简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Drops with Brent Eying $70, GBPUSD Muted on BoE - US Market Open

Abstract:Crude Oil Drops with Brent Eying $70, GBPUSD Muted on BoE - US Market Open

MARKET DEVELOPMENT – Crude Oil Drops with Brent Eying $70, GBPUSD Muted on BoE

市场发展 - 原油价格下跌,布伦特原油价格上涨70美元,英镑兑美元在英国央行疲惫不堪

DailyFX Q2 2019 FX Trading Forecasts

DailyFX Q2 2019年外汇交易预测

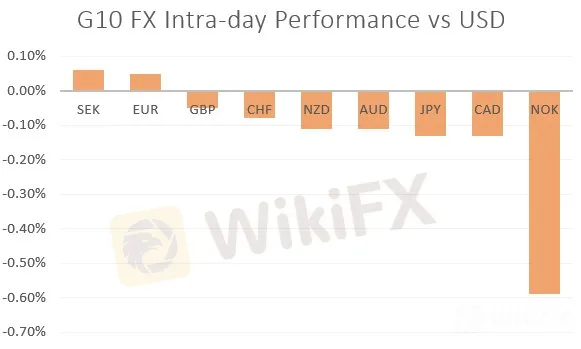

Crude Oil: Despite the increased risk premium for oil prices, stemming from the tensions in Venezuela, alongside the supply risks from falling Iranian oil exports with oil waivers now expired. Yesterday‘s bearish DoE report, which saw US crude production jump to a fresh record high, coupled with a sizeable inventory build has dampened sentiment in the energy complex with Brent eying a move to $70, while WTI hovers near Friday’s lows. Alongside this, softer equity prices have also kept oil prices on the backfoot after Feds Chair Powell noted that soft inflation is likely due to transitory factors. As such, commodity currencies (NOK, CAD, RUB) have been the notable laggard vs the greenback.

原油:尽管委内瑞拉的紧张局势导致油价风险溢价上升,随着石油豁免导致伊朗石油出口下降的供应风险已经到期。昨日看跌的美国能源部报告显示,美国原油产量跃升至历史新高,加上相当大的库存增加打压了能源综合体的情绪,布伦特原油价格上涨至70美元,而WTI徘徊在周五的低点附近。除此之外,在Feds Chair Powell指出软通胀可能是由于短暂因素引起的,股市价格走软也使得油价继续处于后脚。因此,商品货币(NOK,CAD,RUB)显着落后于美元。

GBPUSD: Today‘s so-called super Thursday BoE QIR, was far from with GBP seeing an overall muted impact to the release. The BoE had upgraded their near-term growth and inflation forecasts; however, the bank rate projection had actually been downgraded in the longer term, thus dampening the initial rise in the Pound. Alongside this, while the BoE attempted to sound hawkish, the fact of the matter remains the same. The BoE’s hands are tied until we see clarity over Brexit, thus the recent extension to the end of October, limits the possibility that we will see a rate hike this year.

英镑兑美元:今天所谓的超级周四英国央行QIR,远非如此英镑对发布的整体影响较小。英国央行已上调近期增长和通胀预测;然而,从长期来看,银行利率预测实际上已被降级,从而抑制了英镑的初始上涨。除此之外,虽然英国央行试图发出强硬态度,但事实仍然如此。在我们看到英国退欧的清晰度之前,英国央行的手是紧张的,因此最近延长到10月底,限制了我们今年加息的可能性。

EURUSD: Yesterday‘s less dovish FOMC meeting saw the Euro drop back towards the 1.12 handle, having hit highs of 1.1260. This mornings, Eurozone PMI figures had been somewhat encouraging, from the likes of Spain, France and Greece. However, the initial optimism had been dampened by Germany’s manufacturing PMI report, which yet again disappointed expectations. Eyes now turn towards tomorrows EZ CPI report and given the lift in German prices, risks are tilted to the upside.

欧元兑美元:昨天不太温和的联邦公开市场委员会会议看到欧元回落至1.12关口,触及高点1.1260。今天上午,欧元区采购经理人指数的数据在西班牙,法国和希腊等国家都有所鼓舞。然而,最初的乐观情绪受到了德国制造业PMI报告的打击,该报告再次令人失望。现在眼睛转向明天EZ CPI报告,并且鉴于德国价格上涨,风险倾向于上行。

Source: Thomson Reuters, DailyFX

来源:汤森路透,DailyFX

DailyFX Economic Calendar: – North American Releases

DailyFX经济日历: - 北美发布

{7}

IG Client Sentiment

{7}

How to use IG Client Sentiment to Improve Your Trading

如何使用IG客户端情绪来改善交易

WHATS DRIVING MARKETS TODAY

今天的推动市场

“FTSE Trying to Gain a Footing at Trend Support on BoE Day” by Paul Robinson, Currency Strategist

“FTSE试图在BoE日获得趋势支持”,货币策略师Paul Robinson

“Litecoin (LTC) Price - Setting Up for Another Spike Move?” by Nick Cawley, Market Analyst

“Litecoin(LTC)价格 - 为另一个人设立Spike Move?”作者:市场分析师Nick Cawley

“GBP Technical Analysis Overview: GBPUSD, EURGBP” by Justin McQueen, Market Analyst

“技术分析概述:GBPUSD,EURGBP”作者:Justin McQueen,市场分析师

“Bank of England Leaves Rates Unchanged, GBP Price Volatile” by Martin Essex, MSTA , Analyst and Editor

“英格兰银行保持利率不变,英镑价格波动”,作者:Martin Essex,MSTA,分析师和编辑

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

“使用外汇有效交易IG的全球市场主题”作者:Tyler Yell,CMT,外汇交易指导员

--- Written by Justin McQueen, Market Analyst

- - 由市场分析师Justin McQueen撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator