简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

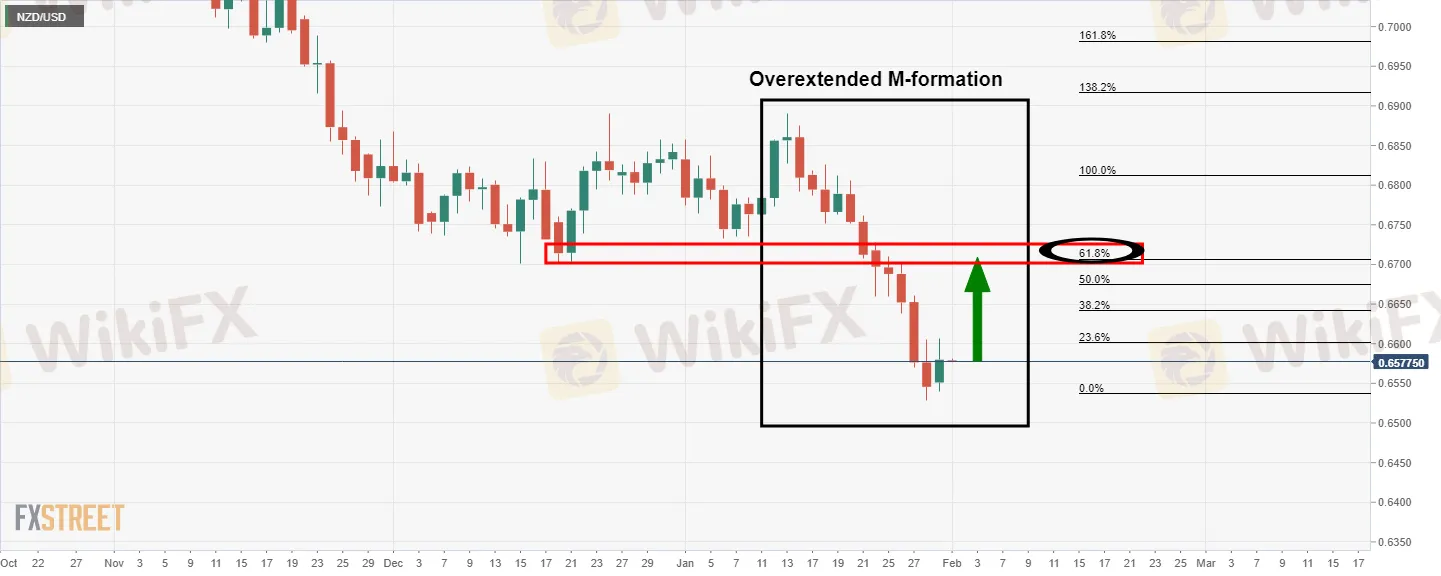

NZD/USD Price Analysis: Traders await RBA volatility to decipher the code in the market structure

Abstract:The M-formation is overextended, but it is a reversion pattern nevertheless and the price would be expected to correct towards the 61.8% Fibonacci retracement level over the course of the comings days.

NZD/USD traders await key events to take place this week.

The technical outlook is bullish while buyers move in to correct the dominant bearish trend.

It is quite out there in terms of volatility in Asia due to the holidays in the region. However, on a bigger scale, NZD/USD is poised for higher levels in its correction of the daily bearish trend as follows:

NZD/USD daily chart

However, given the number of critical events this week, including the Reserve Bank of Australia at the top of the hour, traders would be prudent to allow these to play out (the cause) in order to decipher the code within the market structures subsequent of the price action (the effect).

The RBA could be the catalyst, on a hawkish outcome, to send the kiwi on the coattails of a rally in the Aussie up to test the 38.2% Fibo near 0.6640 for the day ahead. From a 4-hour basis, the structure is ripe for a run to test the resistance on the way there:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

WikiEXPO Dubai 2024 is set to open!

4 Days Left

7 Days Left!WikiEXPO Dubai 2024 is about to make a stunning debut!

Seeing Diversity Trading Safely

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

Currency Calculator