Broker Information

PORTFOLIO PERSONAL INVERSIONES

PPI

No Regulation

Platform registered country and region

Argentina

+54 0800 345 7599

Sarmiento 459. Piso 4. C1041AAI CABA.

--

--

--

consultas@portfoliopersonal.com

Company Summary

Argentina|5-10 years|

Argentina|5-10 years| https://www.portfoliopersonal.com/En/

Website

Influence

D

Influence index NO.1

Japan 2.60

Japan 2.60No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

| PPI Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Argentina |

| Regulation | Unregulated |

| Market Instruments | Equity, sovereign bonds, stock exchange overnight, cedears, dollar MEP, mutual funds, futures, T-bills, corporate bonds, options, PPI Global |

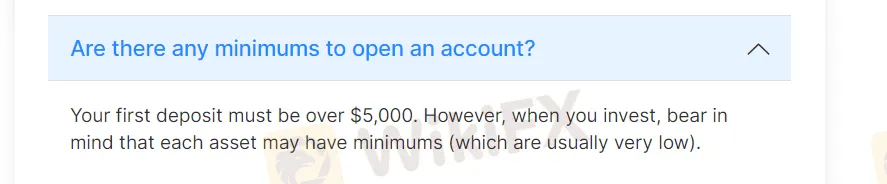

| Minimum Deposits | $5,000 |

| Demo Account | Unavailable |

| Customer Support | Phone and email |

PPI, one of the leading financial investment companies with over 20 years of experience in the market. Founded in 1999 and based in Argentina, PPI has established itself as an investment institution. PPI offers a wide range of market instruments such as equity, sovereign bonds. To begin investing with PPI, a minimum deposit of $5,000 is required. However, it has no regulation.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

| Pros | Cons |

|

|

|

|

|

|

|

- Tailored Services: PPI offers tailored services, indicating a commitment to personalized financial solutions tailored to each client's unique needs and investment goals. This personalized approach can enhance the client experience and address individual requirements.

- Availability of FAQ Section and Social Media: PPI's provision of an FAQ section and active presence on social media platforms demonstrates a commitment to transparency, communication, and client engagement. This can foster greater accessibility to information and support for clients.

- Unregulated: PPI's status as an unregulated financial institution may raise concerns regarding the level of oversight, investor protection, and adherence to industry standards. Clients should be cautious when engaging with unregulated entities due to potential risks associated with the lack of regulatory oversight.

- High Minimum Deposit Requirement: PPI imposes a minimum deposit requirement of $5,000. This could potentially deter individuals with smaller investment budgets or those who prefer to start with a lower initial investment.

- Demo Account Unavailability: The absence of a demo account may hinder prospective clients who prefer to familiarize themselves with the platform and test strategies using virtual funds before making actual investments. This could potentially impact the onboarding experience for new investors.

- Salty Commissions: PPI's commission structure can be perceived as high and costly by clients. High commission fees can potentially reduce overall investment returns for clients and may discourage some individuals from utilizing PPI's services.

At present, PPI operates without any legitimate regulations in place, resulting in a lack of government or financial authority oversight over their operations. This absence of oversight imposes a considerable level of risk when considering investments with PPI. Acknowledge that the absence of valid regulation exposes investors to potentially uncertain outcomes and could potentially compromise their financial security and investments. Therefore, before engaging in any investment activities with PPI, individuals should carefully assess the potential risks and make informed decisions.

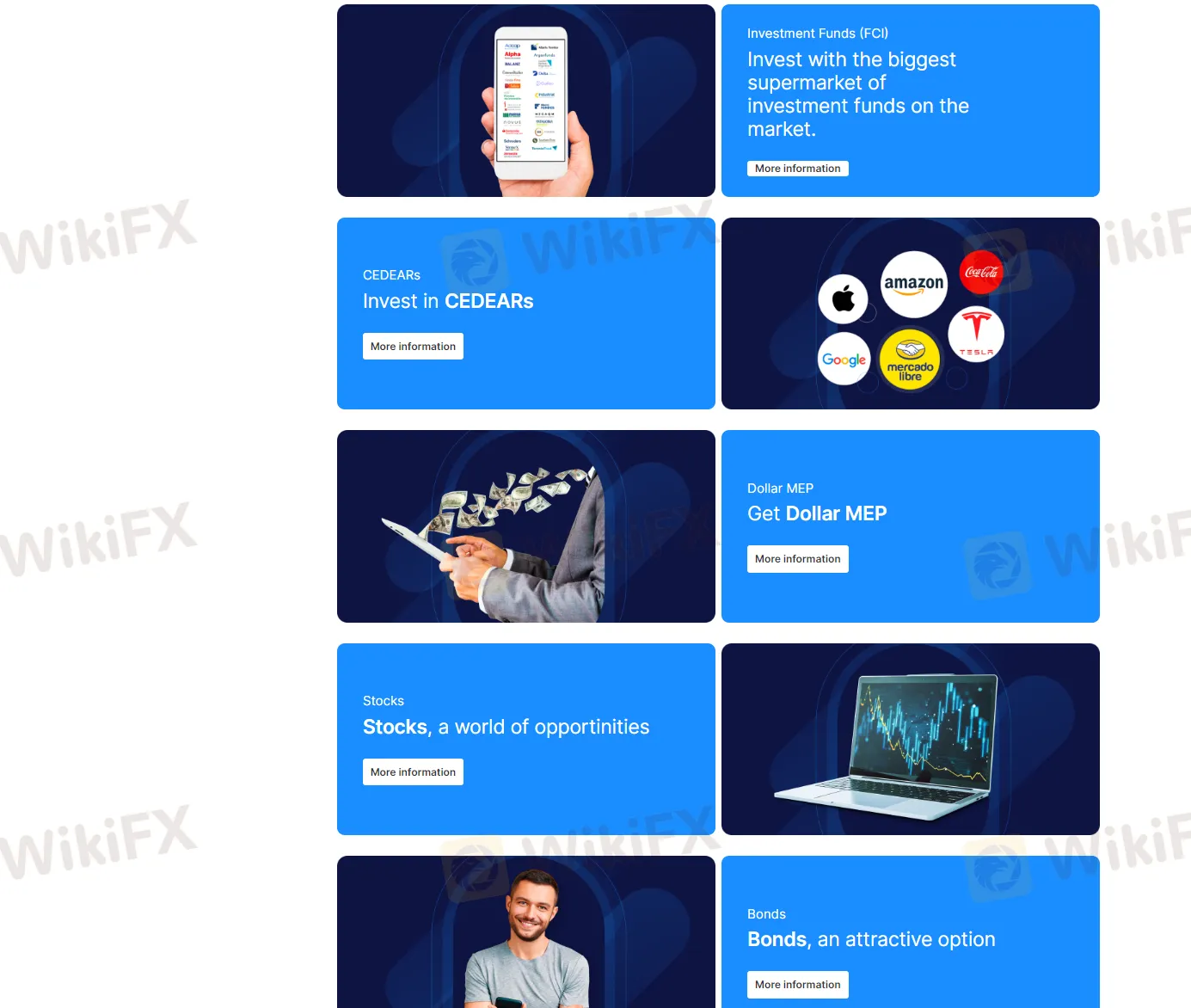

PPI provides a range of diverse trading instruments to cater to various investment preferences. These instruments include:

- Equity: PPI offers investments in stocks or shares of companies, allowing investors to own a portion of the company and potentially benefit from its financial performance.

- Sovereign Bonds: PPI facilitates trading of government-issued bonds, which are considered relatively low-risk investments backed by a country's sovereign guarantee.

- Stock Exchange Overnight: PPI allows investors to engage in short-term trading activities on the stock market, where positions are bought and sold within a single trading day.

- Cedears: PPI offers certificates of deposit for Argentine stocks, known as Cedears, which enable investors to gain exposure to international companies' shares listed on foreign exchanges.

- Dollar MEP: PPI facilitates trading of the MEP (Mercado Electrónico de Pagos) dollar, a financial instrument used in Argentina to access US dollars through local currency operations.

- Mutual Funds: PPI provides access to professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of assets.

- Futures: PPI allows participation in futures contracts, which are agreements to buy or sell an asset at a predetermined price on a specified future date.

- T-Bills: PPI enables investors to trade Treasury bills, short-term debt securities issued by governments to fund their financial activities.

- Corporate Bonds: PPI facilitates trading of fixed-income securities issued by corporations, providing opportunities for investors to earn regular interest payments.

- Options: PPI offers options trading, which grants the right (but not the obligation) to buy or sell an asset at a predetermined price within a specified timeframe.

- PPI Global: PPI provides access to international investment opportunities through its global division, allowing investors to diversify their portfolios beyond domestic markets.

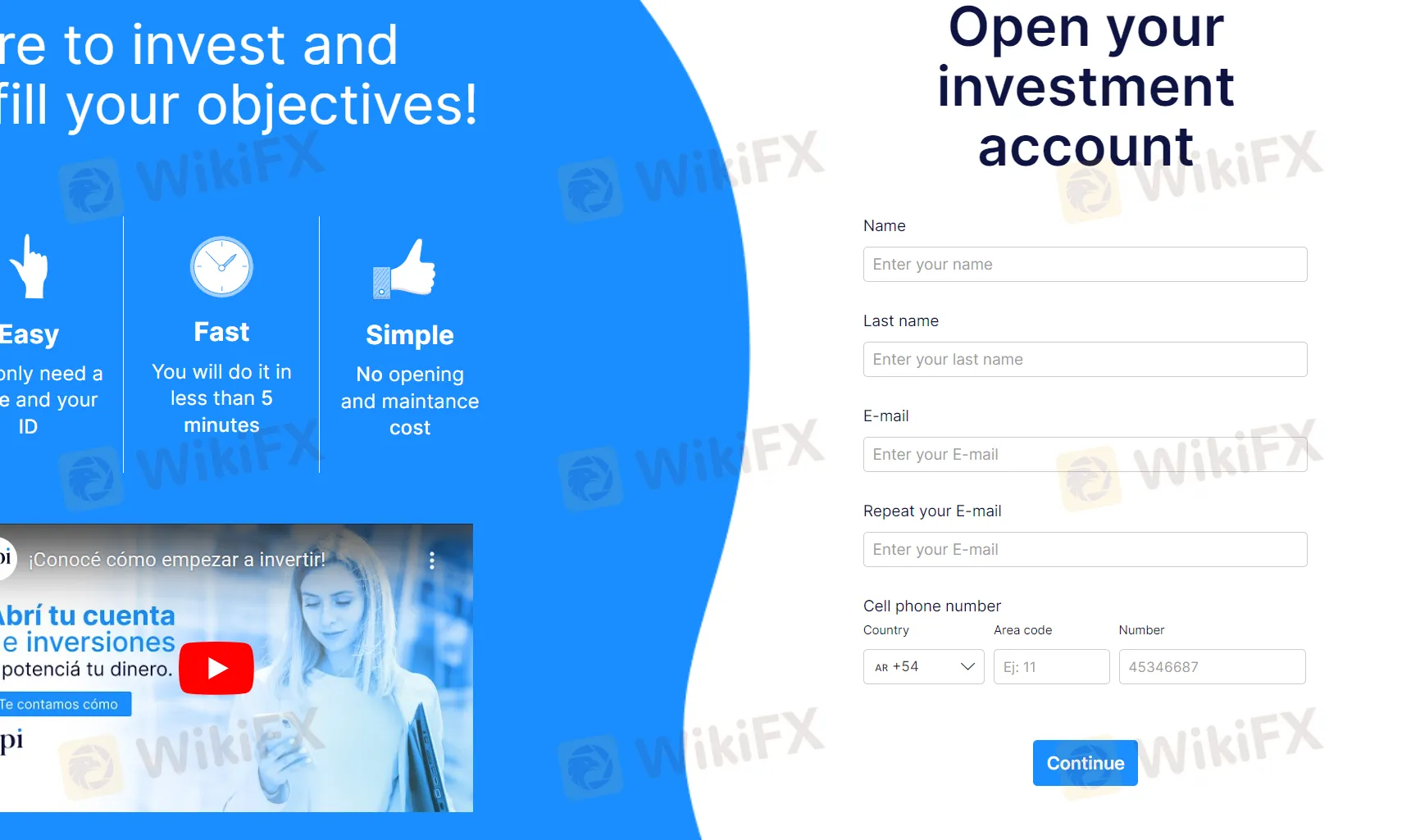

To open an account with PPI, please follow these steps:

| Steps | |

| 1 | Fill out the application form with the following details: |

| - Name | |

| - Last Name | |

| - E-mail: | |

| - Repeat E-mail: | |

| - Cell Phone Number: | |

| - Country: ???????? +54 | |

| - Area Code: [Enter your area code, e.g., 11] | |

| - Phone Number | |

| 2 | Review the information provided for accuracy |

| 3 | Submit the completed application form |

| 4 | Await review and follow up with any additional instructions from PPI |

The minimum deposit required to open an account with PPI is $5,000. This means that in order to start investing or trading with PPI, you will need to deposit at least $5,000 into your account.

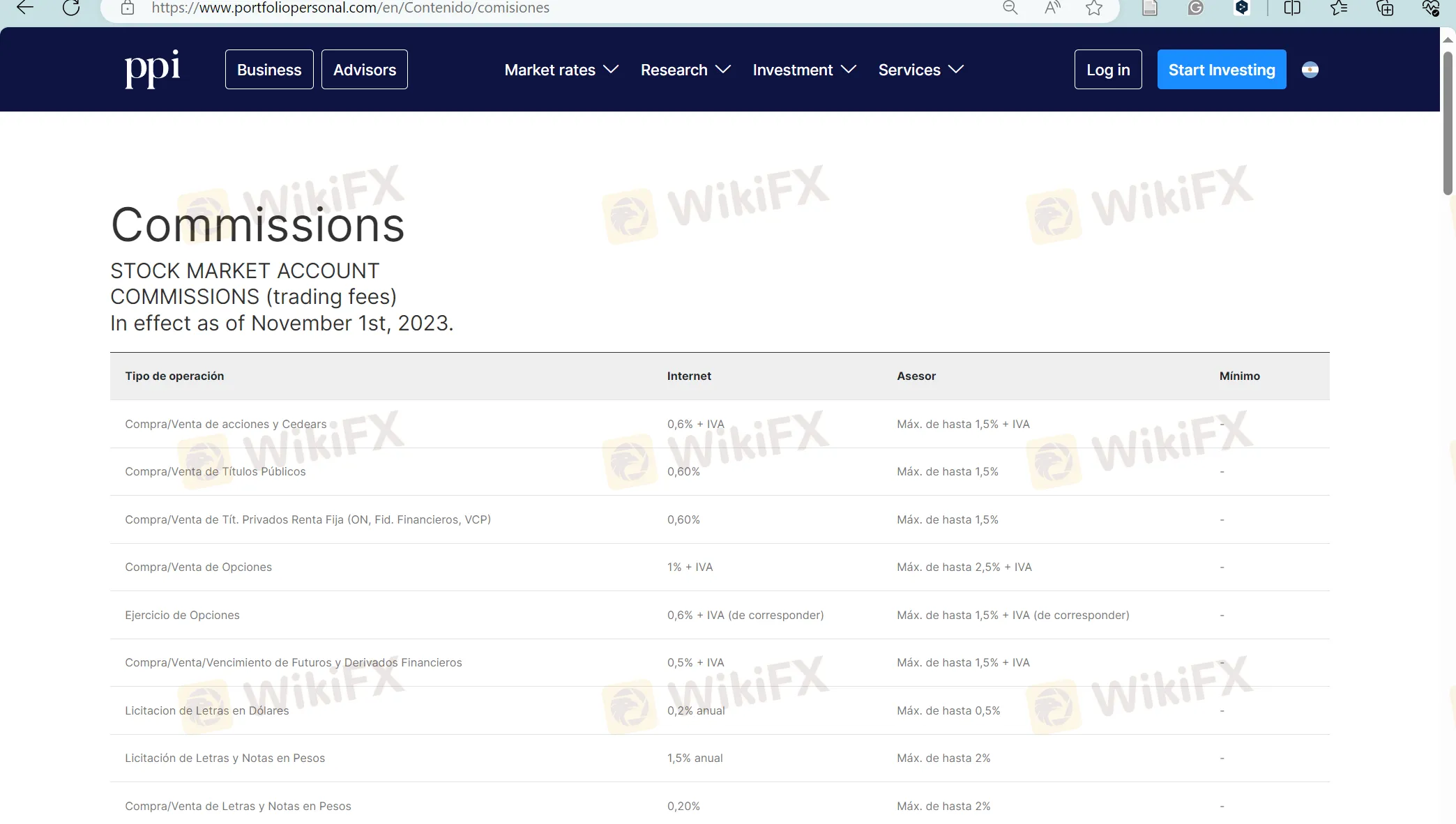

Besides, the commissions for PPI's services vary depending on the type of operation being conducted. Here's some example of the commissions for different types of transactions:

| Type of Transaction | Commission | Maximum Commission |

| Stocks and Cedears (Internet) | 0.6% + VAT | Up to 1.5% + VAT |

| Government Bonds | 0.60% | Up to 1.5% |

| Fixed-Income Private Securities (ON, trust certificates, etc.) | 0.60% | Up to 1.5% |

| Options Trading | 1% + VAT | Up to 2.5% + VAT |

| Exercise of Options | 0.6% + VAT (if applicable) | Up to 1.5% + VAT (if applicable) |

| Futures and Financial Derivatives Trading | 0.5% + VAT | Up to 1.5% + VAT |

Traders should review the specific terms and conditions related to commissions on the website or directly click:

https://www.portfoliopersonal.com/en/Contenido/comisiones.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: 0800 345 7599

Email: aperturas@portfoliopersonal.com

Address: Sarmiento 459. 4th floor C1041AAI CABA

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube, Spotify and Linkedin.

Whats more, PPI provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information. By offering this resource, PPI aims to provide transparency and clarity to their clients, helping them make informed decision.

In conclusion, PPI is a financial institution with a focus on providing tailored investment services to its clients. Their emphasis on tailored services suggests a commitment to personalized financial solutions, aimed at addressing individual client needs and investment goals. Additionally, PPI maintains an FAQ section and an active presence on social media platforms, indicating efforts to enhance communication, transparency, and client engagement.

However, an important point to note is that PPI is unregulated, which may raise concerns about the level of oversight, investor protection, and adherence to industry standards.

| Q 1: | Is PPI regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at PPI? |

| A 2: | You can contact via telephone: 0800 345 7599 and email: aperturas@portfoliopersonal.com. |

| Q 3: | Does PPI offer demo accounts? |

| A 3: | No. |

| Q 4: | What is the minimum deposit for PPI? |

| A 4: | The minimum initial deposit to open an account is $5,000. |

| Q 5: | What services and products PPI provides? |

| A 5: | It provides equity, sovereign bonds, stock exchange overnight, cedears, dollar MEP, mutual funds, futures, T-bills, corporate bonds, options, PPI Global. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

PORTFOLIO PERSONAL INVERSIONES

PPI

No Regulation

Platform registered country and region

Argentina

+54 0800 345 7599

Sarmiento 459. Piso 4. C1041AAI CABA.

--

--

--

consultas@portfoliopersonal.com

Company Summary

No comment yet

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now