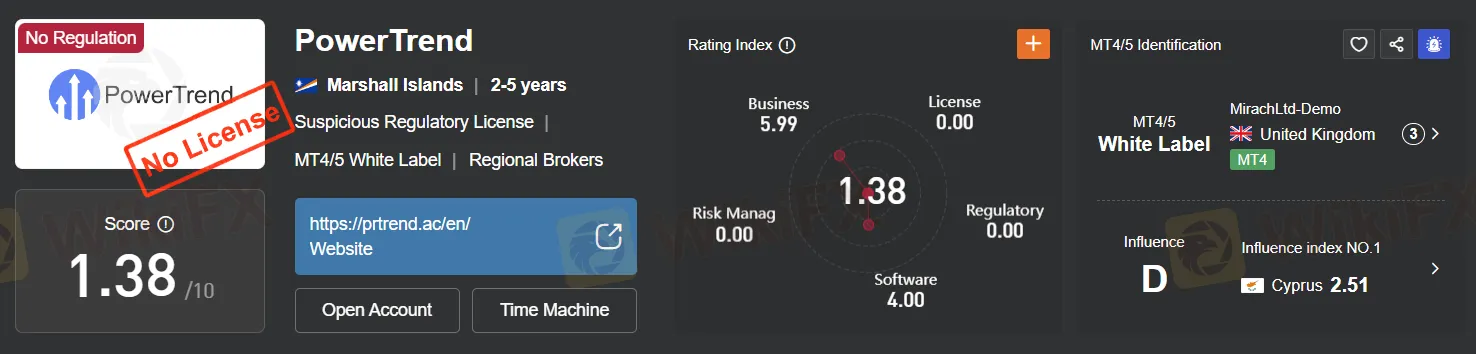

Score

PowerTrend

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://prtrend.ac/en/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Cyprus 2.51

Cyprus 2.51Surpassed 14.50% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 2037694835

+7 9651435984

Other ways of contact

Broker Information

More

Mirach Ltd

PowerTrend

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $500 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.1 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $5,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.1 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $10,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.5 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $ 35,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 1.5 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed PowerTrend also viewed..

XM

GTCFX

Neex

Vantage

PowerTrend · Company Summary

| Aspect | Information |

| Registered Country/Area | Marshall Islands |

| Company Name | PowerTrend |

| Regulation | Unregulated |

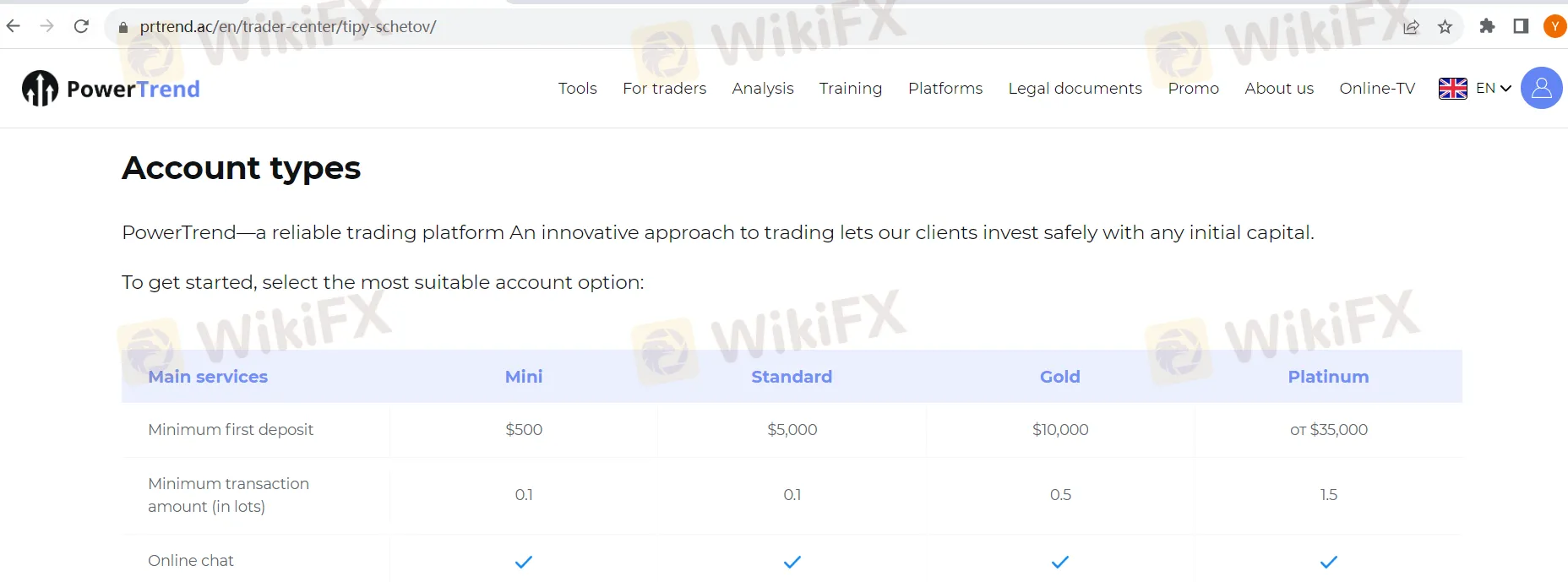

| Minimum Deposit | $500 (Mini), $5,000 (Standard), $10,000 (Gold), $35,000 (Platinum) |

| Maximum Leverage | High Leverage (Specific leverage ratio not provided) |

| Spreads | Varying spreads across different account types |

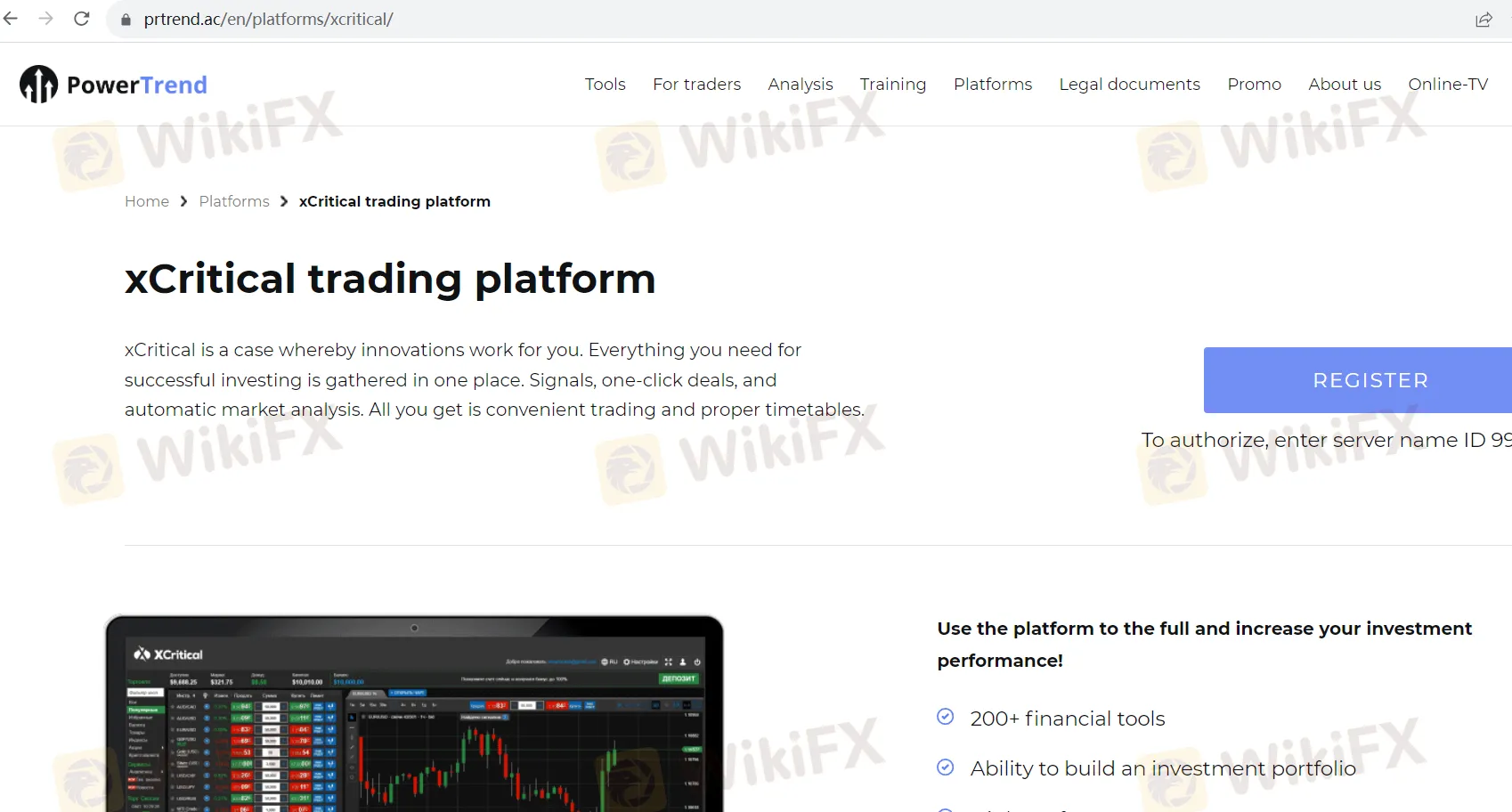

| Trading Platforms | xCritical (Mobile trading platform) |

| Tradable Assets | Stocks, Indexes, Currencies, Cryptocurrencies, Commodities, ETFs |

| Account Types | Mini, Standard, Gold, Platinum |

| Demo Account | Available |

| Customer Support | Phone (UK and Russian numbers), Email, Online Chat, Online Form |

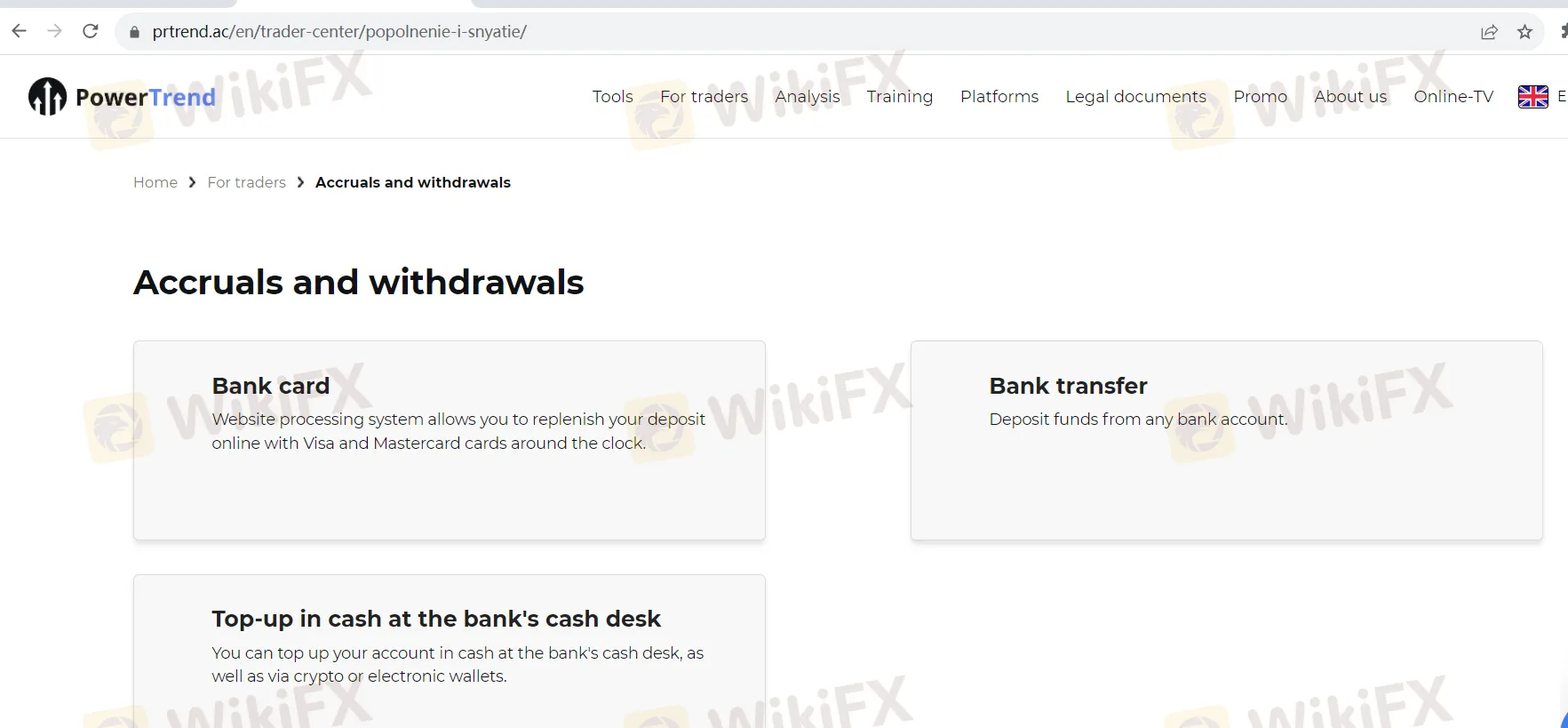

| Payment Methods | Bank Card, Bank Transfer, Cash Replenishment at Bank's Cash Desk |

| Educational Tools | Video Tutorials, Expert Insights, Glossary, Articles |

| Website Status | Website is accessible (as of the provided information) |

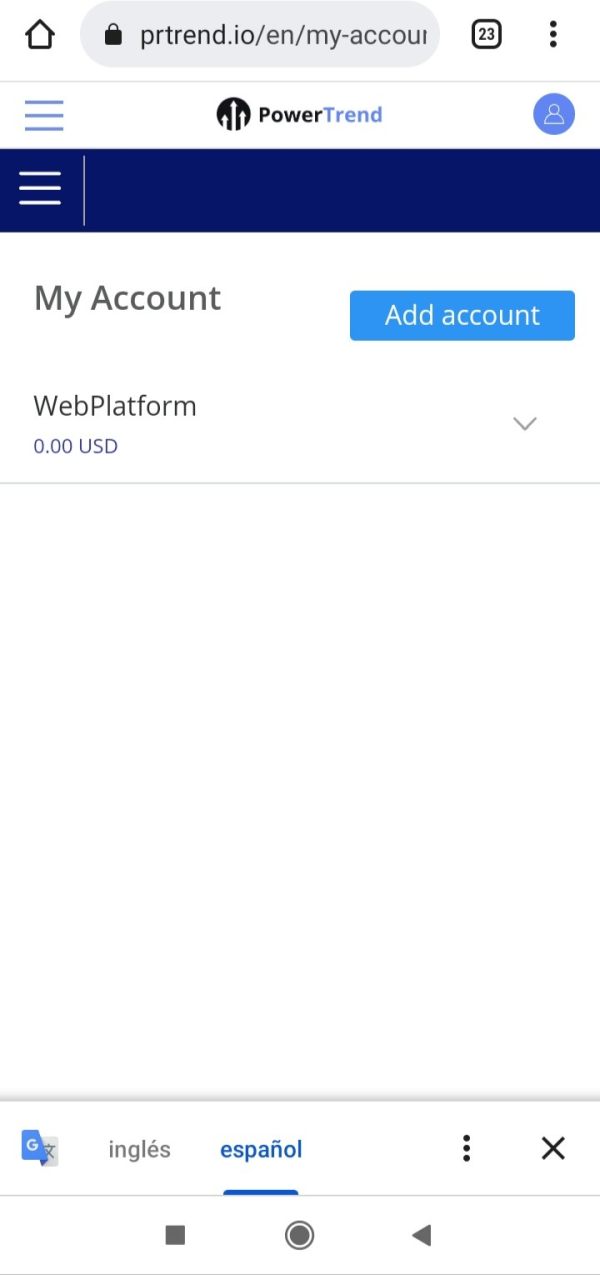

Overview

PowerTrend, based in the Marshall Islands, is an unregulated brokerage firm that offers a range of account types with varying minimum deposit requirements, catering to traders with different levels of experience and capital. While it provides access to a diverse selection of tradable assets, including stocks, indexes, currencies, cryptocurrencies, commodities, and ETFs, it's essential to note that the broker operates with high leverage, although the specific leverage ratio is not provided. Spreads vary across different account types.

Traders can access the xCritical mobile trading platform, which offers convenience and flexibility for trading on the go. PowerTrend also provides a demo account for users to practice trading strategies risk-free.

The broker offers multiple customer support channels, including phone support with UK and Russian numbers, email, online chat, and an online form for inquiries and assistance. Additionally, PowerTrend accepts various payment methods, including bank cards, bank transfers, and cash replenishment at the bank's cash desk.

Traders looking to enhance their skills and knowledge can access a range of educational resources, such as video tutorials, expert insights, a glossary, and articles.

As of the provided information, the PowerTrend website is accessible, but it's important for traders to exercise caution due to the lack of regulatory oversight. Conducting thorough research and due diligence is recommended when considering PowerTrend as a brokerage option.

Regulation

PowerTrend, as a brokerage firm, operates in a regulatory environment that has raised concerns among investors and industry experts due to its lack of regulation. Unlike established and regulated brokerage firms that adhere to strict guidelines and oversight from regulatory bodies, PowerTrend operates without such oversight. This absence of regulatory supervision can pose significant risks to investors, as it may lead to potential misconduct, fraud, or inadequate protection of client assets. Investors are strongly advised to exercise caution when considering PowerTrend as a brokerage option, as the absence of regulatory scrutiny means that there may be limited avenues for recourse in the event of disputes or losses. It is essential for investors to prioritize the security and legitimacy of their chosen brokerage to safeguard their financial interests.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

PowerTrend offers a diverse range of market instruments, multiple account types, high leverage trading, and comprehensive educational resources, making it an attractive option for traders. However, its lack of regulatory oversight raises concerns about investor protection. Traders should carefully consider their risk tolerance and objectives before choosing PowerTrend as their brokerage.

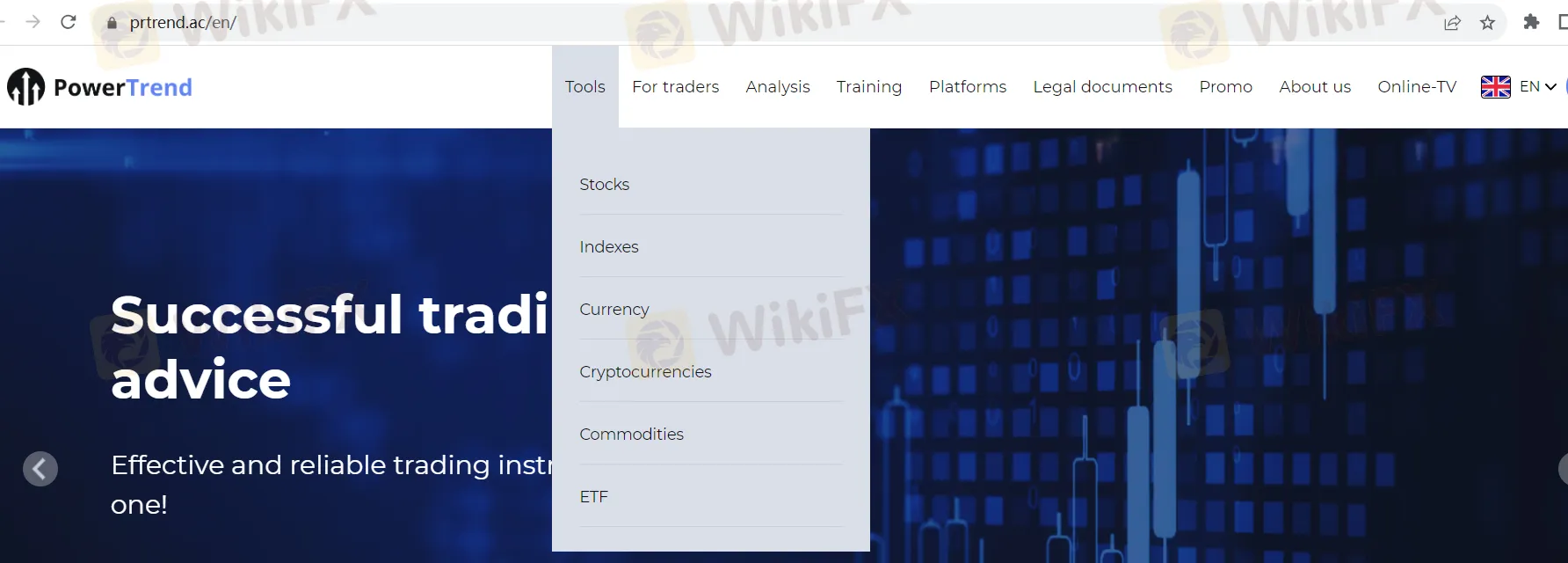

Market Instruments

PowerTrend offers a diverse range of market instruments to cater to the investment needs and preferences of its clients. Here's a description of the market instruments offered by PowerTrend:

Stocks: PowerTrend provides access to a wide array of individual stocks, allowing investors to buy shares in publicly traded companies. Investors can build diversified portfolios by selecting stocks from various sectors and industries.

Indexes: PowerTrend offers exposure to market indices, which represent a basket of stocks from a specific region, sector, or theme. Investors can trade index-related products to gain broad market exposure or to track specific market segments.

Currency: PowerTrend facilitates currency trading, allowing investors to engage in foreign exchange markets. This enables clients to trade different currencies and participate in currency pairs, taking advantage of fluctuations in exchange rates.

Cryptocurrencies: PowerTrend acknowledges the growing popularity of cryptocurrencies and offers the opportunity to trade digital assets such as Bitcoin, Ethereum, and other cryptocurrencies. This allows investors to take positions in the volatile and evolving world of digital currencies.

Commodities: PowerTrend enables clients to invest in physical commodities like gold, silver, oil, and agricultural products. Commodity trading can serve as a hedge against inflation and provide diversification in a portfolio.

Exchange-Traded Funds (ETFs): PowerTrend offers ETFs, which are investment funds that trade on stock exchanges. These funds typically track the performance of an underlying index, asset class, or sector. ETFs provide investors with a convenient way to access a broad range of assets and investment strategies.

PowerTrend's comprehensive selection of market instruments allows investors to construct diversified portfolios tailored to their risk tolerance, investment objectives, and market views. It provides a one-stop platform for trading and investing across various asset classes, giving clients the flexibility to adapt to changing market conditions and investment preferences.

Account Types

The financial services provider offers a range of account types, each tailored to meet the diverse needs and preferences of its clients. The first option, the Mini Account, requires a minimum initial deposit of $500 and allows clients to trade with a minimum transaction amount of 0.1 lots. While it provides access to an online chat for support, it does not grant access to all platform features, including the ability to trade on indexes. Additionally, features like more information in Autochartist, SMS signals, a VIP manager, an individual direct telephone line, special promotions, one-on-one trading, and personal reports on the stock market are not available with this account type.

For clients seeking more comprehensive services, the Standard Account might be a suitable choice. With a higher minimum first deposit requirement of $5,000, it allows traders to start with a minimum transaction amount of 0.1 lots. This account type offers access to online chat, all platform features including trading on indexes, and more information in Autochartist. However, it does not provide SMS signals, a VIP manager, an individual direct telephone line, special promotions, one-on-one trading, or personal reports on the stock market.

The Gold Account is designed for clients who are willing to commit a minimum initial deposit of $10,000. It offers a higher minimum transaction amount of 0.5 lots and provides access to online chat, all platform features including trading on indexes, more information in Autochartist, SMS signals, and a VIP manager. While it offers special promotions, it does not include features like an individual direct telephone line, one-on-one trading, or personal reports on the stock market.

The most premium option, the Platinum Account, is suitable for high-net-worth individuals and experienced traders. The initial deposit requirement starts from $35,000, and it allows for a minimum transaction amount of 1.5 lots. This account type offers a comprehensive range of services, including online chat, access to all platform features, more information in Autochartist, SMS signals, a VIP manager, an individual direct telephone line, special promotions, one-on-one trading, and personal reports on the stock market. It caters to clients looking for a complete and personalized trading experience.

In summary, the financial services provider offers a tiered account structure to accommodate investors with varying levels of experience and capital. Clients can choose the account type that aligns with their financial capacity and trading objectives, with higher-tier accounts offering a broader range of services and support.

Leverage

PowerTrend offers “high leverage” trading, which enables traders to control larger positions in the market than their initial capital would typically allow. This amplifies both profit potential and risk. With high leverage, traders can potentially increase their returns if the market moves in their favor. However, it also means that losses can accumulate rapidly if the market goes against them. Effective risk management is crucial when trading with high leverage, including setting stop-loss orders and diversifying positions. It's important to note that high leverage is not suitable for all traders, especially beginners, as it requires a deep understanding of market dynamics and risk management strategies.

Spreads and Commissions

PowerTrend provides spreads for various currency pairs across five account types: Mini, Standard, Silver, Gold, and Platinum. These spreads, representing the difference between bid and ask prices, are pivotal in determining trading costs.

Across the board, Platinum accounts consistently offer the tightest spreads, signifying lower trading costs. In contrast, Mini and Standard accounts feature wider spreads, while Silver and Gold accounts fall in between.

For traders, this means that Platinum accounts are ideal for those prioritizing low trading costs, while Mini and Standard accounts may suit those with smaller initial deposits. The choice of spreads is pivotal for trading strategies, as narrower spreads are typically preferred for short-term trading, whereas wider spreads might be acceptable for longer-term positions.

It's crucial to note that alongside spreads, some brokers may impose commissions, which should also be factored into the evaluation of the overall trading cost.

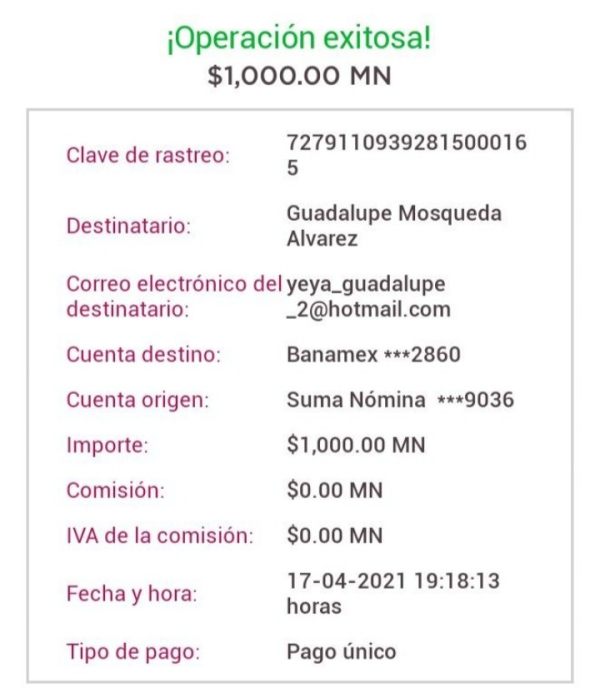

Deposit & Withdrawal

Deposit Methods:

Bank Card:

Description: The website processing system allows users to replenish their account online using Visa and Mastercard cards, 24/7.

Minimum/Maximum Transfer: The minimum deposit amount is $10, and the maximum is $5,000.

Commission for Input: There is no commission charged for depositing funds via bank cards.

Terms of Enrollment: Deposits made through bank cards are processed instantly.

Bank Transfer:

Description: Clients can deposit funds from any bank account into their trading account.

Minimum/Maximum Transfer: The minimum deposit amount is $10, and there is no specified maximum limit.

Commission for Input: The commission for bank transfers may be charged by the bank facilitating the transfer, not by the financial service provider.

Terms of Enrollment: Bank transfers typically take 3 to 5 days to be credited to the trading account.

Cash Replenishment at the Bank's Cash Desk:

Description: Clients can top up their account in cash at the bank's cash desk or via crypto or electronic wallets.

Minimum/Maximum Transfer: The minimum amount for cash replenishment at the bank's cash desk is $10, with no specified maximum limit.

Commission for Input: There is no commission mentioned for cash replenishment at the bank's cash desk.

Terms of Enrollment: Cash deposits at the bank's cash desk take 1 to 3 days to be credited.

Withdrawal Methods:

Withdrawal Fee: The withdrawal fee is not specified for bank card deposits and may vary depending on the method chosen.

Terms of Receipt after the Execution of the Withdrawal Request: The time it takes to receive funds after submitting a withdrawal request ranges from 1 minute to 5 days, depending on the chosen withdrawal method.

It's important for users to consider any potential fees associated with their chosen withdrawal method and be aware of the processing times. Additionally, the availability of specific methods and terms may vary depending on the financial service provider and the region in which it operates. Clients should review the provider's official documentation or contact customer support for the most up-to-date and region-specific information regarding deposits and withdrawals.

Trading Platforms

xCritical is an innovative trading platform that gathers all the essential tools for successful investing in one place. It offers features like one-click trading, automatic market analysis, and signals, making trading convenient and timely. With access to over 200 financial instruments and the ability to build portfolios, xCritical ensures high performance and offers tools like Stop Loss and Take Profit directly on the chart. It also provides an income calculation function and a detailed transaction history for informed decision-making. Additionally, xCritical is available as a mobile app for both iOS and Android, allowing traders to stay informed and trade on the go.

Customer Support

PowerTrend offers a variety of convenient customer support options, ensuring users can easily reach out for assistance. They provide phone support with UK and Russian phone numbers, an email address for inquiries, real-time online chat, and an online form for questions and suggestions. This multi-channel approach caters to different preferences and ensures prompt assistance, demonstrating their commitment to user support and satisfaction.

Educational Resources

PowerTrend's educational resources, available through the link provided (https://prtrend.ac/en/learning-center/), appear to offer valuable support and knowledge to traders looking to enhance their skills and understanding of financial markets. Here's a description of these educational resources:

Trading Video Tutorials: PowerTrend provides trading video tutorials that allow users to learn about various aspects of trading in the financial markets. These tutorials are valuable for traders, whether they are beginners looking to get started or experienced traders seeking to refine their strategies. Video tutorials are an effective way to grasp complex concepts through visual explanations.

Expert Experience: Users have the opportunity to benefit from the experience of PowerTrend's experts. By adopting the insights and strategies developed over many years by these experts, traders can gain valuable knowledge and confidence in their trading activities. Learning from experienced professionals can help traders make informed decisions.

Glossary: The educational resources include a glossary section where users can familiarize themselves with essential terms related to trading. A comprehensive understanding of trading terminology is crucial for making informed and confident trading decisions. The glossary helps users navigate the language of the financial markets.

Articles: The inclusion of articles in the educational resources is a valuable addition. These articles likely cover a range of topics related to trading, including market analysis, strategies, risk management, and more. Articles provide in-depth insights and can serve as a valuable reference for traders seeking to expand their knowledge.

Overall, PowerTrend's educational resources seem to provide a holistic approach to learning and improving trading skills. From video tutorials and expert insights to a glossary and articles, these resources cater to traders at various levels of expertise. Whether traders are looking to start with the basics or deepen their understanding of the financial markets, these educational materials can be a valuable asset in their journey toward confident and informed trading.

Summary

PowerTrend, as a brokerage firm, operates without regulatory oversight, which has raised concerns among investors due to potential risks. While it offers a range of market instruments, including stocks, indexes, currencies, cryptocurrencies, commodities, and ETFs, investors are advised to exercise caution. The broker offers various account types, each with different features and minimum deposit requirements. PowerTrend provides high leverage trading, which can amplify both profits and risks, necessitating effective risk management. Spreads and commissions vary across different account types, with Platinum accounts typically offering tighter spreads. Deposits and withdrawals can be made through various methods, with processing times and fees depending on the chosen method. The xCritical trading platform offers comprehensive tools and is available on mobile. Customer support is accessible through phone, email, online chat, and an online form. Educational resources include video tutorials, expert insights, a glossary, and articles, catering to traders of all levels. Investors should carefully consider the risks associated with PowerTrend's lack of regulation and trading conditions before proceeding.

FAQs

Q1: Is PowerTrend a regulated brokerage firm?

A1: No, PowerTrend operates without regulatory oversight, which has raised concerns among investors due to potential risks.

Q2: What market instruments does PowerTrend offer for trading?

A2: PowerTrend provides access to stocks, indexes, currencies, cryptocurrencies, commodities, and ETFs to cater to diverse investment needs.

Q3: What is the minimum deposit required to open an account with PowerTrend?

A3: The minimum initial deposit varies based on the account type, starting from $500 for a Mini Account and going up to $35,000 for a Platinum Account.

Q4: Does PowerTrend provide educational resources for traders?

A4: Yes, PowerTrend offers a range of educational resources, including video tutorials, expert insights, a glossary, and articles to help traders enhance their skills and knowledge.

Q5: Can I contact PowerTrend's customer support through online chat?

A5: Yes, PowerTrend provides online chat support in addition to phone, email, and an online form for inquiries and assistance.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now