简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Support and Resistance

Abstract:Get our trading strategies with our monthly & weekly forecast of currency pairs worth watching using support & resistance for the week of February 21, 2022.

This week I will begin with my monthly and weekly forecasts of the currency pairs worth watching. The first part of my forecast is based upon my research of the past 20 years of Forex prices, which show that the following methodologies have all produced profitable results:

Trading the two currencies that are trending the most strongly over the past 6 months.

Trading against very strong weekly counter-trend movements by currency pairs made during the previous week.

Carry Trade: Buying currencies with high interest rates and selling currencies with low interest rates.

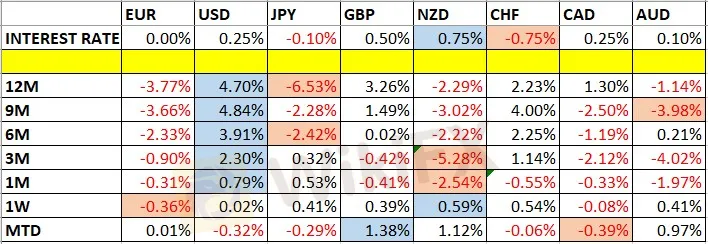

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast February 2022

For the month of February, I forecasted that the EUR/USD currency pair will fall in value. The performance to date of this forecast is as follows:

| Currency Pair | Forecast Direction | Interest Rate Differential | Performance to Date |

| EUR/USD | Short ↓ | +0.25% (0.25% - 0.00%) | -0.76% |

Weekly Forecast 20th February 2022

In my previous forecast last week, I made no weekly forecast. I again make no forecast this week.

The Forex market saw its level of directional volatility fall last week, with only 3% of all the important currency pairs or crosses moving by more than 1% in value. Directional volatility is likely to increase or remain the same over this coming week, especially if military conflict between Russia and Ukraine begins.

Last week was dominated by relative strength in the New Zealand Dollar, and relative weakness in the Euro, but the numbers were so small as to be negligible.

You can trade our forecasts in a real or demo Forex brokerage account.

Key Support/Resistance Levels for Popular Pairs

I teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

| Currency Pair | Key Support / Resistance Levels |

| AUD/USD | Support: 0.7157, 0.7082, 0.7006, 0.6963Resistance: 0.7191, 0.7293, 0.7321, 0.7344 |

| EUR/USD | Support: 1.1279, 1.1195, 1.1183, 1.1089Resistance: 1.1418, 1.1671, 1.1688, 1.1711 |

| GBP/USD | Support: 1.3458, 1.3401, 1.3375, 1.3340Resistance: 1.3664, 1.3769, 1.3852, 1.3898 |

| USD/JPY | Support: 114.80, 114.55, 114.23, 113.07Resistance: 115.34, 115.56, 115.71, 115.95 |

| AUD/JPY | Support: 82.41, 81.89, 80.79, 80.40Resistance: 84.35, 84.83, 84.96, 85.20 |

| EUR/JPY | Support: 130.00, 129.31, 128.30, 127.44Resistance: 131.16, 131.51, 131.91, 132.35 |

| USD/CAD | Support: 1.2645, 1.2535, 1.2498, 1.2372Resistance: 1.2812, 1.2901, 1.2959, 1.3025 |

| USD/CHF | Support: 0.9159, 0.9072, 0.9000, 0.8969Resistance: 0.9213, 0.9228, 0.9291, 0.9370 |

That is all for this week. You can trade my forecasts in a real or demo Forex brokerage account to test the strategies and strengthen your self-confidence before investing real funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

BaFin Issues Warning Against Clone Broker Exploiting Pepperstone's Identity

The German Federal Financial Supervisory Authority (BaFin) has recently flagged a fraudulent clone of the licensed retail FX and CFD broker Pepperstone. This fake entity, operating under the domain pepperstone.life, has been offering financial and investment services without obtaining the necessary regulatory authorisation.

TikTok: A Rising Hub for Investment Scams in Malaysia

The Royal Malaysian Police (PDRM) have raised concerns over the increasing use of TikTok by criminal syndicates to lure victims into investment scams.

Webull Canada Expands Trading Hours with Options Trading

Webull Canada now offers extended trading hours from 4 a.m. to 5:30 p.m. ET, plus options trading. Gain flexibility and manage risk in an ever-changing market.

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator