Score

iForex

Japan|2-5 years|

Japan|2-5 years| https://iforex-ja.site

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

iFOREX.

iForex

Japan

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed iForex also viewed..

XM

Neex

GO MARKETS

FXCM

iForex · Company Summary

| Aspect | Information |

| Company Name | iForex |

| Registered Country/Area | Japan |

| Founded year | 2020 |

| Regulation | Not regulated |

| Market Instruments | Stocks, precious metals, energy commodities, stock indices, currency pairs |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:400 |

| Spreads | Starting from 0.7 pips |

| Trading Platforms | Proprietary iForex H5 platform |

| Customer Support | Limited, only available in Japanese |

Overview of iForex

iForex, established in Japan in 2020, offers a range of trading assets, including stocks, precious metals, energy commodities, stock indices, and currency pairs. Its various selection allows traders to engage in various markets, potentially enhancing their trading opportunities.

However, iForex operates without regulatory oversight, posing risks to traders due to the absence of safeguards typically provided by regulatory authorities. While the platform offers competitive spreads and leverage of up to 1:400, negative user reviews regarding customer support and potential withdrawal issues highlight areas of risks for traders considering the platform.

Is iForex legit or a scam?

iForex operates without regulation from any authority. This absence of oversight can lead to potential risks for traders, including uncertainty about the platform's compliance with industry standards and the protection of clients' funds.

Pros and Cons

| Pros | Cons |

| Wide range of assets including stocks, precious metals, energy commodities, stock indices, and currency pairs | Lack of regulatory oversight |

| Competitive spreads starting from 0.7 pips | Negative user reviews |

| Leverage up to 1:400 | No availablecustomer support channel |

| Potential withdrawal issues | |

| High risk of scams |

Pros:

Wide range of assets: iForex offers a wide selection of assets, including stocks, precious metals, energy commodities, stock indices, and currency pairs. This allows traders to access various markets and diversify their investment portfolios according to their preferences and trading strategies.

Competitive spreads: With spreads starting from as low as 0.7 pips, iForex provides competitive pricing compared to other brokers in the market. Tight spreads can help traders reduce trading costs and improve their overall profitability, especially for frequent traders or those engaging in scalping strategies.

Leverage up to 1:400: iForex offers leverage of up to 1:400, allowing traders to amplify their trading positions with a smaller initial investment.

Cons:

Lack of regulatory oversight: iForex operates without regulatory oversight, which raises risks regarding the safety and security of traders' funds. Regulatory oversight provides a layer of protection for traders by ensuring that brokers adhere to industry standards and practices.

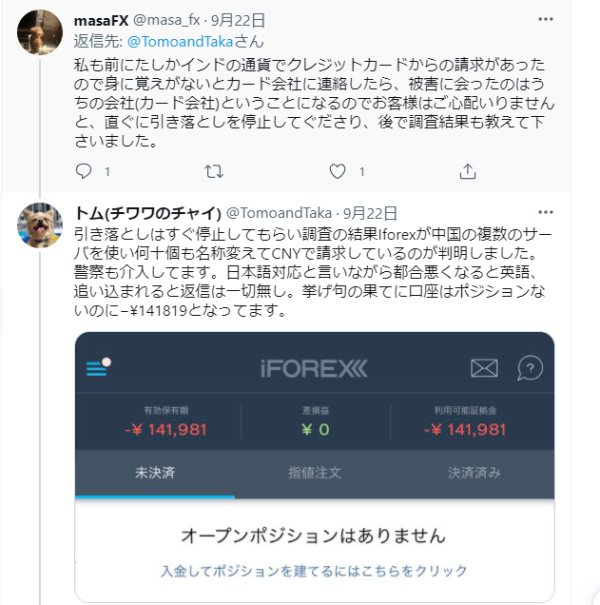

Negative user reviews: There are numerous negative user reviews regarding iForex, citing issues such as poor customer service, platform malfunctions, and difficulties with withdrawals. These reviews indicate potential challenges or dissatisfaction experienced by traders on the platform.

No available customer support channel: iForex lacks readily available customer support channels, such as telephone numbers or email addresses, which can be problematic for traders seeking assistance or resolution of issues. Without effective customer support, traders face difficulties in resolving queries in a timely manner.

