Score

FNB

India|5-10 years|

India|5-10 years| https://www.fnb.co.za

Website

Rating Index

Influence

Influence

AAA

Influence index NO.1

South Africa 9.77

South Africa 9.77Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

India

IndiaUsers who viewed FNB also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

fnb.co.za

Server Location

South Africa

Website Domain Name

fnb.co.za

Website

HTTP://CO.ZA/CGI-BIN/WHOIS.SH

Company

UNIFORUM ASSOCIATION

Server IP

196.11.125.167

Company Summary

| Aspects | Information |

| Company Name | FNB |

| Registered Country/Area | South Africa |

| Founded Year | 2015 |

| Regulation | Not regulated |

| Market Instruments | Credit cards, SIM cards, e-wallets, Petro Card, private banking, savings, investments, loans, insurance, forex solutions, etc. |

| Account Types | Shares Zero, Share Saver, Share Builder, Share Investor, Tax-free Shares, Local Trader, Global Trader |

| Spreads | Starting from 0 |

| Trading Platforms | Online banking platform, FNB App on smartphones |

| Customer Support | Phone: 0875759404, Email: info@fnb.co.za, Live chat |

| Deposit & Withdrawal | FNB Pay, Partner Wallets (Google Wallet, Apple Pay, etc.) |

Overview of FNB

FNB, founded in 2015 in South Africa, operates as a versatile financial institution offering a range of market instruments, including credit cards, e-wallets, private banking, and forex solutions.

Despite providing a broad array of account types like Shares Zero and Global Trader, FNB lacks regulation, posing potential risks for users. The bank's advantage lies in its comprehensive services, but drawbacks include the absence of regulatory oversight. FNB has grown into a prominent financial player, emphasizing convenience through online banking and smartphone apps for trading activities.

Is FNB legit or a scam?

FNB operates without regulation from any supervisory authority, prompting potential issues regarding the exchange's transparency and oversight. Unregulated platforms lack the safeguards and legal protections provided by regulatory bodies, increasing the risk of fraud, market manipulation, and security breaches.

The absence of proper regulation will pose challenges for users seeking recourse or dispute resolution. Furthermore, the lack of regulatory oversight contributes to a less transparent trading environment, making it challenging for users to evaluate the exchange's legitimacy and reliability.

Pros and Cons

| Pros | Cons |

| Diverse account options | Not regulated |

| Advanced digital tools | Customer service responsiveness varies |

| Convenient online banking | Not available in some countries or regions |

| Easy-to-use platform | Limited educational Resources |

Pros:

Diverse Account Options:

FNB offers a wide array of account options, allowing customers to choose accounts that align with their specific financial needs and preferences.

Advanced Digital Tools:

The bank provides advanced digital tools, enhancing the overall banking experience for users. These tools include online and mobile banking features, facilitating convenient and efficient financial management.

Convenient Online Banking:

FNB's online banking platform is user-friendly and offers convenience for customers to manage their accounts, conduct transactions, and access various banking services from the comfort of their homes

Wide Range of Financial Products:

FNB provides a comprehensive range of financial products, catering to different needs such as savings, investments, loans, and insurance, offering customers a one-stop solution for their financial requirements.

Cons:

Not Regulated:

One notable drawback is that FNB is not regulated. Regulatory oversight is crucial for ensuring adherence to industry standards and protecting the interests of customers.

Customer Service Responsiveness Varies:

The responsiveness of FNB's customer service varies. Some customers may experience prompt and efficient service, while others will face delays or challenges in obtaining assistance.

Not Available in Some Countries or Regions:

FNB's services are not available in some countries or regions, limiting accessibility for customers who require international banking services.

Limited Educational Resources:

FNB's educational resources are relatively limited. Customers seeking extensive educational materials or guidance on financial matters will find the bank lacking in this aspect. Additional resources could contribute to a more informed customer base.

Market Instruments

FNB provides a wide array of financial products and services, showcasing a wide range of offerings. Among the advertised assets, customers can find various credit cards, SIM cards, e-wallets, and the Petro Card. The platform extends its services beyond traditional banking, encompassing private banking, savings and investments, financial planning, loans, insurance, and forex solutions, among others.

In addition to conventional banking services, FNB presents a comprehensive suite of financial instruments and tools. The inclusion of forex solutions reflects a commitment to the needs of users engaged in foreign exchange activities. This broad range of offerings meet the multifaceted requirements of individuals and businesses, providing a one-stop platform for financial needs. However, users should carefully assess the specific terms and conditions associated with each product and service to make informed decisions based on their financial goals and preferences.

Account Types

Shares Zero:

The Shares Zero account offered by FNB is characterized by zero monthly fees, providing investors with exposure to top-listed shares, both locally and globally. This account type is suitable for cost-conscious investors who seek a fee-minimizing approach while diversifying their portfolio across various markets.

Share Saver:

For those seeking an affordable investment option, the Share Saver account allows investors to start with as little as R300. The account offers a hands-off approach, where FNB makes investment decisions on behalf of the investor. This account is suitable for individuals who prefer a more automated and cost-effective investment strategy.

Share Builder:

The Share Builder account provides investors with the flexibility to choose from a pre-selected basket of shares and invest in Krugerrands. It serves those who want a balance between control over their investment choices and the simplicity of a pre-constructed portfolio

Share Investor:

Designed for investors who wish to quickly seize market opportunities, the Share Investor account allows users to invest in the full range of JSE listed shares. This account type is ideal for individuals who actively manage their portfolios and seek a comprehensive array of investment options within the local market.

Tax-free Shares:

The Tax-free Shares account enables investors to start their journey with a minimum investment of R300 per month. All returns generated from this account are tax-free, making it suitable for individuals who prioritize tax efficiency in their investment strategy.

Local Trader:

The Local Trader account is tailored for individuals who actively engage in trading activities. It equips users with trading tools and market research, enabling them to make informed decisions while keeping up to date with market trends.

Global Trader:

For investors looking to diversify their portfolio globally, the Global Trader account allows investment in 30+ global exchanges, with the flexibility to trade in one of three major currencies. This account type serves individuals seeking international exposure and the ability to trade across various global markets.

How to Open an Account?

Visit the FNB Website:

Access the official FNB website using a web browser.

Choose “Open an Account”:

Navigate to the account section on the website.

Select the option to “Open an Account.”

Select Account Type:

Choose the specific type of account you wish to open.

FNB typically offers a variety of accounts, such as savings, checking, or specialized accounts.

Complete Online Application:

Fill out the online application form with accurate personal information.

Provide the required details, including your name, contact information, and any other information as prompted.

Submit Documentation:

Upload the necessary identification documents as specified by FNB.

This includes proof of identity, proof of address, and other relevant documents.

Verification and Confirmation:

Wait for FNB to review your application and verify the provided information.

Upon successful verification, you will receive confirmation of your new account along with any additional instructions.

Spreads & Commissions

The Spreads & Commissions at this financial institution serves various trading preferences. The Shares Zero account stands out with zero monthly fees, making it appealing to cost-conscious investors.

For an affordable option, the Share Saver account allows an entry point as low as R300, appealing to those who prefer automated and cost-effective investing.

Share Builder provides flexibility for investors to choose from a pre-selected basket of shares, suitable for those seeking a balance between control and simplicity.

Share Investor allows swift capitalization on market opportunities, appealing to individuals actively managing their portfolios within the local market.

The Tax-free Shares account, starting at R300 per month, prioritizes tax efficiency in investment strategy.

Tailored for active traders, Local Trader equips users with tools for informed decision-making.

For global diversification, Global Trader enables investment in 30+ global exchanges, appealing to those seeking international exposure. The choice depends on investor preferences, risk tolerance, and desired involvement in portfolio management.

Trading Platform

FNB provides a digital platform for online banking and transactions, offering users the convenience of making global payments and receiving funds from abroad. The online banking platform allows users to initiate global payments by logging in, navigating to the 'Forex' tab, and selecting 'Global Payments.' Users can choose between a 'Once-off Global Payment' for a single or first-time payment and 'Recipients' for repeat payments. The process involves providing transaction details, selecting a reason (BoP code) for the payment, and following on-screen prompts to complete the transaction.

Similarly, the FNB App on smartphones facilitates global payments and receipts. Users can log in, access the 'Forex' tab, and select 'Global Payments' for outgoing transactions or 'Global Receipts' for incoming funds. The app provides options for both one-time and repeat payments, requiring users to input transaction details and select a reason (BoP code) for the payment. The screen prompts guide users through the process to ensure completion.

Deposit & Withdrawal

FNB Pay:

FNB Pay, the digital payment solution offered by FNB, provides users with a convenient and secure method to make payments using their smartphones. The platform supports various payment methods, allowing users to link their FNB accounts to the FNB Pay service. Payment fees associated with FNB Pay are typically aligned with the standard charges for transactions within the FNB ecosystem.

Partner Wallets:

FNB facilitates payments through partner wallets, offering users the flexibility to utilize external digital wallets for transactions. The platform collaborates with various third-party digital wallet(Google Wallet, Apple Pay,etc) providers, allowing users to link their preferred wallet to their FNB account.

Customer Support

FNB provides accessible customer support through multiple channels, including telephone contact at 0875759404, email assistance via info@fnb.co.za, and real-time support through live chat. Users can conveniently seek help or clarification on various queries, ensuring a responsive and comprehensive customer service experience. The availability of these communication channels demonstrates FNB's commitment to addressing customer needs promptly and facilitating effective communication for account-related inquiries or assistance with their financial services.

Conclusion

In conclusion, FNB presents a multifaceted banking experience with a robust set of advantages. Its extensive ATM network, account options, and advanced digital tools contribute to a convenient and comprehensive banking environment. The bank's commitment to providing a range of financial products, from accounts to various services, adds value for customers seeking a holistic financial solution.

However, the absence of regulatory oversight and the variability in customer service responsiveness present challenges. Furthermore, limited availability in certain regions and a lack of extensive educational resources may hinder the bank's accessibility and support for customers seeking in-depth financial guidance.

FAQs

Q: What is FNB's ATM network like?

A: FNB boasts an extensive ATM network, providing convenient access to cash withdrawal and banking services across various locations.

Q: Are there various account options available?

A: Yes, FNB offers a wide array of account options, allowing customers to choose accounts that align with their specific financial needs and preferences.

Q: What digital tools does FNB provide?

A: FNB offers advanced digital tools, enhancing the overall banking experience with features such as online and mobile banking for efficient financial management.

Q: How convenient is FNB's online banking?

A: FNB's online banking platform is user-friendly, providing customers with convenience to manage accounts, conduct transactions, and access various banking services from home.

Q: Does FNB offer a range of financial products?

A: Yes, FNB provides a comprehensive range of financial products, including savings, investments, loans, and insurance.

Q: Is FNB regulated?

A: No, FNB is not regulated, which will pose challenges as regulatory oversight is crucial for ensuring adherence to industry standards and protecting customer interests.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Global Business

- High potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX5944873722

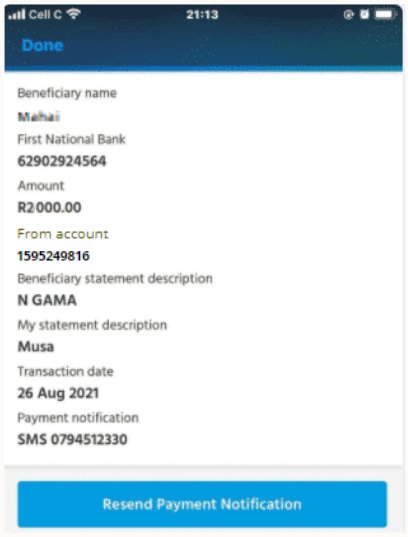

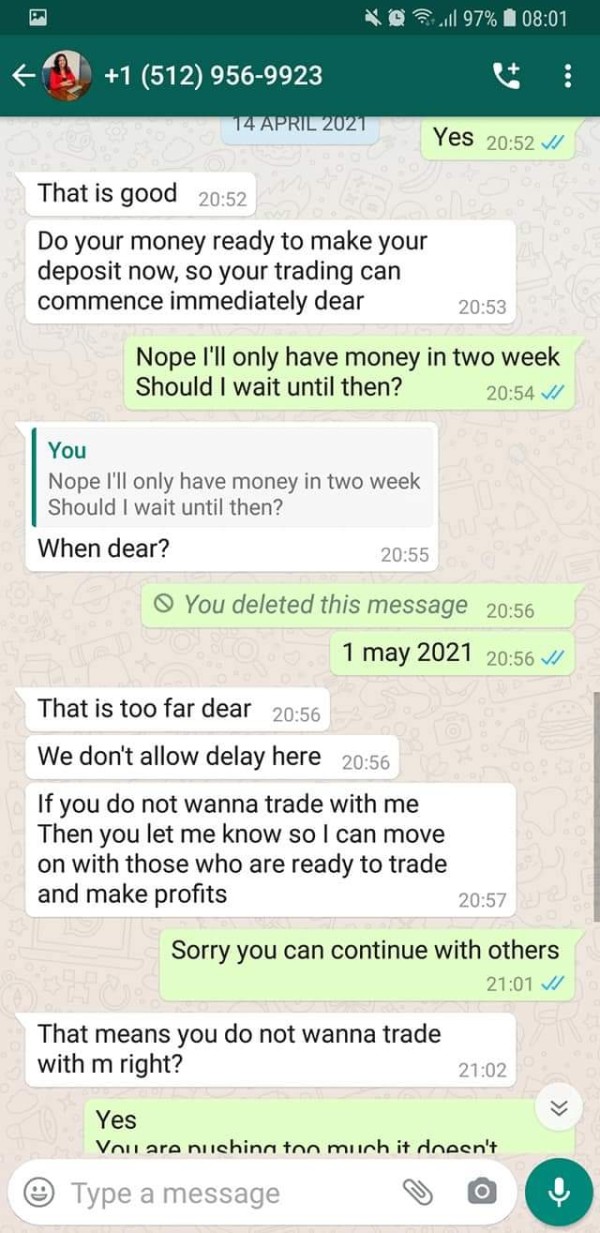

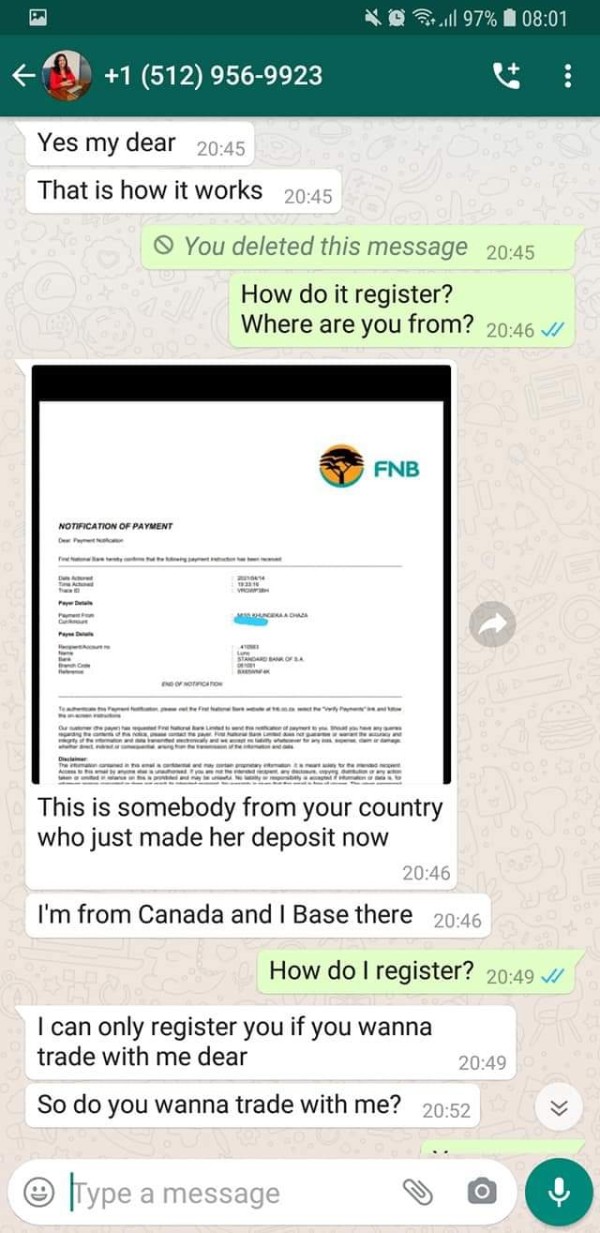

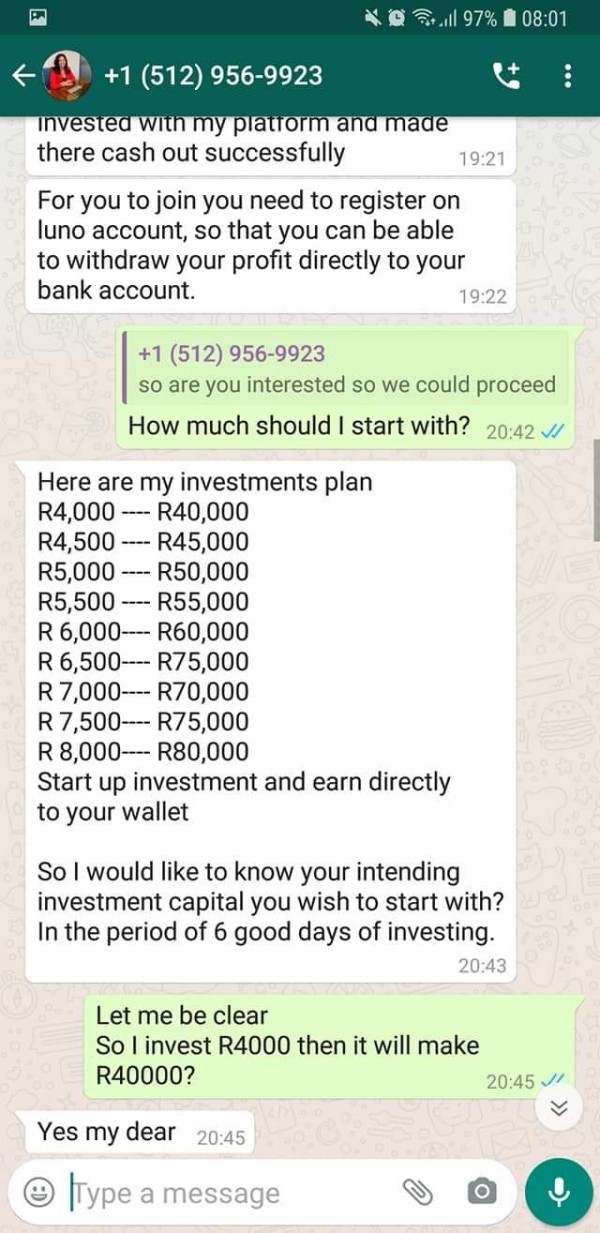

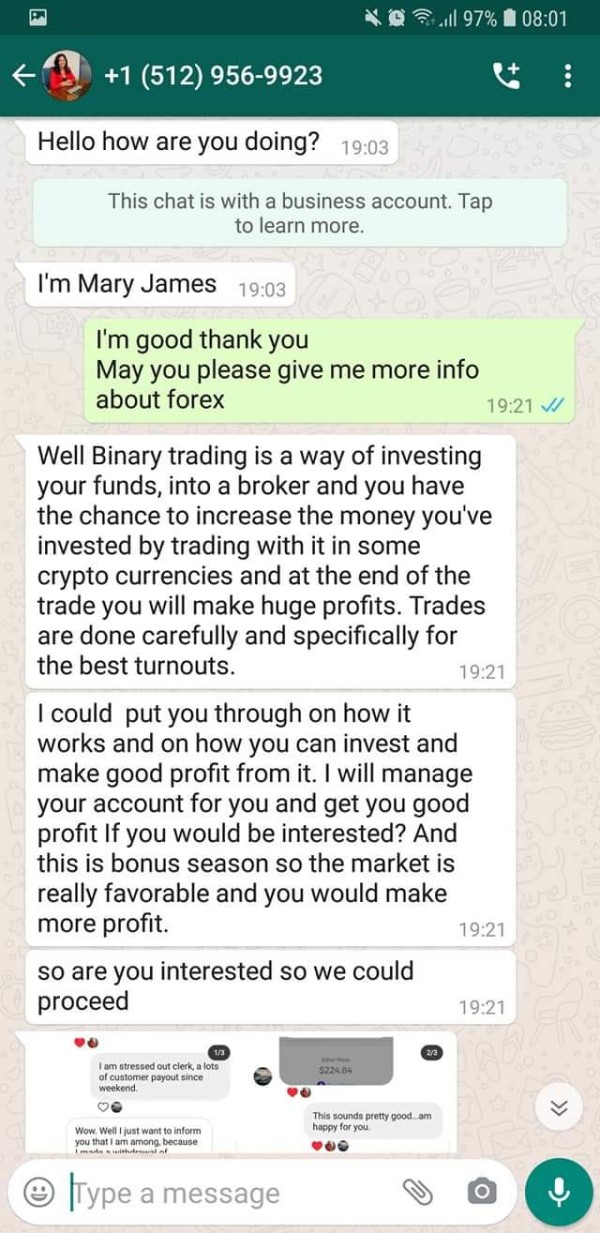

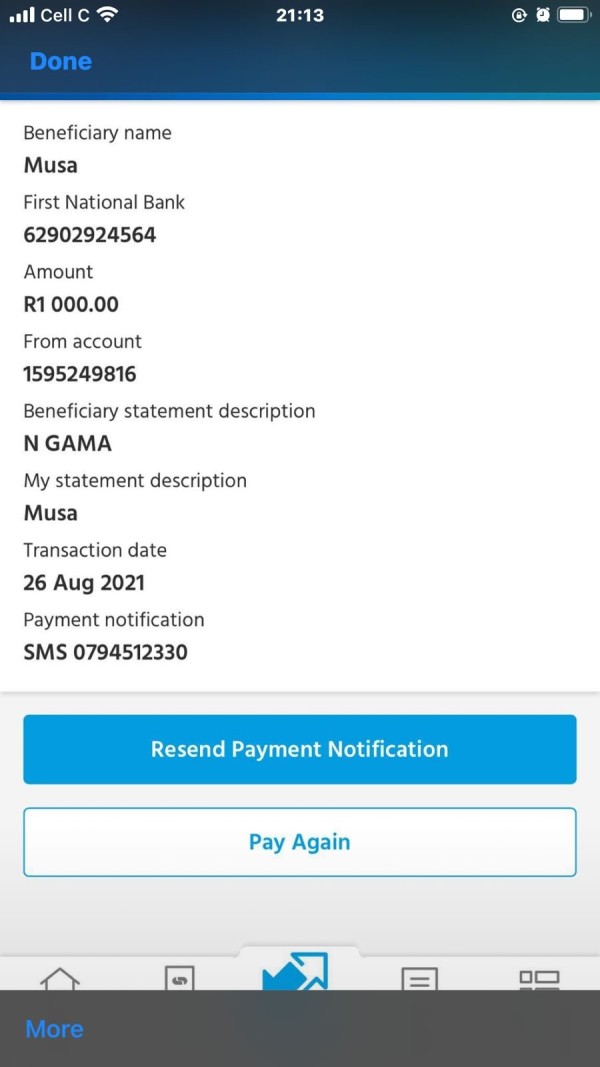

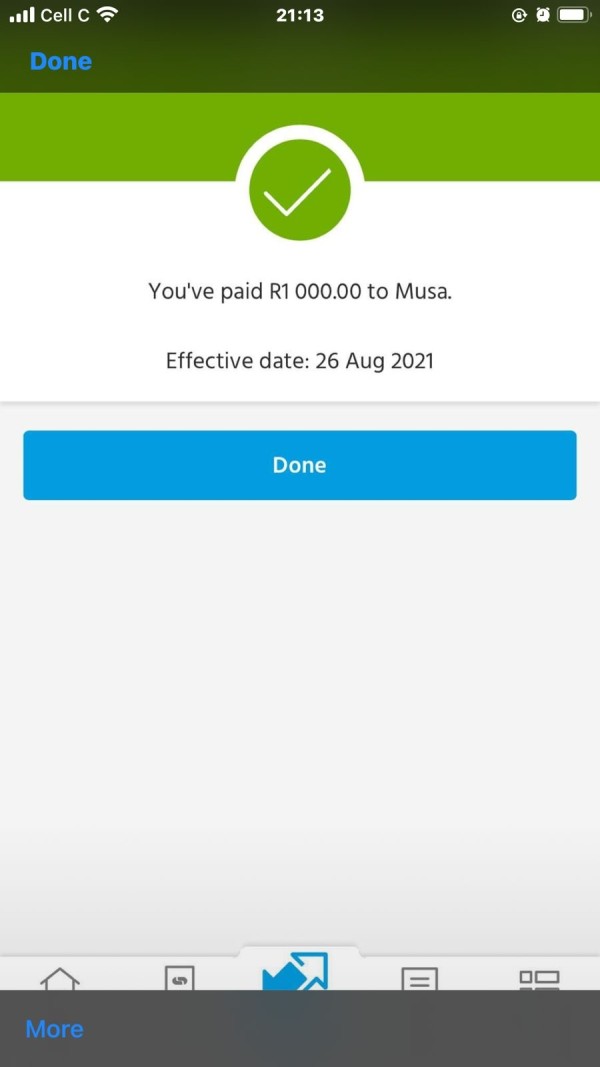

Malaysia

I was scammed and blocked. Here was my evidence of payment.

Exposure

2021-09-22

Andy loh

Malaysia

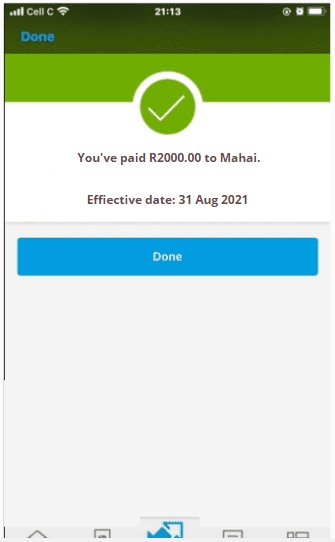

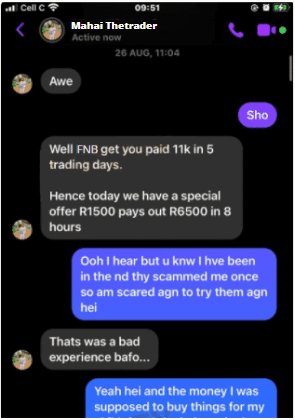

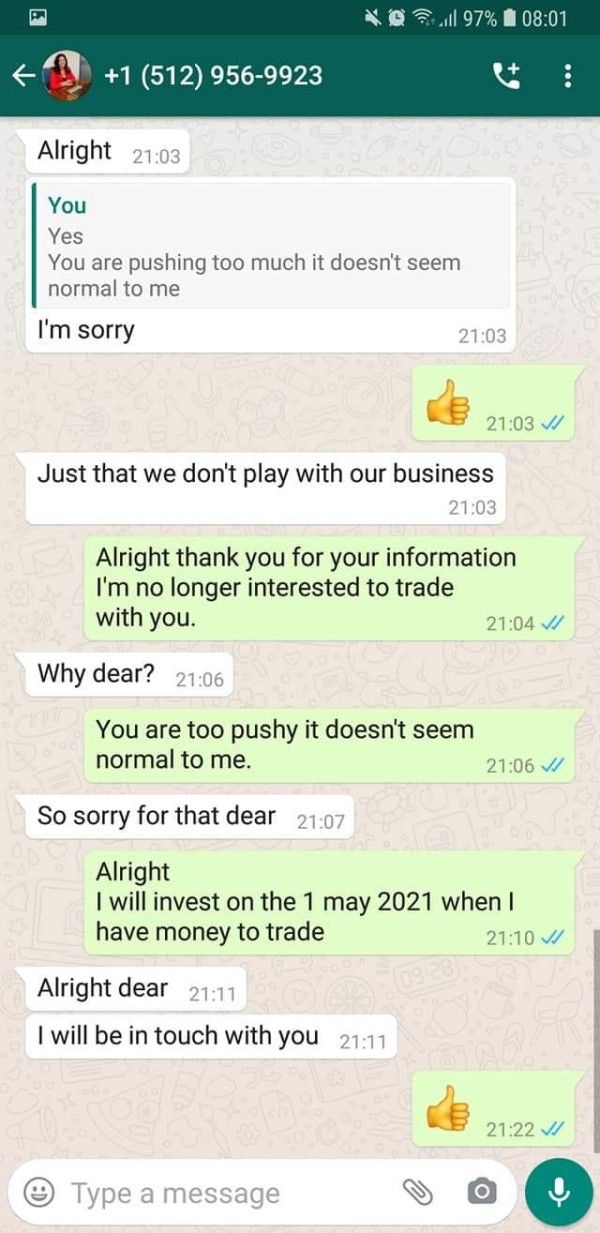

I was scammed by a person called mahai thetrader he told me he is a FNB trader and I can earn 6500 in a day in need to pay 3500 but I told him that I don’t have that money .I only have 2000 rand then he decided to tell me that it fine then he told me that the money will reflect tomorrow .but after i tranfer the money to him Mahai just doesn't answer me anymore.

Exposure

2021-09-14

terongbiru

Malaysia

Big scammer , this woman from this broker has scam me. i will take a legal action for thisbcase. wait for my lawyer

