简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trade With Caution: How Does FxCitizen Defraud Clients?

Abstract:The forex market is massive and involves trillions of dollars traded each day. Such a huge volume of transactions attracts scammers from every nook and corner of the world.

On top of that, increasing numbers of brokers make it even more challenging to find a legitimate broker. This piece discusses how shabby brokers like FxCitizen can scam you by luring you into unrealistic profitable deals. We'll also let you know how to avoid scam brokers.

Quick overview

Founded in 2010, FxCitizen(https://fxcitizen.com/) is an offshore broker based in Vanuatu. The broker provides trading services in forex, indices, and commodities. Other features include different account types, multiple payment options and a trading platform MT5 powered by MetaQuotes. The company entices clients with special bonus offers and cash rebates. Moreover, the broker hosts monthly lucky draws, trading contests and promises fake rewards.

Is FxCitizen regulated?

No, FxCitizen (https://fxcitizen.com/) is not regulated anywhere in the world. The company doesn't even hold registration with any well-known supervisory authority.

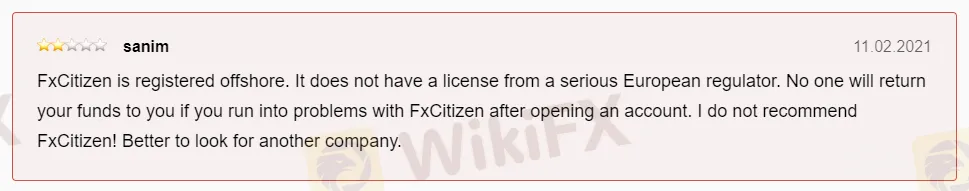

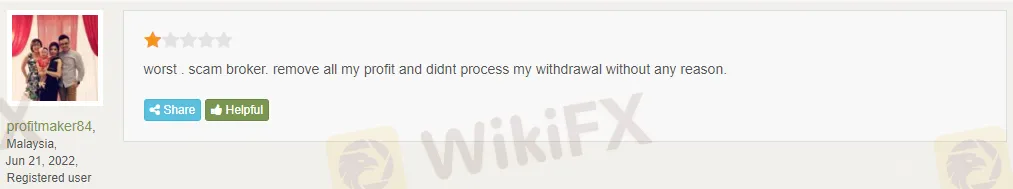

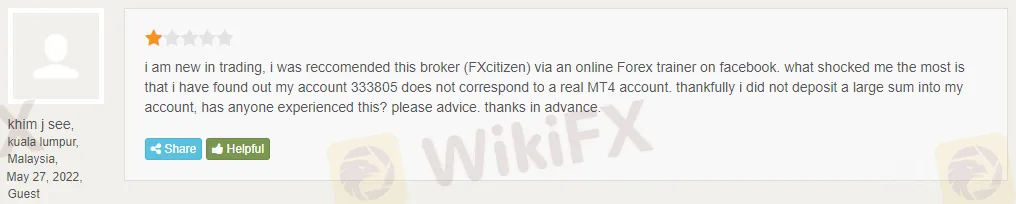

Clientele feedback

FxCitizen holds poor clientele feedback. The company has been accused of multiple issues, including price manipulation, account closures, withdrawal problems, customer support, etc. People have reported the broker's lousy code of conduct on several independent reviewers' portals, including BrokersView. Let us share some screenshots below.

How FxCitizen defraud clients?

FxCitizen marketing agents get connected with clients who attempt to register an account with the company. They pretend to be their account manager, ask them to fund their accounts and keep pushing them unless they do so. Usually, newbies who haven't been exposed to such tactics before become their prey.

Once clients add funds to their accounts, the company barely care about them anymore. It stops answering clients' phone calls and replying to their email messages. The firm doesn't process clients' withdrawal requests either. Clients have also reported that the company manipulates their trades and sometimes even blocks access to their trading accounts.