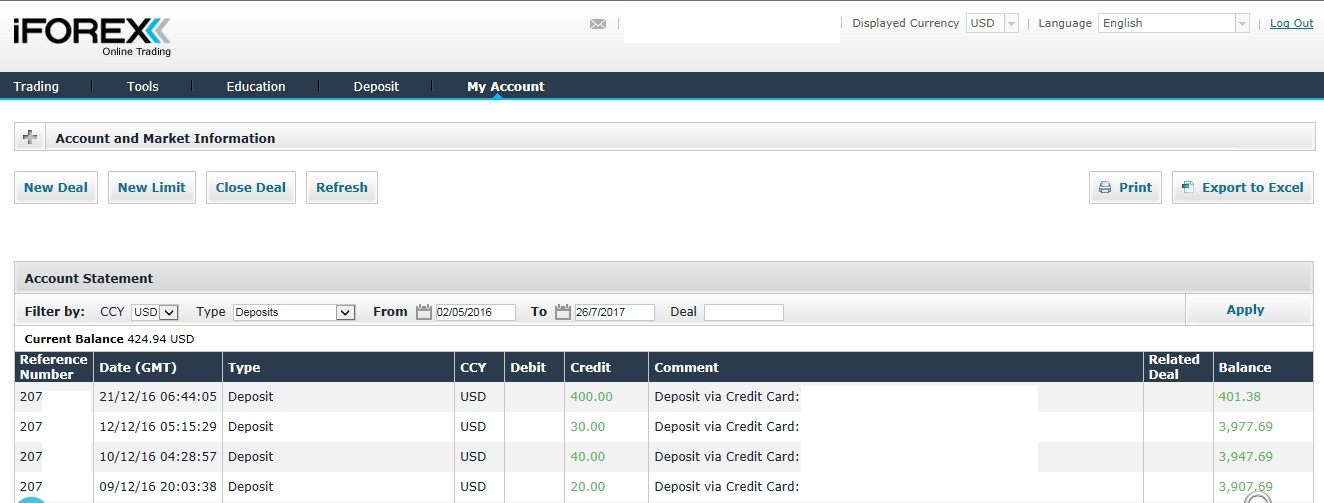

Potential withdrawal issues: Some users have reported encountering challenges or delays when attempting to withdraw funds from iForex accounts. These potential withdrawal issues can undermine trust and confidence in the platform and deter traders from engaging with it. Additionally, the lack of transparency or clarity surrounding withdrawal processes could further exacerbate dissatisfaction among traders.

Market Instruments

iForex offers a variety of trading assets, including stocks, precious metals, energy commodities, stock indices, and currency pairs. These instruments provide traders with various opportunities to engage in financial markets across different sectors and regions.

Stocks represent ownership in publicly traded companies, allowing traders to speculate on their price movements.

Precious metals such as gold and silver are widely traded commodities known for their intrinsic value and safe-haven appeal.

Energy commodities like oil and natural gas are essential resources with prices influenced by geopolitical factors and supply-demand dynamics.

Stock indices track the performance of a group of stocks, providing exposure to broader market trends.

Currency pairs involve trading one currency against another, with fluctuations driven by economic indicators and geopolitical events.

How to Open an Account?

Visit the iForex website: Navigate to the iForex official website and locate the “Open a trading account” button.

Complete the registration form: Fill out the required information accurately, including personal details such as name, email address, phone number, and country of residence. You also need to choose a username and password for your account.

Verify your identity: Follow the instructions provided by iForex to verify your identity. This typically involves uploading a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Once your identity is verified, your account will be activated, and you can start trading.

Leverage

iFOREX offers a maximum leverage of 400x, allowing traders to amplify their trading positions significantly. With a loss cut level set at a margin maintenance rate of 0%, traders can explore trading possibilities to their fullest extent.

Leverage enables traders to control larger positions with a relatively small amount of capital, potentially increasing both profits and losses.

Spreads & Commissions

iFOREX offers competitive spreads on its trading instruments, with a minimum spread of 0.7 pips for currency pairs such as USD/JPY and EUR/USD.

These narrow spreads provide traders with cost-efficient trading opportunities, allowing them to enter and exit positions with minimal cost impact.

Additionally, for commodities like WTI Crude Oil, iFOREX offers similarly tight spreads, with a minimum spread of 2 pips. This enables traders to engage in commodity trading with favorable pricing conditions, enhancing their potential for profit.

Trading Platform

iForex does not utilize the widely popular MT4 or MT5 trading platforms. Instead, it offers proprietary iForex H5 platforms, which are designed in-house by iForex.

