Score

CTIN

Australia|5-10 years|

Australia|5-10 years| https://ctin.com.au/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:CTIN Financial Services Pty Ltd

License No.:504151

Single Core

1G

40G

1M*ADSL

Basic Information

Australia

AustraliaUsers who viewed CTIN also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

ctin.com.au

Server Location

United States

Website Domain Name

ctin.com.au

Server IP

143.204.83.12

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Aspect | Information |

| Registered Country/Area | Australia |

| Company Name | CTIN Financial Services Pty Ltd |

| Regulation | ASIC (License number: 504151) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Competitive and transparent |

| Trading Platforms | CTIN Trader Pro, CTIN Trader Web, CTIN Trader Mobile |

| Tradable Assets | Over 20,000 global shares |

| Account Types | Trading Account, Demo Account |

| Demo Account | Available for practice |

| Customer Support | 24-hour support |

| Payment Methods | Information not provided |

| Educational Tools | None |

Overview

CTIN Financial Services Pty Ltd, headquartered in Australia and regulated by ASIC under license number 504151, offers a range of trading opportunities with a focus on global shares. While specific details such as minimum deposit requirements and maximum leverage are not specified, they provide competitive and transparent spreads. Clients have access to a variety of trading platforms, including CTIN Trader Pro, CTIN Trader Web, and CTIN Trader Mobile, catering to different trading preferences. With over 20,000 global shares available for trading, CTIN offers both Trading and Demo accounts. Their 24-hour customer support ensures assistance at any time, although information about payment methods and educational tools is not provided, suggesting room for improvement in these areas.

Regulation

CTIN Financial Services Pty Ltd is currently regulated by the Australia Securities & Investment Commission (ASIC) under license number 504151, with an effective date of October 30, 2018. They operate under a Straight Through Processing (STP) license type and are regulated by ASIC in Australia. This license type does not allow for sharing. CTIN Financial Services Pty Ltd is located at Level 5, 250 Queen Street, Melbourne VIC 3000, and can be reached at the phone number 0452116826. While the provided information does not include an expiry date or a website for the licensed institution, it signifies that CTIN Financial Services Pty Ltd is operating within the regulatory framework established by ASIC as of the last available update.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CTIN Financial Services Pty Ltd presents several advantages, including a wide range of global market instruments, competitive fees, and 24/7 customer support. They also offer mobile trading apps for convenience and custody services for secure asset storage. However, the absence of educational resources for clients and the lack of information regarding deposit and withdrawal methods on their website are notable drawbacks. Additionally, there is limited information available about their regulatory compliance and no official website mentioned, which could affect transparency and trustworthiness.

Market Instruments

CTIN offers a diverse range of market instruments to cater to the trading needs of its clients. These market instruments include:

International Shares: CTIN allows traders to buy and sell international shares from various stock markets around the world. This includes access to over 20,000 global shares, making it possible for traders to invest in companies listed on major stock exchanges worldwide.

Low and Transparent Fees: CTIN boasts competitive and transparent pricing with commissions starting as low as $3 per trade on both US and international shares. This fee structure is designed to provide cost-effective trading options.

Currency Conversion Services: CTIN offers currency conversion services at a low flat rate of just 0.5%. Traders can establish multi-currency accounts and easily convert between different currencies as needed, although there may be restrictions in place for certain countries.

Mobile Trading: CTIN provides dedicated mobile trading apps for major devices, including iOS and Android. This allows traders the flexibility to execute trades and manage their portfolios while on the go.

24-Hour Support: CTIN offers round-the-clock customer support with a highly trained team available 24 hours a day. This ensures that traders can access assistance and resolve any issues at any time, regardless of their geographical location.

Technology: CTIN's trading platform is built with a focus on speed and stability. It combines professional tools with a user-friendly and customizable interface to provide an efficient and effective trading experience.

Transparent Pricing: CTIN's fee structure is straightforward and transparent, ensuring that traders only pay the costs they see upfront. This transparency is important for traders to make informed decisions about their investments.

Custody Services: For those trading or investing exclusively in global shares, CTIN offers custody services through their Global Custodian. This service ensures the safekeeping of shares and related assets.

Available Markets: CTIN provides access to a wide range of stock markets and indices in local denominations, including but not limited to:

Australia: Top ASX 200 and other Australian stocks.

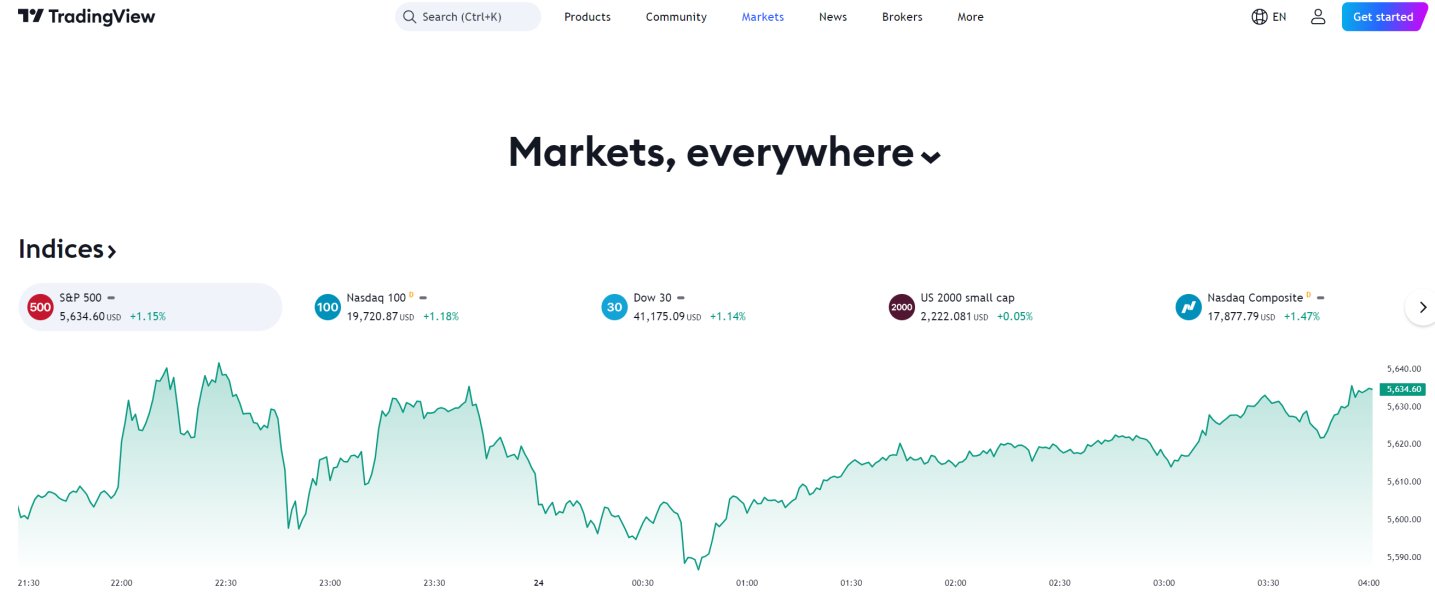

US: S&P 500, Dow Jones 30, NASDAQ 100, and many other US-listed stocks.

UK: FTSE 100, FTSE 250, and various other UK-listed stocks.

Hong Kong: Hang Seng stocks and most listed stocks.

Singapore: All STI stocks and most listed stocks.

Japan: All Nikkei 225 stocks and most listed stocks.

South Korea: All KOSPI stocks and most listed stocks.

Germany: All DAX, HDAX, MDAX stocks and most listed stocks.

Other European and Asian Markets: Austria, Belgium, Czech Republic, Denmark, Finland, France, Greece, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, Ireland, India, Malaysia, New Zealand, Taiwan, and potentially other markets upon request.

CTIN's market instruments provide traders with access to a wide range of global investment opportunities, coupled with competitive pricing and comprehensive support services.

Account Types

CTIN offers two primary types of trading accounts to cater to the needs of its clients: Trading Accounts and Demo Accounts.

Trading Account:

Access to over 20,000 global shares.

Competitive and transparent fee structure with commissions starting at $3 per trade.

Low flat-rate currency conversion fees at 0.5%.

Mobile trading capabilities with dedicated apps for iOS and Android.

24-hour customer support for assistance at any time.

Professional trading technology for speed, stability, and a user-friendly interface.

Custody services for holding global shares exclusively with the Global Custodian.

Description: A Trading Account with CTIN is designed for clients who wish to actively participate in the financial markets and execute real trades. It provides access to a wide range of international shares from various stock markets worldwide, including the US, UK, Australia, Hong Kong, Singapore, Japan, and more.

Features:

Advantages: This account type is suitable for traders and investors looking to actively manage and trade international shares with access to various global markets while benefiting from competitive fees and robust customer support.

Demo Account:

No real funds are at risk; trades are executed using virtual money.

Allows users to test trading strategies, explore platform features, and gain confidence in their trading abilities.

Offers a hands-on experience with real-time market data.

An excellent educational tool for beginners and a platform for experienced traders to test new strategies.

Description: A Demo Account provided by CTIN serves as a risk-free environment for individuals who want to practice and familiarize themselves with the CTIN trading platform without using real money. It offers a simulated trading experience that mimics actual market conditions.

Features:

Advantages: The Demo Account is a valuable tool for traders of all levels to refine their trading skills and gain experience in a risk-free environment before transitioning to a live Trading Account.

Spreads & Commissions

The fee structure for CTIN (the company you're referring to) appears to be straightforward and transparent. Here's a breakdown of the key fees and charges associated with their services:

Commission Fees:

CTIN charges a low, fixed rate commission per share or a set percentage of the trade value, whichever is greater. This fee structure is applicable to various countries and stocks.

Minimum Per Order:

For each country and stock market, there is a minimum order amount specified. In the case of Australia, for example, the minimum per order is AUD8.

Percentage of Trade Value:

CTIN charges a percentage of the trade value for each transaction. The percentage may vary slightly depending on the country and stock market. For most countries listed, this percentage is 0.08% of the trade value.

Exchange and Regulatory Fees:

CTIN states that no additional exchange or regulatory fees are charged to clients. This means that the fees mentioned include all exchange and regulatory fees, providing clarity and simplicity for traders.

Custody Fees:

CTIN holds all stocks in custody for its clients, and there is no additional custody fee mentioned. This implies that clients do not need to pay separate fees for stock custody services.

Currency Conversion Fee:

CTIN charges a flat rate of only 0.5% for currency conversions. This fee applies when converting one currency to another in the context of trading.

Additional Taxes:

Any applicable stamp duty or tax will be added to the overall value of the transaction. This means that clients may need to pay additional taxes depending on their location and the specific transaction.

Different Fees for the United States:

Notably, the fee structure for trading in the United States is slightly different. The commission is USD8 plus 0.02 cents per share traded.

| Country | Minimum per Order | Percentage of Trade Value | Currency Conversion Fee | Additional Taxes |

| Australia | AUD8 | 0.08% | 0.50% | Applicable |

| Austria | EUR8 | 0.08% | 0.50% | Applicable |

| Belgium | EUR8 | 0.08% | 0.50% | Applicable |

| Canada | CAD8 | 0.08% | 0.50% | Applicable |

| China | CNY48 | 0.08% | 0.50% | Applicable |

| Czech Republic | CZK600 | 0.15% | 0.50% | Applicable |

| Denmark | DKK80 | 0.08% | 0.50% | Applicable |

| Finland | EUR8 | 0.08% | 0.50% | Applicable |

| France | EUR8 | 0.08% | 0.50% | Applicable |

| Germany | EUR8 | 0.08% | 0.50% | Applicable |

| Hong Kong | HKD60 | 0.08% | 0.50% | Applicable |

| India | INR400 | 0.08% | 0.50% | Applicable |

| Italy | EUR8 | 0.08% | 0.50% | Applicable |

| Japan | JPY1000 | 0.08% | 0.50% | Applicable |

| Malaysia | MYR24 | 0.08% | 0.50% | Applicable |

| Netherlands | EUR8 | 0.08% | 0.50% | Applicable |

| New Zealand | NZD8 | 0.08% | 0.50% | Applicable |

| Norway | NOK80 | 0.08% | 0.50% | Applicable |

| Portugal | EUR8 | 0.08% | 0.50% | Applicable |

| Singapore | SGD20 | 0.08% | 0.50% | Applicable |

| Spain | EUR8 | 0.08% | 0.50% | Applicable |

| Taiwan | TWD170 | 0.08% | 0.50% | Applicable |

| United Kingdom | EUR8 | 0.08% | 0.50% | Applicable |

| United States | USD8 | 0.02 cents per share | 0.50% | Applicable |

| Sweden | SEK80 | 0.08% | 0.50% | Applicable |

| Switzerland | EUR8 | 0.08% | 0.50% | Applicable |

| South Korea | KRW6500 | 0.08% | 0.50% | Applicable |

Please note that the “Additional Taxes” column indicates that any stamp duty or tax applicable will be added to the transaction value, and this may vary by location and transaction type. Additionally, the United States has a different fee structure, with a fixed commission plus a per-share fee.

Trading Platforms

CTIN offers three distinct trading platforms to cater to the diverse needs and preferences of traders and investors. These platforms vary in terms of functionality, accessibility, and mobility:

CTIN Trader Pro:

Intuitive and multi-screen interface, designed for traders who require advanced tools and capabilities.

Fully customizable to tailor the trading environment to individual preferences.

Offers a comprehensive set of tools and features to support sophisticated trading strategies.

Provides the power and performance needed by experienced traders.

Allows access to account information and trading on the go through CTIN Trader Web or CTIN Trader Mobile.

Target Audience: Advanced and professional traders.

Platform Type: Downloadable and fully customizable professional-grade platform.

Compatibility: Available for both Windows and Mac operating systems.

Features:

CTIN Trader Web:

User-friendly interface designed for both new and experienced traders.

Supports trading across various asset classes and all CTIN products.

Fast and reliable performance with real-time market data.

Accessible across multiple devices without the need for downloads or installations.

Offers a balance between functionality and accessibility for traders who prefer web-based platforms.

Target Audience: Most traders and investors seeking ease of use and flexibility.

Platform Type: Web-based trading and investment platform.

Compatibility: Accessible on any PC, Mac, tablet, or smartphone with a web browser.

Features:

CTIN Trader Mobile:

Designed for convenience and ease of use while trading on mobile devices.

Supports trading across various asset classes and all CTIN products.

Offers fast and reliable performance, ensuring timely execution of orders.

Native mobile app experience optimized for touchscreens.

Provides access to trading and account information anytime, anywhere.

Target Audience: Traders and investors who require mobility and prefer trading on the go.

Platform Type: Mobile application for trading and investing.

Compatibility: Available as a native application on tablets and smartphones via the Apple App Store or Google Play Store.

Features:

Overall, CTIN's suite of trading platforms caters to a wide range of traders, from professionals who require advanced tools to those who prioritize accessibility and mobility. Traders can choose the platform that best aligns with their trading style and preferences, and they also have the flexibility to switch between platforms as needed.

Deposit & Withdrawal

The absence of deposit and withdrawal method information on CTIN's website raises concerns about transparency, credibility, and competitiveness. Clients need clear details on how they can manage their funds, and this missing information can lead them to question the legitimacy of the institution. It's essential for CTIN to provide this information promptly to build trust, remain competitive, and ensure potential clients can make informed financial decisions.

Customer Support

CTIN provides multiple ways for customers to reach out and get in touch, indicating a commitment to good customer support:

Contact Form: The presence of a contact form on their website allows customers to conveniently send inquiries or messages related to their products. It's an easy and efficient way for customers to reach out with their questions or concerns.

Physical Office Location: CTIN provides an office address, which is helpful for customers who prefer face-to-face interactions or need to send physical documents or correspondence. This demonstrates a willingness to engage with clients in person.

Phone Support: The availability of a phone number, along with specified operating hours, shows that CTIN is responsive to customer inquiries over the phone. Having set hours helps manage customer expectations regarding when they can reach a live representative.

Legal Information: CTIN provides legal information, including its ACN, ABN, and AFSL numbers. This information is essential for clients seeking assurance of the company's legal standing and compliance.

Overall, CTIN seems to have a multi-faceted approach to customer support, with options ranging from online forms for written inquiries to direct phone support during specified hours. This demonstrates a commitment to being accessible and responsive to customer needs and inquiries.

Educational Resources

CTIN does not offer educational resources for its clients, potentially missing an opportunity to provide valuable information and guidance to help clients make informed financial decisions and enhance their financial literacy. Educational resources can be instrumental in empowering clients to better understand the products and services offered, as well as the broader financial landscape, ultimately fostering trust and confidence in the institution.

Summary

CTIN Financial Services Pty Ltd, based in Melbourne, Australia, is a regulated financial institution operating under license number 504151 from the Australia Securities & Investment Commission (ASIC) since October 30, 2018. They offer a range of market instruments, including international shares, with competitive and transparent fees, mobile trading options, and 24-hour customer support. Clients can choose between Trading and Demo accounts to suit their trading needs. The fee structure is straightforward, with commissions and percentage-based fees, and there are multiple trading platforms available, catering to various trader preferences. However, CTIN lacks educational resources on its website, which could be beneficial for clients looking to enhance their financial knowledge. Additionally, information about deposit and withdrawal methods is conspicuously absent from their website, which may raise concerns about transparency.

FAQs

Q1: What is CTIN Financial Services Pty Ltd's regulatory status?

A1: CTIN Financial Services Pty Ltd is regulated by the Australia Securities & Investment Commission (ASIC) under license number 504151, with regulatory oversight effective from October 30, 2018.

Q2: What types of accounts does CTIN offer?

A2: CTIN provides two primary account types: Trading Accounts for active traders, offering access to global shares, and Demo Accounts, which allow users to practice trading with virtual funds.

Q3: Can I trade international shares with CTIN?

A3: Yes, CTIN offers access to over 20,000 global shares from various international stock markets, enabling you to invest in companies listed worldwide.

Q4: What are CTIN's trading platform options?

A4: CTIN offers three trading platforms: CTIN Trader Pro for advanced traders, CTIN Trader Web for user-friendly web-based trading, and CTIN Trader Mobile for trading on the go via mobile devices.

Q5: Does CTIN provide customer support outside regular business hours?

A5: Yes, CTIN offers 24-hour customer support, ensuring assistance is available at any time, regardless of your location or trading schedule.

Keywords

- 5-10 years

- Regulated in Australia

- Straight Through Processing(STP)

- Suspicious Scope of Business

- Medium potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now