简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Treasury Targets Sanctions Evasion Networks and Russian Technology Companies Enabling Putin’s War

Abstract:Treasury also expands sanctions authorities to include aerospace, marine, and electronics sectors

WASHINGTON — Today, the Department of the Treasury‘s Office of Foreign Assets Control (OFAC) is continuing to impose severe costs on the Russian Federation for its unprovoked and unjustified war against Ukraine by targeting operators in the Russian technology sector to prevent it from evading unprecedented multilateral sanctions and procure critical western technology. OFAC is designating 21 entities and 13 individuals as part of its crackdown on the Kremlin’s sanctions evasion networks and technology companies, which are instrumental to the Russian Federation‘s war machine. Treasury has also determined that three new sectors of the Russian Federation economy are subject to sanctions pursuant to Executive Order 14024 (E.O. 14024). This allows Treasury impose sanctions on any individual or entity determined to operate or have operated in any of those sectors. Today’s sanctions are a part of the Administration‘s comprehensive response to Russia’s to restrict their access to resources, sectors of their economy that are essential to supplying and financing the continued invasion of Ukraine.

“Russia not only continues to violate the sovereignty of Ukraine with its unprovoked aggression but also has escalated its attacks striking civilians and population centers,” said Secretary of the Treasury Janet L. Yellen. “We will continue to target Putins war machine with sanctions from every angle, until this senseless war of choice is over.”

One of the technology companies designated today exports more than 50 percent of Russian microelectronics and is Russia‘s largest chipmaker. This follows OFAC’s March 24 designation of dozens of companies in Russia‘s defense-industrial base that are directly supporting Putin’s unjustified war against the people of Ukraine. Treasury took todays action in close coordination with our partners who are similarly committed to ensuring the Russian Federation is not exploiting their jurisdictions for its destructive aims.

Additionally, today OFAC is designating Russian government malicious cyber actors. The United States will continue to hold Putins cyber actors accountable for destructive, disruptive or otherwise destabilizing cyber activity targeting the United States and its allies and partners.

Today‘s actions demonstrate the U.S. government’s commitment to countering the evasion of sanctions that the United States and our allies and partners have put in place to impose unprecedented costs on the Russian Federation for its aggression against Ukraine. The Treasury Department will use all authorities at its disposal to enforce sanctions against the Russian government and its proxies.

RUSSIAN SANCTIONS EVASION NETWORKS

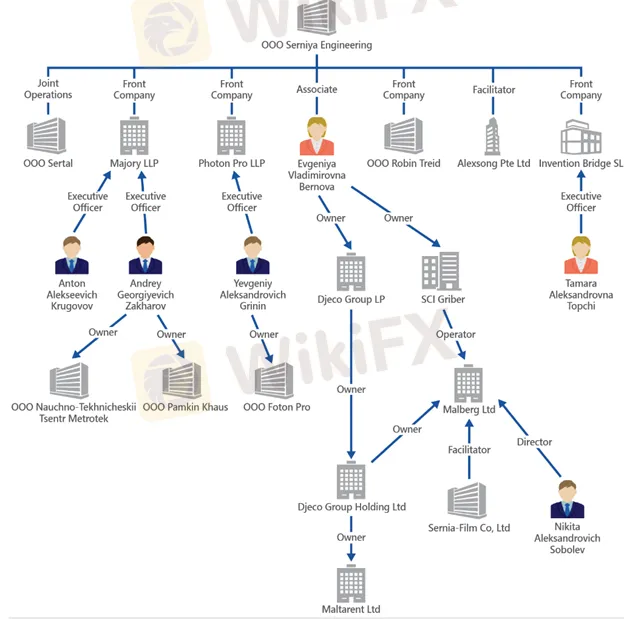

Moscow-based OOO Serniya Engineering (Serniya) is at the center of a procurement network engaged in proliferation activities at the direction of Russian Intelligence Services. This network operates across multiple countries to obfuscate the Russian military and intelligence agency end-users that rely on critical western technology. Serniya and Moscow-based OOO Sertal (Sertal) work to illicitly procure dual-use equipment and technology for Russias defense sector. Russia-based OOO Robin Treid, United Kingdom-based Majory LLP, United Kingdom-based Photon Pro LLP, and Spain-based Invention Bridge SL are front companies utilized by Serniya to facilitate its procurement of key equipment for the Government of the Russian Federation (GoR). Within the past month, the European Union and Japan have placed export-related restrictions on Serniya, Sertal, and Photon Pro. The UK is also taking coordinated action on the companies within its jurisdiction.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator