简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Why African startups need more investments in $5 to $50 million range – Report

Abstract:A new report by Endeavor, the community of high-impact entrepreneurs in Nigeria, has established the need for more investments in the range of $5 million to $50 million for African startups. According to the report, this is the untapped area for investors as most deals sealed in the last two years have been between $0.2 million to $5 million range.

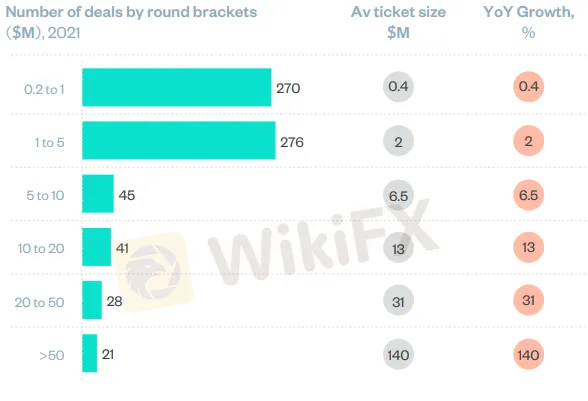

A new report by Endeavor, the community of high-impact entrepreneurs in Nigeria, has established the need for more investments in the range of $5 million to $50 million for African startups. According to the report, this is the untapped area for investors as most deals sealed in the last two years have been between $0.2 million to $5 million range.

Between 2020 and 2021, the report titled: “The Inflection Point: Africas Digital Economy Is Poised To Take Off”, notes that over 600 African startups had raised funds under $5 million, adding that as these companies grow, they would require funds in the $5 to 50 million bracket to scale. It adds that this presents opportunities for investors that are looking to invest in startups in Africa.

While analysing the African digital economy, the report projects that by 2050, Africa will be home to a third of the world‘s young people, adding that the continent is urbanising faster than other regions. Additionally, it says 1 in 6 of the world’s internet users will be in Africa in 2025.

What the report is saying

Most deals in Africa are in the $0.2-5million range with $1-5million bracket growing the fastest;

Over 600 deals in this bracket compared to less than 150 in higher brackets 1-5million round experienced the fastest growth compared to all brackets (142%)1.

Therefore, the demand in the $5-50million bracket is likely to increase in the coming years when these 600 companies ‘graduate’.

However, given the significant drop in deal activity from $5million onwards, it is likely that there will be insufficient supply to meet demand.

This presents an opportunity for investors in larger brackets e.g., >5m USD

What they are saying

Commenting on the report, Tosin Faniro-Dada, CEO and Managing Director of Endeavor Nigeria, said, “The data gathered in this report is clear – Africa is the next digital growth frontier. The combination of our young and digitally savvy population, an emerging technology ecosystem, and the impact of the COVID-19 pandemic on behaviours is set to trigger an inflection point in our digitization journey. We have been excited by the increased levels of funding that our entrepreneurs are attracting but we want to make it even easier for more investors to bring out their cheque books to catalyse the growth that we believe is pending”.

Partner at McKinsey and Company, Topsy Kola-Oyeneyin, said: “We‘ve seen a few eye-catching funding rounds and acquisitions in Africa’s technology ecosystem in recent years but the findings of this report suggest that we barely scratched the surface. A number of sectors across the continent are still underpinned by informality and fragmentation, limiting the availability and affordability of products and services. These opportunities for disruption abound across the continent and this report will make it easier for interested investors to adjust their business models effectively to capitalise on these opportunities”.

Endeavor‘s report aims to shed more light on Africa’s market dynamics. For investors, it hopes to help them build local market intelligence. And though they are inclined to follow the money, Endeavor wants them to look beyond usual market opportunities and map out exit pathways.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

GCash, Government to Launch GBonds for Easy Investments

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Google Warns of New Deepfake Scams and Crypto Fraud

Countdown to WikiEXPO Dubai 2024 — “Seeing Diversity, Trading Safely”

Former Director Sentenced for Share Disclosure Breach

PayPal Expands PYUSD Use for Seamless Cross-Border Transfers

Currency Calculator