These platforms provide basic trading features necessary for executing trades and managing positions. While they lack the advanced functionalities and customization options found in other platforms like MT4 or MT5, the iForex H5 platforms provide a user-friendly trading experience for traders of varying skill levels.

Traders can access essential trading tools and indicators through these platforms, allowing them to analyze markets and make informed trading decisions.

The iForex H5 platforms serve as a functional and accessible option for traders seeking to engage in the financial markets through iForex.

Deposit & Withdrawal

iFOREX facilitates deposit and withdrawal processes to enable traders to fund their accounts and access their funds easily.

Traders typically need to deposit around $100 to commence real trading, although some brokers require even lower initial deposits, such as $10, to accommodate different trading preferences and risk appetites.

Upon making their first deposit, traders can benefit from a 125% deposit bonus, up to a maximum of $1,600. Additionally, for purchases exceeding $1,600, traders receive a 40% bonus, capped at $2,000. This bonus scheme incentivizes traders to deposit larger amounts and enhance their trading capital.

Moreover, iFOREX offers an opportunity for traders to earn a 3% interest on their effective holdings when they deposit more than $1,000 for the first time. This interest is calculated based on the trader's account balance and is transferred to their account on a monthly basis.

Customer Support

iForex's customer support appears to be tailored primarily to the Japanese market, as its website is available exclusively in Japanese.

However, there is a notable absence of contact information such as a telephone number or email address provided on the website. This limited accessibility to customer support channels poses challenges for traders seeking assistance or information about the platform and its services. Without readily available contact options, traders experience difficulty in resolving issues or obtaining timely support, potentially impacting their overall trading experience.

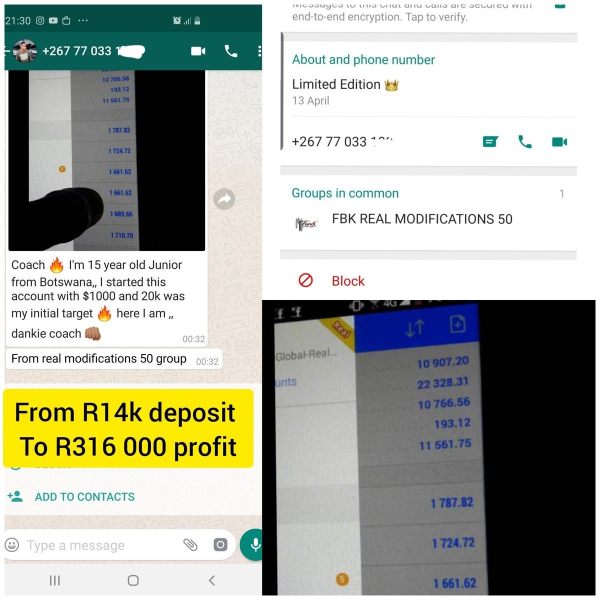

Exposure

The exposure of iForex to various complaints and negative feedback from users raises issues about the platform's integrity and reliability.

Users have reported instances of scams, difficulties in withdrawing funds, and allegations of unethical practices such as manipulating spreads and promising unrealistic returns. Such exposure can significantly influence trading on the platform, as it erodes trust and confidence among traders. The negative sentiment generated by these complaints deter potential traders from engaging with iForex and could lead existing users to seek alternative trading platforms.

Additionally, the lack of transparency and accountability highlighted in these user experiences underscores the importance of thorough due diligence when selecting a brokerage platform.

Conclusion

In conclusion, iForex offers a wide range of trading assets and competitive spreads, making it attractive for traders seeking diversity and cost-effective trading options. The leverage of up to 1:400 can also appeal to those looking to amplify their trading potential.

However, the lack of regulatory oversight poses a significant disadvantage, potentially exposing traders to higher risks. Additionally, negative user reviews and limited customer support channels deter prospective traders from engaging with the platform, highlighting the importance of thorough research when considering iForex for trading activities.

FAQs

Q: What markets can I trade on iForex?

A: iForex offers a variety of trading assets, including stocks, precious metals, energy commodities, stock indices, and currency pairs.

Q: What is the minimum deposit required to open an account?

A: The minimum deposit requirement varies depending on the account type, starting from $100.

Q: Is iForex regulated?

A: iForex operates without regulation, which poses risks to traders.

Q: Can I access educational resources on iForex?

A: iForex provides limited educational resources, such as blogs and FAQs, to assist traders in their journey.

Q: What leverage does iForex offer?

A: iForex offers leverage of up to 1:400 for traders, allowing them to magnify their trading positions.

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now