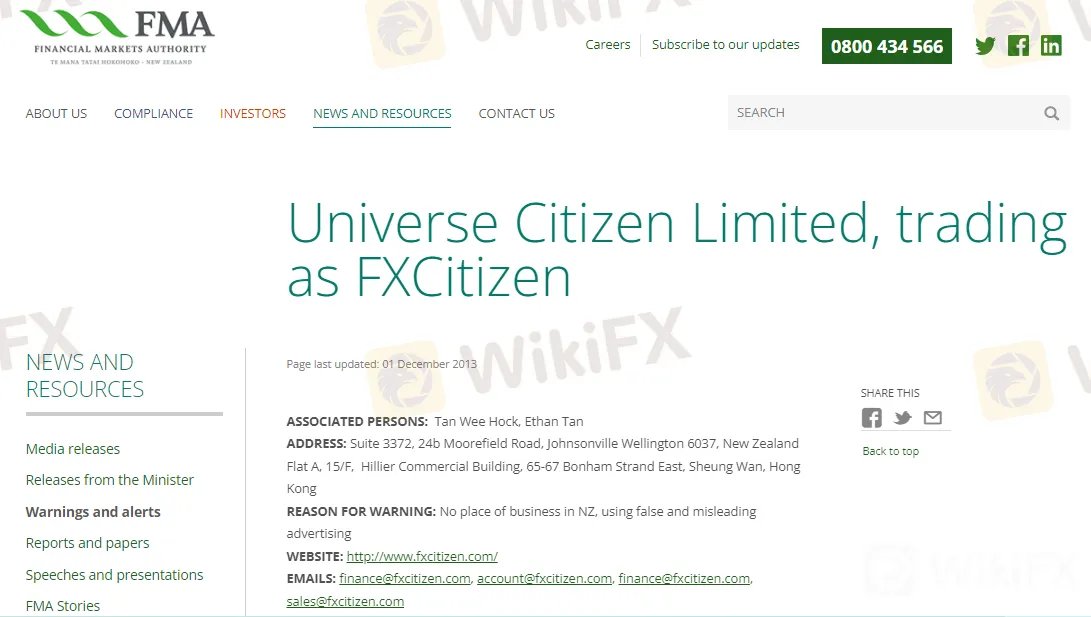

Notably, the broker has been warned by the Financial Markets Authority (FMA) New Zealand because of projecting misleading information.

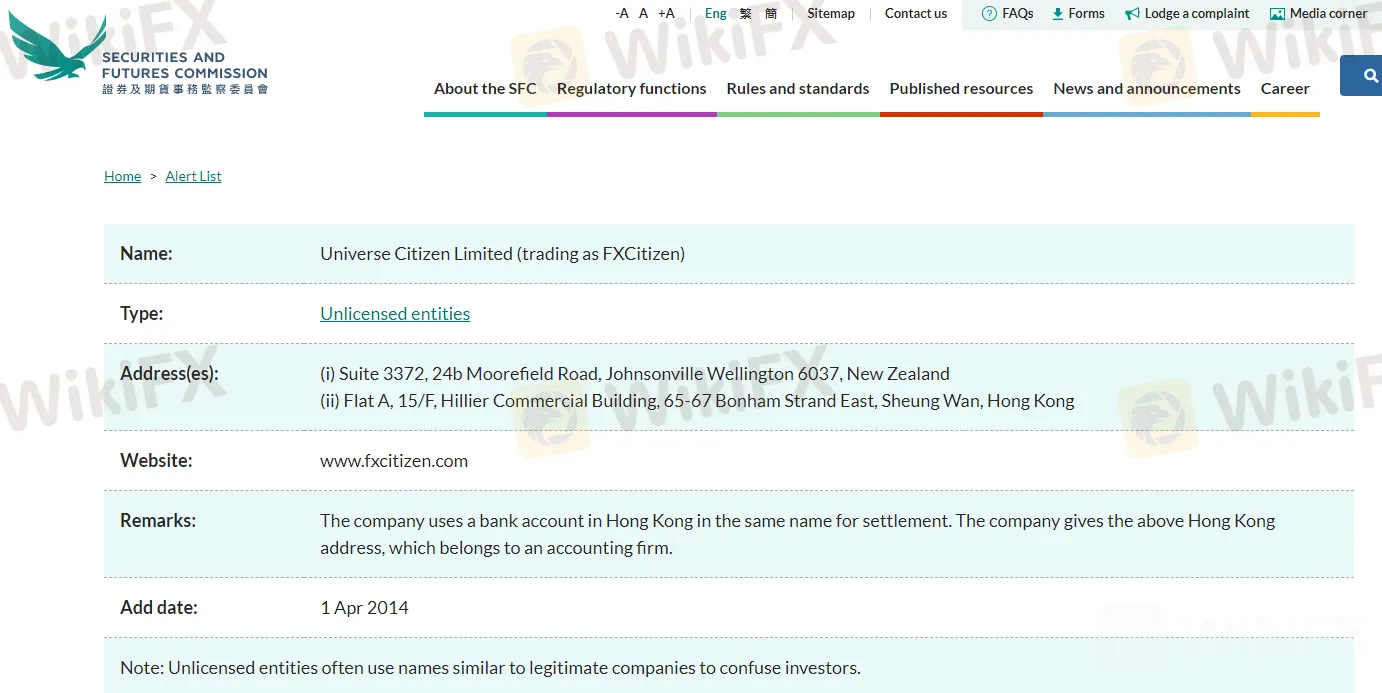

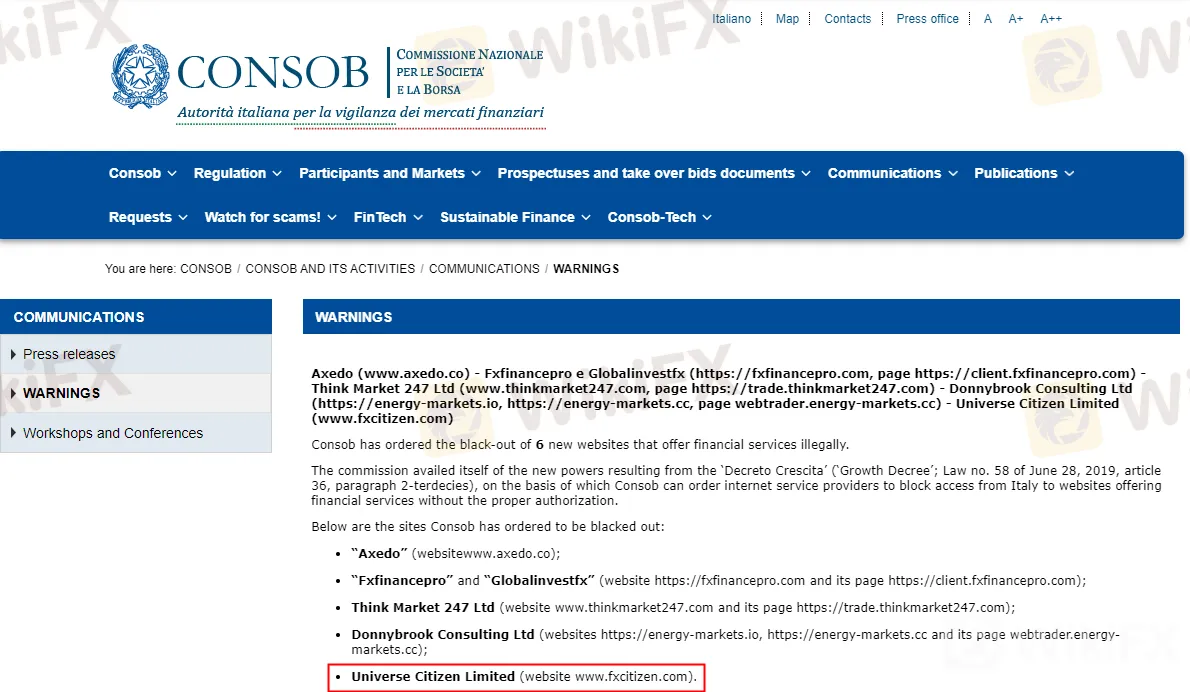

The Securities and Futures Commission in Hong Kong(SFC) also added the company to “Alert List” and the Italian Companies and Exchange Commission(CONSOB) also warned public that the broker offers financial services illegally.

What to do if I already have deposited funds with FxCitizen?

Being an existing client, you can only initiate a withdrawal request with the company. The broker is unlikely to process your withdrawals, not for big amounts at least. Therefore, try recovering your funds in small chunks. You might incur a higher withdrawal fee, but it is still worth it if you can get your funds back.

How to avoid signing up with scam brokers like FxCitizen?

First, make sure that you open an account with a regulated broker. Secondly, it should be a reputable entity. Remember, you can't start making thousands of dollars overnights in a highly volatile market like forex. Therefore, if someone promises unrealistic returns, believe it to be a scammer. Avoid paying any heed to such offers and refuse them straight away.

Bottom line

Although it is not always true for an unregulated broker to be a scam, precautions are still necessary. There is no use in crying over spilt milk, so better to proceed with care. A reputable regulated broker is always better than signing up with a non-regulated entity.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SFC Freezes $91M in Client Accounts Amid Fraud Probe

SFC freezes $91M in client accounts at IBHK, SBI, Monmonkey, and Soochow over suspected hacking and market manipulation during unauthorized online trades.

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Currency Calculator