简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is WARLOCK MARKET trustworthy?

Abstract:WARLOCK MARKET is an online forex and CFDs brokerage company offering financial services to its clients. But is WARLOCK MARKET trustworthy? Is WARLOCK MARKET legal in the US, Africa, or Europe? Is WARLOCK MARKET a scam? Those are important questions that many traders are eager to know the answer to. Therefore, WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyze the reliability of this broker from specific information, regulation, exposure and etc. And you should never miss it.

What does WARLOCK MARKET look like?

Found in 2003, WARLOCK MARKET claimed itself to be one of the worlds leading online trading brokers offering professional online trading services to individual investors, financial institutions, banks, and brokers.

If you want to know whether WARLOCK MARKET is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of the WARLOCK MARKET based on the facts.

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 33,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether WARLOCK MARKET is a scam or not, we evaluated WARLOCK MARKET from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of WARLOCK MARKET based on its general information and regulatory status

To understand WARLOCK MARKET better, we explore WARLOCK MARKET by analyzing main perspectives:

A. General Info of WARLOCK MARKET

B. Regulatory Status

C. Fund Security

A. General Info of WARLOCK MARKET

WARLOCK MARKET's general info has been shown below:

(source: WikiFX)

(source: WikiFX)

WARLOCK MARKET is headquartered in London: 5 Harbour Exchange, London, E14 9GE, United Kingdom. WARLOCK MARKET provides online FX and CFD trading services to individual investors, traders, fund managers, and other financial institutions.

Based on its website, WARLOCK MARKET supports 5 languages, including English, Chinese, and Spanish.

Trading Platform

WARLOCK MARKET uses the MetaTrader 5 as its main trading platform. MetaTrader 5 is the mainstream trading platform that many solid brokers use. It is a fast, secure, and flexible way to trade in today's markets. Once logged in, customers who invest in WARLOCK MARKET have 25/7 access to a broad range of liquid financial trading instruments including Foreign Exchange, Equity Indices, Precious Metals, and Commodities.

Lower Trading Spreads

WARLOCK is the world's many high-end transaction server configuration to ensure stable trading platform can be connected at any time, to avoid the appearance of the case dropped.

Sufficient Liquidity

WARLOCK signed a number of top international banks, in order to obtain a more adequate trading liquidity. This is one important difference between STP mechanisms and market maker mechanisms. In a market maker mechanism itself acts as a market maker trading liquidity providers, in other words, customers do not have to worry about the situation of illiquidity and transaction price deviations occur, but whether the transaction and the transaction price is the market maker to decide of;

ECN / STP Trading Patterns

WARLOCK No trader trading platform using straight-through transaction processing technology (ECN / STP), all orders of all customer transactions brokered directly with international banks and anonymously send and rapid turnover, these banks have a banking license and the legitimate forex liquidation qualifications, so investors fairs safer. The statistics, WARLOCK orders turnover rate of 99.89% milliseconds turnover, the turnover time of extreme market average is 0.5 milliseconds.

Account Types

Both Standard and ECN accounts are available.

Funding Procedures

Customer service

Clients can contact WARLOCK MARKET via WhatsApp, Live Chat and Email: support@warlockmarket.com

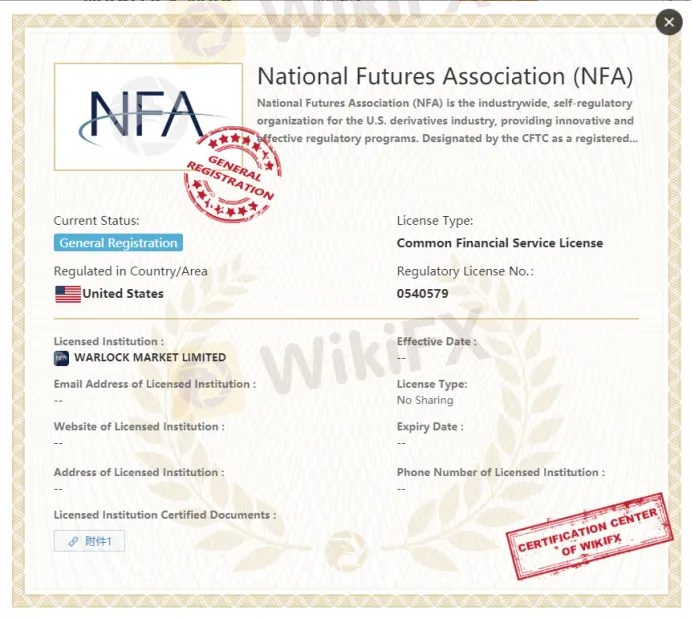

B. Regulatory Status

The legitimate license of WARLOCK MARKET

WARLOCK MARKET is a regulated broker. According to its website, WARLOCK MARKET is now licensed by the Financial Conduct Authority (FCA) EEA. According to WikiFX, WARLOCK MARKET is also regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) with license number: M21349412 and National Futures Association (NFA) with license number: 0540579. Therefore, this broker is legal to do business in Canada and the US.

(source: WikiFX)

C. Fund Security

Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back. However, it didn't mention which financial institution these segregated accounts hold in.

2. The feedback from Twitter

Unfortunately, we didn‘t find the official account of this broker on Twitter. It is hard to find the traders’ comments related to this broker on Twitter.

3. Exposure related to Exness on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

As of April 5, 2022, WikiFX didnt received any complaints related to WARLOCK MARKET yet.

4. Special survey about WARLOCK MARKET from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform,instruments etc |

| Risk management index: the degree of asset security |

According to WikiFX, this broker has been given a decent rating of 6.49/10.

(Note: Because different regions have different levels of regulatory strictness, the score of the same broker might be slightly varied in different regions. For details, please consult WikiFX customer service.)

(source: WikiFX)

B. Field Investigation

To help you fully understand the broker, WikiFX investigates the brokers by sending surveyors to the broker's physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

As of April 5, 2022, WikiFX didn't make a field survey on WARLOCK MARKET yet.

5. Conclusion:

WARLOCK MARKET is a solid forex broker offering excellent trading service. It is regulated. And your money is safe under the regulated brokers. If you want to choose a trustworthy broker to invest in, this broker is a wise choice, although some other brokers are also as good as WARLOCK MARKET.

WikiFX contains details of more than 33,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Webull Partners with Coinbase to Offer Crypto Futures

Webull partners with Coinbase Derivatives to offer crypto futures, providing US investors access to Bitcoin and Ethereum contracts with lower entry barriers.

eToro Expands Nationwide Access with New York Launch

eToro launches in New York, offering fractional stock, ETF, and options trading nationwide. Discover innovative features like copy trading and free education.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator