Score

TDX Global

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://tdxtrades.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

TDX Global Technologies Limited

TDX Global

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | Forex – 1:500, Indices – 1:100, Commodities – 1:100 |

| Minimum Deposit | -- |

| Minimum Spread | 2 |

| Products | Forex , CFD’s, Commodities |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | Forex – 1:500, Indices – 1:100, Commodities – 1:100 |

| Minimum Deposit | -- |

| Minimum Spread | 1 |

| Products | Forex , CFD’s, Commodities |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $7/Lot |

| Benchmark | -- |

|---|---|

| Maximum Leverage | Forex – 1:500, Indices – 1:100, Commodities – 1:100 |

| Minimum Deposit | -- |

| Minimum Spread | -- |

| Products | Forex , CFD’s, Commodities |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $5/Lot |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed TDX Global also viewed..

XM

Neex

FXCM

GO MARKETS

TDX Global · Company Summary

| TDX Global | Basic Information |

| Registered Country | United Kingdom |

| Founded | 2021 |

| Regulation | FinCEN, ASIC |

| Tradable Assets | Currency, Metals, Commoditties, Indices, Stocks, Cryptocurrency |

| Account Types | Classic, ECN, Ultra |

| Demo Account | Available |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 (forex ), 1:100 ( commodities and indices) |

| Spread | From 0.1 pips |

| Trading Platform | MetaTrader 5 (MT5) |

| Social Trading | No |

| Payment Methods | Help2pay, Fpay247, 5Pay, Tether, Bank Transfer |

| Educational Resources | Daily Market Outlook & CalendarDaily Trading IdeasTechnical Analysis |

| Customer Support | Phone, Email, Online Chat, Contact form |

| Promotions | No |

General Information

TDX Global is a regulated brokerage firm, headquartered in the United Kingdom since 2021. TDX Global provides a diverse selection of trading accounts, including Classic, ECN, and Ultra. With a reasonable minimum deposit requirement of $100, the broker ensures accessibility to a wide range of markets. Traders can benefit from competitive leverage options, offering up to 1:500 for forex trading and 1:100 for commodities and indices. TDX Global prioritizes tight spreads, commencing from as low as 0.1 pips, to facilitate cost-effective trading for its clients.

The broker's chosen trading platform is the highly regarded MetaTrader 5 (MT5), known for its advanced features, comprehensive charting tools, and flexible trading capabilities. TDX Global proudly offers a broad array of tradable assets, including currencies, metals, commodities, indices, stocks, and cryptocurrencies. A demo account is readily available to traders, allowing them to practice and refine their strategies in a risk-free environment before engaging in live trading.

The company strives to provide exceptional customer support through various channels, including phone, email, and online chat, ensuring prompt assistance to address any inquiries or concerns. TDX Global supports multiple payment methods, such as Help2pay, Fpay247, 5Pay, Tether, and bank transfers, facilitating seamless transactions for its clients.

Although social trading features and promotional campaigns are not currently offered, traders can access valuable resources such as daily market outlooks, calendars, trading ideas, and technical analysis, contributing to their trading knowledge and decision-making processes.

Is TDX Global Legit?

TDX Global presents two regulatory licenses, a Crypto Licence (No. 31000245195471) issued by the Financial Crimes Enforcement Network (FinCEN) in the US and an Appointed Representative (AR) license (No. 001285191) from the Australian Securities & Investment Commission (ASIC), which might seem reassuring.

