Score

CITIC SECURITTIES

Hong Kong|Above 20 years|

Hong Kong|Above 20 years| https://www.citics.com.hk/en/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

+852 2237 6899

+852 2237 9338

Other ways of contact

Broker Information

More

CITIC Securities Wealth Management (HK)

CITIC SECURITTIES

Hong Kong

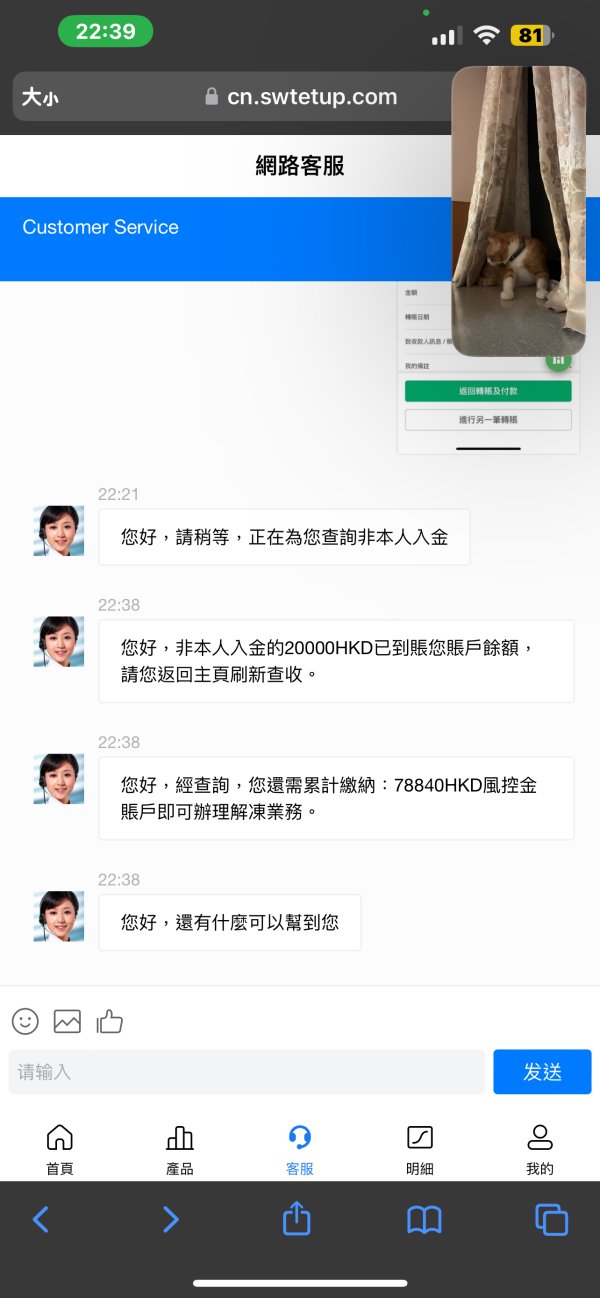

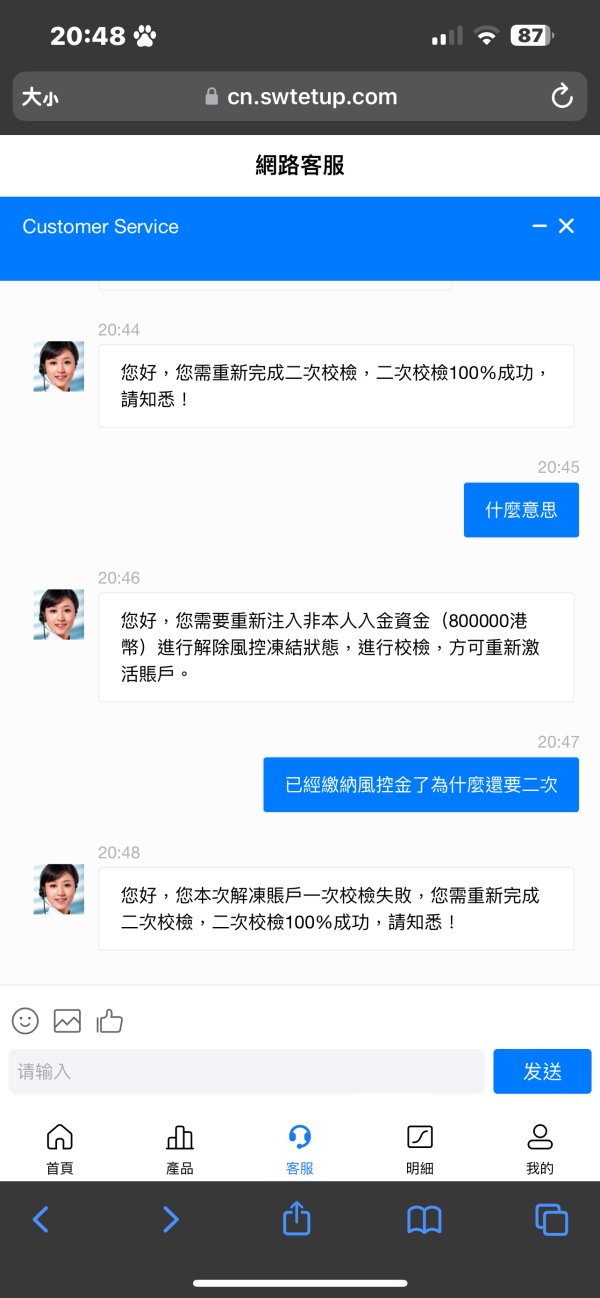

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed CITIC SECURITTIES also viewed..

XM

MiTRADE

IUX

IC Markets Global

CITIC SECURITTIES · Company Summary

| Aspect | Information |

| Company Name | CITIC Securities |

| Registered Country/Area | China |

| Founded Year | 1995 |

| Regulation | Regulated by the SFC |

| Minimum Deposit | $0 |

| Maximum Leverage | Up to 1:20 |

| Spreads | Start from 0.02% |

| Trading Platforms | Desktop, mobile, web trading platfom |

| Tradable Assets | Stocks, indices, commodities |

| Account Types | Standard, VIP, Institutional accounts |

| Customer Support | Email csi-callcentre@citics.com.hk.Phone 852 2237 6899 |

| Deposit & Withdrawal | Bank transfer and debit cards |

| Educational Resources | Online courses, webinars, tutorials, articles |

Overview of CITIC Securities

CITIC Securities, established in 1995, stands as the largest Chinese investment holding company renowned for its comprehensive range of financial services. Regulated by the SFC, CITIC Securities is a trusted name in the financial industry. As a member of the SIPF (China Securities Investor Protection Fund), the broker prioritizes the safeguarding of its clients' investments.

CITIC Securities offers a flexible trading environment, allowing account currency options in USD, CNY, and HKD. What sets them apart is their approach to minimum deposits, which starts from zero units of the base currency of the account, promoting accessibility to a wide range of investors. Leveraging up to 1:20 empowers traders to amplify their positions.

One notable advantage of CITIC Securities is their competitive edge in spreads, offering an advantageous no-spread feature.

https://www.youtube.com/watch?v=zjvILtuDvfs

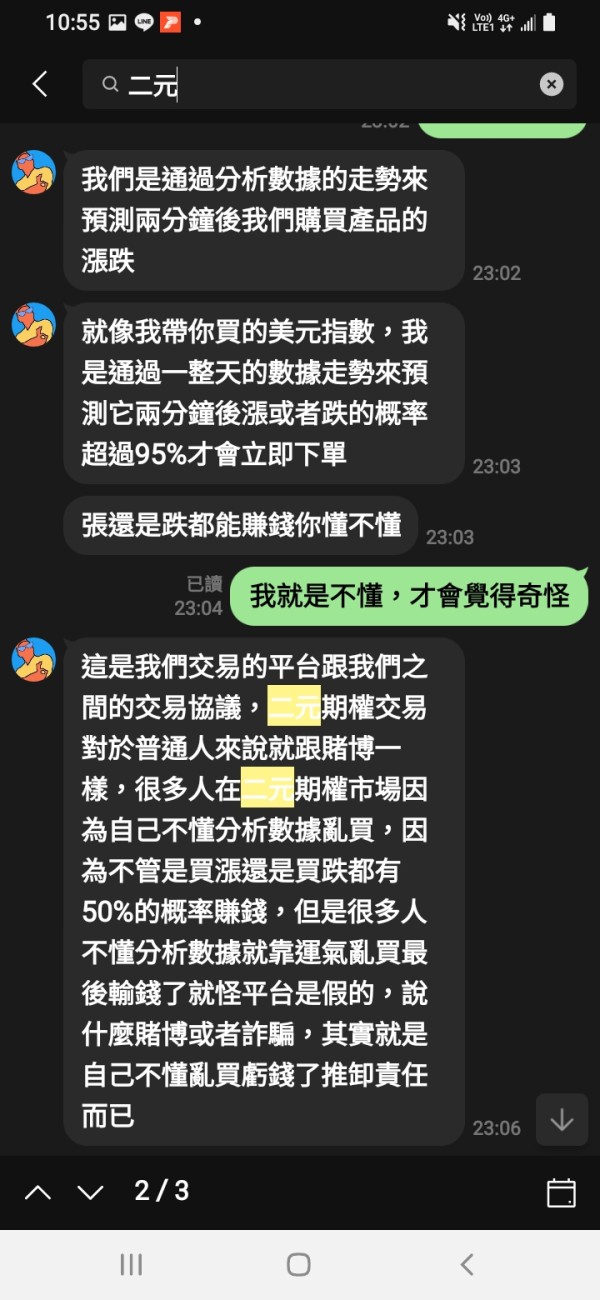

Is Citic securitties legit or a scam?

CITIC Securities operates under the regulatory oversight of the Securities and Futures Commission of Hong Kong (SFC), ensuring a secure and compliant trading environment. As of the current status, CITIC Securities is fully regulated by the SFC, holding a license for dealing in futures contracts. The license, designated as AHR752, was granted to CITIC Securities Futures (HK) Limited, which operates as a subsidiary of CITIC Securities.

Pros and Cons

CITIC Securities offers several advantages that make it an attractive choice for traders. Firstly, there are no minimum deposit requirements, providing clients with flexibility in funding their accounts. The company strictly adheres to legal regulations, ensuring that only government-approved products and services are available to its customers, which enhances the overall security and reliability of the platform. Additionally, CITIC Securities provides versatile trading terminals accessible from both mobile and desktop devices, offering convenience and flexibility to traders. Investors also benefit from a wide range of investment options, including trust transfers, passive income on pension accounts, and the ability to activate algorithmic trading.

However, there are certain limitations to consider when trading with CITIC Securities. The broker primarily serves clients from China and Hong Kong, restricting its services to a specific geographical region. Additionally, CITIC Securities has a limited selection of assets, focusing primarily on local Chinese market securities.

| Pros of CITIC Securities | Cons of CITIC Securities |

| No minimum deposit requirements | Serving only clients from China and Hong Kong. |

| Strict adherence to legal regulations | Limited selection of assets |

| Versatile trading terminals accessible | Customer support can be slow at times |

| Diverse investment options | |

| Professional market research tools | |

| - Efficient and rapid digital account opening process within one business day. |

Market Instruments

Citic Securities offers a well-rounded selection of financial instruments, with a primary focus on:

Stocks: Users can trade a wide range of stocks, allowing them to participate in the performance of various companies and industries.

Indices: The platform provides access to global indices, enabling traders to engage with the broader stock market movements and economic trends.

Commodities: Citic Securities offers commodities such as precious metals (e.g., gold and silver) and energy commodities (e.g., oil). These commodities serve as options for diversification and hedging against economic uncertainties.

Account Types

CITIC Securities offers a variety of account types tailored to meet the diverse needs of traders. The Standard account provides a leverage of 5:1, with a spread of 0.10% and a commission of $10 per trade. Notably, there is no minimum deposit requirement for this account type, making it accessible to all traders. It also includes a demo account for practice and supports multiple trading tools and round-the-clock customer support.

For more advanced traders, the VIP account offers increased leverage at 10:1, a reduced spread of 0.05%, and a lower commission of $5 per trade. A minimum deposit of ¥50,000 is required for this account, which also includes a demo account, versatile trading tools, and 24/7 customer support.

The Institutional account, with a leverage of 20:1, features the most favorable trading conditions, including a minimal spread of 0.02% and a commission of just $2 per trade. A higher minimum deposit of ¥100,000 is necessary to access this account type, which, like the others, provides a demo account, various trading tools, and round-the-clock customer support.

| Account Type | Standard | VIP | Institutional |

| Leverage | 5:1 | 10:1 | 20:1 |

| Spread | 0.10% | 0.05% | 0.02% |

| Commission | $10 per trade | $5 per trade | $2 per trade |

| Deposit | ¥0 | ¥50,000 | ¥100,000 |

| Demo Account | Yes | Yes | Yes |

| Trading Tool | Web platform, mobile app, desktop platform | Web platform, mobile app, desktop platform | Web platform, mobile app, desktop platform |

| Customer Support | 24/7 | 24/7 | 24/7 |

How to Open an Account?

Opening an account with Citic Securities is a straightforward process that can be broken down into six easy-to-follow steps:

Visit the Citic Securities Website: Begin by accessing the official Citic Securities website through your web browser.

Click on “Sign Up” or “Open an Account”: Locate the “Sign Up” or “Open an Account” button on the website's homepage and click on it to initiate the registration process.

Fill in Your Personal Information: Accurately provide your personal details, including your full name, email address, phone number, and country of residence.

Create a Username and Password: Choose a unique username and a strong password for your trading account, ensuring it meets the security requirements provided.

Verify Your Identity: Follow the instructions to verify your identity, which may involve submitting identification documents such as a passport or driver's license.

Fund Your Account: Once your identity is successfully verified, fund your trading account by selecting your preferred payment method and depositing the required amount.

After completing these six steps, your Citic Securities trading account will be ready for you to start trading.

Leverage

CITIC Securities provides varying levels of leverage depending on the account type chosen by traders. Here is an overview of the leverage options:

Standard Account: Traders with a Standard account can access a leverage of up to 5:1. This level of leverage allows for a balanced approach to trading and is suitable for those who prefer lower risk.

VIP Account: VIP account holders have the advantage of higher leverage, with a maximum of 10:1.

Institutional Account: For those seeking even greater leverage, CITIC Securities offers an Institutional account with leverage of up to 20:1. This level of leverage is typically chosen by experienced and institutional traders who are well-versed in managing higher levels of risk.

| Account Type | Standard | VIP | Institutional |

| Leverage | 5:1 | 10:1 | 20:1 |

Spreads &Commissions

CITIC Securities offers competitive spreads across its various account types to cater to the diverse needs of traders. Here is an overview of the spreads available:

Standard Account: Traders with a Standard account can benefit from spreads as low as 0.10%. This account type provides a reasonable spread, making it suitable for those who prioritize cost-effective trading.

VIP Account: VIP account holders enjoy even tighter spreads, starting at 0.05%. The reduced spread enhances the trading conditions for VIP traders, potentially leading to lower trading costs and improved profitability.

Institutional Account: For institutional traders and those looking for the narrowest spreads, CITIC Securities offers an Institutional account with spreads starting at an impressive 0.02%.

| Account Type | Standard | VIP | Institutional |

| Spread | 0.10% | 0.05% | 0.02% |

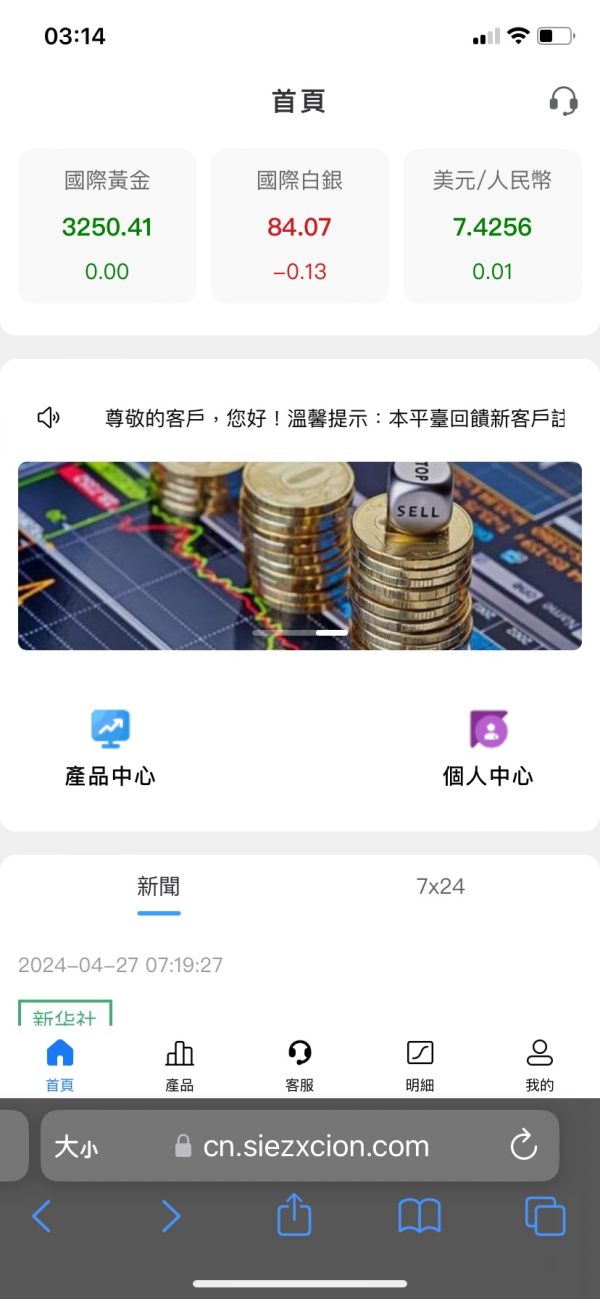

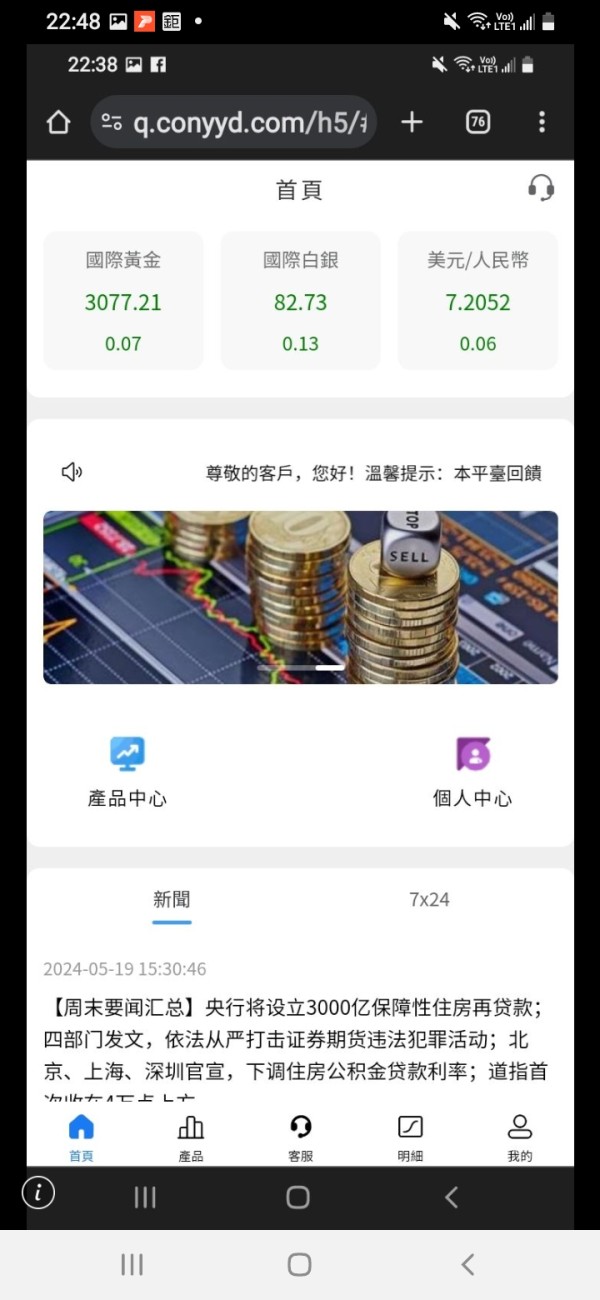

Trading Platform

CITIC Securities offers a comprehensive suite of trading platforms to cater to various preferences and skill levels.

The desktop trading platform, while feature-rich and highly customizable, may be better suited for experienced traders due to its complexity. It provides a clear fee report, excellent chart customizability, and a robust search function. Hoever, it offers limited order types, lacks two-step login security, and has a relatively complex interface.

The mobile trading platform, available for both iOS and Android, offers user-friendliness and convenience. It includes useful features like price alerts and a chatbot. However, it also has limited order types and lacks two-step login functionality.

The web trading platform is user-friendly and straightforward, with a strong search function. It provides a clear fee report but is limited in terms of customizability for charts and workspace. Like the mobile platform, it lacks two-step login security and offers a limited range of order types.

In summary, CITIC Securities offers a variety of trading platforms, each with its own set of advantages and drawbacks. Traders can choose the platform that best aligns with their experience level and trading needs.

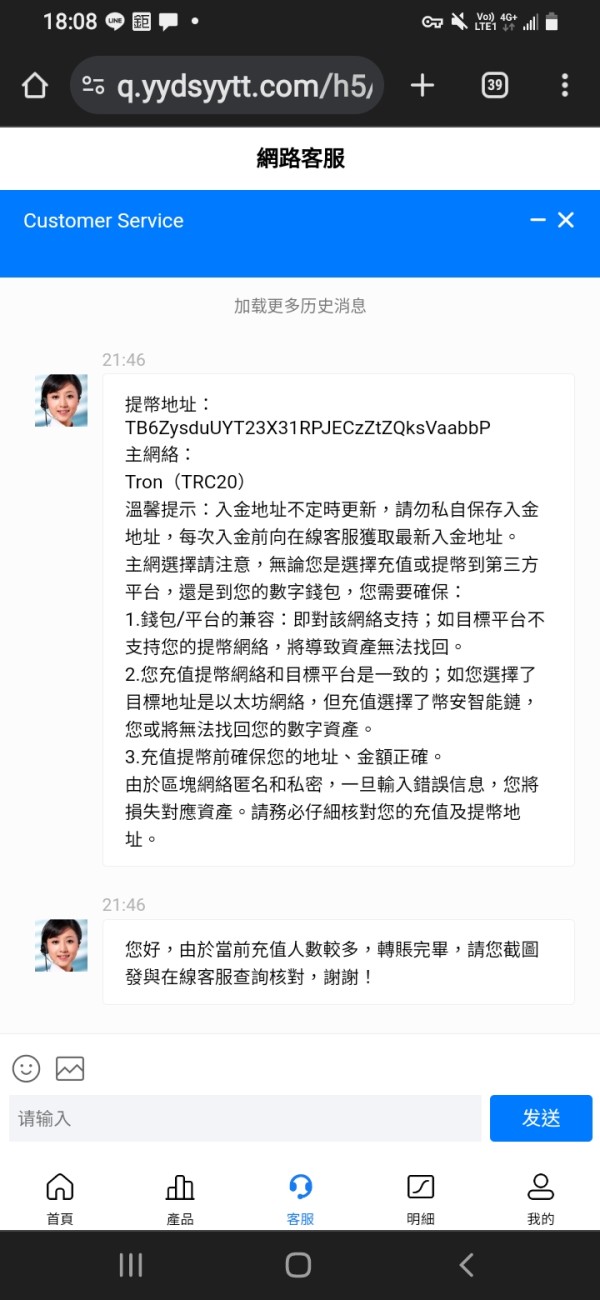

Deposit & Withdrawal

CITIC Securities only provide bank transfer for depositing and withdrawing funds. You can fund your account using bank transfers or debit cards. Please note that credit cards and electronic wallets are not accepted for deposits.

CITIC Securities payment method

| Deposit | Withdrawal | |

| Bank transfer | Yes | Yes |

| Credit/debit card | No | No |

| Electronic wallets | No | No |

One advantage of trading with CITIC Securities is its no withdrawal fee policy. When you decide to withdraw your funds, you can use bank transfers or debit cards. This fee-free approach enhances the overall trading experience, although credit cards and electronic wallets are not available for withdrawals.

Bank transfers may take several business days. It's essential to deposit funds from an account in your name.

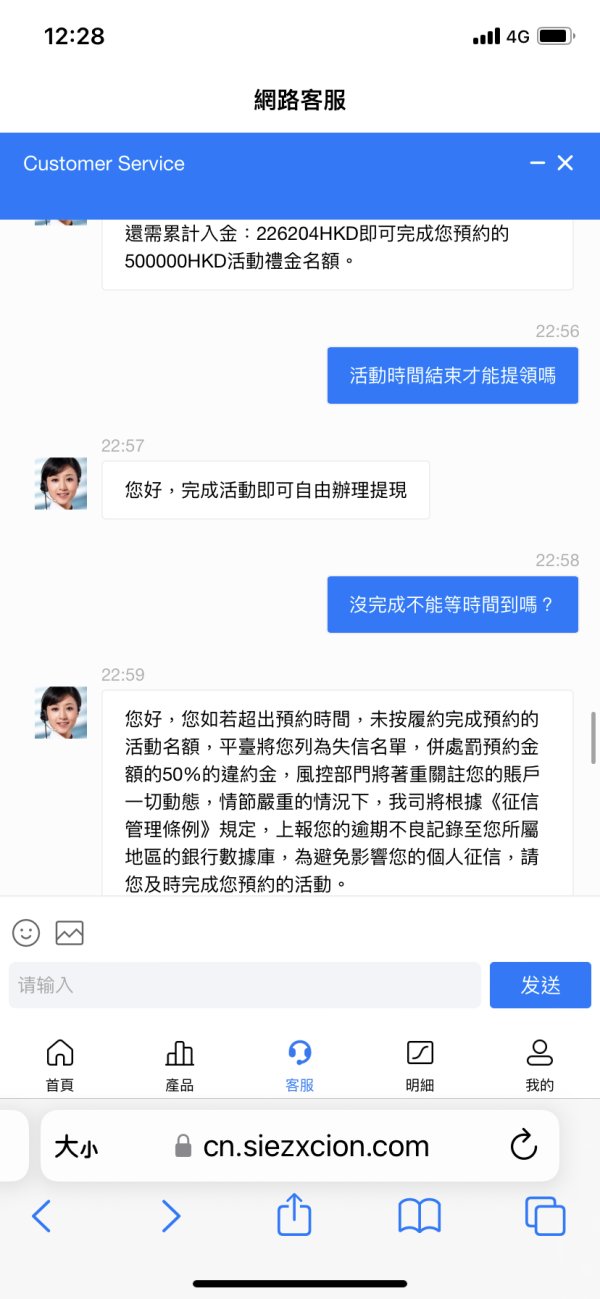

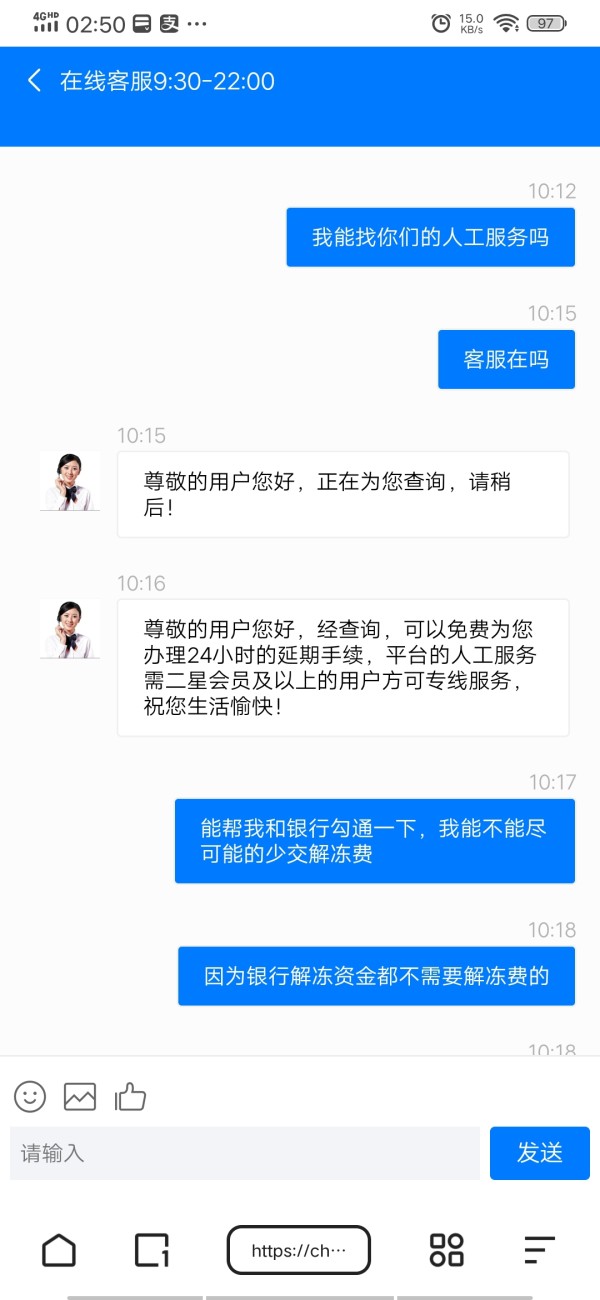

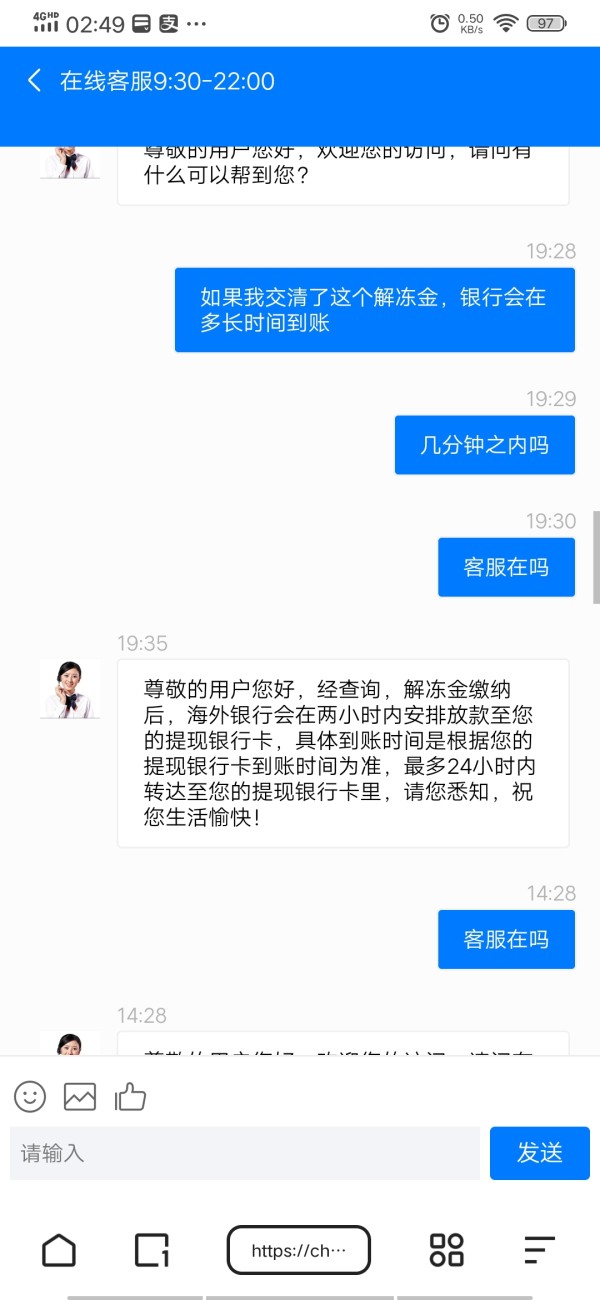

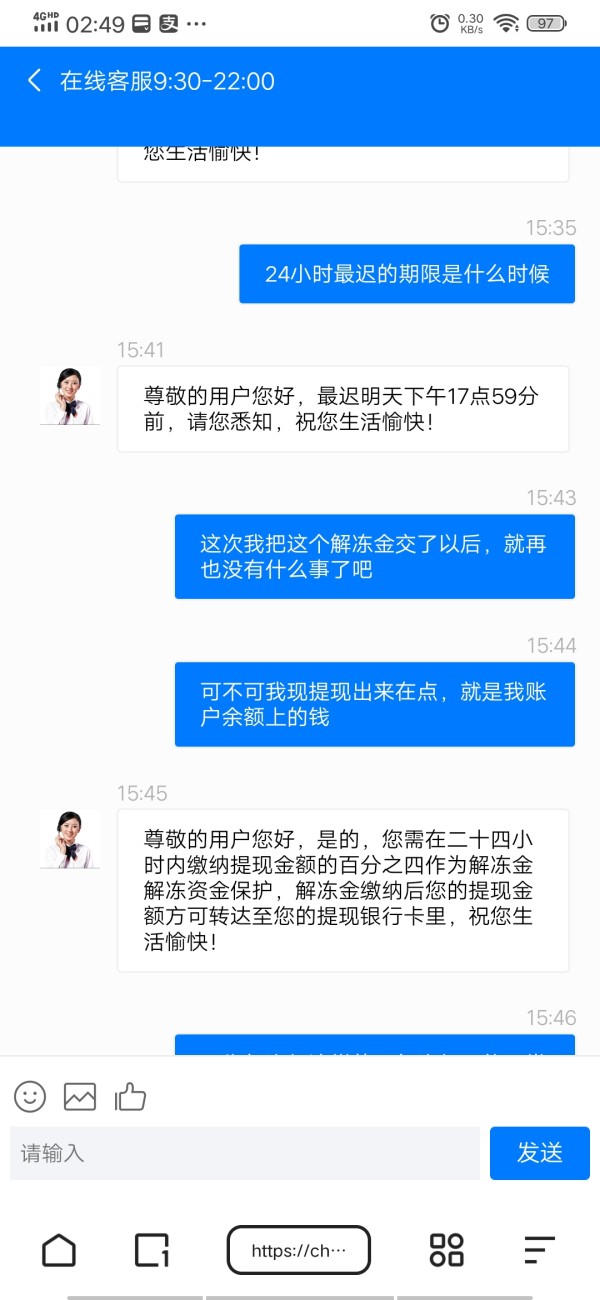

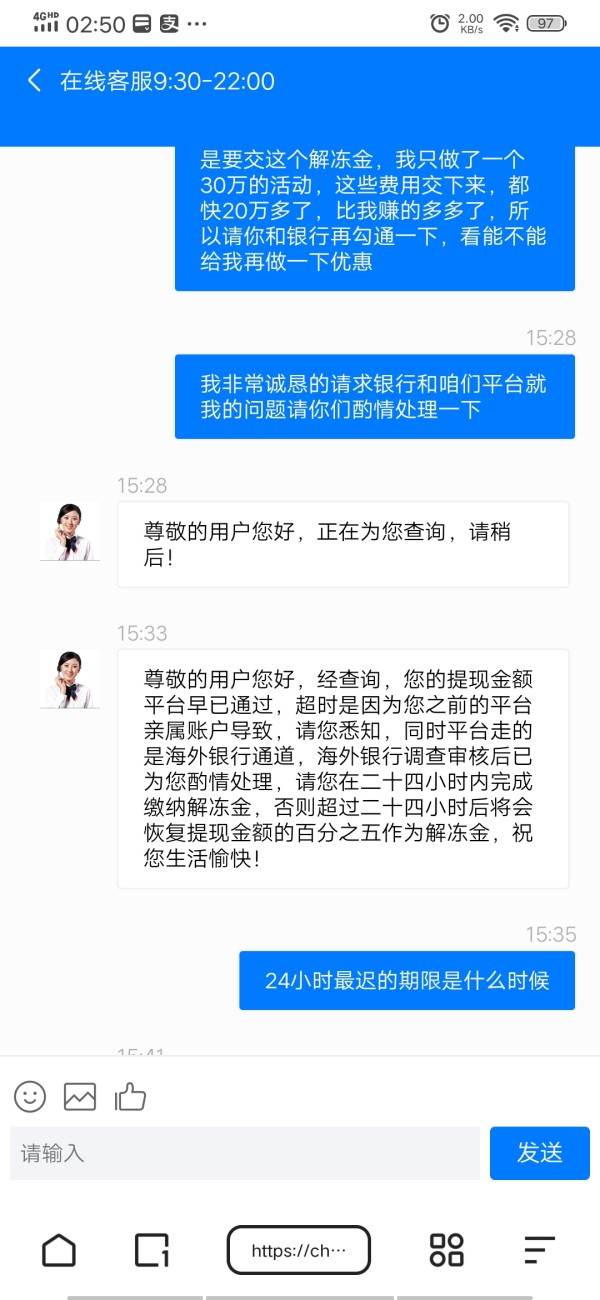

Customer Support

CITIC Securities offers comprehensive customer support to assist clients with their inquiries and concerns. You can reach their dedicated support team through various channels:

Email: For general inquiries, you can contact them via email at csi-callcentre@citics.com.hk.

Telephone: You can reach them through phone:

Switchboard: 852 2237 6899 (Monday-Friday: 9am to 6pm)

Hong Kong Hotline: 852 2237 9338

China Toll Free Line: 400 818 0338

Night Shift Dealing Support Hotline: 852 2237 9466

Fax: You can also contact them via fax:

Switchboard: 852 2104 6862

Account Executive: 852 2845 0151

Complaints: If you have any complaints about their services, they have a dedicated channel for that as well. You can reach them via email at csiwmcomplaint@citics.com.hk.

Educational Resources

Citic Securities recognizes the importance of education for investors and, as such, provides a comprehensive suite of educational resources. Investors looking to expand their knowledge of trading and investing can benefit from these offerings, which include:

Online Courses: Citic Securities offers online courses designed to cater to investors of all levels, from beginners to experienced traders. These courses cover a wide range of topics, including fundamental analysis, technical analysis, risk management, and more. They provide a structured learning path for those looking to build a strong foundation in trading and investing.

Webinars: The platform conducts regular webinars that are accessible to its user base. These live webinars feature expert speakers who delve into various aspects of the financial markets. Participants have the opportunity to interact with presenters, ask questions, and gain valuable insights into market trends, trading strategies, and investment opportunities.

Tutorials: For those who prefer self-paced learning, Citic Securities offers tutorials on various subjects related to trading and investing. These tutorials are easy to follow and provide step-by-step guidance on different aspects of the financial markets. Whether it's understanding how to use trading tools or analyzing market data, these tutorials serve as practical guides.

Articles: Citic Securities maintains an extensive library of articles covering a wide range of financial topics. These articles are a valuable resource for investors seeking in-depth knowledge and analysis. From market trends and economic indicators to trading strategies and investment principles, these articles provide valuable insights to aid decision-making.

Citic Securities understands that a well-informed investor is more likely to make sound financial decisions. Therefore, they have made it a priority to offer a diverse range of educational resources to empower their clients with the knowledge and skills needed to navigate the complex world of trading and investing successfully.

Conclusion

In conclusion, CITIC Securities presents a range of advantages that can appeal to traders seeking flexibility, security, and convenience. The absence of minimum deposit requirements allows clients to tailor their account funding to their preferences. The broker's strict adherence to regulatory standards ensures a safe and reliable trading environment, and the availability of versatile trading terminals across devices enhances accessibility.

Furthermore, CITIC Securities caters to diverse investment preferences, offering options such as trust transfers, passive income on pension accounts, and algorithmic trading. However, it's essential to acknowledge certain limitations, including its focus on serving clients exclusively from China and Hong Kong, which may restrict its services to a specific geographic area.

FAQs

1. Q: Is Citic Securities a regulated platform?

A: Yes, Citic Securities operates under recognized regulatory standards and is considered a legitimate trading and investment platform.

2. Q: What account types are available on Citic Securities.

A: Citic Securities offers Standard, VIP and Institutional accounts.

3. Q: How can I contact Citic Securities' customer support?

A: Citic Securities provides multiple contact options, including phone support and email, ensuring users can reach out for assistance.

4. Q: Are there educational resources available for beginners?

A: Yes, Citic Securities offers a range of educational resources suitable for traders of all experience levels, including beginners.

5. Q: What is the minimum deposit requirement for Citic Securities accounts?

A: The minimum deposit requirement varies based on the chosen account type, the Standard account has no deposit requirment.

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now