Exposure

2021-09-07

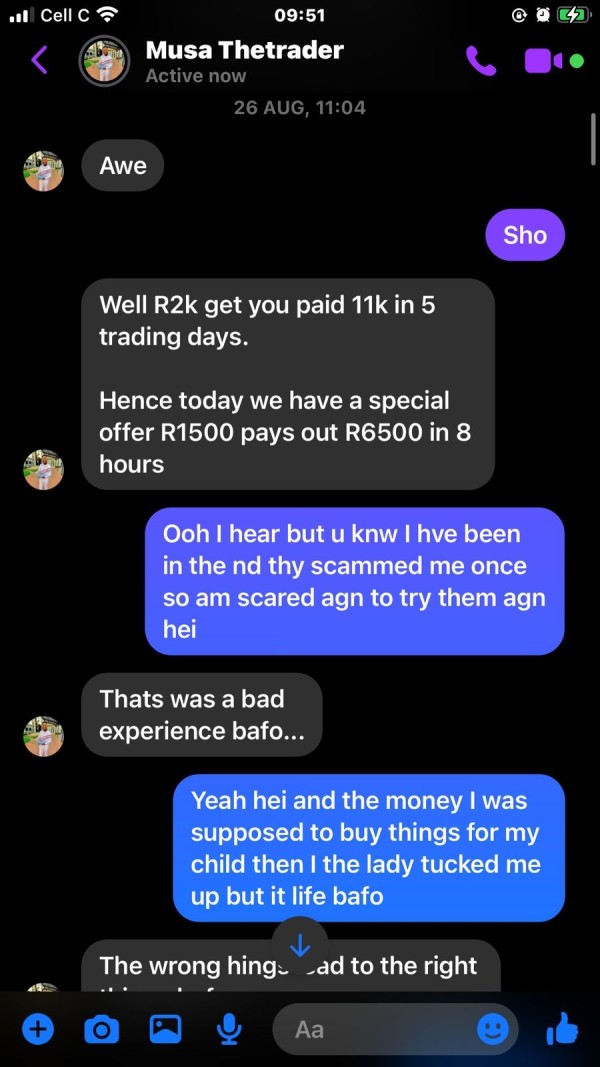

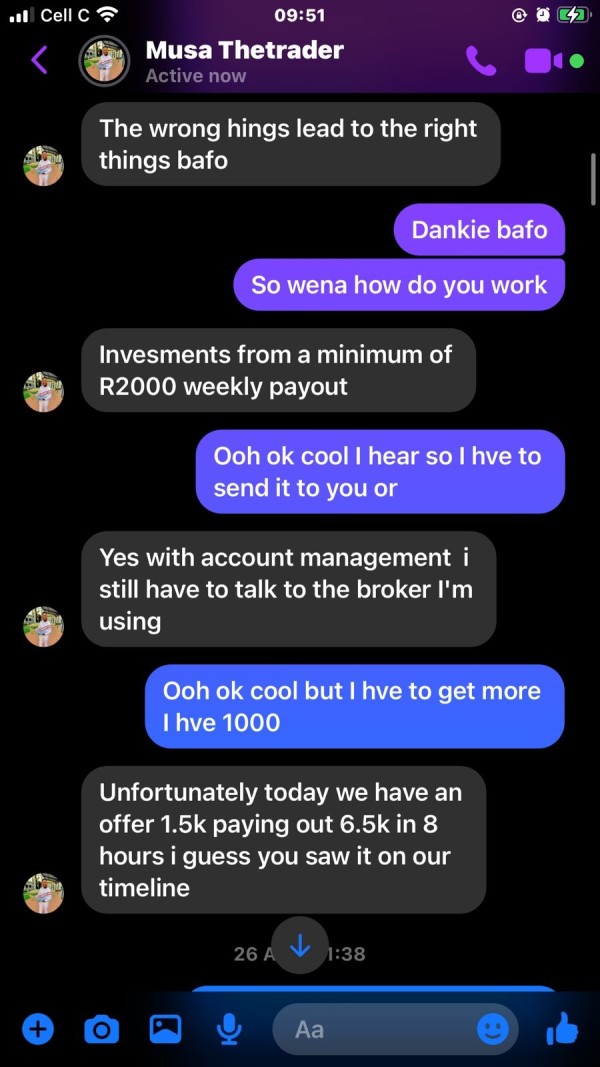

FX3771580176

South Africa

I was scammed by a person called musa thetrader he told me that I can earn 6500 in a day in need to pay 1500 but I told him that I don’t hve that money I have 1000 rand then he decided to tell me that it fine then he told me that the money will reflect tomorrow around 4pm but I am still waiting for it to reflect. Musa just doesn't answer me anymore.

Exposure

2021-08-31

书怀

New Zealand

I recently visited the FNB website to gather information about their services, but was disappointed by the lack of content. As a potential customer, I was hoping to find more detailed information about their offerings, but most of what I found was quite general. Overall, I have no much interest of trading here.

Neutral

2023-03-23

...88414

Ecuador

The content of this website looks very crowded, which makes people not want to look at it seriously. What's more, this company does not have any regulatory license, and is most likely a liar who is not even willing to seriously build their own website.

Neutral

2022-12-05