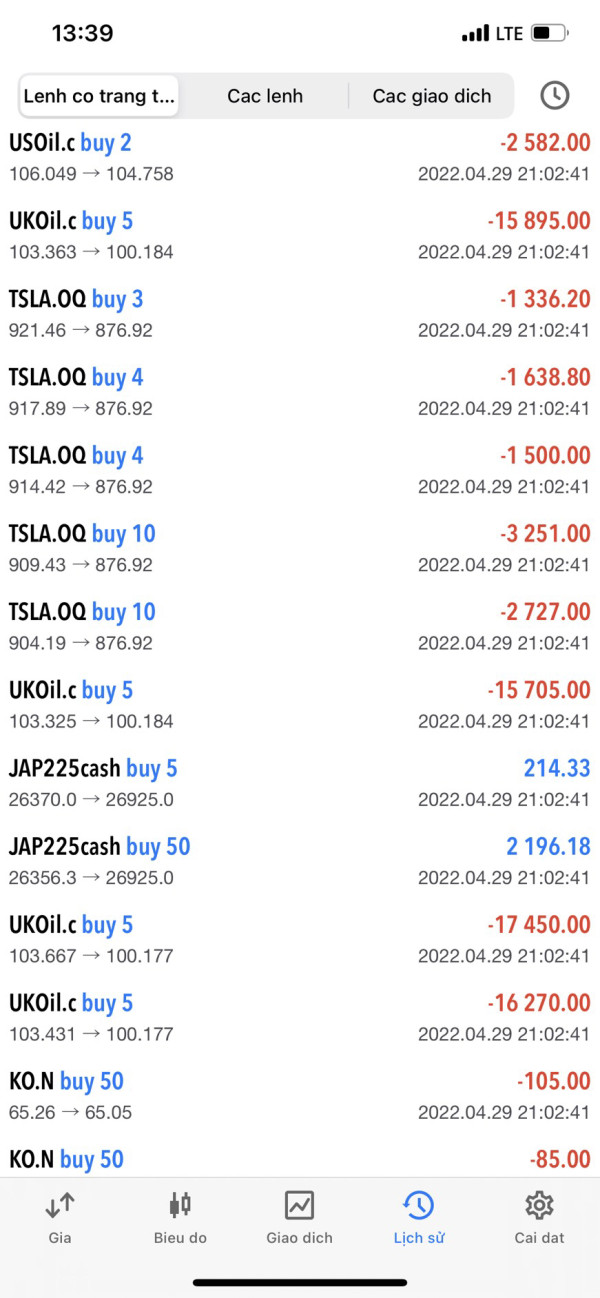

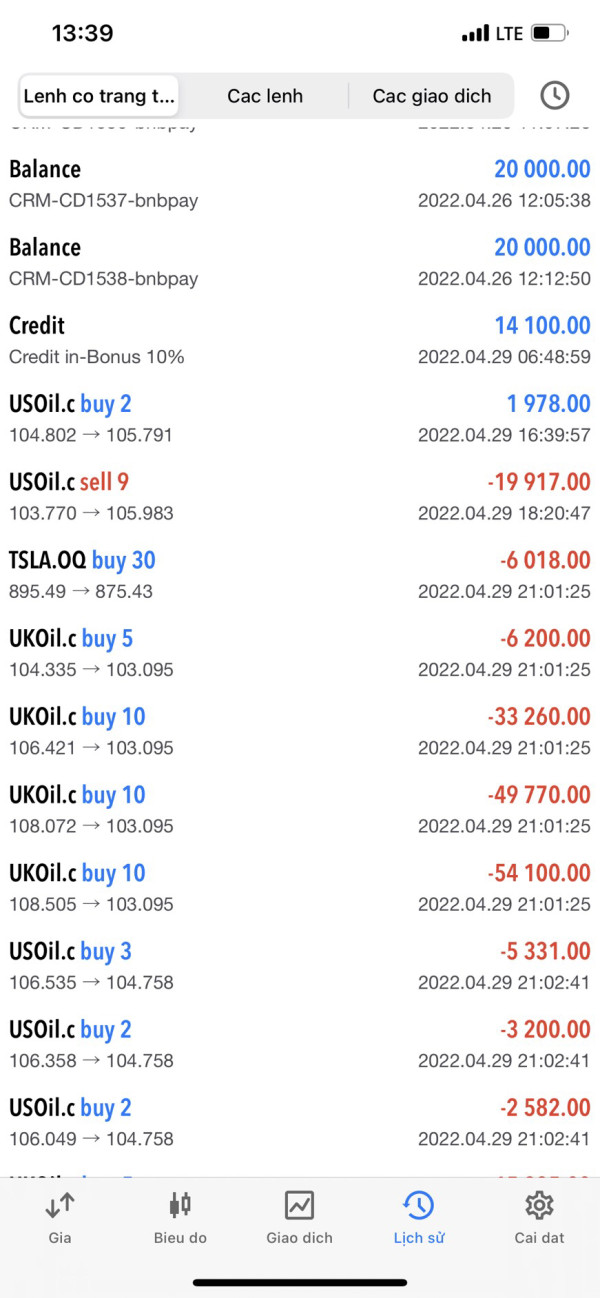

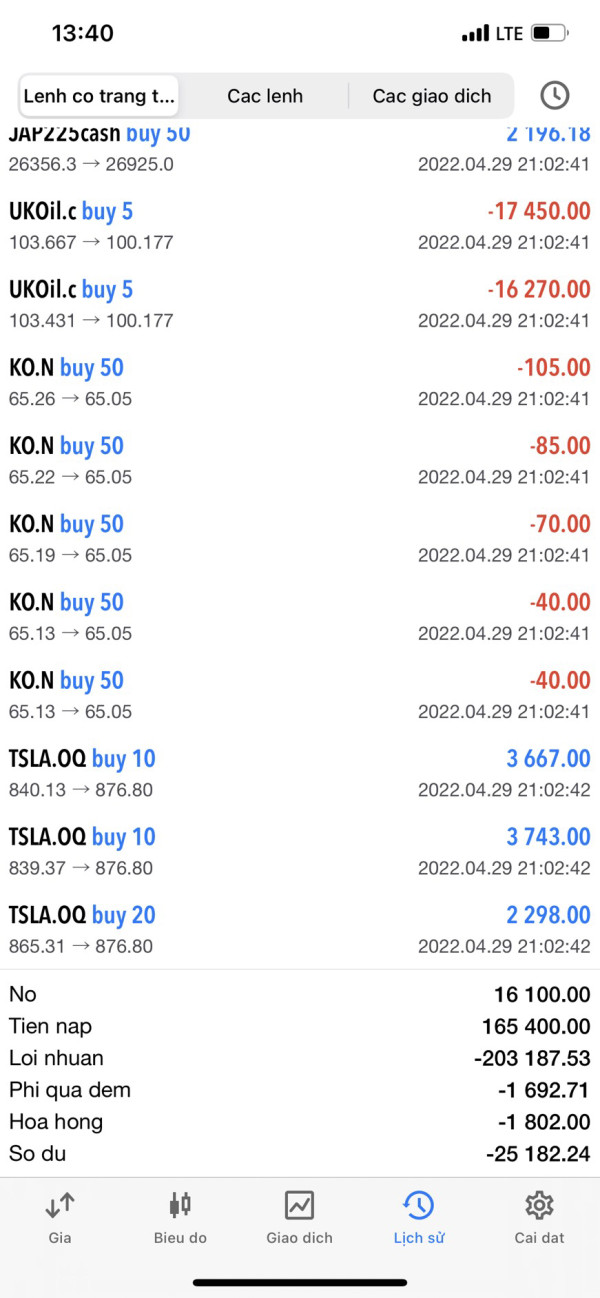

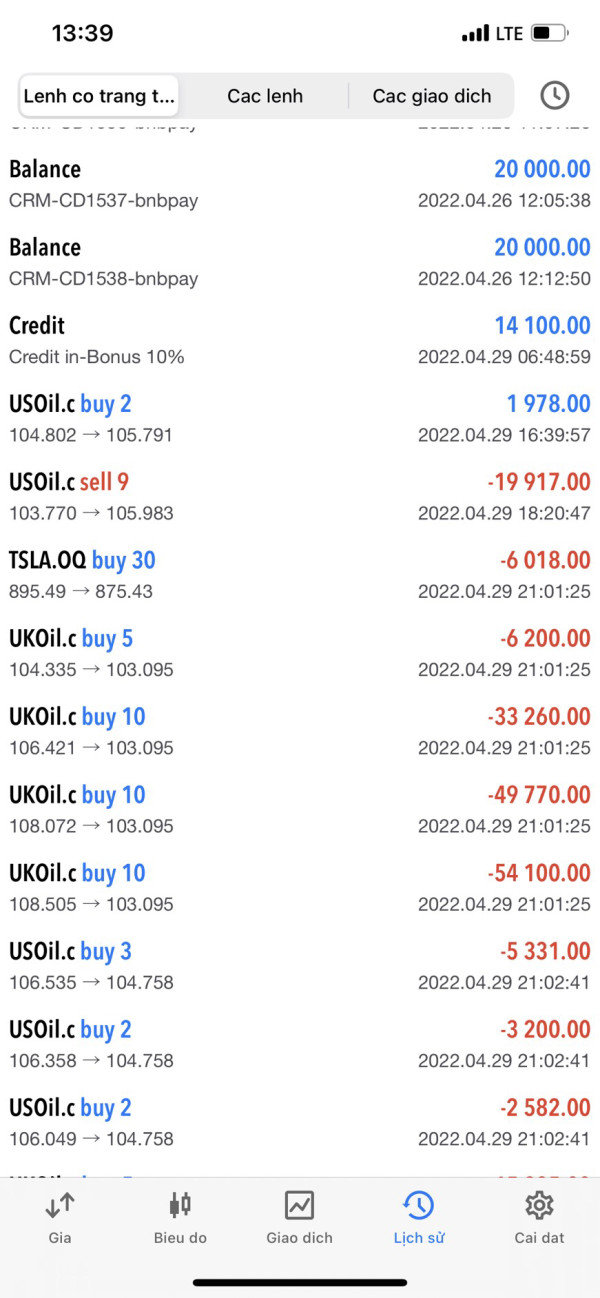

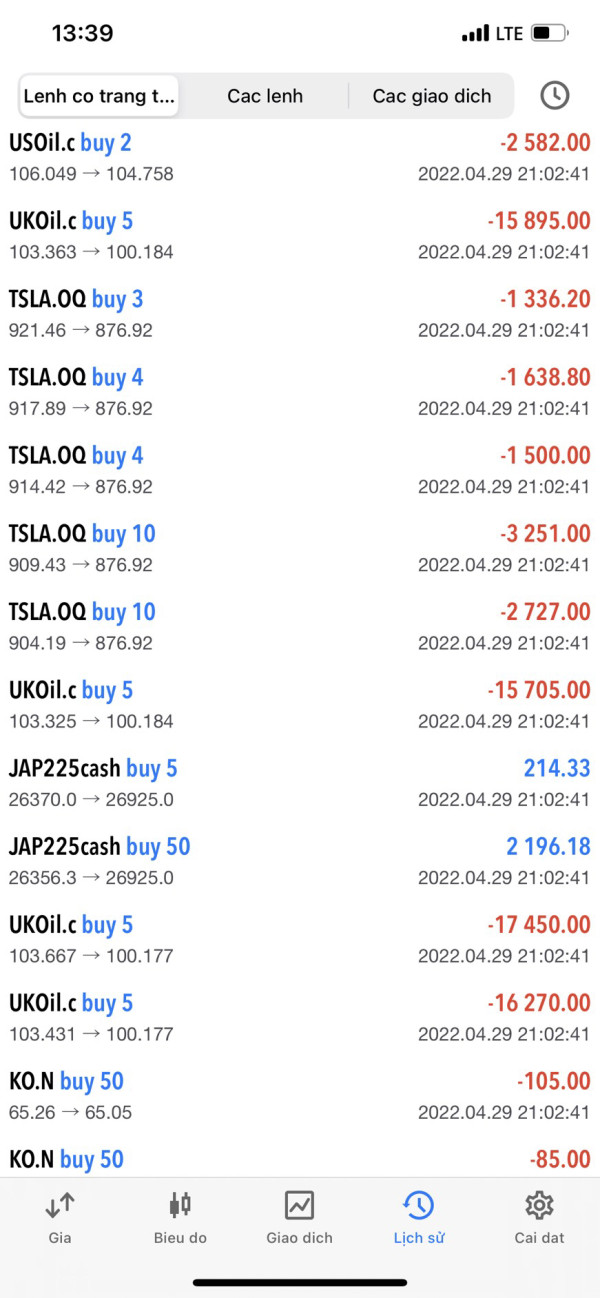

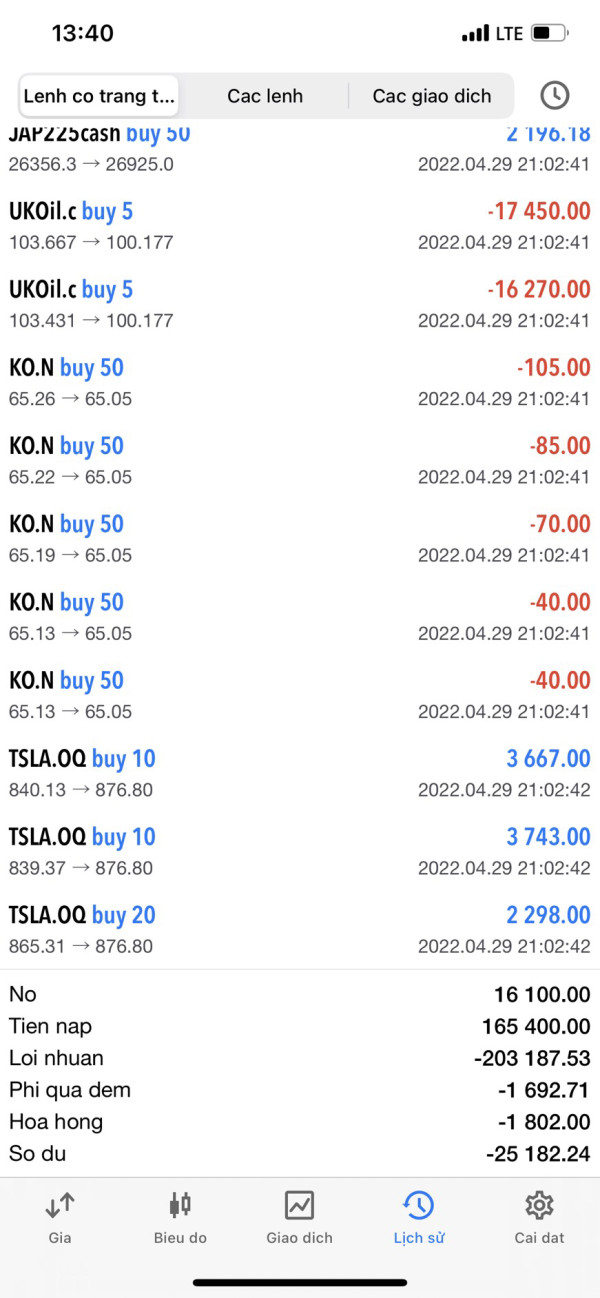

However, caution is warranted. Independent exposures raise concerning issues about withdrawal problems, scams, and severe slippage. These are serious red flags that cast doubt on TDX Global's legitimacy. It's crucial to prioritize reputable brokers with a strong track record and clear regulations offering robust investor protection.

Pros & Cons

TDX Global offers competitive leverage options, and a wide range of tradable assets. Traders can access the MetaTrader 5 trading platform and benefit from various customer support channels and multiple payment methods. Additionally, the availability of a demo account and educational resources can enhance the trading experience.

However, it is important to note user exposures of unable to withdraw, scams and severe slippage, and it does not offer social trading features.

| Pros | Cons |

| Competitive Leverage Options | User Exposures |

| Wide Range of Tradable Assets | No Social Trading Feature |

| Availability of Demo Account | |

| MetaTrader 5 Trading Platform | |

| Various Customer Support Channels | |

| Multiple Payment Methods | |

| Educational Resources Available |

Market Instruments

The trading products available on this broker include: Currencies with about 50+ currency pairs. Metals with tight spreads and greater leverage, Commodities, Stocks, Indices and Cryptocurrencies. Cryptocurrencies prices are driven largely by supply and demand.

Currencies: TDX Global provides access to the forex market, allowing traders to trade various currency pairs, such as EUR/USD, GBP/JPY, or AUD/CAD.

Metals: Traders can also engage in trading precious metals, including gold, silver, platinum, and palladium. These metals often serve as alternative investment options or safe-haven assets.

Commodities: TDX Global offers trading opportunities in a range of commodities, such as crude oil, natural gas, agricultural products (like corn, wheat, and soybeans), and industrial metals (like copper and aluminum).

Indices: The broker provides access to popular indices from around the world, representing the performance of a specific group of stocks. Examples include the S&P 500, FTSE 100, or Nikkei 225, allowing traders to speculate on broader market trends.

Stocks: TDX Global allows traders to trade stocks of individual companies listed on various exchanges globally. Traders can take positions on popular stocks like Apple, Amazon, Google, or Tesla, and potentially benefit from their price movements.

Account Types

TDX GLOBAL offers three different trading accounts, Classic Account with minimum trade size of 0.01 lots and zero commission and 2 pip upward spreads, ECN account with commissions of $7/lots and spreads of 1 pip upward. And ULTRA Account with minimum trade volume also at 0.01 lots, zero spreads and commissions charged t $5/ lots. For all the 3 accounts, the minimum deposit required is $100.

The Classic account is designed to provide traders with a straightforward and user-friendly trading environment. It offers access to a diverse range of financial instruments, including forex, contracts for difference (CFDs), and commodities. The Classic account is suitable for traders who prefer a more traditional trading approach and value simplicity and ease of use.

The ECN (Electronic Communication Network) account is geared towards more experienced traders seeking direct market access and enhanced liquidity. This account type allows traders to interact directly with the market, accessing tight spreads, and potentially benefiting from faster execution speeds. The ECN account is particularly suitable for traders who prioritize transparency and competitive pricing.

For traders seeking the utmost trading conditions and advanced features, the Ultra account is the ideal choice. This account type is designed to meet the needs of professional and institutional traders, offering access to a wide range of financial instruments, including forex, CFDs, commodities, and more. The Ultra account provides advanced trading tools, premium features, and personalized support to cater to the demands of experienced traders.

How to Open an Account?

To open an account with TDX Global, you can follow these general steps:

Visit the TDX Global website: Go to the official website of TDX Global through a web browser. Account Registration: Look for the “Open Account” or “Register” button on the website and click on it. You will be directed to the account registration page.

2. Fill in Personal Information: Provide the required personal information, including your full name, email address, country of residence, and phone number. Ensure that the information you provide is accurate and up to date.

3. Select Account Type: Choose the account type that best suits your trading needs and preferences. TDX Global offers different account types, such as Classic, ECN, and Ultra. Consider the features and benefits associated with each account type before making a selection.

4. Agree to Terms and Conditions: Read and understand the terms and conditions presented by TDX Global. If you agree to abide by these terms, check the box to indicate your consent.

5. Complete Verification Process: Depending on the broker's requirements, you may need to verify your identity and address by providing documents such as a valid passport, government-issued ID, utility bill, or bank statement. Follow the instructions provided by TDX Global to complete the verification process.

6. Fund Your Account: Once your account is successfully registered and verified, you can proceed to fund your trading account. TDX Global will provide you with various payment methods to choose from, such as bank transfers, credit/debit cards, or e-wallets. Select the preferred payment method and follow the instructions to make a deposit.

7. Start Trading: After your account is funded, you can access the trading platform provided by TDX Global, such as MetaTrader 5 (MT5). Familiarize yourself with the platform, explore the available tradable assets, and start executing trades based on your trading strategy and preferences.

Spreads & Commissions

TDX Global offers a range of spreads and commissions across its different account types. The Classic account, which does not charge any commission, provides traders with spreads starting from 2 pips onwards. For those opting for the ECN account, tighter spreads starting from as low as 1 pip are available, but a commission of $7 per lot is applied. Traders seeking the tightest spreads can choose the Ultra account, where spreads start from 0 pips, but like the ECN account, a commission of $7 per lot is applicable. These varying options allow traders to select an account type that best suits their trading style and preferences. When considering trading costs and potential profitability, it is important for traders to evaluate the impact of spreads and commissions on their overall trading strategy.

Trading Platform

TDX Global offers traders access to the MetaTrader 5 (MT5) trading platform, a widely recognized and robust platform in the financial industry. MT5 provides a comprehensive suite of tools and features designed to enhance the trading experience. With its user-friendly interface and advanced charting capabilities, traders can analyze markets, identify trends, and make informed trading decisions. The platform supports multiple order types, including market, limit, and stop orders, allowing traders to execute trades with precision and flexibility.

MT5 also offers a wide range of technical indicators, customizable charting options, and real-time price quotes to aid in market analysis. Additionally, the platform supports automated trading through the use of Expert Advisors (EAs), enabling traders to implement algorithmic strategies and execute trades automatically.

Deposit & Withdrawal

TDX Global offers a variety of deposit and withdrawal options to facilitate smooth transactions for its clients. The minimum deposit across all currencies is set at $100, ensuring accessibility for traders. There are no deposit fees imposed by TDX Global. For withdrawals, the minimum amount is generally set at $100, although some methods may have a lower minimum withdrawal requirement. TDX Global does not charge any withdrawal fees, except for a processing fee of $5 for withdrawals below the specified minimum amount.

Deposits made through Help2pay, Fpay247, 5Pay, and Tether are processed instantly, allowing traders to quickly fund their accounts. Bank transfers, on the other hand, require 3 to 5 business days for processing, with the specific processing time depending on the bank. It is important to note that bank transfer fees and charges are determined by the respective banks and should be referred to for accurate information.

When it comes to withdrawals, TDX Global strives to process them within a maximum timeframe of 1 business day, ensuring prompt access to funds. However, bank transfers may take 3 to 5 business days for processing, depending on the individual bank's procedures.

Customer Service

Clients have the flexibility to choose from various communication channels, including email, phone, online chat, or a contact form, to initiate these transactions.

Here is the detailed contact information of TDX Global:

Educational Resources

TDX Global provides a range of educational resources to support traders in their decision-making and market analysis. These resources include a Daily Market Outlook and Calendar, which offers valuable insights into current market conditions, upcoming events, and economic indicators that may impact trading. Additionally, traders can access Daily Trading Ideas, which provide specific trade suggestions and potential opportunities based on market analysis and research. The broker also offers Technical Analysis tools, empowering traders with the ability to study price patterns, indicators, and chart trends to identify potential entry and exit points.

Conclusion

In conclusion, TDX Global presents a mixed picture with its offerings. On the positive side, the broker offers a diverse range of trading accounts, competitive leverage options, which can be advantageous for traders seeking cost-effective trading opportunities. The availability of the MetaTrader 5 (MT5) platform and a wide selection of tradable assets, including currencies, metals, commodities, indices, stocks, and cryptocurrencies, adds to the appeal of the broker. On the negative side, some user exposure about withdrawal difficulty, scams and severe slippage can't be overlooked. Traders should carefully consider the potential implications and weigh the benefits against the risks before deciding to engage with TDX Global.

FAQS

Question: Is TDX Global regulated?

Answer: Yes. It is regulated by FinCEN and ASIC.

Question: What is the minimum deposit required to open an account with TDX Global?

Answer: $100.

Question: What is the maximum leverage offered by TDX Global?

Answer: 1:500 for forex trading and 1:100 for commodities and indices.

Question: What are the available trading platforms on TDX Global?

Answer: MetaTrader 5 (MT5).

Question: What assets can I trade on TDX Global?

Answer: Currency pairs, metals, commodities, indices, stocks, and cryptocurrencies.

Question: Does TDX Global provide a demo account?

Answer: Yes.

News

Review 12

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now