简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD Eyes Yearly Low Even as ECB Warns of Interest Rate Adjustment

Abstract:EUR/USD fails to extend the series of lower highs and lows carried over from last week

EUR/USD fails to extend the series of lower highs and lows carried over from last week as the European Central Bank (ECB) warns of a looming adjustment in the forward guidance for monetary policy, but the exchange rate may continue to give back the rebound from the yearly low (1.0806) as it continues to fall back from the 50-Day SMA (1.1145).

EUR/USD bounces back from a fresh weekly low (1.0897) as the account of the European Central Banks (ECB) March meeting reveals that “a large number of members held the view that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalisation.”

It seems as though the Governing Council is preparing to shift gears as “the three forward guidance conditions for an upward adjustment of the key ECB interest rates had either already been met or were very close to being met,” but the economic disruptions caused by the Russia-Ukraine war may force President Christine Lagarde and Co. to delay normalizing monetary policy as the central bank acknowledges that “the euro area could fall into technical recession in the summer quarters.”

As a result, the ECB may carry out a wait-and-see approach while it winds down the Asset Purchase Programme (APP) as “the calibration of net purchases for the third quarter will be data-dependent,” and the diverging paths between the Governing Council and Federal Reserve may continue to drag on EUR/USD as Chairman Jerome Powell and Co. plan to“begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.”

In turn, EUR/USD may continue to exhibit a bearish trend in 2022 as it remains under pressure after testing the 50-Day SMA (1.1145), and a further decline in the exchange rate may fuel the tilt in retail sentiment like the behavior seen earlier this year.

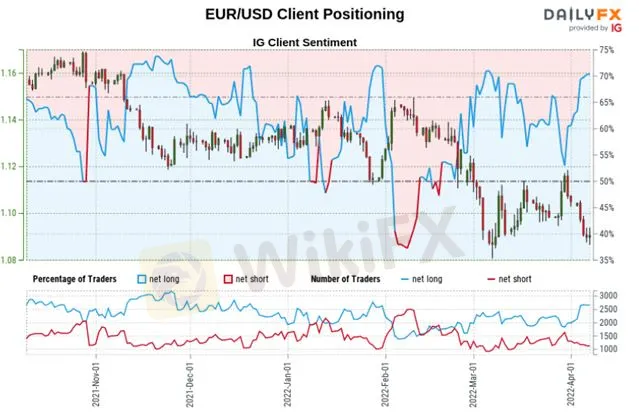

The IG Client Sentiment report shows 68.72% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 2.20 to 1.

The number of traders net-long is 2.13% lower than yesterday and 36.46% higher from last week, while the number of traders net-short is 1.59% higher than yesterday and 18.18% lower from last week. The jump in net-long interest has fueled the crowding behavior as 58.99% of traders were net-long EUR/USD last week, while the decline in net-short position could be a function of profit-taking behavior as the exchange rate bounces back from a fresh weekly low (1.0897).

With that said, EUR/USD may face headwinds throughout the year as the FOMC normalizes monetary policy ahead of its European counterpart, but lack of momentum to test the yearly low (1.0806) may keep the exchange rate within a defined range as it snaps the series of lower highs and lows from last week.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

“Seeing Diversity, Trading Safely”: WikiEXPO Dubai 2024 Opens New Horizons for the Fintech Industry

Dubai, UAE — The WikiEXPO Dubai 2024, hosted by WikiGlobal, successfully concluded on November 27, attracting wide attention from the global financial technology sector. The event was co-organized by WikiFX and the Australian Computer and Law Association (AUSCL), with strong support from the Mauritius Financial Services Institute (FSI) and the government of Liberland. Through an innovative hybrid model of online and offline participation, WikiEXPO Dubai 2024 achieved an impressive 1,267,886 online views and gathered 3500+ on-site participants, bringing together 550+ industry leaders and attracting close coverage from over 1300+ global media outlets.

BaFin Issues Warning Against Clone Broker Exploiting Pepperstone's Identity

The German Federal Financial Supervisory Authority (BaFin) has recently flagged a fraudulent clone of the licensed retail FX and CFD broker Pepperstone. This fake entity, operating under the domain pepperstone.life, has been offering financial and investment services without obtaining the necessary regulatory authorisation.

TikTok: A Rising Hub for Investment Scams in Malaysia

The Royal Malaysian Police (PDRM) have raised concerns over the increasing use of TikTok by criminal syndicates to lure victims into investment scams.

Webull Canada Expands Trading Hours with Options Trading

Webull Canada now offers extended trading hours from 4 a.m. to 5:30 p.m. ET, plus options trading. Gain flexibility and manage risk in an ever-changing market.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator