platform. Aside from the fact that they are unregulated, the most significant factor influencing their score is the evaluations and complaints from their traders all around the world. This is proof that CryptoAllDay is a sham broker.

WikiFX, on the other hand, invites victim traders to make a complaint to WikiFX in order to commence an action in collecting their monies. WikiFX may potentially reveal this unregulated broker's criminal actions. You may contact WikiFX customer service using the information provided below.

Visit CryptoAllDay on WikiFX dealer page for more detials: https://www.wikifx.com/en/dealer/2138772741.html

WikiFX Facts

WikiFX is a worldwide corporate financial information search engine. Its primary duty is to give basic information searching, regulatory license seeking, the credit assessment, platform identification, and other services to the included foreign exchange trading firms.

The portal lists approximately 39,000 brokers, both legal and unregistered. WikiFX's staff has been working hard with 30 financial regulators from across the world to guarantee that the information supplied is factual and correct.

Bottom Line

To summarize, the company's business tactics make it untrustworthy. Aside from being an unregulated brokerage without legal permission, the organization also claims about having expert professionals to manage your investment account. Furthermore, the organization has a negative reputation among customers. As a result, we encourage you to avoid it.

Stay tuned for more Broker News.

Download the WikiFX App from the App Store or Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

In the midst of rapid advancements and evolving landscapes in financial technology, financial regulation, and ensuring financial security, WikiGlobal stands at the forefront, closely tracking these transformative trends. As we embark on our series of exclusive interviews focusing on these pivotal areas, we are delighted to have had an in-depth conversation with.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator