简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Can SQUARED FINANCIAL make your money safe? WikiFX helps you find the answer

Abstract:What does SQUARED FINANCIAL look like? If you want to know whether SQUARED FINANCIAL is a reliable forex broker or not, please continue to read.

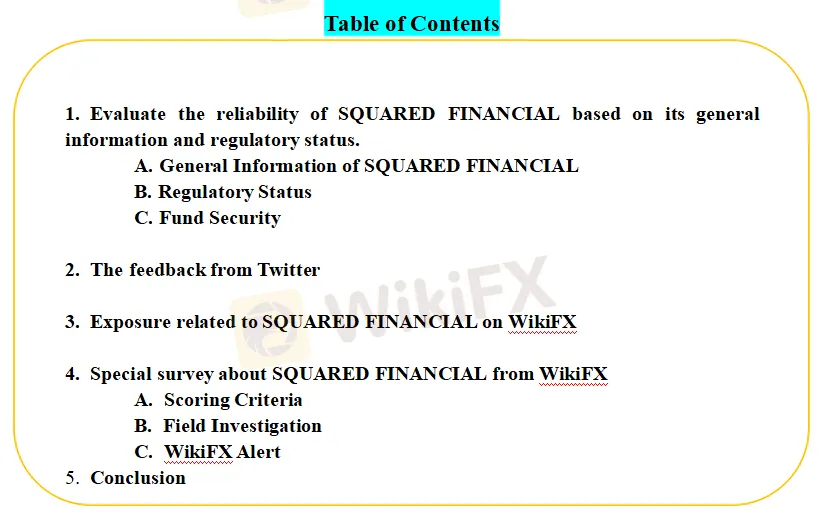

In this article

WikiFX provides inquiry services in the forex field.

Based on the facts, WikiFX evaluates the reliability of SQUARED FINANCIAL.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether SQUARED FINANCIAL is a scammer or not, we evaluated SQUARED FINANCIAL from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of SQUARED FINANCIAL based on its general information and regulatory status

To understand SQUARED FINANCIAL better, we explore SQUARED FINANCIAL by analyzing three main perspectives:

A. General Info of SQUARED FINANCIAL

B. Regulatory Status

C. Fund Security

A. General Info of SQUARED FINANCIAL

SQUARED FINANCIAL s general info has been shown below:

(source: WikiFX)

(source: WikiFX)

Found in 2005, SQUARED FINANCIAL was established by a group of experienced financial services professionals. The broker offers online trading services to individuals. It is located in Limassol, Cyprus.

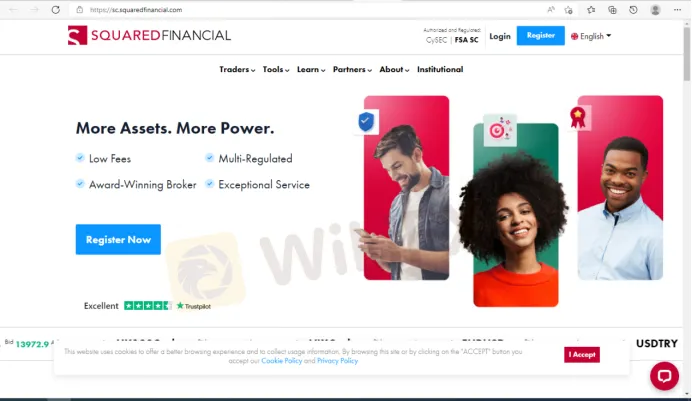

SQUARED FINANCIAL has two different websites, www.squaredfinancial.com and sc.squaredfinancial.com. But the contents in both are slightly different. It depends on which regulatory institution you choose, CySEC or FSA SC.

SQUARED FINANCIAL supports 7 languages, including English, Chinese, and Spanish.

Market Instruments

The company offers investors over 120 trading products in 6 different asset classes, i.e., a selection of CFDs on Forex, precious metals, energy, futures, stocks, and global indices.

Leverage & Account

To meet different traders' trading needs and experience, the company offers two different types of accounts, namely the Pro account (minimum deposit of $0) and the Elite account (minimum deposit of $5,000). The trading leverage is 1:50 for indices and energies and 1:10 to 1:50 for soft commodities. Leverage is 1:200 for Forex products in the Pro account and 1:30 in the Elite account. Leverage is up to 1:200 for precious metals.

Spreads & Commission Fees

Professional accounts are commission-free accounts with spreads starting from 1.2 pips; Elite accounts have a spread of 0.0 pips and a commission of $5 per lot traded.

Trading Platform

SQUARED FINANCIAL offers traders the market-leading MT4 and MT5 trading platforms. Traders can create custom layouts and templates to suit their trading market and style with MT4, efficient, user-friendly, and flexible, available for Apple IOS and Android systems. MT5 is the best choice for modern traders, with a market depth system and a separate order and trade accounting system. It is a highly-versatile trading platform offering a wide range of excellent trading possibilities and embedded expert market analysis tools.

Deposit & Withdrawal

SQUARED FINANCIAL welcomes several methods for traders to deposit and withdraw funds: Visa, MasterCard, Maestro, Wire Transfer, Skrill, NETELLER, UnionPay, and Alipay.

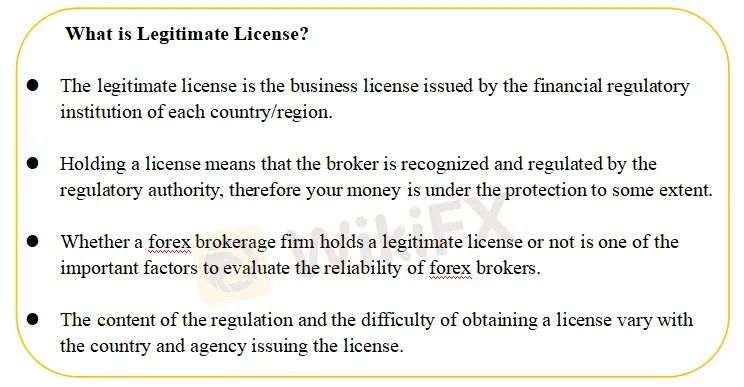

B. Regulatory Status

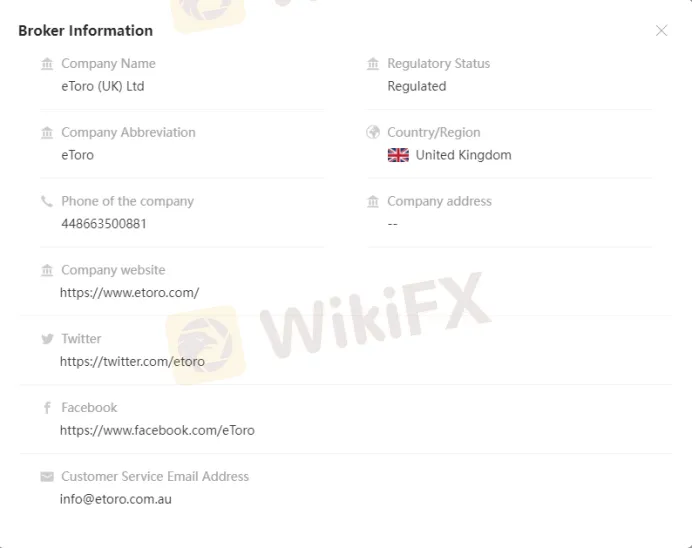

The legitimate license of SQUARED FINANCIAL

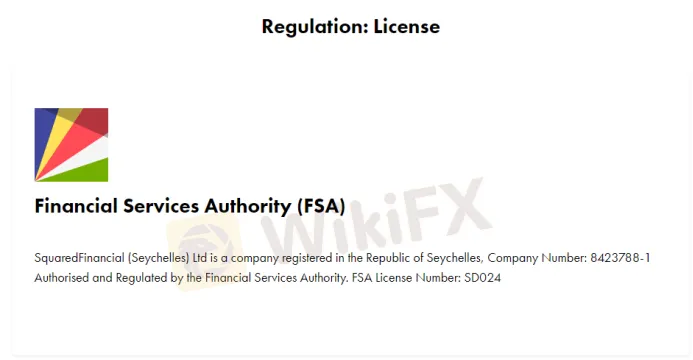

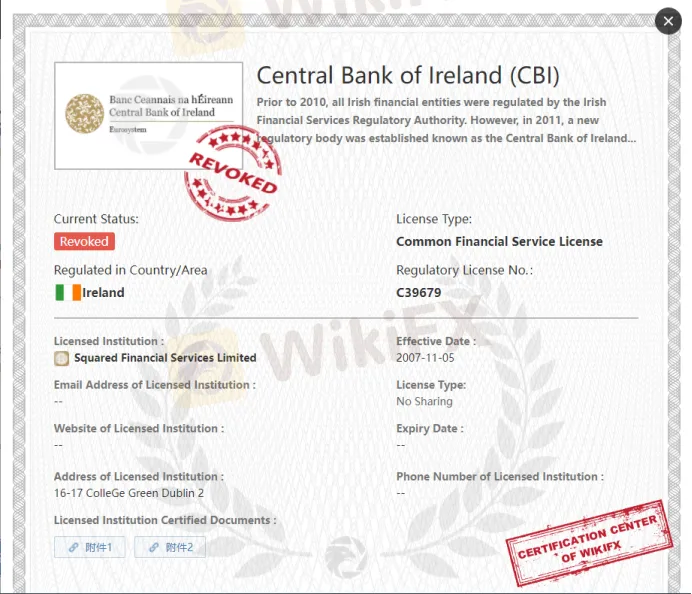

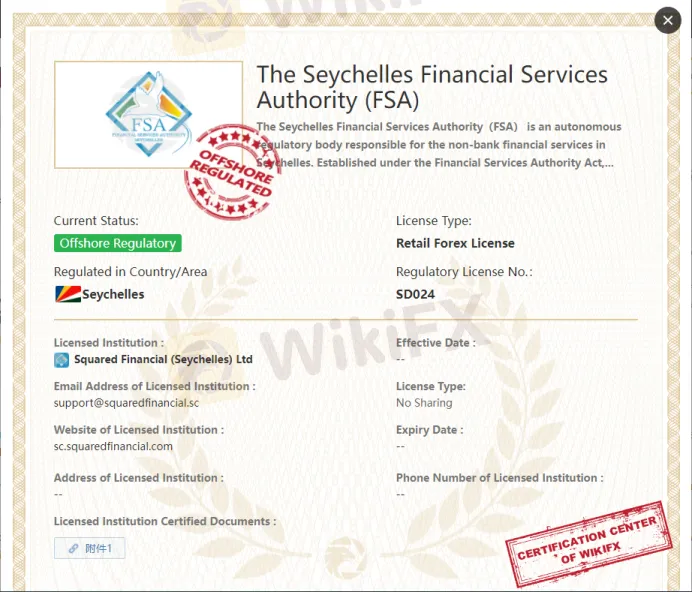

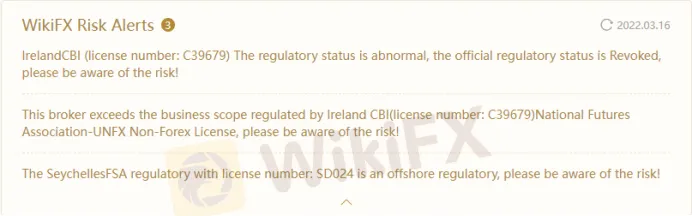

The company is currently regulated by the CySEC with license number: 329/17 and The FSA with license number: SD024. According to WikiFX, the FSA with license number SD024 is an offshore regulatory. It also holds a license issued by the Irish Financial Services Regulatory Authority(IFSRA). However, the regulatory status with CBI with license number C39679 is abnormal. The official regulatory status is revoked .

(source: WikiFX)

(source: SQUARED FINANCIALs website)

(source: WikiFX)

(source: WikiFX)

C. Fund Security

Squared Financial holds a cross-border CySEC license authorizing the provision of investment services. The company complies with EU and local regulations such as the European Markets in Financial Instruments Directive II and the Cyprus Investment Services and Activities and Regulated Markets Law. CFDs are responsible financial instruments with a high risk of rapid losses. According to the company, 79% of their retail investor accounts experience losses.

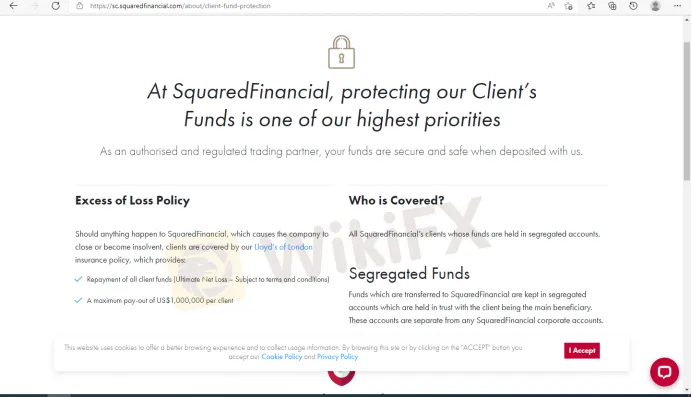

(source: SQUARED FINANCIALs website)

According to its website, SQUARED FINANCIAL guarantees that clients‘ funds are under protection. “All SquaredFinancial’s clients whose funds are held in segregated accounts.” Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back.

(source: SQUARED FINANCIALs website)

Squared Financial holds a cross-border CySEC license authorizing the provision of investment services. The company complies with EU and local regulations such as the European Markets in Financial Instruments Directive II and the Cyprus Investment Services and Activities and Regulated Markets Law. CFDs are responsible financial instruments with a high risk of rapid losses. On its website, it shows traders risk warning: 63.2% of retail CFD accounts lose money.

2. The feedback from Twitter

To figure out whether SQUARED FINANCIAL is a scammer or not, we made a survey about SQUARED FINANCIAL on Twitter.

Reviews on Twitter:

(Source:Twitter)

As of March 16 2022, SQUARED FINANCIAL does have a Twitter account. This account was registered in 2018. And it currently has 379 followers, it is following other 491 accounts. For now, we dont find feedback from the traders on Twitter.

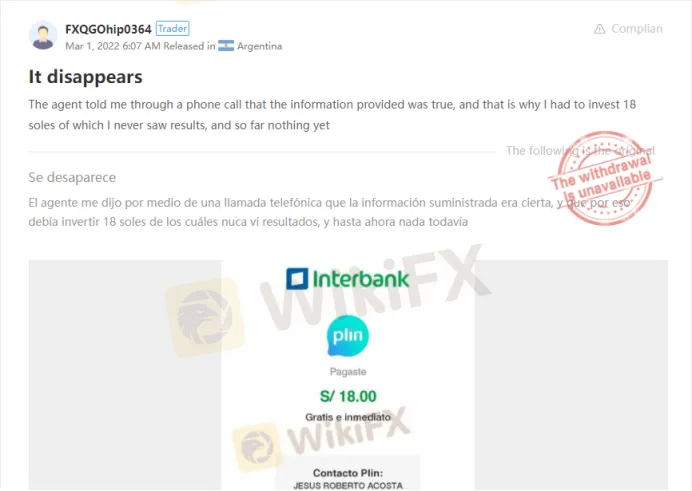

3. Exposure related to SQUARED FINANCIAL on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

As of 16 March 2022, the complaint received by WikiFX against this broker reached 1.

One trader who comes from Argentina reported that he/she lost control of the money. And the trader can not see the results.

4. Special survey about SQUARED FINANCIAL from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments etc |

| Risk Management index: the degree of asset security |

According to WikiFX, SQUARED FINANCIAL has been given a decent rating of 6.99/10.

(source:WikiFX)

In terms of the above, SQUARED FINANCIAL is balanced in every aspects. we can consider SQUARED FINANCIAL as a solid broker.

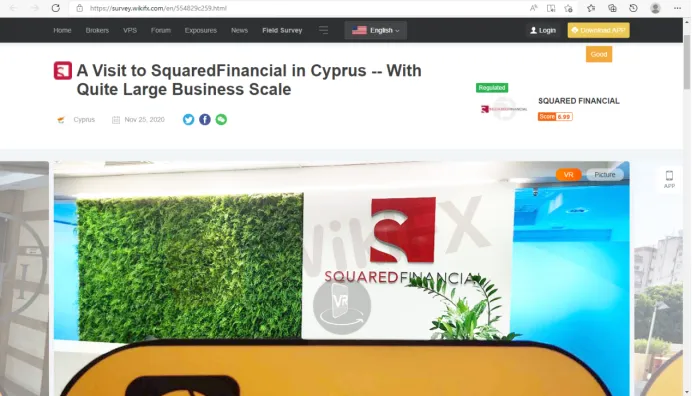

B. Field Investigation

To help you fully understand the broker, WikiFX investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

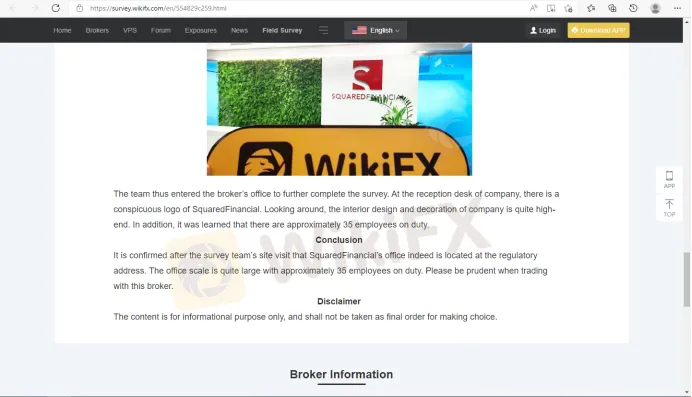

WikiFX did make a field survey on SQUARED FINANCIAL on Nov 2020 and the survey team successfully found the physical address.

(source:WikiFX)

C. WikiFX Alerts

(source: WikiFX)

5. Conclusion:

SQUARED FINANCIAL is a solid broker that is regulated by regulatory institutions. If you want to choose a trustworthy broker to invest in, SQUARED FINANCIAL is a wise choice, although there are some better alternatives. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator