简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

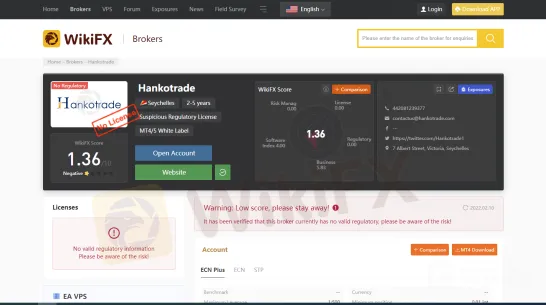

Hankotrade: A Broker That You Need to be Aware of

Abstract: Hankotrade is an online forex broker offering diverse range of trading instruments, mainly including Forex currency pairs, indices, commodities, and cryptocurrencies. Located in 7 Albert Street, Victoria, Seychelles, Hankotrade has operated on the financial market since 2019.

What Hankotrade is

Hankotrade is an online forex broker offering diverse range of trading instruments, mainly including Forex currency pairs, indices, commodities, and cryptocurrencies. Located in 7 Albert Street, Victoria, Seychelles, Hankotrade has operated on the financial market since 2019. Hankotrade is a No Dealing Desk (NDD) broker that sends its clients‘ orders directly to the liquidity providers, thus helping to ensure fast execution of trades without any conflict of interest. However, WikiFX gives Hankotrade a very low rating of 1.36/10. One of the biggest reasons for this is the regulatory status. Please be aware that Hankotrade currently isn’t regulated by any regulatory institution. It doesnt hold a legitimate license, which means your money will not come back if something goes wrong.

Account Type & Minimum Deposit

Hankotrade offers three different types of accounts: ECN Plus account, ECN account and STP account. For ECN Plus account, the minimum deposit is $1,000. For ECN account, the minimum deposit is $100. For STP account, the minimum deposit is $10.

Leverage

Hankotrade provides clients with a leverage of 1:500, which is considered high. Since leverage can amplify both benefits as well as losses, we advise you to be aware of the risk. It is absolutely not a good option to trade with an unlicensed broker with such a high leverage ratio.

Trading platforms

Hankotrade provides traders with MT4 as well as MT5. The MT4 and MT5 trading platforms are the gold standard for Forex trading, with a user-friendly trading interface, powerful charting tools, and a large number of custom indicators that support automated trading.

Deposit&Withdrawal

Hankotrade allows traders to deposit and withdraw funds to their investment accounts via some cryptocurrency payment methods, such as Bitcoin, Ether, Litecoin, Ripple, and Bitcoin Cash. Comparing to other brokers, Hankotrade doesnt have a wide variety of payment methods.

Complaints

WikiFX has received a couple of complaints from clients about Hankotrade. One trader who comes from Philippine said that Hankotrade seemed to get involved in manipulating the MT4 chart. Another trader who comes from Bangladesh reported that he/she experienced serious slippage when he/she traded with Hankotrade.

Limited educational resource

Although Hankotrade claims that they offer demo account for newbies, the brokers website has a limited collection of educational resources.

Conclusion

Hankotrade is an offshore unlicensed broker. This doesn‘t mean it is an absolute scammer. But we should be aware of the risk. It is not reasonable to trade with a broker that doesn’t have a legitimate license since there are a lot of regulated brokers who offer better trading conditions than Hankotrade. WikiFX contains details of more than 31,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator