Score

VFX Financial

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.vfxfinancial.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

+44 (0)20 7959 6900

+1 (416) 613 0260

Other ways of contact

Broker Information

More

VFX Financial PLC

VFX Financial

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 900530)Payment services Non-Forex License. Please be aware of the risk!

WikiFX Verification

Users who viewed VFX Financial also viewed..

XM

VT Markets

FXCM

Decode Global

VFX Financial · Company Summary

| Aspect | Information |

| Company Name | VFX Financial |

| Registered Country/Area | United Kingdom |

| Years | 5-10 years |

| Regulation | FCA (exceeded) |

| Services | FX Risk Management, Treasury management, Trading Support, International payments, Overseas property, and Charities and NGOs |

| Trading and Payment solutions | Forward Contracts, Spot Contracts, Market Orders, Trading Alerts, and Structured Products |

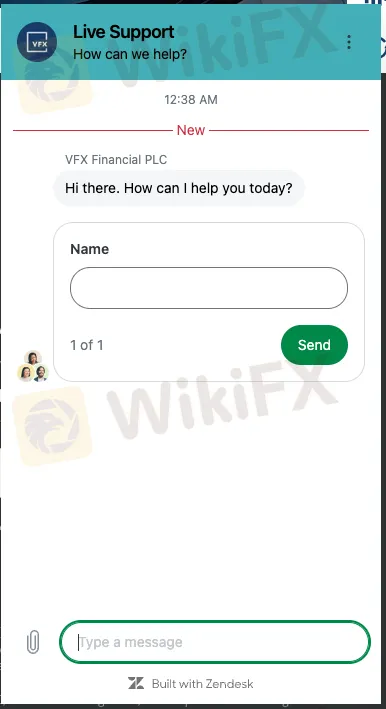

| Customer Support | Tel: LONDON +44 (0) 20 7959 6900 and CANADA +1 (416) 613 0260, Ticket, and Livechat |

Overview of VFX Financial

VFX Financial, a company based in the United Kingdom, has been operating for 5-10 years and was regulated by the Financial Conduct Authority (FCA). Offering a range of services, VFX Financial specializes in FX Risk Management, Treasury Management, Trading Support, International payments, Overseas property, and services applied to Charities and NGOs.

Additionally, VFX Financial provides innovative trading and payment solutions, including Forward Contracts, Spot Contracts, Market Orders, Trading Alerts, and Structured Products. To ensure comprehensive customer support, the company offers various channels such as telephone support with dedicated numbers for London and Canada, a ticketing system, and live chat functionality.

Regulatory Status

VFX Financial, which was regulated by the Financial Conduct Authority (FCA) in the United Kingdom, holds a Payment License under license number 900530. The regulatory status of VFX Financial is listed as “Exceeded”.

VFX Financial PLC, as a licensed institution, operates under the supervision and oversight of the FCA, ensuring compliance with financial regulations. The effective date of its regulatory status is June 12, 2018.

Pros and Cons

| Pros | Cons |

| A range of services offered | Lack of regulatory oversight for services exceeding the FCA license |

| Innovative trading and payment solutions | Limited transparency regarding company operations and practices |

| Comprehensive customer support | Potential for fraudulent activities or scams due to lack of regulation |

Pros:

A range of services offered: VFX Financial offers a wide array of financial services, for various client needs, including FX Risk Management, Treasury management, and International payments, among others.

Innovative trading and payment solutions: The company provides innovative solutions such as Forward Contracts, Spot Contracts, and Market Orders, offering clients flexibility and control over their currency transactions.

Comprehensive customer support: VFX Financial offers multiple customer support channels, including telephone support, ticketing system, and live chat, ensuring clients can access assistance when needed.

Cons:

Lack of regulatory oversight for services exceeding the FCA license: While the company is regulated by the FCA, services exceeding the FCA license may lack regulatory oversight, potentially exposing clients to risks.

Limited transparency regarding company operations and practices: There may be limited transparency regarding how VFX Financial operates, which can be concerning for some clients.

Potential for fraudulent activities or scams: The absence of regulation for certain services could increase the risk of encountering fraudulent activities or scams.

Services

VFX Financial offers a comprehensive suite of services to meet various financial needs:

FX Risk Management: VFX's experienced account managers provide tailored strategies to help clients effectively manage currency fluctuation risk in Foreign Exchange trading. With access to a range of hedging tools and daily market reports, clients can stay informed and mitigate FX risks across over 200 currencies.

Treasury Management: Clients benefit from access to a wide range of currencies, trading strategies, and global liquidity for efficient currency asset planning and organization. VFX's Global Banking Network facilitates quick fund transfers, minimizing costs by avoiding delays and additional fees.

Trading Support: VFX simplifies the trading process with friendly account managers available to assist clients. Specialist FX brokers monitor markets closely and offer services such as limiting orders, executing trades on behalf of clients, and providing options to trade online, by phone, or by email.

International Payments: The international payments service enables easy management of foreign currency payments and receipts in over 63 currencies to over 200 countries. As a member of SWIFT, VFX ensures fast and secure fund transfers with timely processing and email notifications.

Overseas Property: VFX protects clients from exchange rate fluctuation risks and saves on property transactions by delivering time-critical funds to banks or solicitors promptly.

Charities and NGOs: VFX assists in project planning and budgeting for charities and NGOs, offering tighter spreads and deep liquidity in exotic currencies, particularly in African markets. With reliable distribution and disbursement capabilities, VFX ensures transparent and timely funds delivery for comprehensive transaction reporting.

How to Open an Account?

Opening an account with VFX Financial is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the VFX Financial website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: VFX Financial offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the VFX Financial trading platform and start making trades.

Trading and Payment Solutions

VFX Financial offers comprehensive trading and payment solutions designed to meet the needs of businesses and individuals navigating the foreign exchange market.

Forward Contracts provide a proactive approach to managing currency risk by allowing users to secure a competitive exchange rate for future transactions, up to three years in advance. This enables clients to lock in favorable rates today, mitigating the impact of currency fluctuations on future settlements.

Spot Contracts are ideal for immediate currency payments, securing funds at a fixed rate for delivery within two business days. This solution ensures the timely and efficient execution of transactions, providing certainty and stability in volatile market conditions.

Market Orders empower users to set target rates and automatically execute trades when those rates are achieved. Additionally, clients receive pre-advice notifications, keeping them informed even outside of regular trading hours.

Trading Alerts offers real-time notifications via SMS or email when target rates are available, allowing clients to capitalize on favorable market conditions. Confirmations are generated upon order fulfillment and currency crediting, ensuring transparency and accountability throughout the process.

Structured Products provide enhanced flexibility compared to Forward Contracts, offering FX derivatives that mitigate adverse currency fluctuations while enabling clients to capitalize on positive market movements. This innovative solution combines risk management with market opportunity, optimizing outcomes for clients.

VFX Financial APP

VFX Financial provides a convenient mobile app accessible on both iOS and Android devices, empowering users to manage their accounts and finances efficiently while on the move. To download the app, simply navigate to the App Store for iOS or Google Play Store for Android, search for “VFX Financial,” and follow the installation instructions.

The mobile app offers several advantages over the website.

Firstly, it ensures accessibility anytime, anywhere, as long as users have an internet connection. This flexibility allows for the smooth management of accounts and transactions on the go.

Secondly, the app boasts an optimized user interface tailored for mobile devices, enhancing the overall user experience with intuitive navigation and streamlined functionality.

Additionally, users can benefit from push notifications, receiving real-time alerts for account updates, transactions, and market news directly on their mobile devices.

Customer Support

VFX Financial offers robust customer support through various channels to ensure assistance for its clients.

Telephone Support: Clients can reach out to VFX Financial's dedicated support teams via telephone. Contact numbers are provided for different regions, including London at +44 (0) 20 7959 6900 and Canada at +1 (416) 613 0260. Experienced representatives are available to address inquiries and provide assistance during business hours.

Ticket System: VFX Financial employs a ticketing system to streamline communication and address client queries promptly. Through this system, clients can submit their questions or concerns online, receiving efficient responses from the support team.

Live Chat: For immediate assistance and real-time support, clients have access to live chat functionality on the VFX Financial website. This feature allows users to engage with customer support representatives instantly, facilitating quick resolution of issues or inquiries.

Conclusion

In summary, VFX Financial provides various services and innovative solutions with comprehensive customer support. However, there are risks due to the lack of regulatory oversight beyond the FCA license, limited transparency, and the potential for fraud. It's important to be cautious when dealing with unregulated aspects of the company.

FAQs

Q: How is VFX Financial different from other brokers?

A: They offer premium exchange rates, premier service, groundbreaking technology, and online trading.

Q: Does it take longer to buy through a broker than a bank?

A: No. As soon as funds reach a client account, they are automatically sent by international transfer known as SWIFT. It can take as little as a few minutes to deliver funds to an account depending on the destination country.

Q: How quickly can I trade?

A: Your trading account can be activated within minutes of receipt of your completed documentation and VFX Financial authorization.

Q: What is a spot transaction?

A: A spot transaction is an agreement to buy or sell a currency to be delivered and settled usually within two working days, as per the value or settlement date agreed.

Q: Is it important I obtain a commercial rate?

A: Yes, very important; it is always beneficial to look beyond your bank and obtain exchange rates from an external supplier in order to make comparisons. You have nothing to lose by doing this.

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now