简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

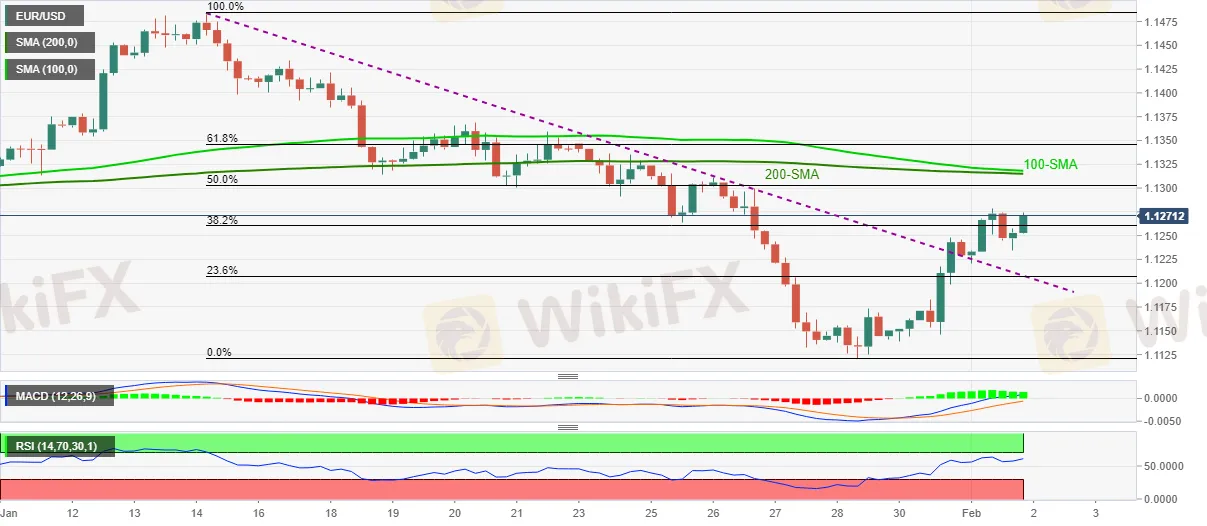

EUR/USD Price Analysis: Bulls eye 1.1315-20 resistance confluence

Abstract:EUR/USD remains on the front foot, carrying the early breakout of short-term descending trend line.

Upbeat MACD, firmer RSI adds to the bullish bias but a convergence of 200-SMA, 100-SMA will be the key.

Sellers will wait for downside break of 1.1200 for fresh entries.

EUR/USD grinds higher around the weekly top near 1.1270 following a three-day uptrend during the initial Asian session on Wednesday.

The major currency pair gained upside momentum after Mondays upside break of a three-week-old descending resistance line, now support around 1.1205.

The bullish bias then gained support from MACD and RSI to flirt with the 38.2% Fibonacci retracement (Fibo.) level of January 14-28 downside.

Its worth noting that the EUR/USD buyers aim for 50% Fibo. around 1.1300 as an immediate target during the further advances. However, a confluence of the 100-SMA and 200-SMA around 1.1315-20 will be a tough nut to crack for the pair bulls afterward.

Meanwhile, pullback moves remain elusive until staying beyond the resistance-turned-support and 23.6% Fibonacci retracement level near 1.1200.

Following that, the yearly low around 1.1120 and the 1.1100 threshold may lure EUR/USD bears ahead of the April 2020 peak surrounding 1.1020.

EUR/USD: Four-hour chart

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull Canada Expands Trading Hours with Options Trading

Webull Canada now offers extended trading hours from 4 a.m. to 5:30 p.m. ET, plus options trading. Gain flexibility and manage risk in an ever-changing market.

Webull and Others Fined $275,000 for Incomplete Suspicious Activity Reports

Webull Financial, alongside Lightspeed Financial Services Group and Paulson Investment Company, LLC, has agreed to pay a collective fine of $275,000 following an investigation by the US Securities and Exchange Commission (SEC). The penalty was issued due to the firms’ failure to include essential information in suspicious activity reports (SARs) over a four-year period.

Barclays Resolves £40M Fine Over 2008 Fundraising Disclosure Failures

Barclays has reached a settlement with the UK’s Financial Conduct Authority (FCA), agreeing to pay a £40 million fine for failing to adequately disclose arrangements with Qatari investors during its critical fundraising efforts amidst the 2008 financial crisis.

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

In the midst of rapid advancements and evolving landscapes in financial technology, financial regulation, and ensuring financial security, WikiGlobal stands at the forefront, closely tracking these transformative trends. As we embark on our series of exclusive interviews focusing on these pivotal areas, we are delighted to have had an in-depth conversation with.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator